SNB cuts Policy Rate by 25bps to 1.25% (vs split expectations between a 25bps cut and a hold); reiterates SNB is willing to be active in the FX market as necessary

INFLATION

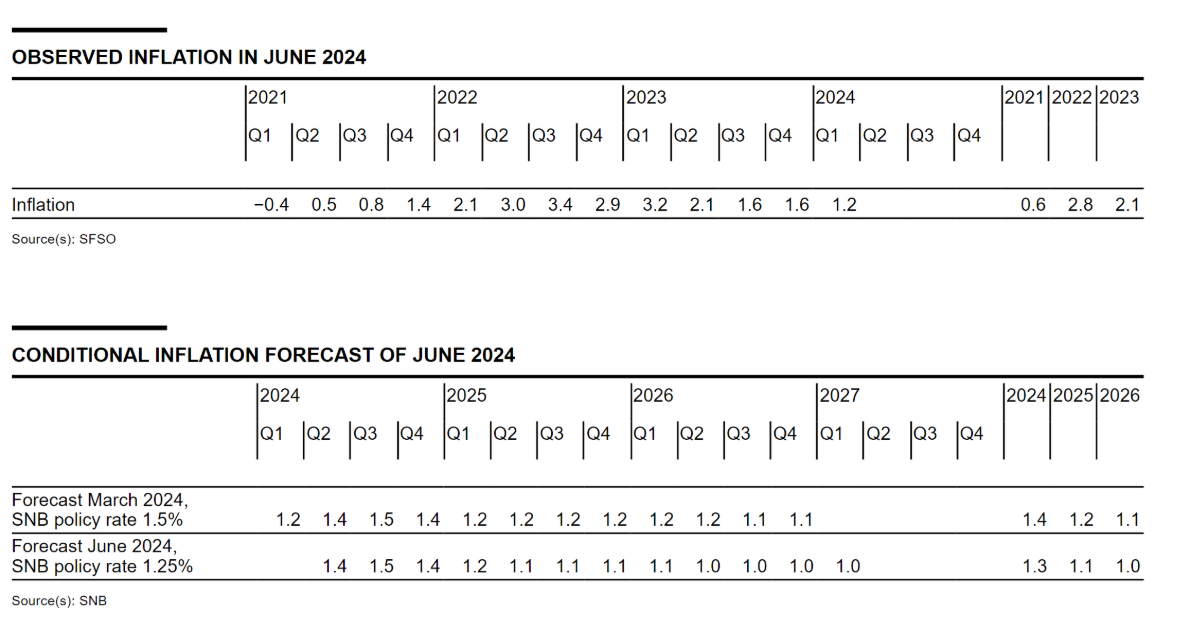

- The underlying inflationary pressure has decreased again compared to the previous quarter

- Inflation has risen slightly since the last monetary policy assessment, and stood at 1.4% in May

- Inflationary pressure abroad is likely to continue to ease gradually over the next quarters.

- The SNB will continue to monitor the development of inflation closely, and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term.

FORECASTS

Reaction details (08:37)

- The decision to cut sparked immediate upside in EUR/CHF, a particularly pronounced move given that expectations heading in were essentially a coin-flip between cutting and easing. Specifically, EUR/CHF spiked higher from 0.9486 to 0.9544

Analysis details (08:42)

- A cut that was seemingly justified by the as-expected development of inflation across Q2 thus far and the view that "the underlying inflationary pressure has decreased again compared to the previous quarter". The statement itself is quite light on specifics, as such the upcoming press conference from Jordan at 09:00BST will draw scrutiny around further easing plans (typically, they do not provide such guidance) and the CHF, particularly in light of its recent marked appreciation and an extensive speech from Jordan in the last few weeks around currency intervention and inflation.

20 Jun 2024 - 08:30- Fixed IncomeImportant- Source: SNB

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts