US Market Open: Equities trade tentatively ahead of US PPI & Fed Chair Powell; GBP is softer post-Pill

14 May 2024, 11:15 by Newsquawk Desk

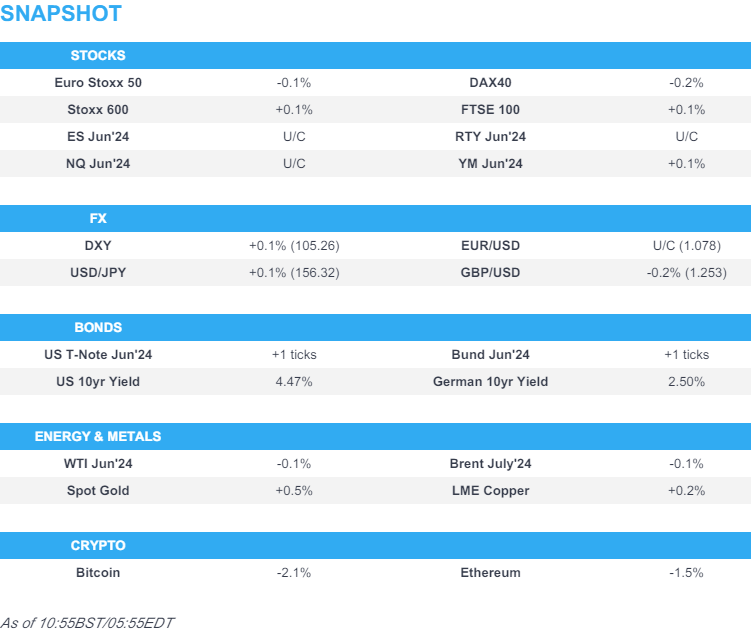

- Equities are mixed, with trade tentative ahead of US PPI & Powell

- Dollar is flat, GBP softer following commentary from BoE’s Pill

- Bonds are firmer, taking a further leg higher after BoE’s Pill before paring on ZEW

- Crude is flat with oil-specific newsflow light, XAU is firmer and base metals are mixed

- White House says US President Biden is directing the USTR to increase tariffs on USD 18bln of imports from China

- Looking ahead, US PPI, OPEC MOMR, Comments from ECB’s Schnabel, Fed Chair Powell & Cook. Earnings from Home Depot

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.1%) are mixed and lack any firm direction, continuing the indecisive performance in APAC trade overnight.

- European sectors hold little bias with the breadth of the market fairly narrow. Autos is found at the top of the pile, building on the prior day’s gains, whilst Travel & Leisure is weighed on by Flutter (-2.5%) post-earnings.

- US Equity Futures (ES U/C, NQ +0.1%, RTY +0.1%) are mostly and modestly firmer, with trade tentative ahead of today’s PPI. Elsewhere, the White House says US President Biden is directing US Trade Representative to increase tariffs on USD 18bln of imports from China (in-fitting with recent reports).

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- Dollar is a touch firmer vs. most peers and briefly popping above yesterday's 105.36 high in quiet trade, though with traders mindful of today's PPI, and CPI on Wednesday, in addition to Chair Powell at 15:00BST/10:00ET.

- EUR is steady vs the USD after the pair failed to hold above the 1.08 mark. EUR/USD is currently contained within yesterday's 1.0765-1.0806 bounds with newsflow light, ZEW data failed to move the markets.

- GBP is the laggard across the majors. GBP was choppy following mixed jobs data, though commentary from BoE's Pill sent Sterling lower. The Chief Economist continued to talk up the possibility of rate cuts. Cable down as low as 1.2510 with eyes on a test of 1.25; not breached since May 9th.

- JPY is once again losing ground to the USD with markets bracing for upcoming US inflation prints, which could be the next inflection point for the pair. USD/JPY has been as high as 156.56 with not much in the way of resistance until 157.

- Mildly diverging fortunes for the antipodes with NZD edging out moderate gains vs. the USD. AUD/USD is holding above the 0.66 mark and respecting yesterday's 0.6587-0.6628 range in quiet trade.

- PBoC set USD/CNY mid-point at 7.1053 vs exp. 7.2307 (prev. 7.1030).

- Click here for more details.

FIXED INCOME

- USTs are incrementally firmer but with magnitudes much more contained than EGBs as we await US PPI ahead of Wednesday's CPI print. USTs at the top-end of 108-24 to 108-29 bounds which are contained by Monday's 108-23 to 109-00 parameters.

- Gilts initially gapped lower by just 11 ticks to 97.52 following the morning's data which was hawkish on the wage components, though upticks in unemployment and another sizeable negative employment change provided some dovish reprieve. Speak from BoE's Pill thereafter lifted Gilts to a 97.89 peak just shy of Monday's 97.93 best.

- Bunds are flat after initially being supported in tandem with Gilt price action; the ZEW data once again came in stronger than expected and prompted Bunds to pullback to the 131.00 mark. Bunds to a 131.13 peak post-Pill matching Monday's best.

- Click here for more details.

COMMODITIES

- Subdued trade across the crude complex following yesterday's gains, which saw the contract settle higher but off best levels in a day with light oil newsflow. Brent Jul'24 sits within a USD 82.98-83.62/bbl parameter.

- Precious metals hold an upward bias despite the stronger Dollar, with outperformance in spot palladium this morning whilst spot gold remains caged ahead of the aforementioned risk events including US PPI and Fed Chair Powell later; XAU sits within a tight USD 2,334.89-2,345.99/oz intraday range thus far.

- Mixed trade across base metals with 3M LME copper futures flat but holding onto a USD 10k+ status, while aluminium prices are subdued following another large warehouse stock metric (+131k/T).

- OPEC OMR due at 11:00BST/06:00ET today

- LME Stocks: Aluminium +131k/T.

- Peru copper production dipped slightly in March and was down 0.1% Y/Y, according to government data.

- Click here for more details.

DATA RECAP

- UK Avg Earnings (Ex-Bonus) (Mar) 6.0% vs. Exp. 5.9% (Prev. 6.0%); Avg Wk Earnings 3M YY (Mar) 5.7% vs. Exp. 5.5% (Prev. 5.6%, Rev. 5.7%)

- UK Employment Change (Mar) -177k vs. Exp. -215k (Prev. -156k); ILO Unemployment Rate (Mar) 4.3% vs. Exp. 4.3% (Prev. 4.2%); UK HMRC Payrolls Change (Apr) -85k (Prev. -67k, Rev. -5k); UK Claimant Count Unem Chng (Apr) 8.9k (Prev. 10.9k, Rev. -2.4k)

- German ZEW Economic Sentiment (May) 47.1 vs. Exp. 46.0 (Prev. 42.9); ZEW Current Conditions (May) -72.3 vs. Exp. -75.8 (Prev. -79.2); Signs of an economic recovery are growing - bolstered by better assessments of the Eurozone and China as a key export market.

- EU ZEW Survey Expectations (May) 47 (Prev. 43.9)

- German HICP Final YY (Apr) 2.4% vs. Exp. 2.4% (Prev. 2.4%); HICP Final MM (Apr) 0.6% vs. Exp. 0.6% (Prev. 0.6%); CPI Final MM (Apr) 0.5% vs. Exp. 0.5% (Prev. 0.5%); CPI Final YY (Apr) 2.2% vs. Exp. 2.2% (Prev. 2.2%)

- Spanish HICP Final YY (Apr) 3.4% vs. Exp. 3.4% (Prev. 3.4%); HICP Final MM (Apr) 0.6% vs. Exp. 0.6% (Prev. 0.6%); CPI YY Final NSA (Apr) 3.3% vs. Exp. 3.3% (Prev. 3.3%); CPI MM Final NSA (Apr) 0.7% vs. Exp. 0.7% (Prev. 0.7%)

- Swiss Producer/Import Price YY (Apr) -1.8% (Prev. -2.1%); Producer/Import Price MM (Apr) 0.6% (Prev. 0.1%)

NOTABLE EUROPEAN HEADLINES

- BoE Chief Economist Pill says there is still some work to do on the persistence of inflation; not unreasonable to believe that over the summer, the BoE will see enough confidence to consider rate cuts. Not unreasonable to believe that over the summer, the BoE will see enough confidence to consider rate cuts; could cut and keep the stance restrictive. Question of when and how restriction is eased. Click here for full details.

- Even a very poor EZ inflation reading this month would not necessarily dissuade the ECB's Governing Council from going through with the 25bp rate cut that has been amply signalled for its June meeting, according to a Eurosystem insider cited by Econostream.

NOTABLE US HEADLINES

- Moody's revised the outlook on 412 US local government issuers from stable to no outlook, while it affirmed issuer and long-term underlying ratings, according to Reuters.

- White House says US President Biden is directing US Trade Representative to increase tariffs on USD 18bln of imports from China. Click here for full details.

- "The Irish govt has hinted it could could provide financial support to Intel (INTC) amid reports that the company is to set up a new plant in Ireland", RTE's Connelly.

GEOPOLITICS

MIDDLE EAST

- "Israeli tanks began to penetrate into the center of Rafah for the first time amid fierce clashes ", according to Al Arabiya

- "Lebanese agency: Israel used 'seismic missiles' in the town of Kafr Kila in southern Lebanon", according to Al Arabiya

- Member of the Hamas Political Bureau told Al Arabiya they are committed to the path of the exchange deal negotiations.

- Heavy Israeli artillery shelling and heavy gunfire reported in the centre and east of the city of Rafah in the southern Gaza Strip, according to Al Jazeera.

- US officials said Israel has mobilised enough forces to launch a large-scale operation in Rafah but they are not sure if We are not sure if Israel has made a final decision to launch a large-scale operation in Rafah, according to CNN.

- US Deputy Secretary of State said we do not believe that the complete victory that Israel seeks to achieve is likely or possible, according to CNN.

- Hezbollah said it targeted two buildings used by enemy soldiers in the settlement of Metulla and achieved a direct hit, according to Al Jazeera.

- EU decided to broaden the scope of its sanctions framework to include not only provision of drones from Iran to Russia but also missiles. It also expands the sanctions regime geographically to cover the Middle East, according to a press release.

OTHER

- US Secretary of State Blinken arrived in Ukraine on a previously undisclosed trip and intends to send the signal of reassurance to Ukraine at a 'very difficult moment', while US-supplied artillery, ATACMS long-range missiles and air defence interceptors are already reaching Ukraine's front lines from the new US aid package approved on April 24th, according to a US official cited by Reuters.

- US and Taiwan navies quietly held Pacific drills in April, while the exercises involved about a half-dozen ships from both sides but officially didn't take place, according to a Reuters source. Furthermore, a source added that exercises were dubbed 'unplanned sea encounters' and gave the navies a chance to practice 'basic' operations.

CRYPTO

- Bitcoin on the backfoot and just shy of USD 62k, whilst Ethereum sits beneath USD 3k.

APAC TRADE

- APAC stocks lacked firm conviction after the indecisive performance in the US ahead of key events.

- ASX 200 was dragged lower by weakness in real estate and consumer staples ahead of the federal budget announcement, while Australian Treasurer Chalmers had previously cautioned against expectations for a welfare 'cash splash'.

- Nikkei 225 was choppy amid a weaker currency, mixed earnings releases and relatively in-line PPI data.

- Hang Seng & Shanghai Comp were initially boosted at the open with strength in tech and real estate although the Hong Kong benchmark eventually faded most of the gains, while sentiment was dampened in the mainland amid the threat of looming US tariffs which are expected to be unveiled today, while developer default concerns also lingered after Agile Group missed a coupon payment and flagged an inability to fulfil all payment obligations.

NOTABLE ASIA-PAC HEADLINES

- China's embassy said China remains open to cooperating with the US on repatriation of illegal immigrants but the US side should also demonstrate sincerity and address China's concerns, creating a suitable atmosphere for such cooperation, according to Global Times.

- Japanese Finance Minister Suzuki said it is important for the government and BoJ to coordinate policy and it is important for currencies to move in a stable manner reflecting fundamentals, while he added they will take a thorough response for forex and are closely watching FX moves, according to Reuters.

- Former BoJ executive says the BoJ may decide to reduce the size of scheduled bond purchases next month amid largely dysfunctional bond market, adding that the BoJ is likely to hold off on raising rates until September, according to Reuters.

- Australian Budget: sees 2023/24 budget surplus at AUD 9.3bln (vs. Exp. AUD 9bln) and deficits in 2024/25 - 2026/27 (as expected). 2024/25 deficit AUD 28.3bln vs. Exp. AUD 13.9bln. 2023/24 CPI seen at 3.5%, 2024/25 at 2.75% 2025/26 at 2.75%. 2023/24 unemployment seen at 4.0%, 2024/25 4.5% and 2025/26 4.5%. 2023/24 GDP growth at 1.75%, 2024/25 at 2% and 2025/26 at 2.25%. Sees iron ore price falling to USD 60/tonne, thermal coal USD 70/tonne for Q1 2025.

EARNINGS

- Sony (6758 JT) 2023/24 (JPY): Net profit JPY 970.57bln (-3.5% Y/Y). Operating profit 1.21tln (-7.2% Y/Y). Guides FY Operating income at 1.28tln (exp. 1.33tln) plans to buyback up to JPY 250bln of own shares; to conduct 5-for-1 stock split effective Oct 1s; sees PS5 sales of 18mln units in the current financial year

- Hon Hai/Foxconn (2354 TT) Q1 (TWD): Net Income 22bln (exp. 29.1bln). Expects Q2 revenues to grow significantly Y/Y (prev. forecast to rise); Q2 revenue for smart consumer electronics to be flattish Y/Y (prev. forecast to be flat).

- Tencent (700 HK / TCEHY) Q1 (CNY): Revenue 159.50bln (exp. 158.81bln). Net Income 41.9bln (exp. 34.5bln); Stepped up our buyback plan, and are on track to repurchase over HKD 100bln of shares in 2024; Investing in AI technology

DATA RECAP

- Japanese PPI MM (Apr) 0.3% vs. Exp. 0.3% (Prev. 0.2%); YY (Apr) 0.9% vs. Exp. 0.8% (Prev. 0.8%, Rev. 0.9%)