US Market Open: US futures are mixed, Bonds edge lower whilst XAU gains; ECB Lagarde due

18 Nov 2024, 11:15 by Newsquawk Desk

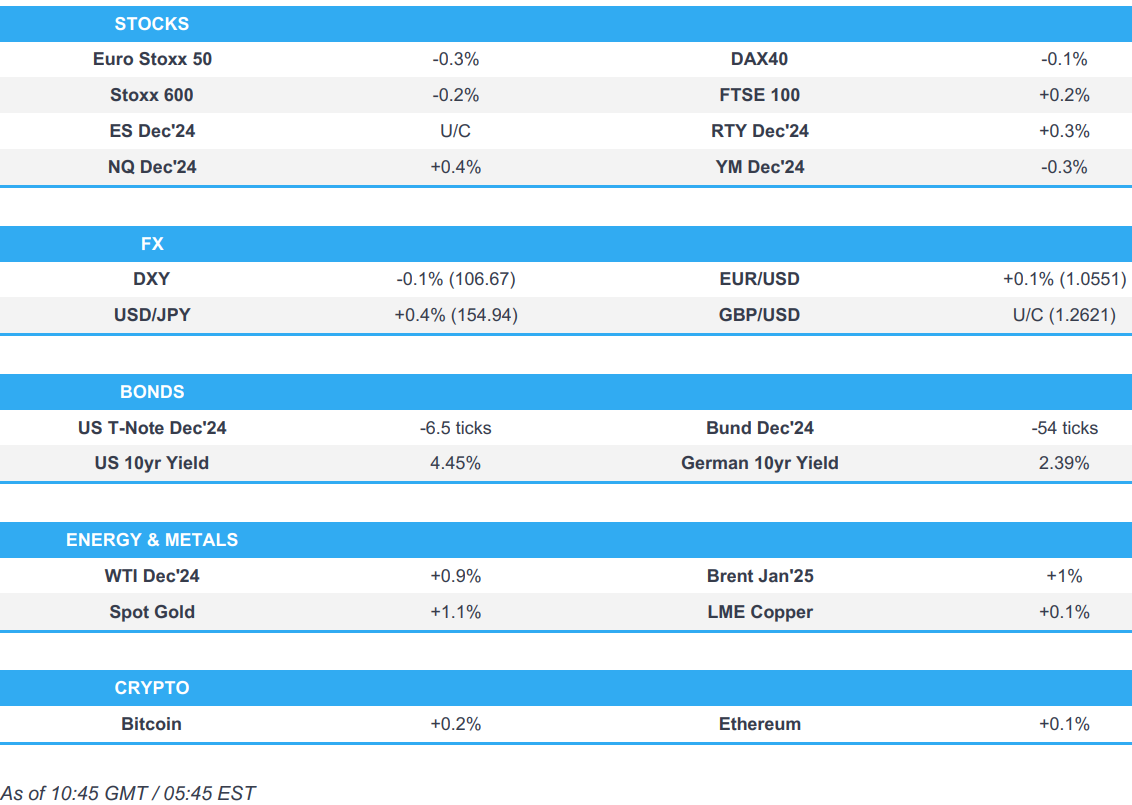

- European bourses are generally on the backfoot, US futures are mixed.

- Dollar is incrementally lower, JPY underperforms after BoJ Governor Ueda continued to signal a lack of urgency to hike rates.

- USTs are marginally lower whilst Bunds extend losses and slips below 132.00.

- WTI & Brent are firmer in what has been a choppy session, XAU eyes USD 2.6k to the upside.

- Looking ahead, ECB’s Lagarde, Lane & Fed’s Goolsbee.

EUROPEAN TRADE

EQUITIES

- European bourses began the session on a mixed/flat footing, and initially lacked any firm direction. Soon after the cash open, sentiment improved, however, this upside quickly dissipated to show a mostly negative picture across Europe.

- European sectors hold a strong negative bias, with only a couple of sectors in positive territory. Basic Resources tops the pile, benefiting from strength in underlying metals prices. Real Estate & Tech are found at the foot of the pile, hampered by the relatively high yield environment.

- US Equity Futures are mixed, with slight outperformance in the tech-heavy NQ, attempting to pare back some of the hefty losses in the prior session.

- Barclays cuts Europoean Healthcare to underweight, Utilities to Market weight, Luxury, Insurance to Overweight

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has kicked the week off on a contained footing with not much to shift the macro dial over the weekend. DXY is currently caged within Friday's 106.33-96 range. If upside resumes, last week's YTD peak sits at 107.06.

- EUR/USD currently sits towards the upper end of Friday's 1.0516-93 range as the USD gives back some of its recent gains. EZ-specific newsflow has been light, but ECB's Lagarde and Lane are due later.

- JPY is the marginal laggard vs. the USD across the majors after BoJ Governor Ueda continued to signal a lack of urgency to hike rates but reiterated the BoJ will continue to adjust monetary support if the economy and prices move in line with their forecasts. He later warned they could be forced to hike rapidly if they don't adjust the degree of monetary support appropriately. USD/JPY currently sits towards the bottom end of Friday's 153.85-156.74 range.

- GBP is steady vs. the USD but in close proximity to Friday's multi-month low at 1.2597 that was triggered by a soft outturn for Q3 UK GDP. Docket for today is light, but inflation/PMI data is due later in the week.

- Antipodeans are both marginally softer vs. the USD with not much in the way of fresh drivers to instigate price action. Both currencies remain sensitive to the fallout from the US election and the tone that Trump will strike towards China.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Minor losses for the Dec'24 UST with prices currently in consolidation mode after the election. The Dec'24 UST contract is currently within Friday's 108.30-109.23+ range; the lower bound of which was a contract low. The US yield curve is marginally bull-steepening with the 2s10s wider by around 14bps.

- Bunds are lower in a slight unwind of some of last week's upside. Macro focus around the Eurozone remains on the growth outlook with ECB's de Guindos this morning remarking that this is where the Bank is currently focusing. The Dec'24 Bund contract is currently lingering below the 132 mark, having breached the low on Friday to a current trough of 131.62. ECB President Lagarde & Lane are due to speak later.

- Gilts are marginally softer, in-fitting with price action in global peers. The macro narrative towards the back-end of last week was characterised by the soft outturn for Q3 UK GDP. The Dec'24 Gilt contract is currently capped by resistance at 94.00 which coincides with Friday's peak. The UK 10yr yield currently lingers just above Friday's trough at 4.46%.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are firmer in what has been a choppy session for the complex thus far, having initially swung between gains and losses since the cash open. Brent’Jan 25 resides towards the upper end of a USD 70.70-71.80/bbl range.

- Precious metals are on a firmer footing, having rallied overnight alongside strength in silver, but without a clear catalyst driving the upside. XAU currently holds towards the upper end of a USD 2,566-597/oz range.

- Base metals hold a positive bias, continuing the price action seen overnight, where the complex benefited from a generally positive risk sentiment in APAC trade overnight.

- US President Biden’s administration plans on releasing a study on LNG environmental impacts and hopes to finalise a clean fuel bill before the January 20th Inauguration Day, according to the White House.

- Goldman Sachs sees Brent crude trading USD 70-85/bbl but could climb on harsher Trump sanctions on Iran, while it reiterated its gold target of USD 3,000/oz by December 2025.

- Russia's Ilsky oil refinery (300k bpd) has asked government for help, mainly over facility modernization and high interest rates.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Rightmove House Price Index MM (Nov) -1.4% (Prev. 0.3%); Rightmove House Price Index YY (Nov) 1.2% (Prev. 1.0%)

- EU Eurostat Trade NSA, Eur (Sep) 12.5B EU (Prev. 4.6B EU)

NOTABLE EUROPEAN HEADLINES

- ECB's Nagel says global integration would have to decline substantially to prompt a notable increase in inflationary pressures. Proposed tariffs by US President-elect Trump would upend international trade but only have a "minor impact" on inflation.

- ECB's de Guindos says balance of risks have shifted to growth from inflation.

- ECB's Makhlouf does not think the job is done on taming inflation; services inflation is higher than he wants. Adds that he does not feel the need to rush, at the moment. Says ECB must think like a long-distance runner. Says prudence and caution have a premium to them, ECB should continue in that manner

- UK government confirmed the spread of bird flu in commercial poultry at premises near Rosudgeon, St. Ives, Cornwall, according to Reuters.

NOTABLE US HEADLINES

- Fed's Barkin (2024 voter) said on Friday that he always expected core PCE would stay in the ‘high twos’ in H2 and is still seeing progress on inflation, while he added that pricing power is getting more limited, according to a Yahoo Finance interview. Furthermore, Barkin said he hopes and expects that inflation numbers will come down in Q1, as well as noted that they are a long way from knowing what will happen with tariffs and it is hard to know the impact.

- Fed’s Collins (2025 voter) said on Friday that there is not a moment where policy forward guidance is a good idea and Fed policy is well positioned for what lies ahead in the economy, while she added it is too soon to say the impact of the election on the economic policy and the Fed needs to see data before deciding on the December FOMC. Furthermore, Collins said they do not need the labour market to soften further and they are not seeing signs of fresh inflation pressures, while she added the data suggests more room to run on the balance sheet rundown, as well as noted that monetary policy is restrictive and will need to ease over time.

- Fed's Goolsbee (2025 voter) said on Friday that he does not like tying the Fed's hands and there is still more data to come when asked about a December rate cut or pause, while he added that markets react immediately and in most extreme terms. Goolsbee also said the Fed needs to focus on longer trends and he will be looking at rate cuts along the lines of the September Fed policymaker projections.

- US President-elect Trump picked Chris Wright to be Energy Secretary and named Commissioner Brendan Carr as the Chairman of the FCC. It was also reported that Trump is considering Kevin Warsh and Marc Rowan for US Treasury Secretary, according to NYT, while Trump was reportedly seeking a pledge that his Treasury Secretary will enact tough tariffs, according to FT.

GEOPOLITICS

MIDDLE EAST

- A Lebanese official says "We are open to the content of the draft US proposal and deal with it positively", via Al Jazeera.

- Israel conducted a strike on Beirut which killed Hezbollah’s media relations chief Mohammad Afif, according to security sources cited by Reuters.

- Tens were killed in an Israeli strike on a residential building in northern Gaza’s Beit Lahiya, according to Reuters.

- Iranian Foreign Minister Araqchi said he strongly denies the reported meeting between Iran’s envoy and Elon Musk, while he added if the IAEA Board of Governors passes a resolution against Iran, Tehran will take reciprocal action and implement new measures in its nuclear program.

- Iran reportedly keeps the door open to talks with US President-elect Trump and its Deputy Foreign Minister noted that Tehran favours negotiations but will not yield to maximum pressure strategy, according to FT.

OTHER

- US President Biden’s administration lifted restrictions on Ukraine using US-made weapons to strike deep inside Russia, according to sources familiar with the decision cited by Reuters. NYT also reported that President Biden allowed Ukraine to strike Russia with long-range US missiles, while Ukrainian President Zelensky said missiles speak for themselves and such things are not announced regarding long-range strikes.

- Russia's Kremlin on reported decision by Biden Administration to allow Ukraine to strike deep into Russia says these reports did not have official sources; if such a decision has been made by the US, this will usher in a new round of tensions. It would mean a new situation with the involvement of the US in the Ukraine conflict. If Western weapons are fired deep into Russia, this will not be Ukraine doing the targeting, but those countries which gave permission.

- US President Biden's decision to allow Ukraine to use long-range missiles to hit the Russian depth was communicated to Kyiv about 3 days ago, while the motive behind the decision is to deter North Korea from sending more troops to Russia, according to a source cited by Axios.

- Russian upper house’s international affairs committee deputy head Dzhabarov said the decision to allow Ukraine to strike inside of Russia with US missiles is an unprecedented step that could lead to World War Three and will receive a swift response, according to TASS. Furthermore, it was also reported that a senior Russian senator said the US decision to allow Kyiv to strike Russia with long-range weapons represents escalation and could result in the Ukrainian statehood being in complete ruins by the morning.

- Ukrainian President Zelensky said Russia launched around 120 missiles and 90 drones in a massive combined air strike on Ukraine’s energy infrastructure early on Sunday morning, while Ukraine’s largest private power company said the Russian air strike damaged thermal power stations, according to Reuters. Furthermore, Russia’s Defence Ministry said Russian forces launched a massive strike on Ukraine’s critical energy infrastructure facilities that support the defence industry and military enterprises, according to RIA.

- Russian forces struck critical infrastructure in Ukraine’s Zaporizhzhia region and western Ukraine’s Rivne region, while Russia’s missile attack damaged energy infrastructure in Ukraine’s north-western Volyn region.

- Poland activated aircraft to ensure airspace security after Russia launched a missile attack on Ukraine.

- French President Macron said the massive Russian attack on Ukraine shows Russian President Putin does not want peace and they must continue helping Ukraine defend itself.

- Australia’s Defence Minister Marles said Japanese troops are to have regular deployment in Australia and focus on cooperation between Australian and US Marines.

- North Korean leader Kim urged the military to improve capabilities for fighting an actual war, while he added that threats by the US and allies brought tensions and calls for war preparations, according to KCNA.

- North Korea said Russia’s delegation led by the national resources minister arrived in North Korea, according to KCNA. It was separately reported that North Korea may end up sending 100k troops to Russian President Putin to support Russia’s war in Ukraine although it was also stated that the move is not imminent and troops could rotate in batches, according to Bloomberg.

CRYPTO

- Bitcoin holds just above USD 91k, after slipping below USD 90k in the prior day.

APAC TRADE

- APAC stocks began the week with a mildly positive following last Friday's tech-led declines on Wall St which were triggered by hot US data and with quiet newsflow from over the weekend aside from Russian geopolitical-related headlines.

- ASX 200 was contained as losses in tech, healthcare and financials offset gains in utilities, commodities and consumer stocks.

- Nikkei 225 declined at the open after last Friday's currency strength and with a surprise contraction in Machinery Orders, although was off today's worst level with some mild support seen as the yen weakened following BoJ Governor Ueda's comments.

- Hang Seng and Shanghai Comp traded higher amid a focus on recent earnings releases and after the PBoC continued its liquidity efforts, while Chinese President Xi said that China is 'ready to work' with Trump during a meeting with US President Biden.

NOTABLE ASIA-PAC HEADLINES

- RBA's Kent says most borrowers have buffers to help manage higher interest rates; Worth reviewing the RBA's approach to forward guidance from time to time; forward guidance in Australia might be less useful than in the US

- US President Biden told Chinese President Xi that keeping open lines of leader-to-leader communication is vital through transition and beyond, while they agreed that AI will not ever take control of nuclear weapons and Biden raised concerns about unfair, non-market economic practices by China and issues in the South China Sea.

- Chinese President Xi told US President Biden that China’s commitment to a stable, healthy and sustainable development of China-US relations remains unchanged and China is willing to maintain dialogue, expand cooperation and manage differences with the US government in an effort to realise a smooth transition period in China-US relations. Xi also told Biden that common interests between their countries are expanding rather than shrinking and that containing China is unwise, unacceptable and bound to fail. Furthermore, Xi said the China-US relationship would make considerable progress when the two countries treat each other as a partner and a friend and that he is ready to work with Donald Trump to manage ties.

- Chinese President Xi told US President Biden the Taiwan question, democracy and human rights, the system, and rights to development are China’s four red lines which allow no challenge, while Xi said the US should refrain from making any moves that have a chilling effect and told Biden to deal with the Taiwan issue with “extreme caution”, according to state media.

- China’s Commerce Minister met with the Canadian Minister for International Trade in Peru and discussed the tariff situation.

- China's securities regulator said it is to improve the coordination mechanism for overseas listing supervision and regulation, while it will expand the scope of eligible stocks under the stock connect.

- China and the EU are said to have reached a “technical consensus” in talks regarding tariffs the bloc applied to Chinese electrical vehicles, according to a Weibo account affiliated with the state-run China Central Television cited by Automotive News.

- BoJ Governor Ueda said they will continue to raise the policy rate and adjust the degree of monetary support if the economy and prices move in line with their forecasts, while he also stated there is no change to BoJ's stance to underpin economic activity and the timing of rate hike will depend on economic, price, and financial outlook. Ueda said they will make a policy decision by updating the economic and price outlook with data and information available at the time, while he noted that gradually adjusting the degree of monetary support will contribute to durably achieving the price target through sustained economic growth and they must be vigilant to various risks including overseas and market developments. Furthermore, Ueda said there are numerous factors they want to check including on US economy but won't necessarily wait until there is clarity for all of them and if they don't adjust the degree of monetary support appropriately, they could be forced to hike rates rapidly.

- Xiaomi (1810 HK) Q3 adj net income RMB 6.3bln (exp. 5.9bln); Q3 revenue RMB 92.51bln (exp. 90.28bln)

DATA RECAP

- Japanese Machinery Orders MM (Sep) -0.7% vs. Exp. 1.9% (Prev. -1.9%)

- Japanese Machinery Orders YY (Sep) -4.8% vs. Exp. 2.2% (Prev. -3.4%)

- Singapore Non-Oil Exports MM (Oct) -7.4% vs. Exp. 2.3% (Prev. 1.1%)

- Singapore Non-Oil Exports YY (Oct) -4.6% vs. Exp. 4.0% (Prev. 2.7%)