Riksbank maintains its Rate at 4.00% as expected; "It is likely that the policy rate can be cut in May or June if inflation prospects remain favourable."

COMMENTARY

- Monetary policy needs to be adjusted cautiously

- there are risks that could cause inflationary pressures to rise again.

- Monetary policy should therefore be adjusted cautiously going forward, in the form of gradual cuts in the policy rate.

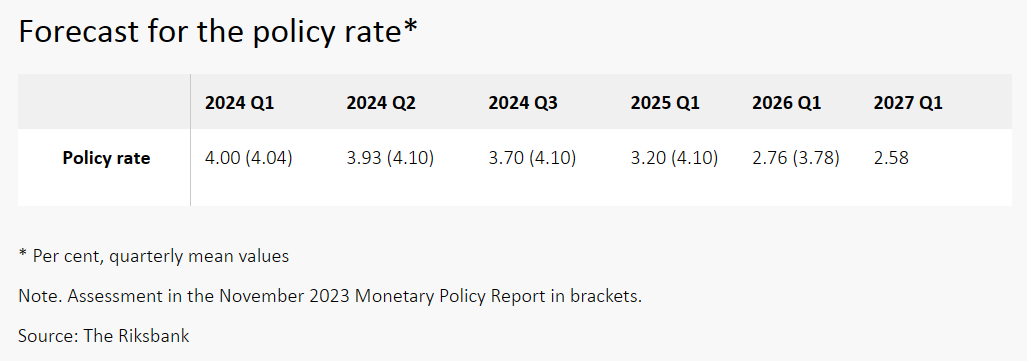

RATE FORECAST

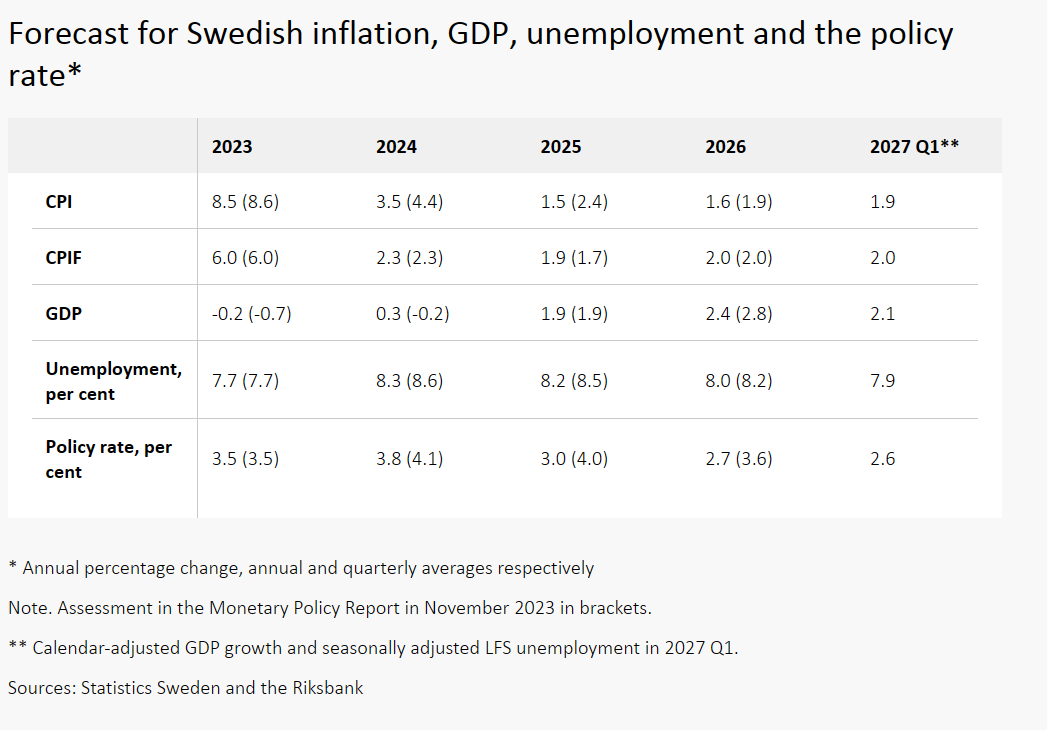

ECONOMIC FORECASTS

Reaction details (08:38)

-

EUR/SEK was ticking higher into the announcement. On the decision, it lifted from 11.4890 to a session high of 11.5116 before paring back towards pre-release levels.

Analysis details (08:45)

- Overall, very much as expected from the Riksbank with rates left unchanged and guidance pointing towards a H1 cut.

- The timing of that cut has been left open between either May or June, contingent on the development of inflation. On this, the SEK will likely play a key role as assuming the ECB/Fed go in June the Riksbank will be conscious of the fact that a cut in May could weaken the SEK even further, a dynamic which may tip the balance in favour of June over May unless inflation surprises to the downside in the interim.

- As a reminder, the SEB FI survey (pre-meeting) highlighted that the odds of a June cut over May increase markedly if EUR/SEK is above 11.60 (currently 11.48, session high 11.51)

27 Mar 2024 - 08:30- Fixed IncomeImportant- Source: Newswires

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts