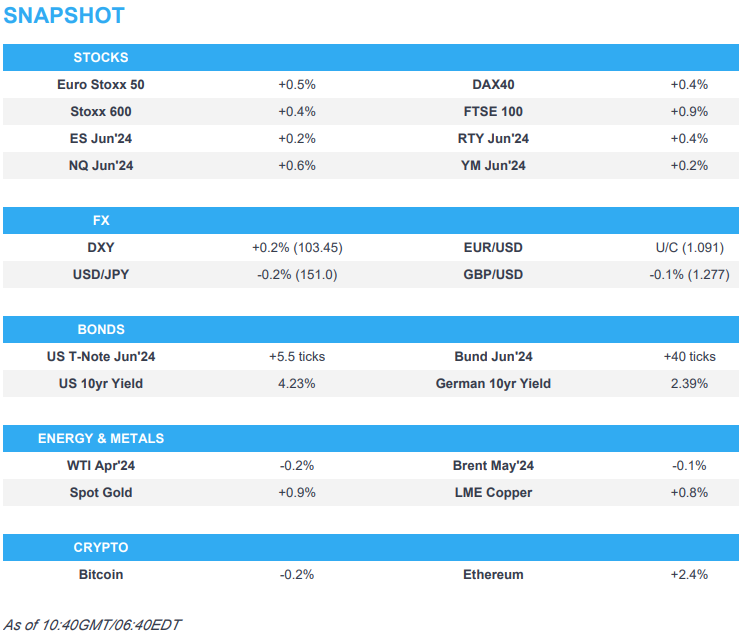

US Market Open: Equities climb higher, AUD bid post-jobs data & Bonds benefit from EZ PMIs; US IJC due

21 Mar 2024, 10:58 by Newsquawk Desk

- Equities firmer in a continuation of the post-Fed rally; European bourses off best after EZ PMIs

- Dollar stronger, AUD bid post-jobs data and CHF lower after SNB cut rates by 25bps

- Bonds higher taking impetus from the poor French PMI and dire accompanying German commentary

- Crude pares initial gains, base metals benefit from risk sentiment

- Looking ahead, US IJC, Fed's Barr, Supply from the US, Earnings from FedEx, Nike

EUROPEAN TRADE

EQUITIES

- European equities, Stoxx600 (+0.4%) are entirely in the green, with sentiment lifted following a post-FOMC equity rally in the US & APAC. Following the release of poor French PMIs and bleak German commentary, equities have edged off best levels.

- European sectors are firmer; Tech takes the top spot, with optimism permeating within the sector after strong Micron results and Basic Resources benefits from broader strength in base metal prices.

- US equity futures (ES +0.4%, NQ +0.7%, RTY +0.6%) are stronger, in a continuation of the prior day's post-FOMC rally; Micron (+16% pre-market) is soaring after beating on EPS/Revenue and lifting guidance.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD is attempting to claw back post-FOMC losses with some help via EZ-PMI releases. DXY still has some way to go to close the gap to yesterday's best at 104.14. High print for today at 103.66 coincides with the 200DMA.

- EUR has been dragged lower by EZ PMIs which were indicative of the composite figure approaching neutral territory; EUR/USD on a 1.09 handle after slipping to a low of 1.0888.

- GBP is a touch softer vs. the USD but near post-FOMC highs which saw Cable peak at 1.2803. UK PMIs saw services and composite miss but the manufacturing print edge closer to neutral. Focus ahead is firmly on the BoE.

- JPY pausing for breath vs. the USD after vaulting to a high of 151.81 yesterday, which saw the pair stop shy of the 2023 high at 151.91 and 2022 peak at 151.94.

- AUD the best performer across the majors following encouraging jobs metrics. AUD/USD as high as 0.6634 but unable to breach last week's best at 0.6638. NZD marginally higher vs. USD despite the surprise contraction in Q4 GDP data.

- CHF is the clear laggard across the majors as the SNB surprises with a 25bps rate cut and reiterates a willingness to intervene in the FX market. EUR/CHF as been as high as 0.9782 to its highest level since July last year; 0.9842 was the high that year.

- An unchanged announcement from the Norges Bank but one which sparked NOK strength given the repo path has not formalised a Q4-2024 rate cut as some were hoping for. As such, EUR/NOK slipped from 11.5300 to 11.4857. However, a modest dovish move was seen on Governor Bache indicating the first cut is "likely" in September.

- PBoC set USD/CNY mid-point at 7.0942 vs exp. 7.1792 (prev. 7.0968).

- Click here for more details.

FIXED INCOME

- Choppy price action for Bunds owing to varied PMIs from France and Germany. The former sparked a dovish reaction with Bunds lifting from 131.90 to 132.72, whilst the German metrics sent Bunds back down to 131.85, though downside was shortlived given the Manuf. miss and SNB rate cut.

- USTs are underpinned by the dovish fixed narrative which is dictating EGBs/Gilts into the BoE post-SNB/PMIs. Action which has taken USTs to a 110-24+ high, eclipsing the post-FOMC 110-22 peak.

- Gilt price action is in-fitting with EGBs and as such approached their own PMIs with gains of around 30 ticks on the session. A release which saw two-way action with Gilts initially slipping to 99.24 (strong Manuf.) before rebounding to 99.46 (Comp. & Serv. miss); BoE up next.

- Spain sells EUR vs exp. EUR 5.5-6.5bln 2.50% 2027, 5.75% 2032, 3.45% 2043 Bono

- France sells EUR 12.498bln vs exp. EUR 11-12.5bln 2.50% 2027, 2.75% 2029, and 1.50% 2031 OAT

- Click here for more details.

COMMODITIES

- Crude was initially firmer after the Fed-induced Dollar decline coupled with broader risk appetite, and geopolitics. However, the complex then trimmed gains after PMIs for France and Germany painted a bleak economic recovery picture; Brent is now lower on the session and just shy of USD 86/bbl.

- Precious metals extend on post-Powell gains despite an attempted recovery in the Dollar, with spot gold topping USD 2,200/oz to fresh ATHs in APAC trade while spot silver gained status above USD 25.50/oz.

- Base metals are higher across the board in the after-math of the FOMC which boosted broader market sentiment.

- Click here for more details.

CENTRAL BANKS

- SNB cut its Policy Rate by 25bps to 1.50% (exp. 1.75%); FX language reiterated "willing to be active in the foreign exchange market as necessary", Ready to intervene in FX; Loosening permitted by inflation progress. Click here for details.

- SNB Chairman Jordan says that rates were able to be lowered as the fight against inflation has been effective. Says we give no forward guidance on future interest rates and will see where we are in 3 months time. Says we remain willing to sue balance to be active on forex market and could be sales of purchases; situation in ME is tricky; neither sales of forex are in focus at the moment

- Norges Bank maintains its Key Policy Rate at 4.50% as expected; reiterates guidance that "policy rate will likely need to be maintained at the current level for some time ahead". Click here for more details.

- Norges Bank Governor Bache says the rate path indicates a cut is most likely in September, second rate cut indicated by end of Q1'25

- Taiwan hikes its benchmark interest rate to 2.0% from 1.875%

NOTABLE EUROPEAN HEADLINES

- EU New car registrations (Feb): +10.1% (prev. 12.1%); battery electric market share 12% (prev. 10.9%). EU27 New Car Registrations by Manufacturer (Y/Y). Volkswagen (VOW3 GY) +8.7%; Stellantis (STLAM IM/STLAP FP) +11.2%; Renault (RNO FP) +5.9%; BMW (BMW GY) +7.0%; Mercedes Benz Group (MBG GY) -2.1%; Volvo Cars (VOLCAR SS) +33.9%. (acea)

- Portugal's President named centre-right democratic alliance leader Luis Montenegro as the new PM, according to Reuters.

PMI DATA

- French HCOB Services Flash PMI (Mar) 47.8 vs. Exp. 48.7 (Prev. 48.4); HCOB Manufacturing Flash PMI (Mar) 45.8 vs. Exp. 47.5 (Prev. 47.1); HCOB Composite Flash PMI (Mar) 47.7 vs. Exp. 48.6 (Prev. 48.1); Softer across the board sparking a fleeting dovish reaction.

- German HCOB Manufacturing Flash PMI (Mar) 41.6 vs. Exp. 43.1 (Prev. 42.5); HCOB Services Flash PMI (Mar) 49.8 vs. Exp. 48.8 (Prev. 48.3); HCOB Composite Flash PMI (Mar) 47.4 vs. Exp. 47 (Prev. 46.3); "Germany is not getting back on track; Overall, Germany now teeters on the edge of a technical recession; our GDP nowcast is at -0.3%. This corresponds to the rate of contraction in the fourth quarter of 2023."; downbeat commentary & dovish SNB continued the post-France dovish move.

- EU HCOB Composite Flash PMI (Mar) 49.9 vs. Exp. 49.7 (Prev. 49.2); HCOB Manufacturing Flash PMI (Mar) 45.7 vs. Exp. 47 (Prev. 46.5); HCOB Services Flash PMI (Mar) 51.1 vs. Exp. 50.5 (Prev. 50.2).

- UK Flash Composite PMI (Mar) 52.9 vs. Exp. 53.1 (Prev. 53); Flash Services PMI (Mar) 53.4 vs. Exp. 53.8 (Prev. 53.8); Flash Manufacturing PMI (Mar) 49.9 vs. Exp. 47.8 (Prev. 47.5); "The survey data are indicative of first quarter GDP rising 0.25% to thereby signal a reassuringly solid rebound from the technical recession seen in the second half of 2023".

OTHER DATA

- UK PSNB Ex Banks GBP (Feb) 8.401B GB vs. Exp. 5.95B GB (Prev. -16.691B GB, Rev. -16.114B GB); PSNB, GBP (Feb) 7.477B GB (Prev. -17.615B GB, Rev. -17.038B GB); PSNCR, GBP (Feb) 3.024B GB (Prev. -23.344B GB, Rev. -22.482B GB)

- French Business Climate Mfg (Mar) 102.0 vs. Exp. 100.0 (Prev. 100.0, Rev. 101)

- EU Current Account NSA, EUR (Jan) 24.87B (Prev. 42.66B); Current Account SA, EUR (Jan) 39.35B (Prev. 31.95B)

NOTABLE US HEADLINES

- Nvidia (NVDA) - Announced that Q1 2025 earnings would be published on May 22nd, 2024. Separately, CEO told CNBC that Nvidia has created markets that did not exist before, rather than take share from existing markets. Added that the most important thing for a country is to create its own sovereign AI.

- Micron Technology (MU) - Its share price surged 18% higher afterhours on a profit beat and solid outlook. Q4 adj. EPS 0.42 (exp. -0.25), Q4 revenue USD 5.824bln (exp. 5.34bln). Said AI demand and tight supply accelerated its return to profitability. Expects DRAM and NAND pricing levels to increase further throughout 2024. Expects bit demand growth for the industry to be near the long-term CAGR for DRAM in 2024; expects 2024 industry supply to be below demand for both DRAM and NAND. Said inventories for memory and storage have improved significantly in the data centre unit; In the data centre segment, total industry server unit shipments are expected to grow mid to high single digits in calendar year 2024. Sees Q3 adj. Plans Q3 capex higher than in Q2. Now expects positive FCF in fiscal Q3 and Q4. EPS at 0.45 (exp. 0.17), and sees Q3 revenue of USD 6.6bln (exp. 5.976bln). Sees 2024 front-end cost reductions, excluding the impact of HBM, to track in line with long-term expectations. Sees record revenue and much improved profitability in FY25.

- Apple (AAPL) - AAPL's shares fell 1.3% afterhours on news that the DoJ plans to sue Apple for antitrust violations, which could be announced on Thursday, alleging it blocked rivals from iPhone features, Bloomberg reports. The report said it signals an intensification of the Biden Administration's tech antitrust battles, including recent cases against Google (GOOG), Meta Platforms (META), and Amazon (AMZN).

GEOPOLITICS

- US military said coalition forces destroyed an unmanned aerial vehicle fired by Yemen's Houthis in the Red Sea and destroyed an unmanned surface vessel on March 20th, according to Reuters.

- Australia and Britain signed a defence pact which includes a status of forces agreement and makes it easier for the respective forces to operate together in each other’s countries, while the agreement also formalises the established practice of consulting on issues that affect our sovereignty and regional security.

- "Al-Arabiya sources: Pressure on Israel to postpone the Rafah operation for at least 45 days", according to Al Arabiya; "The mediators and America rejected a preliminary Israeli proposal on the military operation in Rafah"

CRYPTO

- Bitcoin climbed back to best levels at USD 68k, before paring back to around the USD 66k level.

APAC TRADE

- APAC stocks were mostly underpinned after the fresh record levels on Wall St post-dovish FOMC where the Fed maintained the projection for 3 rate cuts in 2024 and Powell downplayed recent hot inflation data.

- ASX 200 strengthened with sentiment also helped by a stellar jobs report and a fall in unemployment, while gold miners outperformed after the precious metal rose above USD 2,200/oz to a new all-time high.

- Nikkei 225 rallied from the open to unprecedented levels north of 40,800 despite recent hawkish source reports.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark rallied to just shy of the 17,000 level amid strength in the property sector and as the Fed projection for three rate cuts keeps similar action on the table for the HKMA. Conversely, the mainland lagged as the PBoC injected the least amount of funds in its open market operations since August last year despite the PBoC's Deputy Governor reaffirming that China's monetary policy has ample room and there is still room for cutting RRR.

NOTABLE ASIA-PAC HEADLINES

- HKMA maintained its base rate unchanged at 5.75%, as expected. HKMA said financial and monetary markets in Hong Kong continue to operate in a smooth and orderly manner, while it added that the HKD exchange rate remains stable and Hong Kong dollar interbank rates might remain high for some time.

- PBoC Deputy Governor Changneng Xuan said they will promote effective investment and help resolve excess capacity, while he added that China's monetary policy has ample room and there is still room for cutting RRR. PBoC Deputy said he expects China's nominal economic growth to be around 8% in 2024 and will maintain appropriate growth in credit and total social financing, while they will guide banks to lower deposit rates and lower financing costs, support consumption and investment, as well as promote a rebound in prices.

- China's Vice Finance Minister said fiscal policy will provide the necessary support for achieving the 2024 growth target and China's government debt is at an appropriate level, while he said China has continued to reduce the overall level of tariffs, which has now been reduced to 7.3% and is relatively low in the world, according to Reuters and Global Times.

- China state planner vice chair said they will speed up approval for investment projects and that total bond funds for government investment will exceed CNY 6tln, while they will step up support for private investment and encourage private firms to participate in infrastructure investment projects, according to Reuters.

- BoJ Governor Ueda said the BoJ is expected to maintain an accommodative monetary policy for the time being and accommodative monetary policy is likely to underpin the economy, while he added that cost-push pressure on inflation is dissipating but service prices continue to rise moderately and the preliminary wage negotiation outcome tends to be revised down but even so, they thought the final outcome would be a fairly strong number. BoJ Governor Ueda said as they end massive stimulus, they will likely gradually shrink the balance sheet and at some point reduce JGB purchases but at present, they have no clear idea regarding the timing of reducing JGB buying and scaling back the size of the balance sheet. Furthermore, he said they are not immediately thinking of selling BoJ's ETF holdings and will take plenty of time examining how to reduce ETF holdings.

- BoJ is reportedly seen weighing the next rate hike in July or October as the Yen weakens, according to Nikkei. A source noted that additional hikes are of course on the table and that an early hike leaves room for the BoJ to consider rolling out another increase before the end of the year, while the timeline would keep the BoJ coming off like they are rushing to hike rates. Furthermore, it was stated that a growing number see a July rate boost as another possibility if a weak yen raises the price of imports and accelerates inflation, forcing the BoJ to step in. It was earlier reported that the Yen's decline appears to be raising little alarm at the BoJ for now which was to be expected given that Governor Ueda is maintaining an accommodative stance on policy, according to a source at the BoJ cited by Nikkei. However, it was noted that some at Japan's Finance Ministry are wary of rapid fluctuations in the currency market driven by speculative trades.

- Fitch expects BoJ to raise policy rate to 0.25% by 2025.

- CNOOC (600938 CH) FY (CNY) IFRS Net 123.84bln (exp. 130.33bln); In 2024, will insist on increasing oil and gas reserves and production; ongoing recovery trajectory in China will support demand for oil and gas

DATA RECAP

- Japanese Trade Balance (JPY)(Feb) -379.4B vs. Exp. -810.2B (Prev. -1760.3B); Exports YY (Feb) 7.8% vs. Exp. 5.3% (Prev. 11.9%); Imports YY (Feb) 0.5% vs. Exp. 2.2% (Prev. -9.6%, Rev. -9.8%)

- Japanese Manufacturing PMI Flash SA (Mar) 48.2 (Prev. 47.2); Services PMI Flash SA (Mar) 54.9 (Prev. 52.9); Composite Flash SA (Mar) 52.3 (Prev. 50.6)

- Australian Employment (Feb) 116.5k vs. Exp. 40.0k (Prev. 0.5k); Unemployment Rate (Feb) 3.7% vs. Exp. 4.0% (Prev. 4.1%); Participation Rate (Feb) 66.7% vs. Exp. 66.8% (Prev. 66.8%)

- Australian Manufacturing PMI Flash (Mar) 46.8 (Prev. 47.8); Services PMI Flash (Mar) 53.5 (Prev. 53.1); Composite PMI Flash (Mar) 52.4 (Prev. 52.1); GDP QQ (Q4) -0.1% vs. Exp. 0.1% (Prev. -0.3%)

- New Zealand GDP YY (Q4) -0.3% vs. Exp. 0.1% (Prev. -0.6%)