US Market Open: USD softer, European bourses gain and US futures wane ahead of CPI

10 Apr 2025, 11:10 by Newsquawk Desk

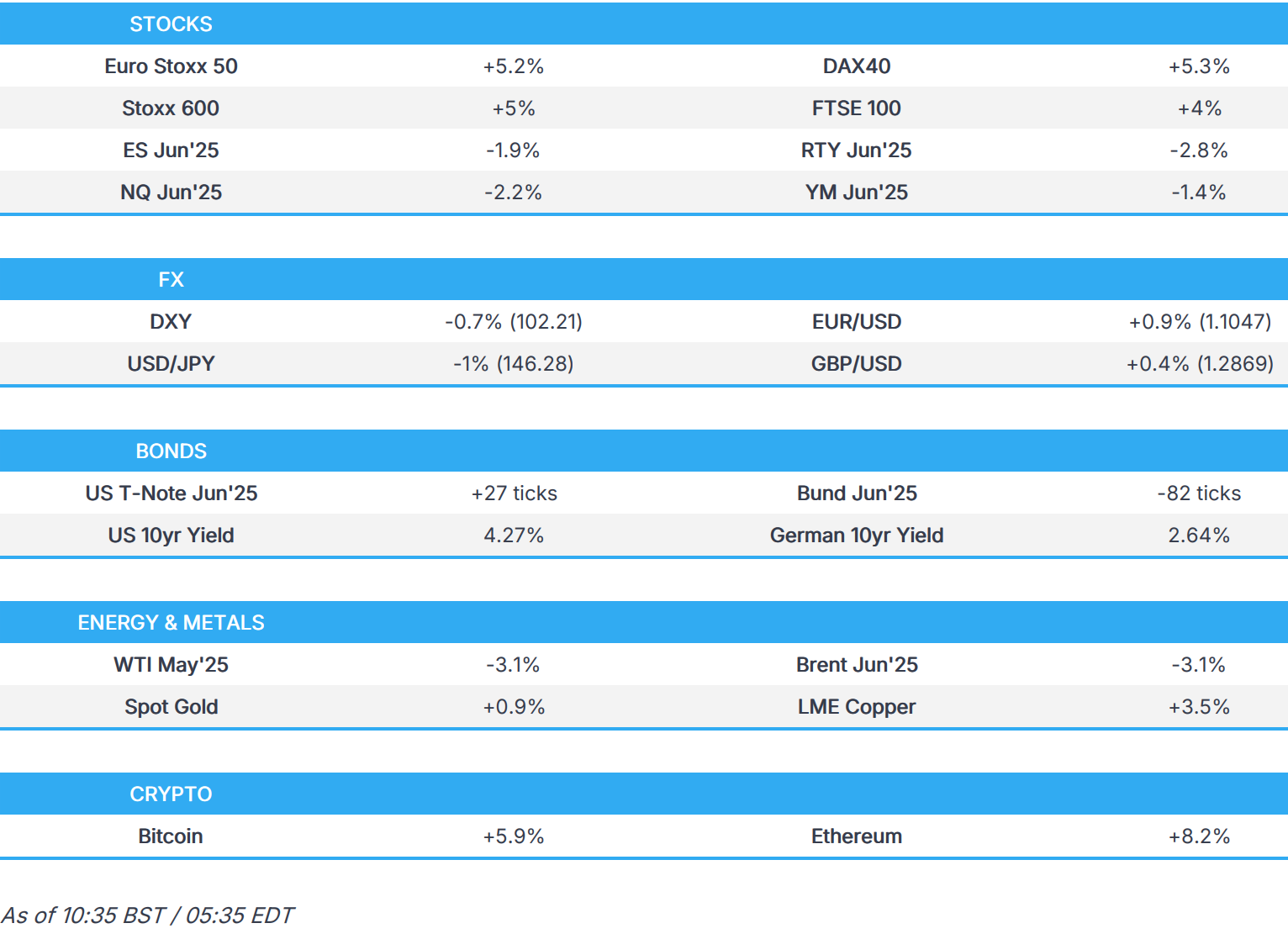

- European bourses gain as they react to Trump’s 90-day tariff pause whilst US futures wane.

- USD is softer vs. most peers as markets digest Trump's tariff walk back.

- “Beautiful” trade for USTs, Gilts bid but fading, Bunds languish in the red.

- Crude remains subdued while base metals surge and gold holds onto gains.

- Looking ahead, US CPI, US Jobless Claims, Chinese M2 Money Supply, Speakers including, BoE’s Breeden, Fed’s Logan, Bowman, Schmid, Goolsbee & Harker, SNB’s Tschudin & Moser, Supply from the US.

TRADE/TARIFFS

US

- US President Trump said he was thinking about pausing tariffs for the past few days and the decision to pause tariffs came together on Wednesday morning, while he added they don't want to hurt countries that don't need to be hurt and that sectoral tariffs are still coming. President Trump also said he thinks they will end up making a very good deal with China, as well as stated he is not concerned about escalation with China outside of the trade war and 'can't imagine' a further increase of tariffs on China.

- White House said there is no 10% baseline tariff on Canada and an official confirmed there was no change to autos, steel and aluminium tariffs, as well as no change to Canada and Mexico tariffs. Furthermore, a White House official commented that the 90-day 'pause' on tariffs does not apply to tariffs on Canada and Mexico, with the 25% tariff on non-USMCA trade with Canada and Mexico to remain in effect, except for the 10% tariff on energy and potash.

- US Commerce Secretary Lutnick expects the EU will delay its planned tariff retaliation after Trump's announcement. It was separately reported that the EU weighs buying more US gas due to Trump tariff pressure, according to FT.

APAC

- China's Foreign Ministry, on US tariffs, says taking further measures to oppose US moves it not only aimed at protecting own sovereignty, security and development interests. China does not want to fight, "but will not fear when they come our way".

- China's MOFCOM says the challenges facing foreign trade have significantly increased. Resilience of foreign trade has not diminished. "Door is open", but pressure threats & blackmail are not the correct approach China's foreign trade has the confidence to deal with various risks and challenges. Position is clear and consistent. If US insists on its own way, China will follow it to the end. China has taken and will continue to take resolute countermeasures to safeguard its sovereignty, security, and development interests.

- China's Commerce Minister said China is willing to resolve differences through consultation and negotiation, but reiterated if the US side is bent on having its own way, China will fight it to the end and noted the so-called ‘reciprocal tariffs’ of the United States are a serious infringement of the legitimate interests of all countries. China's Commerce Minister also held talks with EU trade chief Sefcovic and said that China is willing to deepen China-EU trade, investment and industrial cooperation, while he added the two sides will discuss trade transfer issues, and handle trade frictions properly.

- Shenzhen E-commerce Association representing over 3,000 Amazon (AMZN) sellers said tariffs make it very hard to survive in the US market and some sellers are still proceeding to ship goods to the US, while others are trying to find new markets. Furthermore, it stated that US tariffs are an unprecedented blow and will lead to the collapse of more small and medium-sized businesses and rapidly accelerate China’s unemployment rate.

- Japanese Economy Minister Akazawa is to visit US as early as next week to meet with US Treasury Secretary Bessent, according to NHK.

OTHER

- Canada's PM Carney said the pause on reciprocal tariffs announced by US President Trump is a welcome reprieve for the global economy, while he added that Trump's signal that the US will engage in bilateral negotiations, would likely result in a fundamental restructuring of the global trading system.

- UK and India have agreed 90% of their free trade agreement, according to sources cited by The Guardian.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +5.4%) opened on a very strong footing, as the region reacted to the latest Trump tariff updates. In terms of price action, indices have been gradually edging off best levels since the European cash open – there is no specific driver for the pressure, but potentially some profit-taking, given the hefty advances.

- European sectors are entirely in the green, benefiting from the risk tone. Banks outperform today; the sector has been hit in the past few weeks given the yield uncertainty that entered the markets due to the latest Trump tariffs. Basic Resources and Tech are both benefiting from the positive risk tone.

- US equity futures (ES -1.6%, NQ -2.2%, RTY -2.8%) are lower across the board, giving back some of the significant strength seen in the prior session which saw the SPX gain more than 9% after US President Trump announced a 90-day pause on some tariffs.

- TSMC (TSM / 2330 TT) March (TWD) Revenue 285.96bln (prev. 260.01bln M/M); Q1 Sales 839.25bln (exp. 836bln), +41.6% Y/Y.

- MediaTek (2454 TW) March sales +10.93% Y/Y at TWD 55.99bln.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. most peers after a bit of a bounce in the Greenback yesterday after US President Trump announced a 90-day pause in tariff actions and cut reciprocals to 10% for nations that asked for talks. On net, the decision by Trump has enhanced the outlook for global trade and underpinned risk sentiment in the market. However, tensions remain and reprieve for the market will likely not be granted until the pause becomes a permanent state of affairs. Furthermore, Trump has also opted to lift the tariff on China to 125%. Attention today will temporarily return to the data slate with CPI metrics. DXY is currently within Wednesday's 101.83-103.33 range.

- EUR is one of the better performers vs. the USD after a particularly choppy session yesterday. The initial reaction to the Trump tariff walk back saw the surge in the USD outweigh the potential upside for EUR with EUR having benefitted in recent sessions after being viewed as a liquid alternative to the Greenback. Since then, EUR has recouped some lost ground vs. the USD with EUR/USD back on a 1.10 handle but still south of Monday's best at 1.1094.

- USD/JPY has faded some of the prior day's gains after briefly surging above the 148.00 level owing to President Trump's 90-day reciprocal tariff pause. Hopes remain high that Japan can strike a deal with the US for a more permanent level of reprieve amid recent comments from Treasury Secretary Bessent that Japan would be top of the list when it comes to negotiations after approaching the US quickly. Elsewhere, the latest Japanese PPI data printed firmer than expected. USD/JPY is holding above the 146 mark and within Wednesday's 143.98-148.28 range.

- GBP is firmer vs. the USD but weaker vs. the EUR. Whilst GBP has benefitted from the risk-on price action triggered by President Trump's tariff walk back, ultimately the move is of little direct benefit to the UK given that it was only subject to the 10% baseline tariff and did not have reciprocal tariffs imposed on it in the first place. Cable is now back above its 200DMA at 1.2813 with a current session peak at 1.2881. The next target comes via the 1.29 mark.

- Antipodeans are both stronger vs. the USD but less so for AUD. Whilst China is a big export market for both, price action for AUD has been tempered to a greater extent. Whilst markets are celebrating some of the tariff relief yesterday, concern still lingers over the tensions between US and China as Trump further increased tariffs on the nation to 125% with immediate effect.

- PBoC set USD/CNY mid-point at 7.2092 vs exp. 7.3484 (Prev. 7.2066).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are back above the 111-00 mark after slumping to a 110-01 low on Wednesday. The trough was hit in the choppy trade that occurred in the hour after Trump’s 90-day & China update, during this period USTs moved by over a full point. The low coincided with the FOMC Minutes, however the account was largely ignored. Since, USTs have been grinding higher and holding just off a 111-08 peak and back within reach of Wednesday’s 111-20 high. Strength comes as US equity futures find themselves under modest pressure, pulling back a touch from Wednesday’s record moves and as the pause alleviates some immediate concern around the bond market. Ahead, US CPI and a 30yr auction.

- In contrast to USTs, Bunds have been lower by over 150 ticks this morning. Seemingly trading as you would expect a haven to in the context of European bourses catching up to the c. 10% gains seen stateside on Wednesday. European specifics are a little light with some confusion over whether Trump’s reciprocal cut to 10% applies to the bloc, given the EU has outlined its initial retaliation. Bunds hit a 129.02 base but have since lifted markedly off lows to a 129.84 peak. However, this still leaves them significantly lower on the session and shy of 130.75 and 130.58 from the last two sessions.

- Gilts gapped higher by just five ticks at the open given the two-way lead from the above before slipping by 10 ticks to a 90.65 trough, following the risk tone and Bunds. However, this was almost immediately retraced as Gilts spiked above 91.00 and continued to climb to a 91.51 peak. While the strength in Gilts is pronounced, the benchmark failed to breach yesterday’s 91.74 peak and has already begun to pullback from best levels despite the continued gains seen in USTs. With Gilts currently on track to end the week with losses of 300 ticks. Action underscores that the UK’s fiscal position remains precarious in the eyes of the market.

- Spain sells EUR 6.5bln vs. Exp. EUR 5.5-6.5bln 3.50% 2029, 2.55% 2032 & 3.15% 2035 Bono

- Click for a detailed summary

COMMODITIES

- Crude is on the backfoot as the complex gives back some of the significant, Trump-induced, upside seen in the prior session. Overnight, the complex was relatively rangebound near best levels - though the European morning has seen continued downward pressure. As it stands, Brent Jun'25 resides near the lower end of a USD 63.35-66.08/bbl range.

- Precious metals are mixed, with spot gold continuing recent strength whilst spot silver is a little lower. The yellow-metal is currently higher by around USD 30/oz and sits towards the midpoint of a USD 3,071.59-3,132.59/oz range.

- Base metals have been boosted by the positive risk tone. 3M LME Copper currently higher by around 3.5% and trades within a USD 8,842.57-9,061/t range.

- Peru Mining Chamber said Peru's 2025 copper production is expected to increase by 2-4%.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK RICS Housing Survey (Mar) 2.0 vs. Exp. 8.0 (Prev. 11.0)

- Italian Industrial Output YY WDA (Feb) -2.7% vs. Exp. -1.9% (Prev. -0.6%, Rev. -0.8%); Industrial Output MM SA (Feb) -0.9% vs. Exp. -1.0% (Prev. 3.2%, Rev. 2.5%)

NOTABLE EUROPEAN HEADLINES

- German Economic Institutes cut 2025 GDP growth forecast to 0.1% (prev. 0.8%); 2026 GDP growth seen at 1.3% (prev. 1.3%)

- ECB's Villeroy says US President Trump's pause decision is less bad new but still bad news elements out there in America; protectionism remains a bad element for the American economy

- UK's ONS says it aims to publish the transformed labour survey in November 2026; could come in 2027

NOTABLE US HEADLINES

- Multiple US Republicans told Punchbowl they were closely watching bond markets on Wednesday and were aware of the fears about what rising yields may have been saying about US governance, via Punchbowl.

- Fed's Hammack (2026 voter) said their desk stands ready to engage in money markets if needed but have been seeing markets work themselves out, while she added that markets are strained but functioning.

- Fed's Kashkari (2026 voter) said things have changed dramatically this afternoon and there'll be a little less of an impact on inflation if the tariff pause endures, but added uncertainty could still cause an economic downturn. Furthermore, he said tariffs can cause inflation and that the bar for cutting rates is still high.

- US President Trump signed an executive order requiring the automatic rescission of outdated regulations to unleash American innovation and energy production. Trump also signed orders on restoring maritime dominance and modernising defence acquisitions which will scrutinise programs 15% over costs or 15% behind schedule and directs DHS to enforce collection of harbour maintenance fee and other charges on foreign cargo. Furthermore, the maritime order establishes a maritime security trust fund and shipbuilding financial incentives program, as well as directs an increase in the fleet of US-flagged commercial vessels.

- US Senate confirmed Paul Atkins for the Securities and Exchange Commission chair role.

- US House Speaker Johnson scrapped the vote on the Trump budget blueprint amid conservative opposition.

GEOPOLITICS

- US President Trump reiterated Iran cannot have a nuclear weapon and said that if it requires military, "we're going to have military" with Israel to be involved with that.

- US and Russia undertook a prisoner swap early-Thursday in Abu Dhabi, via WSJ citing officials; swap was reportedly organises by the CIA Director and a senior Russian official.

- Adviser to Iran leader Khamenei says "continued threats" against Tehran could lead to expulsion of IAEA inspectors and transfer of enriched material to unknown locations, via Journalist Elster

CRYPTO

- Bitcoin has been boosted by the broader positive risk tone; BTC currently trading above USD 81k.

APAC TRADE

- APAC stocks surged following the historic rally on Wall St where the S&P 500 posted its biggest gain since 2008 after US President Trump announced a 90-day pause on reciprocal tariffs to countries aside from China.

- ASX 200 rallied with the broad-based gains led by outperformance in the tech and energy sectors, while National Australia Bank revised its RBA forecast in which it now sees an oversized 50bps cut in May and the OCR to decline to 2.6% by February next year.

- Nikkei 225 rocketed to back above the 34,000 level as Japanese exporters cheered the tariff-related relief.

- Hang Seng and Shanghai Comp joined in on the global rally but with the advances somewhat moderated in the mainland after US President Trump upped the total tariffs on China to 125% from 104% due to China's recent retaliation, while reports also reported that Chinese leaders are to meet on stimulus following the tariff shock.

NOTABLE ASIA-PAC HEADLINES

- China's MOFCOM holds Export Control Work Conference between April 9-10th, according to a statement; set to further improve China's export control system.

- Chinese leaders are to meet on stimulus following President Trump's tariff shock, according to Bloomberg.

- President Trump commented have to wait and see what happens with China on the TikTok deal and that it is still on the table.

- Japan nominated former Mitsubishi Corp. executive Kazuyuki Masu as the new BoJ board member.

- Taiwan's central bank said it will continue to hold US treasuries and sees it as ideal to have US treasuries as more than 80% of its forex reserves, while it will assess whether or not to increase this.

- Fast Retailing (9983 JT) 6mnth net profit JPY 233.57bln (+19.2%); operating profit JPY 304.22bln (18.3%), pretax profit JPY 363.7bln (+21.5%); raises FY profit guidance; NA segment expected to report a decline in business profit in H2 amid tariffs

DATA RECAP

- Chinese CPI YY (Mar) -0.1% vs. Exp. 0.0% (Prev. -0.7%)

- Chinese PPI YY (Mar) -2.5% vs. Exp. -2.3% (Prev. -2.2%)

- Japanese Corp Goods Price MM (Mar) 0.4% vs. Exp. 0.2% (Rev. 0.2%)

- Japanese Corp Goods Price YY (Mar) 4.2% vs. Exp. 3.9% (Prev. 4.0%, Rev. 4.1%)