US Market Open: Stateside equity futures tentative ahead of US bank earnings, DXY bid and Bunds outperform; Fed speak due

12 Apr 2024, 11:05 by Newsquawk Desk

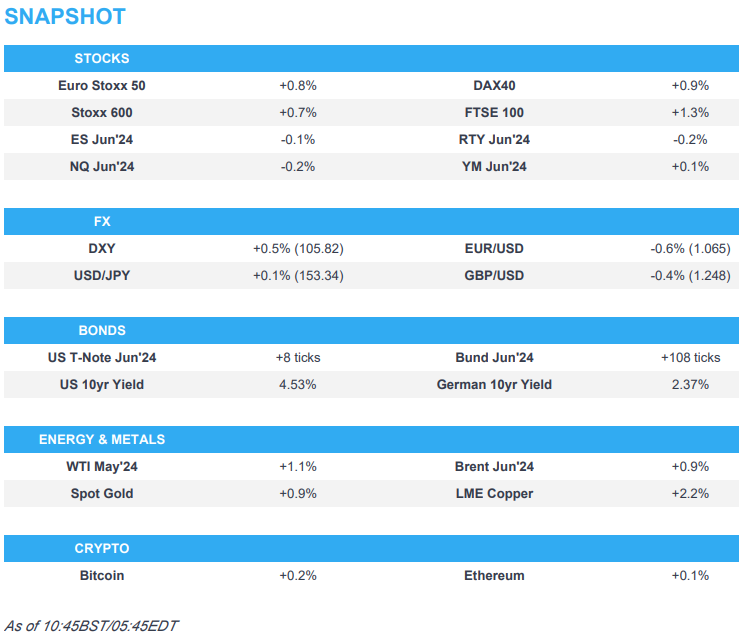

- European bourses are entirely in the green, Stateside futures are contained on either side of the unchanged mark

- Dollar is bid which has weighed on G10 peers, with EUR down to 1.0657

- Fixed complex higher with Bunds outperforming as markets digest Thursday’s ECB announcement and Fed divergence

- Crude is bid given the heightened geopolitical environment, XAU makes record highs

- Looking ahead, Uni. of Michigan (Prelim.), BoE Forecast Review, Fed’s Collins, Schmid, Bostic & Daly, Earnings from Wells Fargo, JNJ & Citi

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+1.1%), jumped higher at the open and continued to make session highs as the morning progressed, though upward momentum has slowed in recent trade as we await US bank earnings.

- European sectors are firmer across the board; Once again Basic Resources and Energy top the pile, lifted by gains in the commodities complex. Optimised Personal Care is found at the foot of the pile.

- US Equity Futures (ES U/C, NQ -0.1%, RTY U/C) are trading on either side of the unchanged mark, seemingly taking a breather following strong Stateside performance in the prior session; Intel (-1.8%) and AMD (-1.9%) pressured in the pre-market on China-related reports via the WSJ.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD is stronger vs. most peers as Wednesday's CPI report has prompted a reassessment of the Fed's position vs. other major central banks in the easing cycle. Interim resistance comes via the 13th Nov high at 105.95 but broader focus is on a breach of 106 to the upside.

- EUR's descent vs. the Greenback has continued into today's session as emphasis on potential diverging Fed/ECB paths guides price action. EUR/USD hit a new YTD at 1.0676.

- GBP initially defended the 1.25 mark, before succumbing to the broader Dollar strength; An in-line UK GDP release has been vastly overshadowed by a broad reassessment of the relative BoE/Fed paths. GBP entered 2024 on the front foot amid expectations it would lag the Fed and ECB in cutting rates.

- JPY is holding up better than peers vs. the USD. Albeit, it has been a pretty painful week for the JPY following Wednesday's US CPI print which launched the pair from a 151 handle to 153+.

- Antipodeans are both softer vs. the USD to similar degrees amid light newsflow for both currencies. AUD/USD is below its 50 and 200DMAs at 0.6543 but holding above the weekly low at 0.6498.

- PBoC set USD/CNY mid-point at 7.0967 vs exp. 7.2365 (prev. 7.0968).

- Click here for more details

FIXED INCOME

- USTs off lows with newsflow light into a number of Fed speakers. USTs have bounced by around 10 ticks from today's 108-00+ base, but remain much closer to the week's trough of 107-27+ than the 109-26+ peak.

- Bunds are bid as markets digest the ECB's read-between-the-lines guidance towards a June cut with sources and ECB speakers since outlining this more explicitly, guidance which contrasts with hawkish Fed re-pricing. Bunds have been lifted back towards this week's 132.86 peak, currently 132.44, whilst the German 10yr yield sits comfortably below 2.40%.

- Gilts gapped higher by around 30 ticks given the above EGB action, and remained near session highs at around 97.87. A slightly stronger UK GDP print will give the BoE scope to continue to traverse the Table Mountain; Bernanke forecast review due shortly.

- Click here for more details.

COMMODITIES

- Crude is firmer on the session, given the heightened geopolitical environment and despite the firmer Dollar. Brent June trades within a USD 90.04-64/bbl parameter thus far.

- Precious metals are surging across the board despite the rise in the Dollar with the geopolitical landscape underpinning the havens ahead of weekend risk and a potential Iranian offensive against Israel; XAU tested USD 2,400/oz to the upside at fresh ATHs.

- Base metals are also soaring despite the stronger Dollar and downbeat headline Chinese trade data, with the internals revealing a Y/Y increase in copper imports.

- Shanghai Gold Exchange will raise margin requirements for some gold futures contracts to 9% from 8% effective from the settlement on April 15th and will raise daily trading limits for some gold futures contracts to 8% from 7%.

- MMG 's (1208 HK) Las Bambas copper mine in Peru and protestors reached a deal on lifting the road blockade near the mine, according to sources cited by Reuters.

- Japanese aluminium premiums for April-June shipments at USD 145-148/T, +61-64%, via Reuters citing sources.

- IEA OMR: World oil demand growth forecast -130k BPD to 1.2mln BPD; 2025 demand growth seen at 1.1mln due to sub-par economic outlook; China's 2023 post-COVID release of pent-up demand has effectively run its course. Sustained output curbs by the OPEC+ alliance mean that non-OPEC+ producers, led by the Americas, will continue to drive world oil supply growth through 2025. Robust production from non-OPEC+ coupled with a projected slowdown in demand growth will lower the call on OPEC+ crude by roughly 300 kb/d in 2025.

- Click here for more details.

NOTABLE HEADLINES

- ECB's Kazaks says they will cut in June if nothing surprising occurs, via TV3; data will be clearer by then. Wage growth remains strong but inflation has decreased. The time for a cut is approaching.

- ECB's Stournaras says now is the time to diverge from the Fed; reiterates call for four rate cuts this year; there is a risk inflation will undershoot 2%.

- Riksbank's Breman says inflation has fallen from high levels but the risk of setbacks remains. Key factor is that household inflation expectations remain at a high level. Today's inflation figure shows we have a positive ground for inflation stabilising at 2%. Believe that household inflation expectations will also fall in the future as price increases slow; Co. pricing behaviour will be key.

- Goldman Sachs expects the ECB to cut rates four times this year in June, July, September & December

DATA RECAP

- UK GDP Estimate MM (Feb) 0.1% vs. Exp. 0.10% (Prev. 0.20%, Rev. 0.3%); YY -0.2% vs. Exp. -0.40% (Prev. -0.30%); 3M/3M 0.2% vs. Exp. 0.10% (Prev. -0.10%). Click here for more details.

- Swedish CPIF Ex Energy YY (Mar) 2.9% vs. Exp. 3.20% (Prev. 3.50%); click here for more details.

- French CPI (EU Norm) Final YY (Mar) 2.4% vs. Exp. 2.4% (Prev. 2.4%); CPI (EU Norm) Final MM (Mar) 0.2% vs. Exp. 0.3% (Prev. 0.3%)

- Spanish HICP Final MM (Mar) 1.4% vs. Exp. 1.3% (Prev. 1.3%); CPI YY Final NSA (Mar) 3.2% vs. Exp. 3.2% (Prev. 3.2%); CPI MM Final NSA (Mar) 0.8% vs. Exp. 0.8% (Prev. 0.8%); HICP Final YY (Mar) 3.3% vs. Exp. 3.2% (Prev. 3.2%)

- Italian Industrial Sales YY WDA (Jan) 3.0% (Prev. -0.1%); Industrial Sales MM SA (Jan) -0.5% (Prev. 2.1%)

NOTABLE US HEADLINES

- BofA and Deutsche Bank expect only one interest rate cut by the Fed this year in December, while HSBC expects 75bps of rate cuts by the Fed in 2024 and for the Federal Reserve to start cutting interest rates by 25bps in June.

- China has reportedly told telecom carriers to phase out foreign chips which are core to their networks by 2027, in a blow to Intel (INTC) and AMD (AMD), according to WSJ citing sources.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "The (Israeli) army and the Mossad approved plans to target the heart of Iran if Israel (is) bombed from inside Iranian territory", via Al Jazeera citing Yedioth Ahronoth.

- Hamas sources: "The organization's leadership informed the mediators that it is not interested in further discussions about the deal, as long as there is no progress in its demands...", according to journalist Kais citing Hezbollah-affiliated press.

- "US official to Al-Arabiya: We will participate in the response if Iran escalates with an appropriate response", according to Al Arabiya

MIDDLE EAST

- Israel is prepared for an Iranian strike from its territory in the next 48 hours, according to WSJ. Israeli army said Iran is preparing its proxies in the region to attack them, according to Al Arabiya.

- Israeli Defence Minister Gallant told US Defense Secretary Austin that a direct Iranian attack on Israeli territory would compel Israel to respond in an appropriate way against Iran, according to Axios.

- Iran reportedly signalled to Washington it will respond to Israel's attack on its Syrian embassy in a way that aims to avoid major escalation and it will not act hastily, according to Reuters citing Iranian sources. Furthermore, a source familiar with US intelligence was not aware of the message conveyed but said Iran has been very clear its response would be controlled and non-escalatory, and planned to use regional proxies to launch a number of attacks on Israel.

- US President Biden's administration officials judge that Iran is planning a larger-than-usual aerial attack on Israel in the coming days which will likely feature a mix of missiles and drone strikes, according to two US officials cited by Politico.

- US official said the US expects an attack by Iran against Israel which they think will be calibrated to be bigger than usual but not so big it would draw the US into war, while US officials have also been in touch with regional partners to discuss efforts to manage and ultimately reduce further risks of escalation.

- US said it had restricted its employees in Israel and their family members from personal travel outside the greater Tel Aviv, Jerusalem and Be'er Sheva areas amid Iran's threats of retaliation against Israel.

- US State Department senior official said a robust conversation with Iraq is likely to lead to a second US-Iraq joint security cooperation dialogue later this year.

OTHER

- US President Biden warned that any attack on Philippine vessels in the South China Sea would invoke their mutual defence treaty.

- China's top legislator Zhao Leji and North Korean counterpart discussed promoting exchange and cooperation in all fields, according to KCNA.

- Four drones shot down overnight near Russia's Novoshakhtinsk in a town in near proximity to an oil refinery

CRYPTO

- Bitcoin is incrementally firmer and holds just above USD 70K.

APAC TRADE

- APAC stocks traded mixed despite the gains on Wall St where softer-than-expected PPI eased some inflationary fears, while participants in the region were also cautious as they awaited the latest Chinese trade data.

- ASX 200 marginally declined as weakness in consumer-related sectors overshadowed the gains in gold miners.

- Nikkei 225 was underpinned on the back of a weaker currency and despite the selling pressure in Fast Retailing.

- Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong amid broad selling after the local benchmark index pulled back from the 17,000 level, while the mainland struggled for direction leading into the Chinese trade data.

NOTABLE ASIA-PAC HEADLINES

- US Senate Banking Committee Chair Brown urged for President Biden to permanently ban EVs produced by Chinese companies, according to a letter cited by Reuters.

- Japanese Finance Minister Suzuki said a weak yen has pros and cons, as well as noted that a weak yen could push up import prices and have a negative impact on consumers and firms. Suzuki reiterated that rapid FX moves are undesirable and that he is closely watching FX moves with a high sense of urgency, while he also repeated it is desirable for FX to move stably reflecting fundamentals and he won't rule out any steps to respond to disorderly FX moves.

- Bank of Korea kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously, while it stated that it is premature to be confident that inflation will converge on the target level and it will maintain a restrictive policy stance for a sufficient period. BoK said it would monitor various factors including inflation slowdown, as well as financial stability and economic growth risks but noted the growth forecast is to be consistent with its earlier forecast or could be higher. BoK Governor Rhee said one in seven board members said the door for a rate cut should be open for the next three months and all 7 members said it is hard to predict policy decisions for H2. Furthermore, Rhee said the board is open to a rate cut if CPI slows in H2 although rate cuts might be difficult this year should inflation remain sticky and they have not signalled for a rate cut.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said current monetary policy settings remain appropriate, while it added that the Singapore economy is expected to strengthen and that prospects for the Singapore economy should improve over the course of 2024.

- Chinese Cabinet issues guidelines to strengthen the supervision and prevent risks to promote development of its capital market; China to tighten supervision of stock market to control risks.

- Chinese Cabinet issues guidelines to strengthen the supervision and prevent risks to promote development of its capital market; China to tighten supervision of stock market to control risks.

- China March Trade (USD): Balance 58.55bln (exp. 70.2bln); Exports -7.5% Y/Y (exp. -2.3%); Imports -1.9% Y/Y (exp. -2.3%).

- China's Securities Regulator is proposing stricted differentiated regulatory requirements for high-frequency trading, plans to moderately increase requirements of operating income, net profit for Co's listed on Chinext.

DATA RECAP

- Singapore GDP QQ (Q1 P) 0.1% vs Exp. 0.6% (prev. 1.2%); YY (Q1 P) 2.7% vs Exp. 2.9% (prev. 2.2%)

- China March Trade (USD): Balance 58.55bln (exp. 70.2bln); Exports -7.5% Y/Y (exp. -2.3%); Imports -1.9% Y/Y (exp. -2.3%); click here for the breakdown.