US Market Open: Risk sentiment hit after Trump’s tariff announcement, DXY below 102 whilst EUR/USD climbs above 1.11

03 Apr 2025, 11:30 by Newsquawk Desk

- US President Trump unveiled individual reciprocal tariffs for each country which are essentially half of what countries were charging the US.

- The US is to apply a 20% tariff on imports from EU, 34% tariff on imports from China, 26% tariff on imports from India and 25% tariff on imports from South Korea.

- Trump also stated that the baseline tariff is 10% for all nations and announced 25% auto tariffs, while Canada and Mexico were not subject to reciprocal tariffs for now.

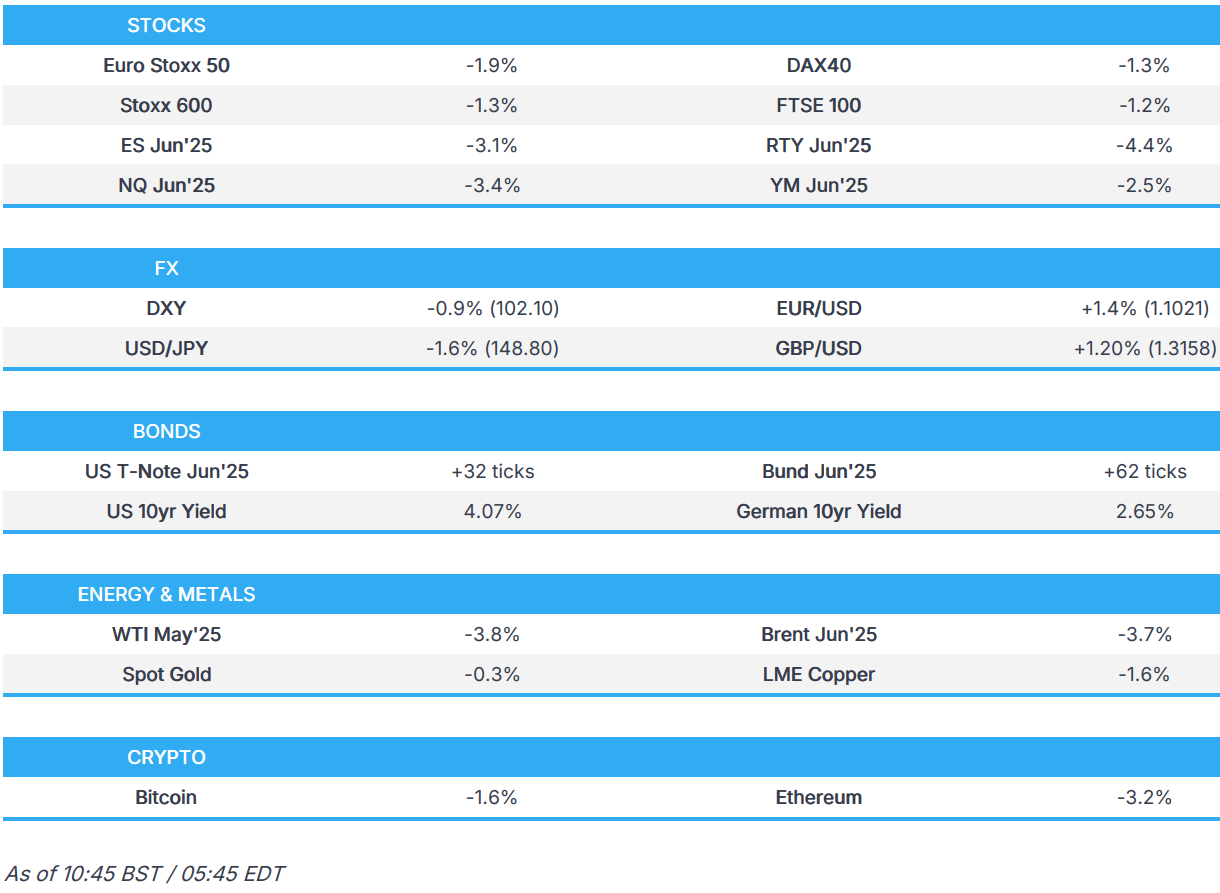

- Indices take a tumble after US tariffs slap sentiment; ES -3.5%

- DXY briefly dipped below 102.00 whilst EUR/USD sits above 1.10; havens bid.

- Yields wilt after Trump's Rose Garden speech, desks diverge on Fed implications.

- Industrial commodities sink amid growth woes and after with focus on a 54% cumulative levy on China.

- Looking ahead, US Weekly Claims, Challenger Layoffs & ISM Services, ECB Minutes, Speakers including Fed’s Cook, Jefferson, US VP Vance, US Commerce Secretary Lutnick, ECB’s Schnabel.

TARIFFS/TRADE

- US President Trump said for nations that treat the US badly, they will calculate the total rate charged, including non-monetary barriers and will charge them half of that rate and therefore won't be reciprocal. Accordingly, he announced the US is to apply a 20% tariff on imports from EU, 34% tariff on imports from China, 26% tariff on imports from India, 25% tariff on imports from South Korea, 10% tariff on imports from UK and 24% tariff on imports from Japan. Trump also stated that the baseline tariff is 10% and announced 25% auto tariffs, while Canada and Mexico were not subject to reciprocal tariffs for now.

- Click for a full Newsquawk Tariff Analysis incl. a tabled tariff breakdown.

US MEASURES

- The announcement, alongside the 25% auto tariffs, included 10% base tariffs whilst "worst offending" countries received country-specific tariffs, with China's total tariffs (including Feb + Mar levies) at 54%. The EU sits with 20% but has vowed a response. The UK fared better with the 10% base rate applied.

- US President Trump's tariff order exempts gold, according to Reuters citing a White House fact sheet. It was also reported that Trump signed an order that aims to close "de minimus" loophole with a further amendment to duties addressing the synthetic opioid supply chain in China as applied to low-value imports. This follows earlier reports that the administration was considering revocation of tariff exemptions for cheap shipments from China, according to Reuters citing a source. CBS also reported that President Trump was considering announcing yesterday a plan for what he calls the “External Revenue Service" and is aiming to again charge tariffs on low-value merchandise shipped from China to individual US consumers, while it was noted that a US loophole had allowed duty-free shipments of Chinese goods worth less than USD 800.

- US senior official said the baseline tariffs rate will go into effect on April 5th at 00:01EDT and reciprocal tariffs will go into effect on April 9th at 00:01EDT, while President Trump’s automobile tariffs took effect 00:01EDT on April 3rd, according to the Federal Register.

US COMMENTARY/DESK VIEWS

- US Treasury Secretary Bessent said will have to wait and see on negotiations of tariffs and advised countries not to panic or retaliate, while he added the latest tariffs are at the high end of the number if there is no retaliation.

- White House senior official said US President Trump will respond to retaliation by other countries to ensure that the emergency order is not undermined.

- US Senate voted 51 to 48 to approve a bill that would terminate Trump's new tariffs on Canadian imports, although a House approval is seen as unlikely.

- Barclays says it sees a "high risk" of the US economy falling into a recession this year.

- Goldman Sachs says the latest US tariffs would further drag China's GDP growth by around 1 percentage point, taking the total drag to 1.7 percentage points

- JPMorgan downgrades emerging market currencies to underweight after US President Trump's tariffs "exceeded the worst case scenario".

- UBS Global Wealth Management says it expects the Fed to deliver 75-100bps of rate cuts over the remainder of the year; notes if tariffs are reduced by year end, near term shock is likely to drive a near term slowdown in the US economy.

- Morgan Stanley no longer expects the Fed to cut rates in June 2025, due to "tariff-induced inflation". Now expect the Fed to remain on hold until March 2026. MS said that if tariffs persist, US economic growth may suffer, with downside risks increasing. Effective tariffs could reach 22% versus 3% at the year's start, raising inflation risks and keeping the Fed from cutting rates in June. That said, it notes that legal challenges under IEEPA remain uncertain. MS recommends positioning for lower Treasury yields and a stronger JPY.

EUROPEAN OFFICIALS/FIRMS

- UK Business Secretary said their approach to Trump's tariff announcement is to remain 'calm and committed' to doing economic deals with the US, while they have a range of tools at their disposal and will not hesitate to act.

- European Commission President von der Leyen said US tariffs are a major blow to the world economy and the consequences will be dire for millions of people around the world. Von der Leyen added that they are prepared to respond and are preparing further countermeasures on US tariffs if negotiations fail.

- Italian PM Meloni said US tariffs are wrong and she hopes to work with the US and Europe to avoid a trade war that would weaken the West.

- ECB's Stournaras says US tariffs are no obstacle to a rate cut this month; tariffs will hit growth, inflation path unchanged.

- ECB's de Guindos says "uncertainty means we need to be extremely prudent when determining the appropriate stance".

- SNB's Tschudin says tariffs on Switzerland are "surprisingly high"; first reaction was visible in the US; the FX reaction is hard to predict High quality could help sustain US demand in Swiss products SNB's clear job is price stability in Switzerland.

- Hapag-Lloyd (HLAG GY) says there is increasing uncertainty due to imposed US tariffs and potential reciprocal tariffs from various nations. Tariffs could impact demand, cargo flows and costs - as such, may have to adj. the service network.

OTHER NATIONS

- Chinese Commerce Ministry says both sides (China and EU) have agreed to resume discussions on a minimum price commitment on Chinese NEVs as soon as possible.

- Canadian PM Carney said US President Trump's tariff announcement has preserved a number of important elements of their relationship, but said they are going to fight these tariffs with countermeasures and will act with purpose and with force, while he added Canada will respond to US tariffs on Thursday.

- China's Commerce Ministry said China firmly opposes US reciprocal tariffs and will resolutely take countermeasures to safeguard its rights and interests, while it urged the US to immediately cancel unilateral tariff measures and properly resolve differences with trading partners through equal dialogue.

- Australian PM Albanese said US tariffs are totally unwarranted and Australia will not impose reciprocal tariffs, while they will continue to make the case for these unjustified tariffs to be removed from exporters. Albanese added the free trade agreement with the US does have dispute resolution mechanisms and they want this to be resolved in a way that avoids those contests.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -1.2%) are entirely and markedly in the red in the fallout of US President Trump’s “Liberation Day”, where the reciprocal tariff announcement was viewed as worse than feared. Wedbush writes that the levies are a “worst case scenario” for Wall Street.

- European sectors are mostly lower and holds a clear negative bias, in-fitting with the risk tone. Healthcare is modestly in the green owing to the defensive risk tone and as the pharmaceutical industry avoided reciprocal tariffs (for now). Consumer Products is underperforming today, given the losses in the Luxury sector as trader’s brace themselves for the hefty tariffs set on China.

- US equity futures are significantly in the red as traders digest the latest reciprocal tariff announcements from US President Trump. Big Tech are moving lower in pre-market trade with Apple (-6%), Amazon (-4.5%), NVIDIA (-3.3%), Tesla (-3.7%) all down. While firms exposed to those hit hard by reciprocal measures are lower, e.g. Nike (-8.5%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- A dire day for the Dollar as global participants react to US President Trump's Liberation Day announcement, amid concerns over reciprocal tariffs weighing on US growth. Focus today will likely be on US Commerce Secretary Lutnick who is due to make the media rounds on CNBC (at 13:00 BST) and Bloomberg TV (at 13:30 BST); stateside data include weekly jobless claims, ISM Services index, although they will likely be overshadowed by the tariff theme. DXY hit a new low for the year at 101.95 (vs intraday high 103.38) - with the 4th October 2024 low (101.81) the next level to the downside.

- EUR is benefitting from the Dollar weakness as opposed to EUR strength in the aftermath of the Trump tariffs. Traders brace for retaliation from the bloc; European Commission President Von der Leyen said the EU is preparing for further countermeasures to protect its interests and businesses if negotiations fail. EUR/USD sits just above 1.10 in a 1.0806-1.1047 range.

- GBP is a beneficiary of the softer Dollar alongside the relatively better tariffs imposed on the UK vs peers. Revisions lower to Services and Composite PMIs were overlooked. GBP/USD hit a new YTD high at 1.3183 (vs low 1.2968), with the next upside level being the 3rd October 2024 high (1.3269).

- Haven FX sit as the top performer amid the flight to quality from the sizeable risk aversion sparked by US tariffs. USD/JPY slipped from a USD 149.24 peak to a current low at 146.32 as it eyes the 4th October 2024 trough (145.91).

- Antipodeans are gaining on the back of the USD weakness but to lesser extents given their high-beta properties, the broader risk aversion, and potential demand implications from China given the US tariffs.

- PBoC set USD/CNY mid-point at 7.1889 vs exp. 7.2532 (Prev. 7.1793).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are bid given the US tariff announcement where the initial relief on reporting around a 10% baseline gave way to marked risk-off as the reciprocal levels were announced. In brief the average US effective tariff rate is (once the measures are implemented) around 23% from around 10%. Further insight into Trump’s tariffs and how the administration feels about the initial comments/responses to the measures from various nations may be provided VP Vance and Commerce Secretary Lutnick who are due to speak from around 13:00BST. US Challenger Layoffs, Jobless Claims and ISM Services are scheduled.

- Hit a 112-24+ peak in the hour after Trump’s speech, at best the benchmark posted gains of around 40 ticks and the 10yr yield hit a 4.04% low, a base which takes us back to November 2024 when the yield was below the 4.0% handle.

- Bunds peaked at 129.94 after Trump’s tariff announcement. A high that takes Bunds around half of the way back to the pre-fiscal change levels. With, as a function of the move lower on fiscal reform, the next chronological resistance point someway off at 132.04. While Bunds peaked at 129.94 and are in the green, they have been pulling back gradually throughout the morning. A pullback which is likely a function of European bourses picking up off worst levels in the morning, though still well into the red, and potentially as the knee-jerk move on growth concerns/general risk is tempered by inflationary concerns.

- Gilts are firmer albeit to a lesser degree vs peers. UK benefits as a function of leaving the EU, with the nation subject to just the 10% baseline tariff, for now at least. Nonetheless, the benchmark gapped higher by 58 ticks and then extended by another 41 to a 93.14 peak. Stopping just shy of a cluster between 93.33-79 from early-March.

- Spain sells EUR 6.24bln vs exp. EUR 5.5-6.5bln 2.40% 2028, 3.10% 2031 & 3.90% 2039 Bono and EUR 0.6bln vs exp. EUR 0.25-0.75bln 1.00% 2030 I/L.

- France sells EUR 12bln vs exp. EUR 10-12bln 3.50% 2033, 3.20% 2035, 3.75% 2056 OAT.

- UK sells GBP 3.25bln 4.375% 2040 Gilt: b/c 2.58x (prev. 2.89x), tail 0.9bps (prev. 0.6bps), average yield 4.917% (prev. 4.836%).

- Click for a detailed summary

COMMODITIES

- Crude is significantly lower, with Brent Jun'25 down by around USD 2.50/bbl, as the complex is swept away by the negative risk-tone following US President Trump's tariff announcement. Pressure since the European morning has continued and the benchmarks currently reside near lows.

- Spot gold climbed to a fresh record high of USD 3,167.74/oz in reaction to the tariff turmoil owning to its haven status. The European morning thus far has seen a slight unwind of that upside, and is now off by around USD 10.50/oz in a USD 3,116.55-3,167.74/oz range. As a reminder, US President Trump's tariff order exempts gold, according to Reuters citing a White House fact sheet.

- Base metals are entirely in the red, in-fitting with the risk tone. On the trade front, Trump excluded steel, aluminium, and gold from reciprocal tariffs, providing some relief to domestic buyers who are already paying 25% duties on these key metals used in industries like automobiles and appliances.

- Kazakhstan supplied 150k/T of oil to Germany via the Druzhba pipeline in March (100k/T in February), via Ifx.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss CPI YY (Mar) 0.3% vs. Exp. 0.5% (Prev. 0.3%); CPI MM (Mar) 0.0% vs. Exp. 0.1% (Prev. 0.6%)

- EU Producer Prices YY (Feb) 3.0% vs. Exp. 3.0% (Prev. 1.8%, Rev. 1.7%); Producer Prices MM (Feb) 0.2% vs. Exp. 0.1% (Prev. 0.8%, Rev. 0.7%)

- EU HCOB Services Final PMI (Mar) 51.0 vs. Exp. 50.4 (Prev. 50.4); HCOB Composite Final PMI (Mar) 50.9 vs. Exp. 50.4 (Prev. 50.4)

- German HCOB Services PMI (Mar) 50.9 vs. Exp. 50.2 (Prev. 50.2); HCOB Composite Final PMI (Mar) 51.3 vs. Exp. 50.9 (Prev. 50.9)

- Italian HCOB Composite PMI (Mar) 50.5 (Prev. 51.9); HCOB Services PMI (Mar) 52.0 vs. Exp. 52.5 (Prev. 53)

- French HCOB Services PMI (Mar) 47.9 vs. Exp. 46.6 (Prev. 46.6); HCOB Composite PMI (Mar) 48 vs. Exp. 47 (Prev. 47)

- Spanish HCOB Services PMI (Mar) 54.7 vs. Exp. 55.5 (Prev. 56.2)

- UK S&P Global Services PMI (Mar) 52.5 vs. Exp. 53.2 (Prev. 53.2); S&P Global Composite PMI (Mar) 51.5 vs. Exp. 52 (Prev. 52)

NOTABLE EUROPEAN HEADLINES

- BoE Decision Maker Panel survey: firms 1-year ahead own price inflation expected at 3.9% (prev. 4.0%) in the three-month period to March.

NOTABLE US HEADLINES

- BofA institute says week-to-March 29th total card spending +0.1% Y/Y (vs prior week +1.5%).

- Fed Governor Kugler said the latest data indicates progress towards the 2% inflation target may have stalled and she supports keeping the current policy rate in place as long as upside risks to inflation continue, given stable activity and employment. Furthermore, she stated that inflation expectations have risen and upcoming policy changes hold upside risk, as well as noted that there may be reasons why tariffs have more prolonged effects.

- US President Trump reiterated that tax cuts will be passed in one big beautiful bill in Congress, while he added they need to get permanent tax cuts.

- US President Trump posted on Truth Social that "Speaker of the House Mike Johnson and Senate Majority Leader John Thune have been working tirelessly on taking the next step to pass the plan for our ONE, BIG, BEAUTIFUL BILL, as it is known, as well as getting us closer to the Debt Extension necessary to continue our great work. The Senate Budget plan gives us the tools that we need to get our shared priorities done, including certain PERMANENT Tax Cuts, Spending Cuts, Energy, Historic Investments in Defense, Border, and much more. We are going to cut Spending, and right-size the Budget back to where it should be. The Senate Plan has my Complete and Total Support. Likewise, the House is working along the same lines. Every Republican, House and Senate, must UNIFY. We need to pass it IMMEDIATELY!"

GEOPOLITICS

- US Treasury Secretary Bessent said the Ukraine deal is coming up and a team from Ukraine may be coming over as soon as this week, while he added that they could see more Iran sanctions.

CRYPTO

- Bitcoin is on the backfoot and holds around USD 83.5k with the complex swept away by the risk tone.

APAC TRADE

- APAC stocks mostly tumbled in the aftermath of the 'Liberation Day' tariff announcements in which US President Trump unveiled reciprocal tariffs which were mostly set at around half of the rate that individual countries were charging the US with the actual baseline at 10%, while he also announced 25% auto tariffs.

- ASX 200 declined with the index dragged lower by underperformance in tech and energy, while there were comments from Australian PM Albanese who said they will not impose reciprocal tariffs and will continue to make the case for these unjustified tariffs to be removed from exporters.

- Nikkei 225 suffered heavy losses with the index firmly beneath the 35,000 level after the US announced 24% tariffs for Japan, while notable losses were seen in the financial sector and automakers were also hit by the 25% auto tariffs.

- Hang Seng and Shanghai Comp were pressured after US President Trump imposed a 34% tariff on China, on top of the existing 20% tariffs, for a total 54% tariff rate which saw the Hong Kong benchmark conform to the broad selling in the Asia-Pac region although the mainland initially showed some resilience with downside somewhat cushioned after stronger-than-expected Chinese Caixin Services PMI data.

DATA RECAP

- Chinese Caixin Services PMI (Mar) 51.9 vs. Exp. 51.5 (Prev. 51.4); Composite PMI (Mar) 51.8 (Prev. 51.5)

- Australian Balance on Goods (AUD)(Feb) 2.97B vs. Exp. 5.40B (Prev. 5.62B)

- Australian Goods/Services Exports (Feb) -3.60% (Prev. 1.30%); Imports (Feb) 1.60% (Prev. -0.30%)

Notable APAC News

- Japanese RENGO trade union third-round data: average wage increase 5.42% for fiscal 2025 vs. 5.40% in the second-round.