US Market Open: US equity futures modestly softer, MU -5.6% post-earnings, USD slips helping to lift Crude & XAU

27 Jun 2024, 11:20 by Newsquawk Desk

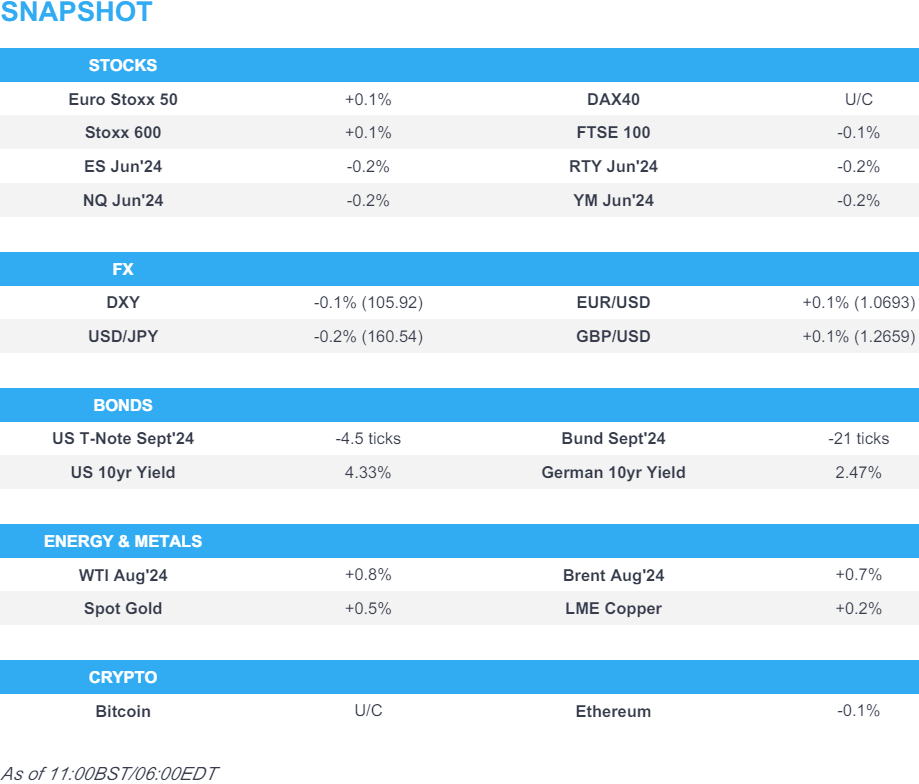

- European bourses are mixed whilst US futures are modestly in the red; Micron -5.5% after its results

- Dollar is slightly softer, Antipodeans outperform & USD/JPY holds around 160.50

- Bonds are modestly softer in a continuation of the prior day’s losses

- Crude & XAU benefit from the softer Dollar, whilst base metals remain subdued

- Looking ahead, US IJC, Durable Goods, GDP & PCE Q1 (Final), Banxico Policy Announcements, Biden-Trump debate, Comments from ECB's Elderson, Supply from the US, Earnings from Nike & WBA

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (U/C), are mixed in what has been a lacklustre and rangebound session thus far.

- European sectors are mixed, with Energy taking the top spot, benefiting from broader strength within the underlying crude complex. To the downside, Retail slumped after H&M (-11%) reported a miss across its results.

- US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.2%) are modestly softer across the board, with sentiment slightly more subdued than peers in Europe.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is steady around the 106 mark ahead of today's US data points, which could ignite some price action for the USD; though, much of the focus will be on US PCE on Friday.

- EUR/USD is stuck on a 1.06 handle after making a new monthly low on Wednesday at 1.0666, it can be noted there is a lot of option activity for the pair due to roll off at the NY fix.

- GBP is a touch firmer vs. USD and EUR. UK-specific newsflow remains light ahead of next week's general election. Cable remains around recent lows with technicians noting that the 50 and 100DMAs at 1.2639 and 1.2640 have now flipped to resistance.

- JPY is marginally firmer vs. the USD but price action is limited compared to yesterday's moves which sent the pair to a 38 year high of 160.87; currently sitting around 160.50.

- Antipodeans are both modestly outperforming vs the Dollar, with the Aussie slightly more in a contamination of the post-CPI strength. AUD/USD has risen to a 0.6672 peak with yesterday's high at 0.6688.

- SEK is softer vs. peers after a dovish tweak to forward guidance from the Riksbank alongside their decision to stand pat on rates.

- PBoC set USD/CNY mid-point at 7.1270 vs exp. 7.2765 (prev. 7.1248).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are down to a 109-28 base with the benchmark on a gradual downward path once the fleeting upside from Wednesday's strong 5yr sale dissipated; 7yr tap this evening. Overnight, Treasuries came under pressure alongside a move lower in JGBs as the latter extended below 143.00 to a 142.58 base.

- An incrementally softer start with Bunds losing the 132.00 handle between the close & open, seemingly following JGBs & USTs at the time, and have since slipped slightly further to a 131.68 WTD base.

- Gilts are the modest underperformer, having opened near the prior day's worst, before extending lower to a 97.93 base; As for the election, the final TV debate added little with polls cementing on a convincing Labour victory.

- Italy sells EUR 7.0bln vs exp. 6.0-7.0bln 3.35% 2029 & 3.85% 2034 BTP and EUR 1.75bln vs exp. EUR 1.25-1.75bln 2032 CCTeu

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have bounced in the European morning after a contained APAC session but remain within the confines of Wednesday's relatively choppy trade. Brent Aug currently just shy of USD 86/bbl.

- Precious metals are slightly firmer given the tepid tone and softer dollar. However, the yellow metal is stuck at the USD 2300/oz mark after losing the figure on Wednesday and slipping to a USD 2293/oz base.

- Base metals are modestly in the red in-fitting with the broader risk tone. Specifics have been relatively sparse with overall macro developments somewhat light thus far.

- Ilsky Refinery in Russia works in normal mode, via Interfax.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Selling Price Expec. (Jun) 6.1 (Prev. 6.4); Economic Sentiment (Jun) 95.9 vs. Exp. 96.2 (Prev. 96.0); Services Sentiment (Jun) 6.5 vs. Exp. 6.4 (Prev. 6.5); Industrial Sentiment (Jun) -10.1 vs. Exp. -9.6 (Prev. -9.9); Consumer Confid. Final (Jun) -14.0 vs. Exp. -14.0 (Prev. -14.0); Cons Infl Expec (Jun) 13.1 (Prev. 12.5); Business Climate (Jun) -0.46 (Prev. -0.39, Rev. -0.40)

- EU Money-M3 Annual Growth (May) 1.6% vs. Exp. 1.5% (Prev. 1.3%); Loans to Non-Fin (May) 0.3% (Prev. 0.3%); Loans to Households (May) 0.3% (Prev. 0.2%)

- Italian Mfg Business Confidence (Jun) 86.8 vs. Exp. 88.7 (Prev. 88.4); Consumer Confidence (Jun) 98.3 vs. Exp. 97.0 (Prev. 96.4)

- Spanish Retail Sales YY (May) 0.2% (Prev. 0.3%)

- Swedish Overall Sentiment (Jun) 96.3 (Prev. 94.0); Manufacturing Confidence (Jun) 99.2 (Prev. 98.5); Total Industry Sentiment (Jun) 97.3 (Prev. 94.6); Consumer Confidence SA (Jun) 93.3 (Prev. 91.3)

NOTABLE EUROPEAN HEADLINES

- ECB's Kazimir says "I expect a quiet summer on ECB rates"; can expect one more rate cut this year.

- UK Labour Party secured a fresh letter of support from business leaders backing plans to overhaul the “apprenticeship levy” if the party wins next week's UK general election, according to FT.

- BoE Financial Stability Report (June): Risks to the UK financial system are broadly unchanged since Q1. But some asset prices have continued to rise and the risk of a sharp correction persists.

- Riksbank maintains its Rate at 3.75% as expected; if inflation prospects remain the same, the policy rate can be cut two or three times during H2'24. Click for full details

NOTABLE US HEADLINES

- Fed Bank Stress Tests showed large US banks are well positioned to weather a recession and stay above minimum capital requirements, while all banks passed the stress tests which paves the way for higher payouts although they reported greater losses than in 2023 stress tests as bank balance sheets are riskier and expenses are higher.

GEOPOLITICS

MIDDLE EAST

- Israeli Cabinet member Dichter says "We are preparing for all possibilities in the north and we will go to war when the time comes", via AJA Breaking

- Israeli Defence Minister Gallant said after meeting with US National Security Adviser Sullivan that significant progress has been made on the issue of the equipping and armaments that Israel needs.

- Israeli Defence Minister Gallant said Israel does not want a war in Lebanon and prefers a diplomatic solution, but cannot accept Hezbollah ‘military formations’ on its border, while he warned that Israel’s military is capable of taking Lebanon ‘back to the Stone Age’ but added that they don’t want to do that. Furthermore, Gallant reaffirmed Israel’s commitment to a ceasefire-hostages deal laid out by US President Biden and discussed with US officials ‘Day After’ proposals for post-war Gaza.

- Israel and the US are concerned that Iran will try to develop its nuclear technology including weapons efforts in the weeks leading up to the US presidential election, according to officials cited by Axios.

- Israeli warplane fired 2 air-to-surface missiles at a two-story building which caused the building to collapse and damaged surrounding structures, while at least 5 civilians were injured by the Israeli airstrikes on the building in Lebanon's Nabatieh, according to Xinhua.

- Syrian state TV reported explosions from an Israeli airstrike on the capital of Damascus.

OTHER

- North Korea said it successfully conducted an important test in advancing missile technology with the test aimed at developing a multiple warhead missile, according to KCNA. However, it was later reported that the South Korean military said North Korea's claim of a successful missile test on Wednesday is a deception and exaggeration.

- Russian Deputy Foreign Minister says western politicians will not be able to shelter in bunkers if it comes to a nuclear conflict, via Tass. Russia could amend the nuclear doctrine in the future, accounting for Ukraine experiences. Already taking measures in response to the US involvement in strikes on Sevastopol.

CRYPTO

- Bitcoin is flat and holds around USD 61k whilst Ethereum is incrementally softer and sits just below USD 3.4k.

APAC TRADE

- APAC stocks were negative amid this week's choppy tech performance with headwinds from higher yields.

- ASX 200 was pressured with real estate leading the declines amid higher yields and firmer inflation expectations.

- Nikkei 225 failed to benefit from stronger-than-expected retail sales with the mood dampened amid rate hike bets for the BoJ's July meeting.

- Hang Seng and Shanghai Comp. traded lower with underperformance in Hong Kong amid pressure in tech and consumer stocks, while the mainland was also pressured as China’s financial industry elites face USD 400k pay caps and bonus clawbacks under President Xi’s “common prosperity” campaign.

NOTABLE ASIA-PAC HEADLINES

- Some bond market participants who met with the BoJ this month, called on the bank to trim bond purchases in several stages to enhance market liquidity, according to minutes of the meeting cited by Reuters.

- BoJ Deputy Governor Uchida said weak JPY is upward factor for prices, closely monitoring in conducting monpol.

- Japanese Government says economy in moderate recovery although it appears to be pausing recently, maintaining the same view for 5 months; warns on risks of elevated interest rates in the West affecting the weak Yen.

- China’s financial elite reportedly face USD 400k pay caps and bonus clawbacks as some of the industry’s biggest companies impose strict new limits to comply with President Xi’s “common prosperity” campaign, according to Bloomberg.

- Japanese Finance Minister Suzuki said won't comment on FX levels and that FX stability is desirable, while he is watching FX moves with a high sense of urgency and is deeply concerned about the FX impact on the economy. Furthermore, Suzuki said they will take necessary actions on FX, as well as noted that rapid and one-sided moves are undesirable.

- Japanese Chief Cabinet Secretary Hayashi won't comment on forex levels and potential FX intervention but said they will take appropriate steps on excessive FX moves and it is important for currencies to move in a stable manner reflecting fundamentals, while he added that rapid FX moves are undesirable.

- S&P China rating affirmed at A+/A-1; outlook stable; says ratings on China reflect country's policy settings that will likely maintain robust economic growth and strong external metrics

DATA RECAP

- Chinese Industrial Profit YY (May) 0.7% Y/Y (Prev. 4.0%); YTD (May) 3.4% (Prev. 4.3%)

- Japanese Retail Sales YY (May) 3.0% vs. Exp. 2.0% (Prev. 2.4%, Rev. 2.0%)

- Australian Melbourne Institute Inflation Expectations (Aug) 4.4% (Prev. 4.1%)

- New Zealand ANZ Business Outlook (Jun) 6.1% (Prev. 11.2%); Own Activity (Jun) 12.2% (Prev. 11.8%)

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.