EU Market Open: European equities to open with modest gains; US senators propose blocking NVDA's Blackwell chips to China

05 Dec 2025, 06:48 by Newsquawk Desk

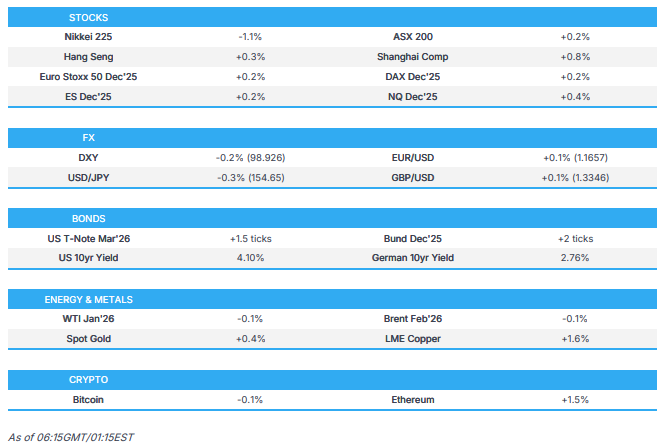

- APAC stocks were mixed, with the regional bourses mostly rangebound, amid light fresh catalysts ahead of US PCE data.

- US senators seek to block NVIDIA (NVDA) sales of advanced chips to China for 30 months and would target NVIDIA's H200 and Blackwell chips, according to FT.

- Russia's Kremlin said Moscow is waiting for the US reaction after the Putin-Witkoff meeting, while it added that there is no plan for a Putin-Trump call for now.

- BoJ is said to likely hike this month and leave the door open to more, while the central bank is to check the data and market moves up to the final decision, according to Bloomberg.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.2% after the cash market closed with gains of 0.4% on Thursday.

- Looking ahead, highlights include German Industrial Orders (Oct), French Trade Balance (Oct), Italian Retail Sales (Oct), EZ Employment Final (Q3), EZ GDP Revised (Q3), Canadian Jobs Report (Nov), US PCE (Sep), US University of Michigan Prelim (Dec), and Comments from ECB's Lane.

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished mixed, with the Russell posting notable gains while the Nasdaq underperformed, and the S&P 500 was roughly flat. Futures were supported briefly in pre-market trade on reports that Meta (META) is cutting 30% of its budget on Metaverse spending, which gave a boost to Meta shares and US indices as the tech giant puts more effort into AI. However, the move was only short-lived for the indices, but Meta still closed with gains of c. 3.5%. Focus then turned to US data, which showed a slowdown both in challenger layoffs and in the total non-farm payroll losses M/M reported by RevelioLabs. There was also a minor M/M improvement on the Chicago Fed unemployment rate estimate for November. Meanwhile, both initial and continued jobless claims came in below all analyst forecasts, helping ease some recent labour market concerns.

- SPX +0.11% at 6,857, NDX -0.10% at 25,582, DJI -0.07% at 47,851, RUT +0.76% at 2,531.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump is to talk trade with Mexico and Canada in Washington DC on Friday, according to CBS. This follows reports that Canadian PM Carney is to have brief meetings with US President Trump and Mexican President Sheinbaum at the World Cup draw on Friday, while Canada's Trade Minister LeBlanc had earlier commented that Carney doesn't plan to talk trade with Trump at the FIFA event.

- US Trade Representative Greer said trade with China needs to be balanced and probably needs to be smaller, while he added they want to have stability in the relationship with China, and that the US trade deficit in goods with China is down about 25%, which is the right direction. Greer also noted there are problems with the US-Mexico-Canada Trade Agreement and that they already have adjustments to some of these challenges, as well as stated that the US wants to make sure that Canada and Mexico aren't used as an export hub for China, Vietnam or Indonesia, among others.

- US senators seek to block NVIDIA (NVDA) sales of advanced chips to China for 30 months and would target NVIDIA's H200 and Blackwell chips, according to FT. It was separately reported that a bipartisan group of US senators, including prominent China hawk Cotton, unveiled a bill that would block the Trump administration from loosening rules that restrict Beijing's access to artificial intelligence chips for 2.5 years, according to Reuters.

- US trade delegation is likely to visit Delhi, India for talks next week, according to Reuters sources.

- Chinese drone maker DJI urged the Trump administration to complete audits or extend the deadline for the security review, according to a letter to Congress.

- China and France issued a joint statement on agricultural cooperation and signed an MOU on registration of infant milk powder formulas, according to Xinhua.

- Japanese Trade Minister Akazawa said they are monitoring US tariff lawsuit developments and he confirmed that Japanese companies have filed lawsuits in the US seeking refunds of additional tariffs.

NOTABLE HEADLINES

- Federal Reserve Board announced a new pricing for payment services provided to banks and credit unions, effective 1st January 2026, while Fed's Bowman emphasised the importance of checks as a payment method and said the Fed cannot endorse the RFI regarding the future of check services.

- US NEC Director Hassett said real wage growth is now higher than inflation, and it is likely that the Fed will cut at the next meeting.

- US Supreme Court revived the redrawn pro-Republican Texas voting map intended to help Republicans keep control of Congress.

- US Homeland Security Secretary Noem said the Trump administration is expanding the countries on the travel ban to over 30, according to Fox News.

APAC TRADE

EQUITIES

- APAC stocks were mixed with the regional bourses mostly rangebound, amid light fresh catalysts ahead of US PCE data.

- ASX 200 edged higher but with gains capped as strength in the mining and materials sectors was partially offset by weakness in consumer discretionary, energy and telecoms, while price action was also contained by the absence of any pertinent data.

- Nikkei 225 underperformed amid the increased BoJ December rate hike bets and after dismal Household Spending data, which showed a surprise contraction.

- Hang Seng and Shanghai Comp saw two-way price action with early headwinds following another consecutive liquidity drain by the PBoC and reports that US senators seek to block NVIDIA (NVDA) sales of advanced chips to China for 30 months, which would target NVIDIA's H200 and Blackwell chips.

- US equity futures remained afloat after the prior day's gains, but with price action contained heading into the Fed's preferred inflation measure.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.2% after the cash market closed with gains of 0.4% on Thursday.

FX

- DXY slightly eased back following the gains during the previous session, where there was a somewhat mixed performance among the dollar's major counterparts, and participants digested some encouraging labour market data, including a larger-than-expected drop in the weekly claims report in which both Initial and Continued Claims printed beneath analysts’ forecast range, while the attention stateside now turns to the Fed's preferred PCE inflation measure.

- EUR/USD nursed some losses after having previously conceded ground to the firmer buck.

- GBP/USD struggled for direction amid a lack of pertinent catalysts, and retained most of its mid-week spoils.

- USD/JPY was choppy and initially returned to the 155.00 level on Gotobi day after rebounding from the prior day's lows, but later retreated amid increased BoJ December rate hike bets and a further source report pointing to the BoJ resuming its policy normalisation this month.

- Antipodeans mildly gained in range-bound trade amid the mixed risk appetite and a relatively quiet overnight calendar.

- PBoC set USD/CNY mid-point at 7.0749 vs exp. 7.0745 (Prev. 7.0733)

FIXED INCOME

- 10yr UST futures marginally rebounded off this week's trough after declining yesterday following the labour metrics.

- Bund futures were contained after recently retreating alongside the pressure seen in global peers.

- 10yr JGB futures remain subdued after suffering from the increased bets for a BoJ December rate hike, with the latest source report noting that the BoJ is likely to hike this month and leave the door open to more.

COMMODITIES

- Crude futures eased back following the prior day's mild gains, in which they continued to claw back some of the losses from earlier in the week that had been triggered by the US-Russia talks in Moscow, while demand was constrained amid light catalysts and after WTI hit resistance around the USD 60/bbl level.

- Spot gold briefly dipped beneath the USD 4,200/oz level in choppy trade ahead of the Fed's preferred inflation gauge.

- Copper futures gradually edged higher with 3-month LME copper prices hitting fresh record highs.

CRYPTO

- Bitcoin was indecisive and returned to flat territory around the USD 92,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ is said to likely hike this month and leave the door open to more, while the central bank is to check the data and market moves up to the final decision, according to Bloomberg.

- RBI cut the Repurchase Rate by 25bps to 5.25%, as expected, with the decision unanimous and it maintained a neutral stance although MPC member Ram Singh wanted the stance to be changed to accommodative from neutral, while the Marginal Lending Facility Rate was lowered by 25bps to 5.50% and the Standing Deposit Facility Rate was reduced by 25bps to 5.00%. RBI Governor Malhotra said since the October policy meeting, the economy has witnessed rapid disinflation, and it is a rare goldilocks period for the Indian economy, but noted that the geopolitical and trade environment weigh on the outlook. Malhotra also announced they will conduct OMO purchases of INR 1tln and a USD 5bln dollar swap, with the primary purpose of open market operations is to provide sufficient liquidity and not influence yields. Furthermore, he said underlying inflation pressures are even lower, and growth is expected to somewhat soften going ahead, but stated that policy space exists to support growth momentum, while the central bank raised its FY26 real GDP growth forecast to 7.3% (prev. 6.8%) and cut its FY26 CPI inflation forecast to 2.0% (prev. 2.6%).

DATA RECAP

- Japanese All Household Spending MM (Oct) -3.5% vs. Exp. 0.7% (Prev. -0.7%)

- Japanese All Household Spending YY (Oct) -3.0% vs. Exp. 1.0% (Prev. 1.8%)

GEOPOLITICS

MIDDLE EAST

- US President Trump plans to announce before Christmas the transition to phase 2 of the agreement to end the war in Gaza and the establishment of the new governing body that will manage the strip, according to Axios's Ravid.

RUSSIA/UKRAINE

- Russia's Kremlin said Moscow is waiting for the US reaction after Putin-Witkoff meeting, while it added that there is no plan for a Putin-Trump call for now.

OTHER NEWS

- US military said it conducted a lethal kinetic strike on a vessel in international waters in the eastern Pacific on Thursday.