US Market Open: Strong TSMC results helps to lift the NQ, USD firmer as attention turns to the ECB and US data

18 Jul 2024, 11:26 by Newsquawk Desk

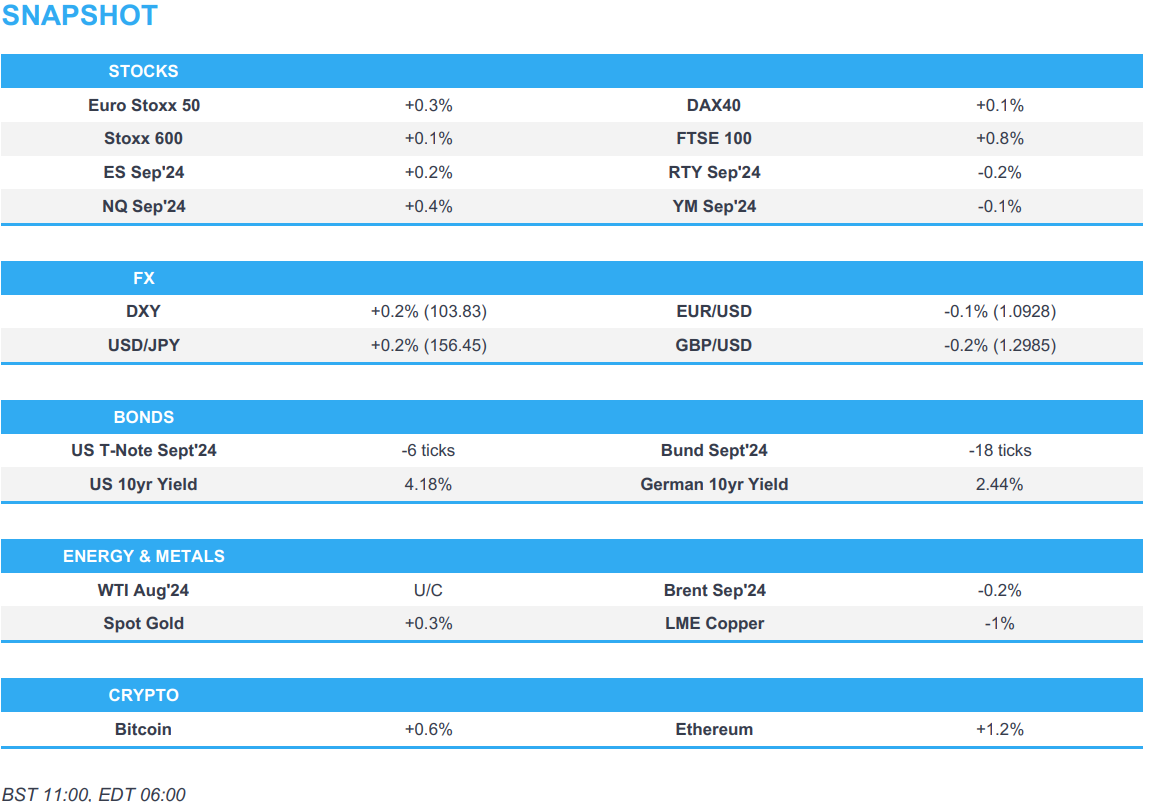

- European equities are choppy, Tech is lower in Europe and fails to benefit from strong TSMC earnings & guidance, but has helped to lift the NQ

- Dollar is firmer, AUD benefits on the region’s jobs data, GBP back below 1.30 post-wages

- Bonds are pressured ahead of the ECB; Bunds saw two-way action around the French & Spanish auctions

- Crude erases initial strength, XAU incrementally firmer and base metals are mixed

- Looking ahead, US IJC, Philly Fed, ECB & SARB Policy Announcement, Comments from ECB President Lagarde, Fed’s Logan, Daly & Bowman, Earnings from Abbott Labs, Blackstone, & Netflix.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.1%) opened on a firmer footing, but at the cash open, contracts quickly dipped off best levels; weakness which was led by a renewed sell-off in the Tech sector.

- European sectors hold a slight positive bias; Autos take the top spot, lifted by post-earning strength in Volvo Car AB (+7.2%). Energy is also towards the top of the pile, given the upside in the crude complex; potentially also weighing on the Travel & Leisure sector, which underperforms.

- US Equity Futures (ES +0.3%, NQ +0.6%, RTY -0.2%) are mixed, with clear outperformance in the tech-heavy NQ, catching a bid following strong TSMC earnings; industry peers such as Nvidia (+2.5%), Micron (+1.7%) and AMD (+2%) all gain.

- TSMC (2330 TT/TSM) Q2 (TWD): Sales 673bln (exp. 657bln), EPS 9.56 (exp. 9.04), Net 247.8bln (exp. 238.8bln), Capex 6.36bln (prev. 5.77bln), Gross Margin 53.2% (exp. 52.6%). Q3 Guidance: Revenue USD 22.4-23.2bln (vs USD 17.3bln in Q3 2023), Gross Margin 53.5-55.5% (vs exp. 52.5%); Sees 2024 Capex USD 30-32bln (prev. USD 28-32bln); Raises FY24 Revenue guidance, implies USD 87.3-88.0bln (vs exp. USD 85.1bln). 2024 revenue to increase slightly above mid-20% range in USD terms (vs prev. forecast of increase in low-to-mid 20% range).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is a touch firmer with an initial attempt at recouping recently lost ground eventually running out of steam. 103.85 is the peak for today but is a far cry from yesterday's 104.29 best.

- EUR is steady vs. peers in the run up to today's ECB release which is largely expected to be a non-event. EUR/USD is currently lingering just below yesterday's multi-month peak at 1.0948.

- GBP was relatively unreactive to what was a relatively in-line UK jobs report which saw the unemployment hold steady and wage growth recede, albeit remain at elevated levels. Nonetheless, Cable has returned to a 1.29 handle after topping out yesterday at 1.3045.

- JPY is slightly steadier trade for the pair after yesterday's sharp sell-off. As it stands, the pair has bounced around a point of its overnight base at 155.38, and currently holds around 156.40.

- AUD the marginal best performer across G10 FX following better-than-expected Australian jobs growth, albeit this was accompanied by an unexpected uptick in the unemployment rate.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are slightly lower, holding under 111-10 and as such shy of yesterday’s 111-15 best while the overnight high of 111-12+ stalled on approach to Tuesday’s 111-13+ peak. Busy US docket ahead, IJC, Philly Fed and leading index and Fed speak from Daly, Logan and Bowman.

- Bunds are marginally softer and nearing yesterday’s 132.25 base which resides just beneath the low-end of today’s 132.29-58 parameters. Region is focused on the upcoming ECB, though no policy change is expected now. Modest and fleeting pressure was seen following the Spanish auction given the robust French outing thereafter which served to bring OATs back above 125.00.

- Once again, Gilts had no real reaction to the morning’s UK data points. The labour series came in almost entirely in-line with expectations, pertinently showing an as-expected easing in the wage rate, and only had a slight dovish impact on BoE pricing. Currently pivoting the 98.57 opening level which is at the bottom-end of a very narrow 11 tick parameter that is entirely within Wednesday’s slim 98.31-66 band.

- Spain sells EUR 6.44bln vs exp. EUR 5.5-6.5bln 1.25% 2030, 3.45% 2034, 0.85% 2037 Bono.

- France sells EUR 11.49bln vs exp. EUR 9.5-11.5bln 1.00% 2027, 2.50% 2027, 2.75% 2030, 2.00% 2032 OAT.

- Click for a detailed summary

COMMODITIES

- Crude spent much of the morning on the front foot, though in recent trade, the crude complex has slipped off best levels, in tandem with today's strength in the Dollar; Brent Sept currently trading around USD 84.90/bbl.

- Firmer trade across precious metals this morning despite a somewhat resilient DXY, but with broader European sentiment tilting lower, particularly in the stock market.

- Mixed trade across base metals amid a lack of drivers this morning, and with the China Third Plenum Communique offering little in terms of explicit stimulus commentary.

- Russian President Putin held a phone call with Saudi Crown Prince MBS, while they noted the importance of cooperation within OPEC+ to ensure energy market stability and both highly appreciate friendly relations between their countries, according to the Kremlin.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Avg Wk Earnings 3M YY (May) 5.7% vs. Exp. 5.7% (Prev. 5.9%); Avg Earnings (Ex-Bonus) 5.7% vs. Exp. 5.7% (Prev. 6.0%)

- UK ILO Unemployment Rate (May) 4.4% vs. Exp. 4.4% (Prev. 4.4%); Employment Change 19k vs. Exp. 18k (Prev. -140k)

- UK HMRC Payrolls Change (Jun) 16k (Prev. -3k, Rev. 54k)

NOTABLE US HEADLINES

- US President Biden tested positive for COVID-19 and is experiencing mild symptoms, while he received his first dose of Paxlovid, according to the White House.

- US Senate Majority Leader Schumer told President Biden in a meeting on Saturday it would be better for the country if he ended his re-election bid, according to ABC News.

- Former House Speaker Pelosi privately told President Biden in a recent conversation that polling showed Biden cannot beat Trump and that he could destroy Democrats' chances of winning the House, according to CNN.

- CNN quoted a senior adviser stating that US President Biden is now more receptive to calls for him to withdraw, while he reportedly asked advisers if they think VP Harris can win the election, according to Al Arabiya and Al Jazeera.

GEOPOLITICS

- Russian Deputy Foreign Minister says Moscow does not exclude deployment of missiles with nuclear warheads in response to deployment of US missiles in Germany, according to Interfax

CRYPTO

- Bitcoin holds just beneath USD 65k, whilst Ethereum continues to climb, but yet to breach USD 3.5k.

APAC TRADE

- APAC stocks followed suit to the tech rout stateside owing to recent concerns of China tech curbs and tariff fears.

- ASX 200 was pressured by weakness in tech and telecoms but with downside cushioned after mixed jobs data which showed higher-than-expected employment change.

- Nikkei 225 underperformed amid recent currency strength and as large tech stocks suffered similar fates to their US counterparts amid the threat of tighter restrictions to supply China, while Japanese trade data showed exports and imports missed estimates.

- Hang Seng and Shanghai Comp. were mixed and ultimately rangebound with sentiment sapped by ongoing protectionist concerns.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi will unveil his long-term vision for China’s economy with the CPC set to publish a document on Thursday offering the first glimpse of what some 400 officials discussed during the Third Plenum, according to Bloomberg. It was later reported that China's Communist Party Central Committee will hold a news conference on Friday to brief the media on the Third Plenum.

- BoJ's Osaka Manager says they wish to maintain an accommodative monetary environment as much as is possible, via JiJi; believe the next monetary policy meeting is extremely important.

- Japanese Cabinet Secretary Hayashi says no comment on FX moves; specifics of monetary policy is up to BoJ, BoJ policy not aimed at guiding forex; closely monitoring forex market. Expects BoJ to conduct appropriate policy to sustainably, stably hit price target, working closely with the government.

- China Third Plenum Communique: Adopts resolution on further deepening reform comprehensively. Click for full details

- Latest BoJ data does not immediately show evidence of intervention on July 17th, according to Reuters

DATA RECAP

- Japanese Trade Balance Total Yen (Jun) 224.0B vs. Exp. -240.0B (Prev. -1221.3B, Rev. -1220.1B)

- Japanese Exports YY (Jun) 5.4% vs. Exp. 6.4% (Prev. 13.5%); Imports 3.2% vs. Exp. 9.3% (Prev. 9.5%)

- Australian Employment (Jun) 50.2k vs. Exp. 20.0k (Prev. 39.7k); Unemployment Rate 4.1% vs. Exp. 4.0% (Prev. 4.0%)

- Australian Participation Rate (Jun) 66.9% vs. Exp. 66.8% (Prev. 66.8%)