US Market Open: DXY nears 104.00 after BoJ sources, XAU at ATHs; docket ahead sparse

09 Apr 2024, 11:40 by Newsquawk Desk

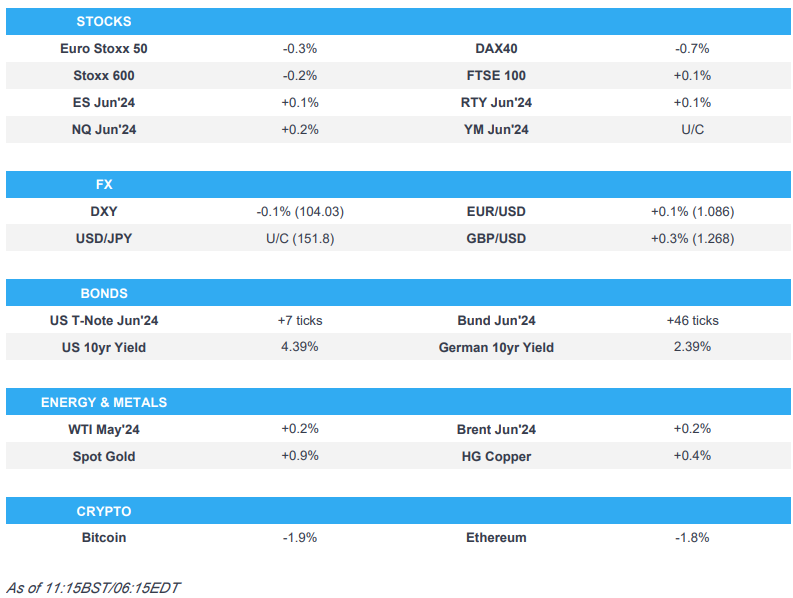

- European bourses in the red with US futures flat in catalyst-thin trade

- DXY steady for much of the morning before USD/JPY came under pressure on a BoJ-related source report

- Fixed income benchmarks bid with EGBs outperforming, no reaction to supply but latest ECB BLS perhaps factoring

- Commodities firmer; crude gains incremental while XAU hit a fresh ATH

- Looking ahead, highlights include US Supply & SNB's Schlegel; EIA STEO.

EUROPEAN TRADE

EQUITIES

- European bourses in the red, Stoxx 600 -0.2%, action is subdued across the board but with some mild divergence in catalysts thin trade.

- DAX 40 -0.6% the relatively underperformer pressured by heavyweights SAP & Daimler Trucks and despite support in Infineon from TSMC; defence names, including Germany's Rheinmetall, pressured after commentary from GS on defence valuations and earlier geopolitical reports around necessary export licenses.

- Sectors more broadly do not have any overarching bias/theme, with relative outperformance in Basic Resources and Energy names echoing underlying benchmarks and helping the FTSE 100 +0.1% tread water.

- Stateside, futures near the unchanged mark (ES +0.1%, NQ +0.1%) with catalysts light thus far and the docket ahead sparse before Wednesday's CPI & Minutes; Tesla -0.3% in focus after a fatal crash lawsuit settled and given the latest CPCA numbers.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- DXY steady for much of the morning and holding above 104.00; modest pressure came as BoJ sources via Bloomberg pulled USD/JPY away from the 151.93 base and by extension the YTD peak at 151.97 above with USD/JPY down to and holding around a 151.74 base.

- EUR slightly softer initially but has derived some modest support alongside GBP in the wake of the JPY-induced USD-pressure. Though, to be clear, action is contained overall with the magnitude of upside marginal.

- Cable saw a slight acceleration in gains after it surpassed the 50- & 100-DMAs of 1.2663 and 1.2668, to a 1.2685 peak.

- Antipodeans steady but have also benefited from the relative USD pressure in the second half of the European morning with participants looking ahead to the RBNZ which is expected to leave rates unchanged; AUD and NZD near highs of 0.6625 and 0.6055.

- BoJ is said to consider raising its inflation forecast following the "surprisingly strong" results from annual wage negotiations, according to Bloomberg sources; Core CPI is seen revised up from the current forecast of 2.4%. BoJ is likely to forecast price growth of around 2%. Officials also highlight that they need be aware of possible downside risks to inflation when making projections for fiscal 2026.

- PBoC set USD/CNY mid-point at 7.0956 vs exp. 7.2248 (prev. 7.0947).

- Click here for more details.

- Click here for today's option expiries for the NY cut.

FIXED INCOME

- Comparably contained start for USTs with the docket sparse, upside potentially via haven flows as geopols remains in focus. Overnight JGB auction was robust though a touch softer than the prior.

- USTs currently post gains of circa. 5 ticks with yields slightly lower but without a clear flattening/steepening bias thus far.

- EGBs & Gilts outperform, no real reaction to supply which was well received despite the lack of fresh concession into the auction while the latest ECB BLS spurred some modest upside in Bunds which are currently around the 132.29 peak; overall, while bid EGBs remain much closer to last week's 131.87 base than the 133.43 peak.

- Gilts outperform, again no reaction to supply with the DMO back in the market on Wednesday. Possible upside from the latest Barclays data though the BRC numbers showed strong March figures, but these often slump ahead in the post-Easter period. Upside brings 99.00 back into play before Friday's 99.15 peak and Thursday's at 99.37 thereafter.

- Click here for more details.

COMMODITIES

- Crude benchmarks incrementally firmer but with action largely sideways in the European morning; WTI May resides in an USD 86.38-86.94/bbl range, while Brent June is within USD 90.38-90.90/bbl parameters.

- Complex remains focused on geopols after Israel pencilled in a date for the Rafah operation while BP expects Q1 upstream production higher Q/Q; EIA STEO due later.

- European and US gas benchmarks diverge with TTF lower while Henry Hub lifts but price action overall is uneventful and absent specific catalysts.

- UK, Germany, Belgium, Netherlands, Denmark and Norway signed a declaration to protect infrastructure in the North Sea.

- Azerbaijan oil production 481k BPD in March (prev. 476k BPD in February), according to the Energy Ministry.

- Morgan Stanley raises its Q3 Brent oil price forecast to USD 94/bbl to reflect geopolitical risks.

- Precious metals bid despite the relatively stable/modestly firmer USD for much of the morning with support coming from the lower yield environment and with haven flows potentially factoring; spot gold at a fresh USD 2365/oz ATH; base peers see a pullback in LME Copper after Monday's marked strength while Dalian iron ore soared in APAC trade.

- Click here for more details.

DATA RECAP

- UK BRC Retail Sales YY (Mar) 3.2% (Prev. 1.0%); Total Sales Y/Y 3.5% (Prev. 1.1%)

- US NFIB Business Optimism Index (Mar) 88.5 (Prev. 89.4)

NOTABLE HEADLINES

- Barclays said UK March consumer spending rose 1.9% vs prev. 1.9% increase in February and was the joint-smallest increase since September 2022, according to Reuters.

- EU Competition Chief Vestager is set to pitch a tougher, joint approach to tackling challenges posed by China as part of a speech in the US, via Politico. To say that the EU has accepted a mistake was made a decade ago by the failure to impose restrictions on China's heavily state-subsidises solar panels. Decision from the EU investigation into Chinese subsidies is said to be picking up pace, decisions expected as soon as the summer; Vestager to say if the investigation finds China EV exports have been subsidised than the EU will impose restrictions.

- ECB Bank Lending Survey - Credit standards were broadly unchanged in the first quarter of 2024. Loan demand from firms declined substantially, contrary to bank expectations of a recovery; Corporate credit standards tightened in Q1 but eased for household mortgages; Banks are expecting a moderate net decrease in demand for loans to firms and a net increase in demand for loans to households in the second quarter of 2024 - click here for more.

- Russian Kremlin says there is no specific time frame for a visit by President Putin to China, but the visit of Foreign Minister Lavrov can be considered as preparation for high-level contacts of which there is a need for.

NOTABLE US HEADLINES

- Fed's Kashkari (non-voter) said can't stop short in the inflation fight with inflation around 3% and need to get to 2%, while he added the base case is that inflation will continue to fall.

- China Auto Industry Body CPCA says China sold 1.71mln cars in March, +5.7% Y/Y; Tesla (TSLA) exported 26.66k China-made vehicles in March (vs 30.22k in February); China's CPCA says China NEV sector is yet to reach levels of severe overcapacity and the current reasonable output bodes well for consumers and the market-oriented economy.

- Microsoft (MSFT) is to invest USD 2.9bln in Japanese data centers amid an AI boom, according to Nikkei citing Microsoft's vice chair and president Brad Smith.

GEOPOLITICS

MIDDLE EAST

- Hamas said Israeli position during last round of negotiations in Cairo remains stubborn and did not meet any demands of Palestinians, while it is still studying Israel's proposal and will inform mediators of its response, according to a statement.

- US Pentagon said Defense Secretary Austin expressed commitment to support an unconditional return of hostages and hopes for a cessation of hostilities through negotiations. Austin also expressed hope that the ongoing negotiations between Israel and Hamas will lead to a truce and he affirmed unwavering US support for defending Israel in light of threats from Iran and its network of proxies, according to Al Jazeera and Al Arabiya.

- US intelligence assesses that Iran has urged several of its proxy militia groups to simultaneously launch a large-scale attack against Israel, using drones and missiles, while they could attack as soon as this week, according to sources cited by CNN. Furthermore, sources familiar with US intelligence said an Iranian attack would likely be carried out by proxy forces in the region, rather than by Iran directly, and one of the sources noted the threat is very clear and credible with the pieces in place to conduct the attack and Iran are just waiting for the right time.

- Iraqi armed faction said they bombed a vital target in Ashkelon in southern Israel and another target in the past 72 hours, according to Al Arabiya.

- US military said it destroyed air defence and drone systems of Houthi forces in an area of the Red Sea, while there were no injuries or damage to US, coalition or commercial ships.

- "Israeli military says it has carried out raids on Syrian army military infrastructure in southern Syria", according to Al Arabiya.

OTHER

- EU Foreign Minister Borrell in a speech within Brussels says that "war is certainly looming all around us" and that a "high-intensity, conventional war in Europe is no longer a fantasy", via FT.

- Australia's PM Albanese said Japan is a natural candidate to cooperate on stage two of the AUKUS security pact but added there are no plans to expand AUKUS membership beyond Britain, Australia and the US. There were prior reports that China was 'gravely concerned' as Australia, US, UK confirmed that Japan was being considered for AUKUS.

- Chinese military newspaper said Japan is showing 'obvious offensive characteristics' with its new Okinawa missile unit, according to SCMP.

- The extraordinary session of the IAEA Board of Governors on the escalation of the situation at the Zaporizhzhia nuclear power plant may be convened Thursday, according to Russia's Permanent Representative to International Organizations.

CRYPTO

- Bitcoin is under modest pressure but has recovered from the earlier USD 69.6k low and seemingly found a base just above USD 70k with the macro docket light ahead of Wednesday's key US events.

APAC TRADE

- APAC stocks traded mostly higher but with price action relatively rangebound with global markets lacking any major catalysts ahead of upcoming risk events.

- ASX 200 was led by miners but with gains capped after weak consumer sentiment and a mixed business survey.

- Nikkei 225 continued to benefit from recent currency weakness with USD/JPY lying in wait for a retest of 152.00.

- Hang Seng and Shanghai Comp. were varied with the Hong Kong benchmark lifted although the psychologically key 17,000 level continued to elude. Conversely, the mainland lagged after another tepid PBoC liquidity operation, while Premier Li recently noted uncertainty and complexity in the external environment are rising.

NOTABLE ASIA-PAC HEADLINES

- HKMA said Hong Kong is considering deepening some of the Connect schemes between Hong Kong and Mainland China.

- BoJ Governor Ueda said Japan's economy is showing some weakness but is recovering moderately and the chance of solid wage growth this year is heightening, while he added the BoJ expects accommodative monetary conditions to continue for the time being and it is important to maintain accommodative monetary conditions as trend inflation is yet to hit 2%. Ueda said if the economy and price developments proceed as projected now, they need to think about reducing the degree of monetary support but added whether this will happen will depend on upcoming data and there is no pre-set idea now on how and when they will adjust interest rate levels. Ueda added that even after March policy shift, expect interest rates to stay low and real interest rates to remain at deeply negative territory. Ueda reiterated that if FX moves have impact on economy and prices in a way that is hard to ignore, we will of course respond with monetary policy.

DATA RECAP

- Australian Westpac Consumer Sentiment Index (Apr) 82.4 (Prev. 84.4); M/M (Apr) -2.4% (Prev. -1.8%)

- Australian NAB Business Confidence (Mar) 1.0 (Prev. 0.0); Conditions (Mar) 9.0 (Prev. 10.0)