US Market Open: Equities firmer, JPY bid after a BoJ/MoF/FSA meeting and Crude lower; Fed's Waller due

27 Mar 2024, 10:44 by Newsquawk Desk

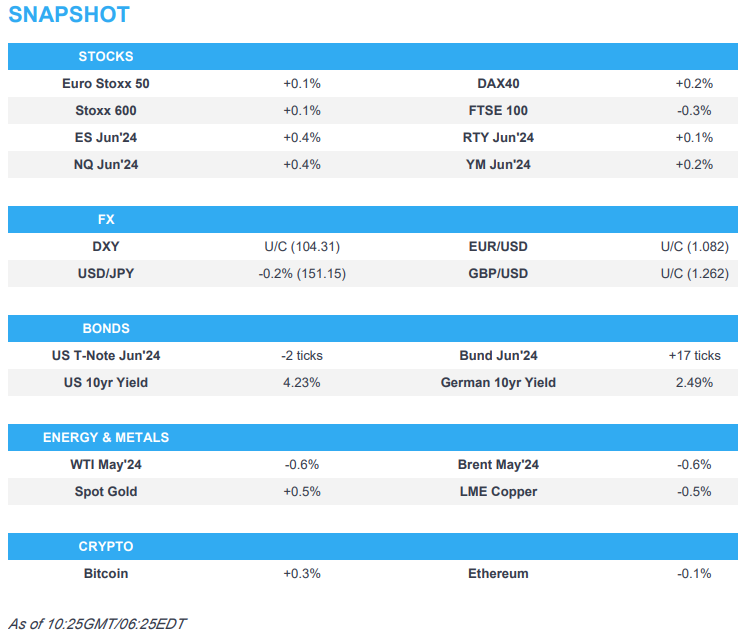

- European bourses are mixed whilst Stateside futures are entirely in the green

- Dollar is flat, JPY higher after a BoJ/MoF/FSA meeting which only resulted in further jawboning from Top Currency Diplomat Kanda

- Bonds mixed though price action has been contained; Bunds rose incrementally on Spanish CPI, upside which proved fleeting

- Crude is softer in a continuation of post-private inventory data action, XAU bid

- Looking ahead, SARB Policy Announcement, BoJ SOO, Comments from ECB’s Elderson & Fed's Waller, Supply from the US

EUROPEAN TRADE

EQUITIES

- An uninspiring session thus far in Europe, Stoxx600 (+0.1%), bourses within tight ranges and sentiment mixed in relatively light newsflow.

- European sectors are mixed with little theme or bias; Retail is the clear outperformer after H&M's (+12%) earnings and Energy lags amid the slide in crude oil prices.

- US Equity Futures (ES +0.4%, NQ +0.4%, RTY +0.1%) are trading on a firmer footing, attempting to make back the losses seen in the prior session.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD is steady vs. peers with DXY in a narrow 104.21-42 range. Upside sees the 25th March high at 104.47. Downside sees yesterday's low at 104.01; all eyes will be on Fed's Waller at 22:00 GMT / 18:00 ET.

- EUR is flat with a lack of fresh catalysts. Currently trading in close proximity to 200 and 50DMAs at 1.0836 and 1.0838 respectively.

- JPY is now firmer vs. the USD after USD/JPY printed a fresh 33yr high overnight. JPY gained strength after news that Japan's BoJ, MoF and FSA to hold a meeting, though subsequent comments from Japan's Top Diplomacy Kanda echoed recent jawboning. These remarks failed to spark any real move in USD/JPY, which remains at troughs around 151.10.

- AUD hampered by softer yuan, iron ore prices and inflation data overnight. AUD/USD has been as low as 0.6512 but holding above last week's trough at 0.6503.

- SEK is a touch softer vs. the EUR but stopping just shy of the 11.50 mark. Riksbank expectedly left rates unchanged and guidance is pointing towards a H1 cut.

- PBoC set USD/CNY mid-point at 7.0946 vs exp. 7.2250 (prev. 7.0943).

- Click here for more details.

- Click here for FX Option Expiries.

FIXED INCOME

- USTs are slightly softer and holds around the 110-19 mark; direction today will be guided by Fed's Waller (Hawk), who in his February remarks foreshadowed the general tone of Powell's speeches thereafter.

- Bund price action has been relatively contained; Spanish Flash CPI showed the core continuing to moderate, resulting in a slight move higher from 133.02 to a peak of 133.11. This move quickly faded and Bunds now reside just above 132.90 into supply.

- Gilts are unchanged with fresh catalysts sparse so far and price action generally dictated by EGBs; currently around 99.50.

- Italy sells EUR 8.25bln vs exp. EUR 7-8.25bln 3.35% 2029, 3.85% 2029, 3.85% 2034 and EUR 1.5bln vs exp. EUR 1-1.5bln 2031 CCTeu; no move in BTPs.

- Click here for more details.

COMMODITIES

- Downbeat trade across the crude complex following the large surprise build in Private Inventories; Brent May fluctuates around USD 85.50/bbl in a USD 85.28-85.87/bbl parameter.

- Uneventful trade across precious metals following Tuesday's volatility which saw spot gold briefly test USD 2,200/oz to the upside.

- Base metals are modestly lower across the board in what is seemingly a weakness stemming from the downbeat sentiment seen across Chinese markets overnight.

- JPMorgan says without counter-measures the Russian decision to cut oil production could lift Brent to USD 90/bbl in April, mid-90s in May and near USD 100/bbl by September

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- Riksbank maintains its Rate at 4.00% as expected; "It is likely that the policy rate can be cut in May or June if inflation prospects remain favourable". Click here for more details.

- ECB's Kazaks said inflation is slowing and the first rate cut is nearing, while he doesn't object to the market view of a June rate cut and said they will lower rates cautiously step by step and must see how the economy reacts to policy easing.

- ECB's Cipollone says uncertainty around inflation is decreasing. Increasingly confident that inflation will converge to 2% by mid-2025. The current economic environment allows for a recovery in real wages in the short term that will not fuel inflation. "The improving inflation outlook, continued strong transmission and further moderation in inflation all create scope for more confidence that we can dial back restriction". "We are coming closer to the point when we will have the confidence to act". Says so far from neutral rate that there is room to adjust

- Germany economic institutes expect German GDP to grow 0.1% in 2024 (prev. 1.3% in Autumn forecast). Expects German inflation at 2.3% in 2024 and 1.8% in 2025. Unemployment rate seen at 5.8% in 2024 and 5.5% in 2025.

DATA RECAP

- Spanish CPI YY Flash NSA (Mar) 3.2% vs. Exp. 3.2% (Prev. 2.8%); Core 3.3% (prev. 3.5%); CPI MM Flash NSA (Mar) 0.8% vs. Exp. 0.60% (Prev. 0.40%); HICP Flash MM (Mar) 1.3% vs. Exp. 1.2% (Prev. 0.4%); Retail Sales YY (Feb) 1.9% (Prev. 0.3%); HICP Flash YY (Mar) 3.2% vs. Exp. 3.3% (Prev. 2.9%)

- EU Business Climate (Mar) -0.3 (Prev. -0.42, Rev. -0.41); Selling Price Expec (Mar) 5.6 (Prev. 3.8, Rev. 3.9) Industrial Sentiment (Mar) -8.8 vs. Exp. -9.0 (Prev. -9.5, Rev. -9.4); Consumer Confid. Final (Mar) -14.9 vs. Exp. -14.9 (Prev. -14.9); Services Sentiment (Mar) 6.3 vs. Exp. 7.8 (Prev. 6.0); Economic Sentiment (Mar) 96.3 vs. Exp. 96.3 (Prev. 95.4, Rev. 95.5); Cons Infl Expec(Mar) 12.3 (Prev. 15.5, Rev. 15.4)

- UK Lloyds Business Barometer (Mar) 42 (Prev. 42)

- Swedish Trade Balance (Feb) 9.3B (Prev. 13.3B); Exports (BLN SEK) (Feb) 171.8B (Prev. 167.8B, Rev. 168.4B); Imports (BLN SEK) (Feb) 162.5B (Prev. 154.5B, Rev. 155.1B)

- Norwegian Retail Sales Ex. Auto (Feb) 0.1% vs. Exp. 0.2% (Prev. -0.1%)

NOTABLE US HEADLINES

- S&P said the outlooks on five US regional banks were revised to negative from stable on commercial real estate risks although their ratings were affirmed, while the banks mentioned were First Commonwealth Financial Corp, M&T Bank Corp, Synovus Financial Corp, Trustmark Corp and Valley National Bancorp.

GEOPOLITICS

MIDDLE-EAST

- At least seven people were killed in an Israeli strike on southern Lebanon, according to two security sources cited by Reuters.

- "Israel Broadcasting Corporation: Hostage exchange negotiations continue despite Hamas' 'negative' response"

OTHER

- China State Council Taiwan Affairs Office spokesperson said some individuals in the US have ulterior motives and are continuously fabricating so-called "timelines" and hyping up the mainland's "military threat" which is creating an atmosphere of war across the Taiwan Straits, while the spokesperson urged the US to stop fanning the flames and take concrete actions in adhering to the one-China principle, according to Global Times

CRYPTO

- Bitcoin has been relatively contained and holds around the USD 70k mark, with Ethereum also holding at key levels around USD 3.5k.

APAC TRADE

- APAC stocks traded mixed after the subdued handover from Wall St heading into quarter-end and Easter.

- ASX 200 was underpinned by strength in the top-weighted financials and consumer-related sectors, while data also provided a tailwind after an improved leading index and softer-than-expected monthly CPI.

- Nikkei 225 outperformed as the yen fell to a 33-year low amid dovish-leaning BoJ comments.

- Hang Seng and Shanghai Comp. declined amid a slew of earnings and weakness in tech with Alibaba pressured after it withdrew its Cainiao IPO application, while the mainland failed to benefit from the PBoC's firm liquidity operation and improved Industrial Profits.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor Pan said bilateral currency swaps help enhance financial safety nets and that China is willing to deepen financial cooperation with other countries, according to Reuters.

- USTR office said the US mission to WTO received a consultation request from China regarding parts of the Inflation Reduction Act and the US is reviewing the request, according to Reuters.

- US President Biden's administration is pursuing TikTok with the FTC investigating the Co. over allegedly faulty privacy and data security practices, according to POLITICO.

- Chinese Foreign Ministry Spokesperson Lin says China has been taking a hard hit as a major trade country; says China has a lot of policy space to shore up the economy; government debt level remains relatively low.

JAPAN

- BoJ Governor Ueda said Japanese households' sentiment indices are improving recently on expectations of wage hikes, while he added that based on current economic and price projections, accommodative financial conditions are expected to continue for the time being and reiterated they are ready to nimbly conduct bond buying operation if long-term rates rise sharply.

- BoJ's Tamura said that based on the current economic and price outlook, the BoJ is likely to maintain accommodative monetary conditions for the time being and they will guide monetary policy appropriately in accordance with economic, price, and financial developments. Tamura stated that they are not there yet to allow market forces to fully drive long-term interest rate moves and the positive wage-inflation cycle is likely to continue, while he added that future monetary policy guidance is very important to ensure BoJ moves slowly but steadily toward policy normalisation. Furthermore, Tamura said promising to continue with accommodative monetary policy won't necessarily conflict with the need to raise interest rates.

- Japanese Finance Minister Suzuki says closely watching FX moves and won't rule out any steps including decisive steps to respond to a disorderly FX move, according to Reuters.

- Japan's top currency diplomat Kanda says there are no plans to issue a statement on forex today; no need to hold three-party talks on FX between the government, FSA and BoJ.

- Japanese Chief Cabinet Secretary Hayashi says rapid FX moves are undesirable, important for currencies to move in stable manner reflecting fundamentals; closely watching FX moves.

- Japanese Finance Minister Suzuki says closely watching FX moves with high sense of urgency; will take decisive action if needed; if any excessive moves, we will not rule out any options.

- Japan Finance Minister Suzuki says we will not say anything when asked whether MoF would conduct steal FX intervention.

- Japan's BoJ, MoF and FSA to hold a meeting to discuss international financial markets at 09:15 GMT; subsequent comments: Japan Top Diplomacy Kanda says recent Yen moves are not reflecting fundamentals; closely watching FX moves with a huge sense of urgency; will not rule out any steps to respond disorderly FX moves. "I do not consider a 4% move in a span of 2 weeks a mild move." A BoJ official said that if Forex market moves affect the economy and price trends, the BJ would respond through monetary policy.

DATA RECAP

- Chinese Industrial Profit YTD YY (Feb) +10.2% (Prev. -2.3%)

- Australian Weighted CPI YY (Feb) 3.4% vs. Exp. 3.5% (Prev. 3.4%)