Riksbank maintains its Rate at 3.75% as expected; if inflation prospects remain the same, the policy rate can be cut two or three times during H2'24

Commentary:

- Conditions for an inflation rate in line with the target also in the slightly longer term are good; long-term inflation expectations are signalling strong confidence and wage increases are moderate.

- New information indicates that inflationary pressures are largely as expected.

- The most recent outcome for inflation excluding energy prices was somewhat higher than expected, which underlines that there can be setbacks when inflation adjusts towards the target. This emphasises the need for policy rate cuts to be made gradually.

- Given that inflation is fundamentally developing favourably, economic activity is assessed to be somewhat weaker, and the krona exchange rate is a little stronger, the forecast for the policy rate has been adjusted down somewhat.

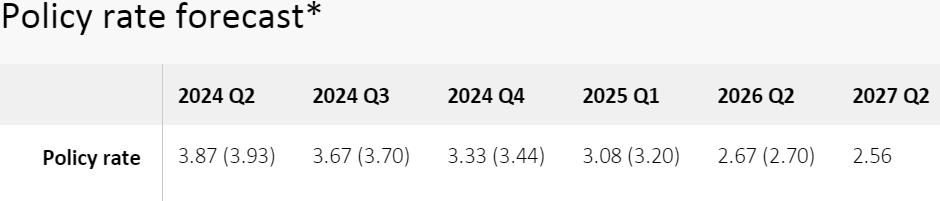

Rate Forecast:

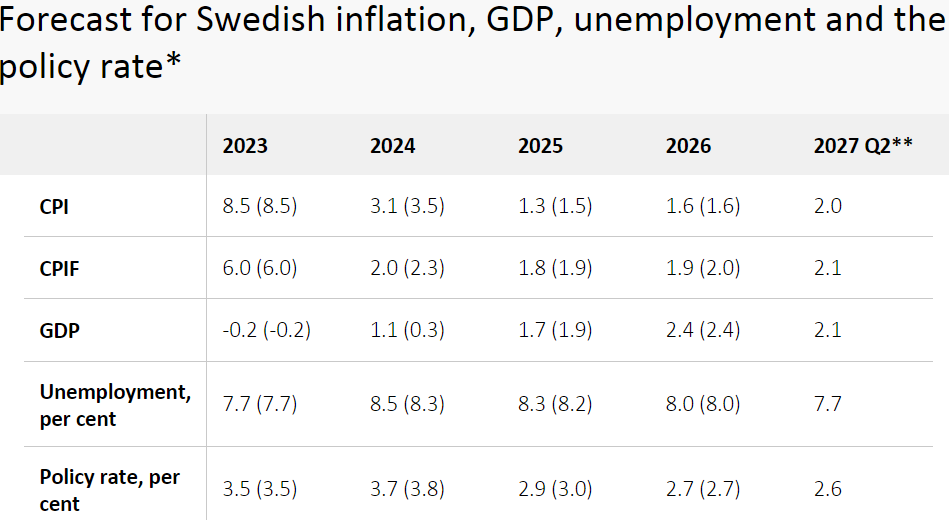

Economic Forecasts:

Reaction details (08:35)

- In reaction to the dovish tweak to guidance which now notes that the policy rate could be lowered two or three times during H2'24, EUR/SEK jumped from 11.3010 to 11.3213 before extending advances to 11.3364

Analysis details (08:47)

- A slightly more dovish than expected Riksbank on the policy path which now includes the possibility of three cuts in H2 (prev. two). While the path and statement are not explicit on the timing of the first H2 cut, market pricing is now essentially fully pricing in an August move (75% probability pre-release) with a second priced for November and around a 40% chance of a third in December.

- Ahead, we look to see how inflation develops as the May reading was slightly hotter than expected (a point the Riksbank acknowledges), but before that attention is on the press conference with Governor Thedeen at 10:00BST to see if we get any meeting-specific guidance.

27 Jun 2024 - 08:30- ForexImportant- Source: Riksbank

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts