US Market Open: US futs mostly lower (RTY leads), USD outmuscled by JPY

27 Nov 2024, 11:35 by Newsquawk Desk

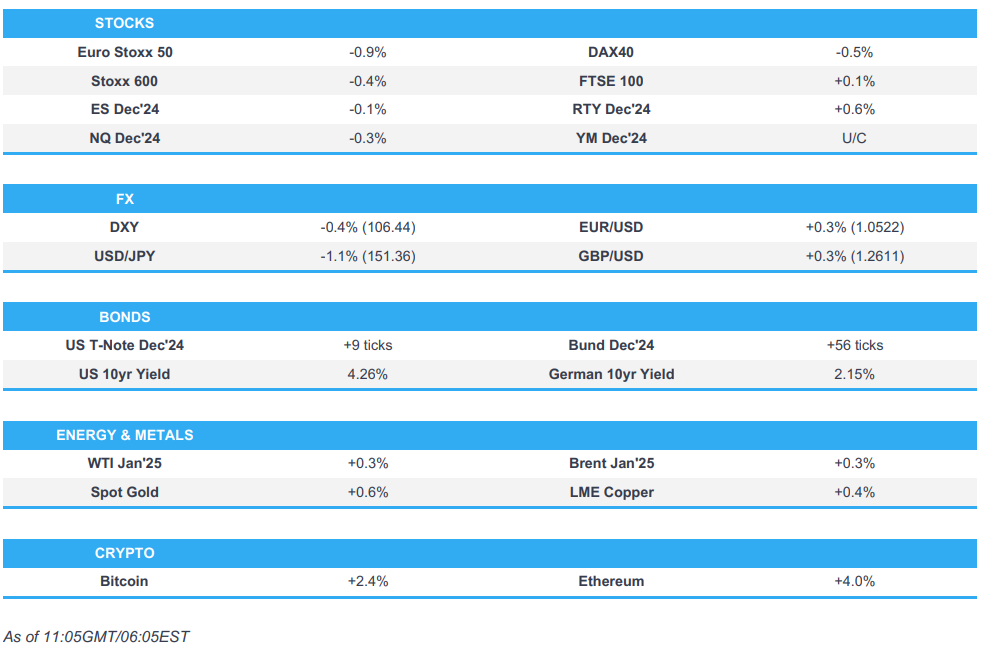

- European equities on the back foot with hawkish remarks from Schnabel weighing, US futures mixed into a packed data docket

- JPY outperforms with the NZD a close second after the RBNZ, EUR lifted by Schnabel; DXY pressured as such

- Fixed benchmarks in the green and towards highs though Bunds were dented by ECB speak, OAT-Bund yield spread at its highest since 2012

- Crude benchmarks are modestly firmer but in narrow ranges awaiting updates around the ceasefire, US data and OPEC+; metals moving higher

- Looking ahead, highlights include US PCE (Oct), GDP 2nd Estimate (Q3), PCE Prices Prelim (Q3), Initial Jobless Claims (23 Nov, w/e), Durable Goods (Oct), Advance Goods Trade Balance (Oct), Comments from ECB’s Lane, US Supply.

- Click for the Newsquawk Week Ahead.

EUROPEAN TRADE

EQUITIES

- European equities are on the backfoot, Stoxx 600 -0.4%, from a macro perspective the main update for the region has come via hawkish comments by ECB's Schnabel.

- Sectors are mixed: outperformance in Personal Care, Drug and Grocery names, whilst a pullback in yields has benefitted the Real Estate sector. Tech hit with SAP pressured after Workday numbers.

- US equity futures are showing a modest reversal of Tuesday's price action where small-caps lagged peers, ES -0.3%, RTY +0.6%. Focus is very much looking ahead to the day's raft of tier 1 US data points.

- US updates from Dell Technologies (-12.6%), HP (-10%), ADSK (-6.3%), CRWD (-5.7%) & Workday (-10%) in focus among others.

- CAICT says shipments of smartphones in China were up +1.8% Y/Y in October at 29.67mln (prev. -25.7% Y/Y in September). Domestic Chinese brands shipped 18.55mln phones in October (79% of the total), while foreign brands shipped 4.903mln units (-28.7% Y/Y). Shipments of foreign branded phones including Apple's (AAPL) iPhones within China were down 55.75% Y/Y in October (prev. -39.8% Y/Y), according to Reuters calculations.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- JPY outperforms with USD/JPY down to a 151.23 trough as traders continue to position for a BoJ rate hike next month following the recent fiscal stimulus announcement by the Japanese government.

- As such, the USD has been hampered with the DXY slipping further on the 106.00 handle and down to a 106.33 base thus far. Docket ahead packed given Thanksgiving adjustments to the data schedule.

- EUR firmer, benefitting from general USD downside and bolstered by hawkish remarks from ECB's Schnabel. Single currency as high as 1.0540, having climbed significantly an overnight 1.0474 base.

- Fundamentals light out of the UK, GBP benefitting from the above USD action and is holding ground against the EUR for the most part thus far.

- NZD a close second to JPY as it stands in terms of best performers, following the RBNZ's 50bps cut which while as expected saw the unwinding of some outside bets for a 75bps move. NZD topped out at 0.59 vs the USD.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks in the green. Spent the first part of the European morning at highs though pulled back modestly on hawkish Schnabel commentary. Since, back towards best as the risk tone continues to deteriorate.

- USTs towards their 110-21+ peak, pulled back modestly on Schnabel but only briefly. Docket ahead is packed with PCE the highlight, and will help to inform the view into December’s FOMC, with markets leaning towards a 25bps cut (60% chance) vs unchanged (40% chance) into the releases.

- Bunds came under pressure on a set of particularly hawkish remarks from ECB’s Schnabel; in particular, her remark on not going below the estimated 2-3% neutral rate is at odds with market pricing.

- OATs near the unchanged mark with focus on the domestic political situation after PM Barnier's remarks around "serious turbulence on financial markets" if the gov't collapses; as such, the OAT-Bund yield spread has hit 90bps, its highest since 2012.

- Gilts outperform, unaffected by Schnabel, specifics for the UK have been light thus far with the docket ahead also sparse.

- Click for a detailed summary

COMMODITIES

- Crude modestly firmer in narrow ranges and well within familiar territory awaiting updates around the ceasefire, US data and OPEC+. Holding around USD 69/bbl and USD 73/bbl respectively for WTI and Brent.

- Gold has gleaned support from the tepid risk tone, which has been deteriorating throughout the morning, and softer USD. As such, XAU is at a USD 2653/oz peak with resistance ahead at USD 2673/oz from November 21st.

- Base metals in the green, despite the tepid tone, action which comes as the complex bounces back from Tuesday’s pressure. Thus far, this has taken the likes of 3M LME Copper back to yesterday's best but shy of the USD 9.1k from Monday.

- US Private Inventory Data: Crude -5.9mln (exp. -0.6mln), Distillates +2.5mln (exp. +0.1mln), Gasoline +1.8mln (exp. -0.1mln), Cushing -0.7mln

- Russia may lift the ban on gasoline exports from refineries for two months from December 1st to January 31st, according to Kommersant citing sources.

- Citi Research said its base case is for OPEC+ to delay the unwind of output cuts by a quarter to April 2025.

- JPMorgan forecasts Henry Hub prices at USD 3.50/MMBtu; TTF at EUR 41.75/MWh. Sees NatGas production likely to grow 3bcf/day in 2025 and again in 2026.

- Click for a detailed summary

NOTABLE DATA RECAP

- German GfK Consumer Sentiment (Dec) -23.3 vs. Exp. -18.6 (Prev. -18.3, Rev. -18.4)

- French Consumer Confidence (Nov) 90.0 vs. Exp. 93.0 (Prev. 94.0, Rev. 93)

- Swiss Investor Sentiment (Nov) -12.4 (Prev. -7.7)

NOTABLE EUROPEAN HEADLINES

- BoE's Lombardelli said US tariffs would pose a risk to UK economic growth and it is unclear what impact tariffs would have on UK inflation, while she added that a tight UK labour market remains a problem and is worried that services inflation remains above pre-COVID levels.

- ECB's Schnabel says she sees only limited room for further rate cuts, via Bloomberg; estimated range for the neutral rate is 2-3%. Can gradually move rates to neutral, not lower. Shouldn't go accommodative on rates. Strong preference for a gradual approach. Need to see services inflation come down. Impact of past tightening fading visibly. May not be so far from neutral rates. Economy is stagnating, no recession risk.

NOTABLE US HEADLINES

- US President-elect Trump picked Jamieson Greer for USTR and Kevin Hassett to head the National Economic Council.

GEOPOLITICS

MIDDLE EAST

- Hamas says it is ready for truce in Gaza after the ceasefire deal between Israel and Hezbollah, according to journalist Guy Elster.

- Israel conducted a series of raids on the town of Naqoura in southern Lebanon and Hezbollah announced targeting "sensitive" military sites in Tel Aviv with a swarm of drones in the hours prior to the ceasefire.

- Streams of cars headed to southern Lebanon after the ceasefire came into force, according to Reuters.

- US senior official said they must all focus on making sure Iran does not continue to use Syria as a highway for weapons into Lebanon.

- Iran's Foreign Ministry said it welcomes the ceasefire in Lebanon and emphasises the responsibility of the international community in effectively pressuring Israel to stop the war in Gaza.

- Syrian state agency reported six people died including two soldiers in an Israeli attack on border crossings between Syria and Lebanon in the Homs countryside.

RUSSIA-UKRAINE

- Russia’s new missile fired at the Ukrainian city of Dnipro last week carried warheads without explosives causing limited damage, according to Reuters citing sources.

CRYPTO

- On the front foot, recouping some of the pressure seen in recent session and on track to snap the three-session streak of downside. However, BTC is yet to test/surpass the 94k mark having topped out at 93.9k thus far.

APAC TRADE

- APAC stocks were mixed following a somewhat similar performance stateside where the S&P 500 and DJIA posted fresh record highs but the small-cap Russell 2000 underperformed amid higher yields owing to Trump's recent tariff threat.

- ASX 200 traded higher with strength in gold, consumer discretionary, tech and financial stocks, while mixed data releases also provided some encouragement as monthly CPI printed softer-than-expected, whilst the trimmed mean metric rose and Q3 Construction Work Done topped forecasts.

- Nikkei 225 underperformed amid a firmer currency and with money markets leaning towards a hike by the BoJ next month.

- Hang Seng and Shanghai Comp were positive albeit with gains capped by a lack of major catalysts and as Industrial Profits data continued to show a double-digit percentage drop Y/Y for October although was not as steep as the prior month's decline.

RBNZ

- RBNZ cut the OCR by 50bps to 4.25%, as expected, while it said the OCR was lowered further as inflation returns to the target and expects to cut the OCR again early next year. RBNZ noted global economic growth is to remain subdued in the near term and economic activity is subdued but added that economic growth is expected to recover over 2025. Furthermore, the central bank lowered its OCR forecasts across the projection horizon with the March 2025 view at 4.07% (prev. 4.62%), December 2025 view at 3.55% (prev. 3.85%) and March 2026 view at 3.43% (prev. 3.62%).

- RBNZ Governor Orr said during the post-meeting press conference 'misnomer' that projections show a slower pace of cuts and stated that projections are consistent with a 50bps cut in February depending on activity, while he added the track suggests a sharper reduction in the Cash Rate than projected in August leaves the door open to further 50bps cut in February. Orr also stated they did not discuss cutting by 75bps and there were no plans for a 25bps or 75bps cut today, as well as noted that they can rule out rates going up in the near-term because of tariffs which they are concerned about.

DATA RECAP

- Chinese Industrial Profits YY (Oct) -10.0% (Prev. -27.1%); YTD YY (Oct) -4.30% (Prev. -3.50%)

- Australian Weighted CPI YY (Oct) 2.10% vs. Exp. 2.30% (Prev. 2.10%)

- Australian CPI ANNL trimmed mean YY (Oct) 3.50% (Prev. 3.20%)

- Australian Construction Work Done (Q3) 1.6% vs. Exp. 0.3% (Prev. 0.1%, Rev. 1.1%)