US Market Open: Equities in the green, CHF slips post-SNB and GBP softer ahead of the BoE; Fed speak due

20 Jun 2024, 11:20 by Newsquawk Desk

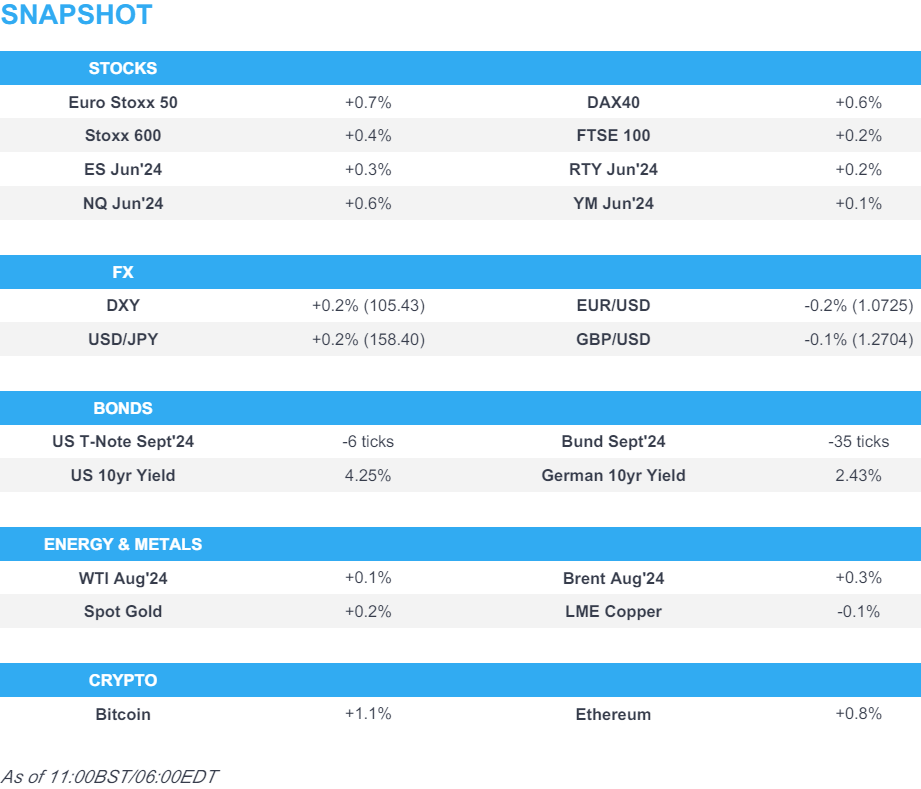

- Equities in the green and Tech leads in Europe; NQ outperforms, lifted by pre-market gains in NVDA +2.7%

- Dollar is firmer, CHF sinks after the SNB cut rates by 25bps, GBP slightly softer ahead of the BoE

- Bonds are softer, Bunds initially lifted post-SNB but has since pared, French auction passes without issue

- Crude is incrementally firmer, base metals gain amid a generally positive risk tone

- Looking ahead, US IJC & Philly Fed Index, BoE Policy Announcement, Comments from Fed’s Barkin & Kashkari, Earnings from Accenture & Kroger

WEDNESDAY RECAP

- A relatively quiet session where the main points of newsflow were: UK CPI Y/Y printed at 2.0%, easing back in-line with the BoE's target however the key All Services measure remained sticky and spurred a hawkish reaction in GBP and Gilts; EU Commission began disciplinary steps against seven nations (incl. France & Italy) over their excessive deficits as expected; Russia's Putin and North Korea's Kim came to a new agreement, on which Putin said they could cooperate within the military sphere; further liquidity boost from the PBoC and efforts from officials to talk up the economy.

EUROPEAN TRADE

CENTRAL BANKS

- SNB cut the Policy Rate by 25bps to 1.25% (vs split expectations between a 25bps cut and a hold); reiterates SNB is willing to be active in the FX market as necessary. SNB Chairman Jordan says "underlying inflation pressure has decreased; we are also willing to be active in the foreign exchange market as necessary. We do not give any forward guidance regarding interest rates; will adjust policy rate to ensure inflation rate stays in range of price stability; FX interventions can be in both directions". Click for more details.

- Norges Bank maintains Key Policy Rate at 4.50% as expected; "the policy rate will likely be kept at that level for some time ahead"; will be a need to maintain a tight monetary policy stance for somewhat longer than previously projected. Norges Bank Governor says neutral long-term interest rate now estimated at 2-3%, slightly higher than before. Click for more details.

- Brazil Central Bank maintained the Selic Rate at 10.50%, as expected, with the decision unanimous, while it stated it decided to interrupt the easing cycle due to the uncertain global scenario, resilient activity in Brazil, higher inflation projections, and unanchored inflation expectations. Furthermore, it said monetary policy should continue being contractionary until the consolidation of both the disinflation process and the anchoring of expectations around the targets, as well as noted that the committee will remain vigilant and future changes in the interest rate will be determined by the firm commitment to reaching the inflation target.

- BoC Minutes noted that the Governing Council considered the merits of waiting until the July 24th meeting to cut rates prior to the June 5th rate announcement and while members recognised the risk that progress on inflation could stall, there was consensus indicators showed enough progress to warrant a cut. Furthermore, members agreed that any future monetary policy easing would likely be gradual and the timing of cuts would depend on the data and implications for the future path of inflation.

- Chinese Loan Prime Rate 1Y (Jun) 3.45% vs. Exp. 3.45% (Prev. 3.45%); 5Y (Jun) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

EQUITIES

- European bourses, Stoxx 600 (+0.3%) are entirely in the green, having initially opened on a tentative footing; stocks caught a bid after the SNB cut rates, though are currently now off worst levels.

- European sectors hold a strong positive bias, though with the breadth of the market fairly narrow. Tech takes the top spot, lifted by gains in the Chip names, whilst Food Bev & Tobacco underperforms.

- US Equity Futures (ES +0.3%, NQ +0.6%, RTY +0.1%) are entirely in the green, with clear outperformance in the NQ, which has been lifted by Nvidia (+3.4% pre-market).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is firmer vs. all major peers with the index propped up by losses in CHF, JPY and EUR. Fresh fundamentals for the US have been lacking with focus on today's weekly jobs figures after last week's unexpected uptick.

- After holding steady in recent sessions, EUR has lost some ground to the broadly firmer USD and moving ever closer to the 1.07 mark. If breached, this could open up a test of the WTD low at 1.0686 and the monthly low at 1.0667.

- Cable is currently pivoting around the 1.27 level ahead of the BoE rate decision. A hawkish outcome could see the pair attempt to print a new weekly high above 1.2739, whilst a dovish release could see the pair try and forge a new low for the month below 1.2656.

- JPY is softer vs. the USD in a continuation of the trend seen since June 13th. Officials continue to jawbone the currency but with little in the way of success. USD/JPY breached its 14th June high at 148.25, now as high as 158.44 with not much in the way of resistance until 159.

- Antipodeans are both broadly steady vs. the USD. AUD/USD has paused its recent run of gains after printing a WTD peak at 0.6679. NZD was unable to capitalise on better-than-expected GDP metrics and is now marginally softer vs. the USD.

- CHF is the laggard across the majors after the SNB cut rates in what was expected to be a finely poised decision. The SNB also reiterated its willingness to intervene in FX markets as necessary; EUR/CHF spiked higher from 0.9486 to 0.9548.

- Norges Bank maintained its key policy rate at 4.50% as expected, noting that "the policy rate will likely be kept at that level for some time ahead". NOK saw marked immediate appreciation on the hawkish adjustment to forward guidance, with EUR/NOK falling from 11.3338 to 11.2928.

- PBoC set USD/CNY mid-point at 7.1192 vs exp. 7.2653 (prev. 7.1159).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer but comfortably within yesterday's ranges where newsflow was light on account of the US holiday, as attention turns to US IJC & Philly Fed data, as well as a few Fed speakers. Holding at the low-end of a 110-16 to 110-26+ range.

- Bunds saw a modest, but shortlived, spike higher following the SNB's 25bps cut lifting Bunds to their 132.59 session peak (vs current 132.30), and were unreactive to softer-than-expected PPI figures.

- Gilts are softer but faring marginally better than peers into the upcoming BoE policy announcement. Currently in a narrow 25 tick band which has seen Wednesday's 98.41 base breached to a current 98.32 base.

- OATs fell from 123.98 to 123.78 following the French auction, given that the smaller than usual covers for the line; however, the sale was at the top end of the amount on offer, and as such, OATs pared much of the pressure.

- Spain sells EUR 5.471bln vs exp. EUR 4.5-5.5bln 3.50% 2029 Bono Auction & 0.70% 2032, 3.45% 2034 ODE.

- France sells EUR 10.5bln vs exp. EUR 8-10.5bln 2.75% 2027, 5.50% 2029, 2.75% 2030, 0.00% 2032 OAT.

- Click for a detailed summary

COMMODITIES

- Crude is modestly firmer amid a lack of macro impulses and following yesterday's US Juneteenth market holiday. Brent Aug holds above USD 85/bbl.

- Firm trade across precious metals (ex-palladium) despite the stronger Dollar and with major macro updates light whilst risk events ahead include the BoE and US IJC. Spot gold reached a high of USD 2,345.75/oz after topping a set of resistance levels including yesterday's high (2,335/oz)

- Mixed trade across base metals with copper moving sideways despite the broader Dollar strength but amid the tentative market tone as traders await the return of US players.

- Norway's Prelim May Oil Production 1.689mln BPD (prev. 1.854mln M/M); Gas Production 10bln cu metres (prev. 10.4bln M/M)

- Click for a detailed summary

NOTABLE DATA RECAP

- German Producer Prices YY (May) -2.2% vs. Exp. -2.0% (Prev. -3.3%); MM (May) 0.0% vs. Exp. 0.3% (Prev. 0.2%)

- Swiss Trade (May) 5.811B CH (Prev. 4.316B, Rev. 4.339B); Swiss Watch exports -2.2% (prev. +4.5%) - on watch exports says "USA (-0.5%) remained at the previous year’s level, while China (-18.0%) and Hong Kong (-22.7%) recorded further major declines."

NOTABLE EUROPEAN HEADLINES

- Savanta poll for Telegraph predicts UK PM Sunak to lose his seat at the July 4th election.

- French PM Attal says Macron's Centrist Camp pledges to reduce electricity bills by 15% next winter; pledges to link pensions to inflation.

- France's National Rally President Bardella says we will bring out an amended 2024 budget this summer.

- Germany's IFO raises 2024 GDP growth forecast to +0.4% (prev. +0.2%)

- ECB's Knot says recent uptick in May inflation figures remind us disinflation is bumpy; On core inflation, not all signs are green yet; may still be transmission in the pipeline; recent shift in market shows road to inflation target is bumpy. There is strong case for using projection meetings to recalibrate policy stance. Can look through small deviations from target as long as ECB responds especially forcefully to larger deviations. Optimal policy path is broadly in line with just under three cuts in 2024, as prices into ECB projections.

- ECB's Centeno says "let's leave all options to July, and naturally September as well", adds we cannot risk undershooting when asked on where rates could go.

NOTABLE US HEADLINES

- Advanced Micro Devices (AMD) investigated claims of a data breach by 'Intelbroker,' involving sensitive information on future products, customer databases, and financial records. AMD believes a limited amount of information related to specifications used to assemble certain products was accessed on a third-party site, but does not believe the data breach will have a material impact on its business. It added that it was working with law enforcement officials to assist in their investigations.

GEOPOLITICS

MIDDLE EAST

- "Israeli officials were in Qatar this week in attempt to nail down hostage deal – report", according to Times of Israel.

- "Israeli Foreign Minister: We must stop Iran now before it is too late", according to Sky News Arabia.

- Lebanon's Hezbollah chief said nowhere in Israel will be safe from the group's attacks in case of war including targets in the Mediterranean and if war is 'imposed' on Lebanon, the group will fight with 'no rules and no ceilings', while Cyprus allowing Israel use of its airports means that it has become a part of the war and that Hezbollah will deal with it as such. In relevant news, Hezbollah announced it was targeting the positions of Israeli soldiers in Jal Al-Alam, Al-Baghdadi and Al-Raheb, according to Sky News Arabia.

- Nine Palestinians were killed in an Israeli air strike targeting a group of citizens and merchants waiting for aid in Gaza, according to medical sources cited by Reuters.

- Israeli media said the US told Israel that Qatar is close to imposing sanctions on Hamas to resume negotiations, according to Sky News Arabia.

- A meeting between US envoy Hochstein and Israeli PM Netanyahu was said to be bad and Hochstein said accusations about withholding weapons are false, according to Axios citing informed sources. Furthermore, US officials said the new dispute between Netanyahu and the Biden administration hinders US-Israeli diplomatic efforts to calm tensions on the border between Lebanon and Israel, while it was reported by Sky News Arabia that President Biden wants to meet with Israeli PM Netanyahu as soon as possible.

- US Central Command said it conducted an air strike in Syria that killed a senior Islamic State official on June 16th.

OTHER

- North Korean leader Kim said Russian President Putin's visit was a meaningful step in developing bilateral ties and protecting world peace and stability, while it was noted that each country is to provide all available military and other assistance if the other faces armed aggression under the North Korea-Russia pact, according to KCNA.

- Japanese Chief Cabinet Secretary Hayashi expressed grave concern that Russian President Putin did not rule out military technology cooperation at the summit with North Korean leader Kim, while he added Putin's comment that the UN Security Council should review North Korean sanctions is utterly unacceptable.

- NATO Secretary General Stoltenberg warned there will be consequences for China if it continues to support Russia's war economy, according to FT.

- US Secretary of State Blinken discussed with his Philippine counterpart China’s actions in the South China Sea which Manila and Washington said was escalatory, according to Reuters.

- Ukrainian drone attacks by SBU Security Agency caused fires at oil depots in Russian regions of Tambov and Adygeya, according to Kyiv intelligence source cited by Reuters

CRYPTO

- Bitcoin is modestly firmer and holds above USD 65.5k, with Ethereum also gaining and now above USD 3.5k.

- Italy is looking at adopt measures to enhance surveillance over risks surrounding crypto assets, according to Reuters sources; including large fines for those who manipulate the market.

APAC TRADE

- APAC stocks were subdued in rangebound trade amid a lack of catalysts and following the US holiday lull.

- ASX 200 was lacklustre as underperformance in defensives outweighed the gains in energy and real estate.

- Nikkei 225 retreated with weakness in the heavy industries clouding over exporter optimism.

- Hang Seng and Shanghai Comp. were lower with the former choppy amid resistance around 18,500, while the mainland was uninspired after China's Loan Prime Rates were unsurprisingly kept unchanged and the PBoC also reverted to a tepid liquidity operation.

NOTABLE ASIA-PAC HEADLINES

- PBoC will make clear it will start to use a short-term interest rate as its main policy rate after reducing the importance of the MLF rate as a policy benchmark, according to PBoC-backed Financial News citing unnamed industry people.

- Toyota (7203 JT) is to reportedly halt six production lines at five plants in Japan from Thursday evening amid parts shortages; will decide on Friday whether to resume production.

- Japanese Top Currency Diplomat Kanda says will thoroughly respond to excessive FX moves, via JiJi; no limit for FX intervention resources. FX market determined by various factors including rate gap. Needs to pay close attention to impact on FX market from central banks' policy decision. Says FX intervention announced in end of May was quiet effective in responding to excessive FX moves caused by speculators.

DATA RECAP

- New Zealand GDP QQ (Q1) 0.2% vs. Exp. 0.1% (Prev. -0.1%); YY 0.3% vs. Exp. 0.2% (Prev. -0.3%, Rev. -0.2%)