US Market Open: Equities mixed, Dollar bid & JPY lower post-BoJ hike; US 20yr supply due

19 Mar 2024, 11:00 by Newsquawk Desk

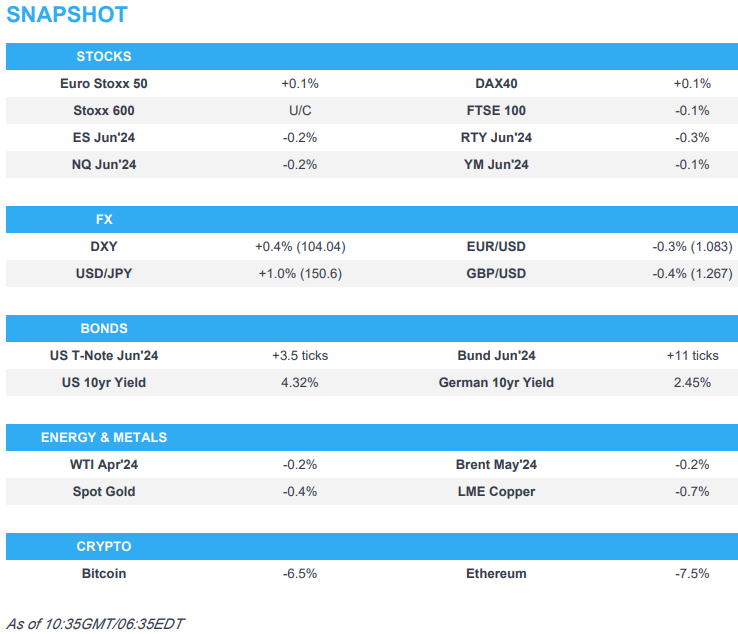

- European bourses are mixed; US equity futures are lower, RTY underperforms

- BoJ carried out a widely telegraphed and dovish exit from NIRP, YCC and ETF/J-REIT buying; RBA U/C, dovish tweak to guidance

- Dollar is firmer and trades around 104.00, JPY underperforms post-BoJ, AUD pressured post-RBA

- Bonds incrementally firmer as attention turns to US 20yr supply

- Crude and XAU are modesty softer, weighed on by the stronger Dollar

- Looking ahead, Canadian CPI & Supply from the US

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.1%) began the session on a mixed footing though have caught a slight bid in recent trade, and reside near session highs; the AEX (+0.4%) outperforms, lifted by gains in Unilever (+4.5%).

- European sectors are mixed; Energy takes the top spot, with Crude just off recent highs whilst Consumer Products and Services is hampered by broader weakness in Luxury names, after weak Chinese price action overnight.

- US equity futures (ES -0.1%, NQ -0.1%, RTY -0.3%) are modestly lower, with mild underperformance in the RTY as it continues the prior day's weakness.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- DXY is boosted by the post-BoJ softness in the JPY. DXY has reached a high of 104.06, bringing into play the March peak of 104.29 into view.

- EUR is swept up by the broadly firmer USD as the pair pulls back from a 1.0906 peak yesterday. If the descent continues, support comes via the 200DMA at 1.0838. EUR downside came to a halt on firm German ZEW metrics.

- GBP is softer vs. the USD. Cable is resting on its 50DMA at 1.2683 with UK-specifics lacking ahead of CPI metrics tomorrow and the BoE on Thursday.

- JPY is the laggard across the majors despite the BoJ ending NIRP. The move was widely expected and despite Ueda opening the door to further hikes, markets expect any hiking campaign by the Bank to be a shallow one. USD/JPY up to 150.69 at best.

- Antipodeans are both faring poorly vs. the USD. AUD eyeing a test of 0.65 to the downside where a large option expiry lies and bids are expected; the RBA kept its Cash Rate Target unchanged at 4.35%.

- PBoC set USD/CNY mid-point at 7.0985 vs exp. 7.2056 (prev. 7.0943).

- Click here for more details.

FIXED INCOME

- Bunds are firmer after being incrementally softer on Monday. Newsflow has been dominated by the BoJ but read-across to EGBs is ultimately limited; EGBs saw modest upside following the better-than-expected German ZEW figures, with Bunds printing highs at 131.89.

- USTs are following EGBs and holds around the 110-00 mark. 20yr supply takes attention ahead of the FOMC on Wednesday.

- Gilt price action is in-fitting with EGBs; Gilts caught a bid following the UK auction and in tandem with a lift in EGBs post-ZEW, currently at 98.90.

- The BoJ's exit from NIRP & YCC saw an initial dip in JGBs and sent the accompanying 10yr yield back to its earlier session high of 0.77%. Thereafter, JGB price action was volatile before settling around 145.60. A pullback which occurred as some of the dovish elements were digested.

- EU opens books to sell EUR-denominated Feb 2050 green NGEU bonds; guidance +82bps to mid-swap; to sell EUR 6bln.

- Order for the new Italian 10yr I/L BTP are in excess of EUR 35bln, according to leads; spread a +23bps over the maturing May 2023 BTP.

- UK sells GBP 2bln 4.75% 2043 Gilt: b/c 3.41x (prev. 3.62x), average yield 4.467% (prev. 4.391%), tail 0.4bps (prev. 0.2bps)

- Click here for more details.

COMMODITIES

- Subdued trade across the crude complex this morning, with prices taking a breather after yesterday's rise; Brent meanders around USD 86.75/bbl after printing a high above USD 87/bbl yesterday.

- Mild downward bias across precious metals amid a firmer Dollar with little reaction to the BoJ overnight as traders gear up for the FOMC and then the BoE; XAU hovers just above USD 2,150/oz.

- Base metals are softer across the board amid the stronger Dollar and following weak Chinese trade overnight.

- UBS sees Brent likely trading between USD 80-90/bbl range this year, with end-June forecast of USD 86/bbl; extension of voluntary OPEC+ cuts for another three months will likely keep oil market underpinned in Q2 2024.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB's Centeno said cutting rates may help prevent a recession.

- ECB's de Guindos says "looking at recent inflation developments, we can see a very clear disinflationary process. This is reflected in both headline and core inflation readings; will have more information in June".

- ECB's De Cos says in June we could start cutting rates but it is conditional on data

- SNB: Identifies a need for action with capital regulations. Regarding AT1 instruments, the aim should be to strengthen their contribution through a timely suspension of buybacks/interest payments alongside a conversion into CET1 capital earlier

DATA RECAP

- German ZEW Current Conditions (Mar) -80.5 vs. Exp. -82.0 (Prev. -81.7); ZEW Economic Sentiment (Mar) 31.7 vs. Exp. 20.5 (Prev. 19.9); Economic expectations for Germany are significantly improving; at the same time more than 80% of those surveyed anticipate that the ECB will cut interest rates in the next 6 months.

- EU ZEW Survey Expectations (Mar) 33.5 (Prev. 25)

- EU Wages In Euro Zone (Q4) 3.1% (Prev. 5.3%, Rev. 5.2%); Labour Costs YY (Q4) 3.4% (Prev. 5.3%, Rev. 5.2%)

- Swiss Trade (Feb) 3662.0M CH (Prev. 4738.0M CH, Rev. 4701M CH); Watch Exports -3.8% (prev. 3.1%)

NOTABLE US HEADLINES

- WSJ's Timiraos "Fed officials have a bias to cut rates but need a credible justification to get started"; "Officials won’t put recession risk front and center this week. Yet that risk is likely to drive its thinking over the remainder of the year".

- US Congressional leaders and the White House reached an agreement to avert a partial shutdown and fund the government through September 30th, according to people familiar with the negotiations cited by Bloomberg.

- US Senators will host a classified briefing on Wednesday with Biden admin national security officials regarding the threats posed by TikTok, according to Reuters citing a congressional aide.

- BofA Fund Manager Survey (March): global growth expectations are at a two year high, recession risks dissipating. Long Magnificent 7 remains the most crowded trade, ahead of short China equities.

- AstraZeneca (AZN LN) to acquire Fusion (FUSN) for USD 21/shr (prev. close 10.64/shr) in cash closing plus a non-transferable CVR of USD 3/shr in USD 2.4bln deal.

- NVIDIA (NVDA) announces Omniverse Cloud APIs to power wave of industrial digital twin software tools and announces Drive Thor. Launches generative AI microservices for developers to create and deploy generative AI copilots across NVIDIA CUDA GPU installed base and it introduces software to help developers sell their AI models. Healthcare launches generative AI microservices to advance drug discovery, medtech and digital health. Microsoft (MSFT) and NVIDIA announce major integrations to accelerate generative AI for Enterprises Everywhere, while Microsoft Azure is to adopt NVIDIA Grace Blackwell super chip to accelerate customer and first-party AI offerings. Announces Earth Climate digital twin with Taiwan's Weather Administration among the first to adopt new Earth-2 cloud APIs. Blackwell platform arrives to power a new era of computing; Introduces Blackwell B200 AI chip. -0.5% in pre-market trade

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said he spoke with Biden about achieving goals in the Gaza war while providing needed humanitarian aid, while it was also reported that President Biden reiterated 'deep concerns' about Israel conducting ground operations in Rafah during the call with Israeli PM Netanyahu.

- Israeli officials said PM Netanyahu narrowed the mandate of the negotiating delegation and set red lines for what they can accept, according to Axios.

- US military said it destroyed seven anti-ship missiles and three unmanned aerial vehicles in Houthi-controlled areas of Yemen, while Houthi media reported six US-British raids near Hodeidah, Yemen, according to Al Arabiya.

- Syrian army ground defences confronted targets in the sky of Damascus and state media reported that Israeli airstrikes were targeting the countryside of Syria's Damascus.

- "Israeli official to the broadcaster: The talks in Doha were positive and we expect difficult, complex and long negotiations", according to Sky News Arabia.

CRYPTO

- Bitcoin (-5.1%) continues to sink lower and now back below USD 64k, with Ethereum (-7.1%) extending losses to a higher degree.

APAC TRADE

- APAC stocks traded mixed as markets digested the first of this week's central bank announcements.

- ASX 200 finished with mild gains after a lack of hawkish surprises at the RBA policy announcement in which it kept rates unchanged and reiterated that the Board remains resolute in its determination, while there was also a slight tweak in its language as guidance around further tightening was softened.

- Nikkei 225 was underpinned after a widely telegraphed and dovish exit from NIRP, YCC and ETF/J-REIT buying which a Nikkei source report had flagged, while the central bank also announced its monthly bond purchase intentions and said it will make nimble responses with JGB purchases and could increase the amount of JGB buying or conduct fixed-rate operations in the event of a rapid rise in yields.

- Hang Seng and Shanghai Comp. lagged with the Hong Kong benchmark dragged lower by weakness in tech stocks as the EU mulls joining the US in reviewing risks of Chinese legacy chips and is flagging potential risks to national security and supply chains.

NOTABLE ASIA-PAC HEADLINES

- RBA kept its Cash Rate Target unchanged at 4.35%, as expected, while it reiterated that the Board remains resolute in its determination to return inflation to the target and inflation continues to moderate but remains high. RBA stated the board is not ruling anything in or out on interest rates (prev. a further increase in interest rates cannot be ruled out) and data is consistent with continuing excess demand in the economy and strong domestic cost pressures, both for labour and non-labour inputs. Furthermore, it noted that higher interest rates are working to establish a more sustainable balance between aggregate demand and supply in the economy and the board expects that it will be some time yet before inflation is sustainably in the target range.

- RBA Governor Bullock said they are making progress in the fight against inflation but reiterated inflation remains high and noted recent data suggests they are on the right track and they are keeping a keen eye on employment numbers. Bullock stated that risks to the outlook are finely balanced and war isn't won yet on inflation, while she noted the change of statement language is in response to data.

- Chinese Foreign Minister Wang Yi said during a visit to New Zealand that China is ready to work with New Zealand to implement an upgraded version of the China-New Zealand FTA and the two sides should launch negotiations on a negative list of service trade as soon as possible to push bilateral cooperation to a new level. Furthermore, he stated that China-New Zealand relations maintain a leading position among China's relations with developed countries, while it was also reported that New Zealand PM Luxon intends to visit China in the coming months following this week's meetings with China's Foreign Minister.

- China State Council issues action plan to make greater efforts to attract and utilise foreign investments; plan is to expand market access and raise the level of liberalisation of foreign investment

- Tencent Music Entertainment Group (TME) Q4 2023 (USD): EPS 0.12 (exp. 0.14), Revenue 0.97bln (exp. 0.93bln).

- Xiaomi (1810 HK) Q4 (CNY): Revenue 73.24bln (exp. 72.51bln); Adj. Net 4.91bln (exp. 3.77bln).

BoJ

- BoJ changed its monetary policy framework in which it ended negative interest rate policy and abandoned YCC, while it will guide the overnight call rate in the range of 0%-0.1% and apply 0.1% interest to all excess reserves parked at the central bank. BoJ also announced to end ETF and J-REIT purchases, as well as gradually reduce the amount of purchases of commercial paper and corporate bonds whereby it will discontinue purchases of CP and corporate bonds in about one year. However, it stated that it will continue roughly the current amount of JGB buying and it expects to maintain an accommodative monetary environment for the time being. Furthermore, the BoJ announced its planned bond purchases and stated that in case of a rapid rise in long-term rates, it will make nimble responses with JGB purchases and could increase the amount of JGB purchases or conduct fixed-rate purchase operations of JGBs, while it will provide loans under Fund Provisioning Measure to stimulate bank lending with an interest rate of 0.1% and a 1-year duration.

- BoJ PRESS CONFERENCE: Governor Ueda says BoJ has confirmed the virtuous cycle of wages and prices; Accommodative financial conditions will be maintained for the time being. Click here for full commentary.

- Japanese Finance Minister Suzuki says the government's view of the economy is the same as that of the BoJ; closely monitoring the economy and financial markets, including FX after the BoJ decision.

- Japan's Business Lobby Keidanren Chief says the appropriate decision was taken at the appropriate time, when asked on the BoJ announcement; does not think USD/JPY at 150 reflects Japan's economic fundamentals; Yen should be firmer considering fundamentals.

- Japan PM Kishida believes it is appropriate that accommodative monetary environment is maintained; did not discuss current issues with BoJ's Ueda