Europe Market Open: European equity futures mostly lower; UK PM Starmer and Chancellor Reeves to ditch income tax increase plans

14 Nov 2025, 06:54 by Newsquawk Desk

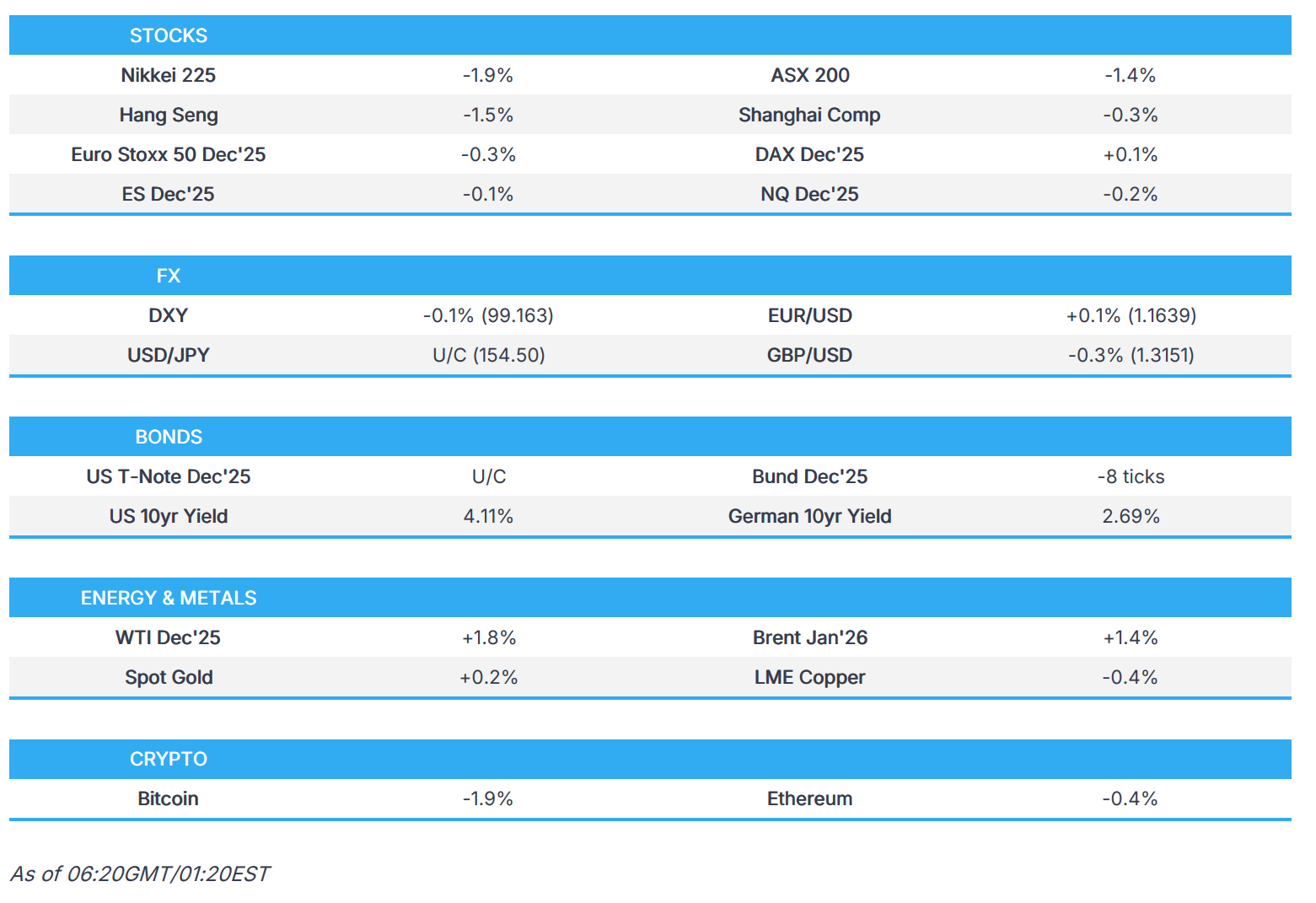

- APAC stocks were pressured following the sell-off stateside, where tech was hit on valuation and China AI race concerns, while sentiment was also not helped by recent hawkish-leaning Fed rhetoric and mixed Chinese activity data.

- Chinese activity data was mixed, in which Industrial Production disappointed and Retail Sales marginally topped estimates, but both showed a slowdown from the previous, while Chinese House Prices continued to contract.

- US BLS said it is working on a plan to release the delayed data and stated, "We appreciate your patience while we work to get this information out ASAP, as it may take time to fully assess the situation and finalise revised release dates", according to WSJ.

- UK PM Starmer and Chancellor Reeves reportedly ditched budget plans to increase income tax rates, according to FT.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.3% after the cash market closed with losses of 0.8% on Thursday.

- Looking ahead, highlights include German Wholesale Price Index (Oct), French/Spanish CPI Final (Oct), EU Trade Balance (Sep), EU GDP Flash Estimate (Q3), Speakers including ECB’s Cipollone, Elderson & Lane, Fed’s Bostic, Schmid & Logan, Earnings from Swiss Re, Allianz & Siemens Energy.

SNAPSHOT

US TRADE

EQUITIES

- US stocks declined with the Nasdaq and big tech names leading the losses, seemingly driven by concerns over the US position in the AI race against China after a slew of positive updates from Chinese tech companies overnight. The SPX sold off by over 100 points at the close, while RUT and NDX clearly underperformed.

- Sectors were predominantly lower, with the homes of the heavy weights, Consumer Discretionary, Tech and Communications the laggards, while Energy, Consumer Staples and Healthcare outperformed, in which energy stocks tracked crude prices higher as Russia appeared frustrated with Ukraine's lack of negotiations although crude settled well off today's highs amid the downbeat risk tone and after inventory data saw a chunky build.

- SPX -1.64% at 6,739, NDX -2.05% at 24,993, DJI -1.65% at 47,457, RUT -2.78% at 2,383.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump's administration is preparing tariff exemptions in a bid to lower food prices, according to NYT

- US Secretary of State Rubio met with Brazil's Foreign Minister and discussed a reciprocal framework for the US-Brazil trade relationship, according to the State Department

- US senior official said agreements with Argentina, Ecuador, El Salvador and Guatemala open markets to US agricultural and industrial products, expects full agreements with most of these countries to be finalised within the next two weeks, in which the four countries agreed not to impose digital service taxes. Furthermore, the tariff rates will remain for these countries, but framework agreements will provide relief in certain areas, including bananas.

- US senior official said talks with Switzerland on Thursday were very positive, and if the deal is accepted by US President Trump, we would see a reduction of tariffs on Swiss imports. The official also commented that they have made a lot of advances with Taiwan.

- European Commission President von der Leyen said ministers agreed to hike duties on small parcels.

- South Korea announced the factsheet with the US was finalised and President Lee said that US President Trump made a rational decision for the factsheet, while Lee added they agreed that investment in the US will be limited to commercially viable projects and that South Korea and the US will build a new partnership for shipbuilding, AI and the nuclear industry. Lee stated that the sides agreed on South Korea building a nuclear-powered submarine, and South Korea will strengthen ties with companies like NVIDIA.

- South Korean Presidential Adviser said the US will give South Korea chip tariff terms that are no less favourable than Taiwan’s, while it was agreed with the US that forex market stability needs to be ensured and that the amount and timing of fund supply to the US can be adjusted if needed for forex stability.

- White House said the US and South Korea deal includes USD 150bln of Korean investment in the shipbuilding sector approved by the US and USD 200bln of additional Korean investment committed pursuant to an MOU on strategic investments, while the US has given approval for South Korea to build nuclear-powered attack submarines. US said it will reduce its Section 232 sectoral tariffs on automobiles, auto parts, timber, lumber and wood derivatives of South Korea to 15%, and for any Section 232 tariffs imposed on pharmaceuticals, the US intends to apply a tariff rate no greater than 15% to originating goods of South Korea. Furthermore, South Korea is committed to spending USD 25bln on US military equipment purchases by 2030 and shared its plan to provide comprehensive support for US Forces Korea amounting to USD 33bln in accordance with South Korean legal requirements, while the US agreed that South Korea will pay USD 20bln annual phased instalments as part of the trade deal.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said outside of data centres, business investment has been tepid and that businesses are learning how to run their firms in an uncertain environment. Musalem said he supported rate cuts so far to protect the labour market and they need to proceed with caution now. Furthermore, he sees limited room to ease without becoming overly accommodative and said policy is closer to neutral than modestly restrictive, while he added they need to continue to lean against inflation.

- Fed's Hammack (2026 voter) said the US economy has been remarkably resilient and that she hears from contacts that inflation is too high and moving in the wrong direction. Hammack stated the employment side of the mandate is challenged amid job market softening, and inflation may be tariff-driven, but service inflation is a real concern, while she added that Fed policy needs to remain somewhat restrictive to push inflation pressures down.

- Fed's Kashkari (2026 voter) said it seems like there are real pockets of weakness in the labour market and corporations are very optimistic about 2026, while he has no strong inclination yet on a December rate cut, but noted data suggests more of the same since the October meeting and that the resilient economy called for a rate pause in October.

- NEC Director Hassett said he expects to see 60k job losses due to the government shutdown, while he responded that the numbers they have are consistent with more rate cuts, when asked about inflation.

- BLS said it is working on a plan to release the delayed data and stated, "We appreciate your patience while we work to get this information out ASAP, as it may take time to fully assess the situation and finalise revised release dates", according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks were pressured following the sell-off stateside, where tech was hit on valuation and China AI race concerns, while sentiment was also not helped by recent hawkish-leaning Fed rhetoric and mixed Chinese activity data.

- ASX 200 was dragged lower by weakness in tech and with nearly all sectors in the red aside from energy.

- Nikkei 225 dipped beneath the 51,000 level and was among the worst performers amid earnings results and tech woes.

- Hang Seng and Shanghai Comp declined with participants digested the recent data releases, including mixed activity data in which Industrial Production disappointed and Retail Sales marginally topped estimates, but both showed a slowdown from the previous, while Chinese House Prices continued to contract. Nonetheless, the downside in the mainland was somewhat cushioned with China pledging to expand domestic demand and stabilise trade.

- US equity futures languished near the prior day's lows following the tech-related selling.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.3% after the cash market closed with losses of 0.8% on Thursday.

FX

- DXY traded little changed overnight after weakening yesterday as USD-denominated assets were hit alongside the risk-off mood. Following the government reopening, markets now await the delayed data, although there has been no schedule announced yet, and White House Economic Adviser Hassett said the jobs part will be released for one month, but not the unemployment rate, due to the shutdown. Furthermore, there were several recent Fed comments, including from Kashkari who said he has no strong inclination yet on a December rate cut, but noted data suggests more of the same since the October meeting and that the resilient economy called for a rate pause in October.

- EUR/USD held on to the prior day's spoils after reclaiming the 1.1600 handle on the back of the recent dollar pressure, while the latest ECB rhetoric provided very little incrementally and participants now look ahead to GDP and employment data.

- GBP/USD pared some of its recent gains with pressure seen following a report that UK PM Starmer and Chancellor Reeves abandoned budget plans to hike income tax rates.

- USD/JPY struggled for direction after the recent choppy mood and with little fresh pertinent catalysts from Japan, while Japanese press noted increasing scepticism among traders that the government will be able to shore up the yen through direct intervention.

- Antipodeans rebounded from the prior day's lows with NZD the outperformer despite a lack of notable drivers, while the RBNZ confirmed it will ease mortgage loan-to-value ratio restrictions as announced last month.

- PBoC set USD/CNY mid-point at 7.0825 vs exp. 7.0964 (Prev. 7.0865).

FIXED INCOME

- 10yr UST futures were contained after retreating on hawkish-leaning Fed commentary and the government reopening, while prices were also not helped by an overall weak 30-year bond auction stateside.

- Bund futures lingered near a monthly low after sliding to sub-129.00 yesterday, while EU GDP and German WPI data loom.

- 10yr JGB futures lacked demand with price action rangebound amid the uninspired mood in global counterparts and the absence of tier-1 data from Japan.

COMMODITIES

- Crude futures rallied following geopolitical headlines, including a Ukrainian drone attack which damaged an oil depot in the Russian Black Sea port of Novorossiysk, while advances gained momentum as Brent crude futures and Shanghai commodities trading got underway.

- US EIA Weekly Crude Stocks w/e 6.413M vs. Exp. 1.96M (Prev. 5.202M)

- US President Trump administration revoked Biden-era limits on Alaska oil drilling.

- Qatar raised the January term premium for Al-Shaheen oil to USD 0.84 per barrel above Dubai quotes.

- Spot gold gradually rebounded from the prior day's trough and briefly returned to above the USD 4,200/oz level.

- Copper futures remained subdued after slipping yesterday alongside the broad risk-off conditions.

CRYPTO

- Bitcoin extended on its recent retreat to beneath the USD 98,000 level amid tech-related woes.

NOTABLE ASIA-PAC HEADLINES

- China stats bureau spokesperson said the economy was generally stable in October, but pressure to adjust the domestic economic structure remains high and stabilisation faces some challenges, while China is to improve the effectiveness of macro policies and to pursue higher-quality economic growth. China will also expand domestic demand on all fronts and will further spur private investment vitality. Furthermore, the spokesperson said China’s investment space and potential remain huge and that China will stabilise trade and help trade firms that have been heavily hit.

- South Korean Finance Minister said they are to prepare measures to stabilise the FX market with the pension fund, while he is concerned about increasing uncertainty in the FX market and noted it is necessary to address imbalances in FX supply and demand.

DATA RECAP

- Chinese Industrial Production YY (Oct) 4.9% vs. Exp. 5.5% (Prev. 6.5%)

- Chinese Retail Sales YY (Oct) 2.9% vs. Exp. 2.8% (Prev. 3.0%)

- Chinese Urban Investment YTD YY (Oct) -1.7% vs. Exp. -0.8% (Prev. -0.5%)

- Chinese Unemployment Rate Urban Area (Oct) 5.1% (Prev. 5.2%)

- Chinese China House Prices MM (Oct) -0.5% (Prev. -0.4%)

- Chinese China House Prices YY (Oct) -2.2% (Prev. -2.2%)

GEOPOLITICS

MIDDLE EAST

- US President Trump told Saudi Crown Prince MBS in a phone call last month that with the Gaza war ending, he expects Saudi Arabia to move toward normalisation with Israel, according to Axios citing officials.

RUSSIA-UKRAINE

- Ukrainian drone attack damages apartment buildings and oil depot in Russian Black Sea port of Novorossiysk.

- Ukrainian air defence units were engaged in Kyiv against what the mayor described as a massive Russian attack.

- US Coast Guard detected and monitored a Russian military vessel operating near US territorial waters approximately 15 nautical miles south of Oahu on October 29th, according to the US Coast Guard.

OTHER

- US senior military officials on Wednesday presented President Trump with updated options for potential operations in Venezuela, including strikes, according to sources cited by CBS News.

- US Defense Secretary Hegseth announces Operation Southern Spear to remove narco-terrorists from the Western Hemisphere.

- China summoned Japan’s envoy over Japanese PM Takaichi's remarks on Taiwan and said the remarks were extremely dangerous.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer and Chancellor Reeves reportedly ditched budget plans to increase income tax rates, according to FT.

- German Budget Committee approved the 2026 budget, which clears the path to parliamentary approval, while the budget has total spending of EUR 524.5bln and includes investments of EUR 58.3bln and borrowing of EUR 97.9bln.