US Market Open: US blocks NVIDIA's scaled-back AI chips to China; DXY firmer and US equity futures lower ahead of UoM

07 Nov 2025, 11:07 by Newsquawk Desk

- US is to block NVIDIA's (NVDA) sale of scaled-back AI chips to China, according to The Information.

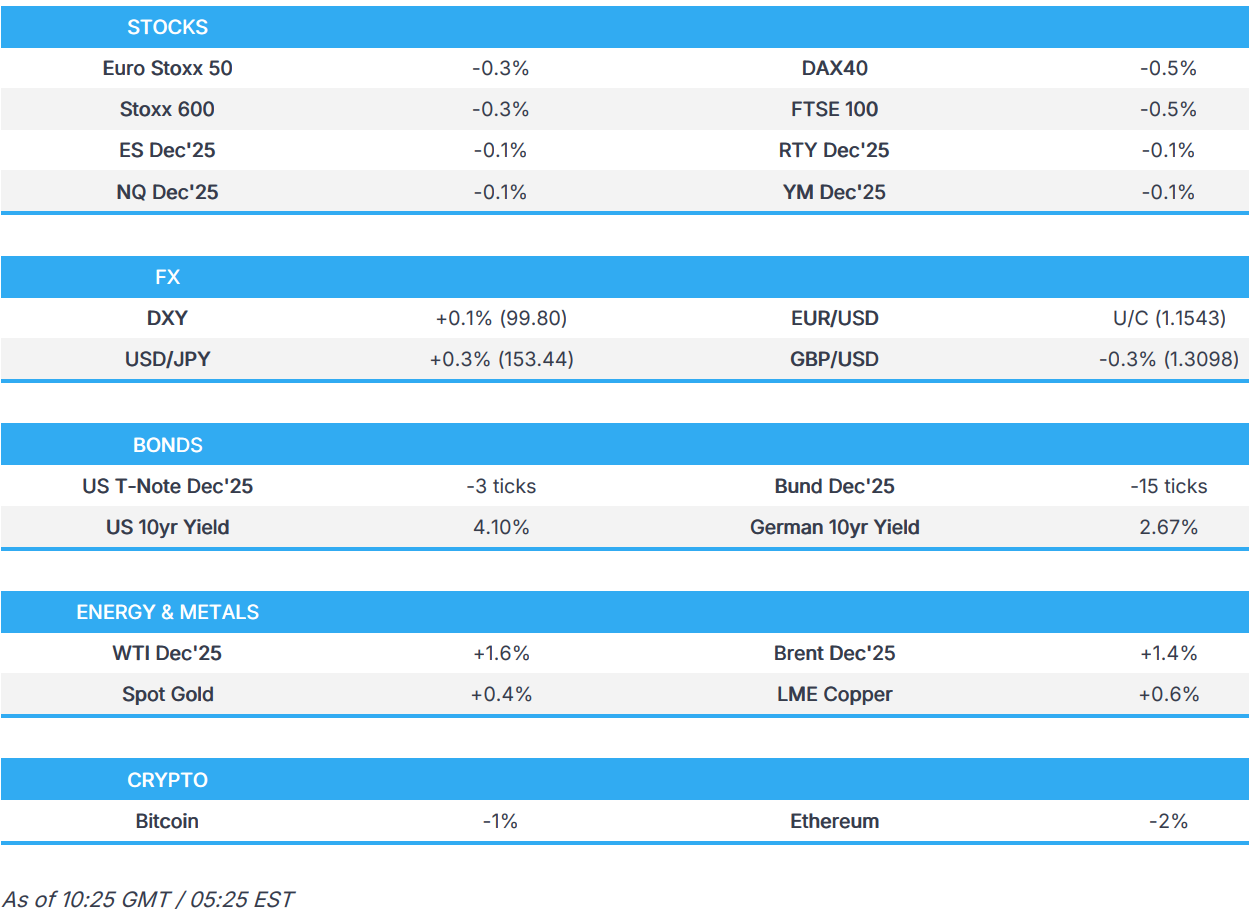

- European bourses opened firmer but ultimately conformed to the subdued risk tone, US equity futures also mildly in the red.

- DXY bid awaiting UoM, trading around 99.78; Kiwi underperforms.

- Bunds were initially hit by the US risk tone, EGBs then slipped on German data, no reaction to the deteriorating European tone.

- Commodities rebound from Thursday’s equity-led selloff; XAU firmer and holds above USD 4k/oz.

- Looking ahead, Canadian Jobs, NY Fed SCE, US University of Michigan Prelim, Speakers including Fed’s Jefferson and Miran, BoE’s Pill, ECB’s Elderson & Nagel.

TARIFFS/TRADE

- US President Trump posts that he's thrilled to announce an incredible trade and economic deal between the US and Uzbekistan in which the latter will be purchasing and investing almost USD 35bln over the next three years, and more than USD 100bln in the next 10 years in key American sectors, including critical minerals, aviation, automotive parts, infrastructure, agriculture, energy & chemicals, information technology, and others.

- US is to block NVIDIA's (NVDA) sale of scaled-back AI chips to China, according to The Information.

- Netherlands is said to be ready to drop control of Nexperia if chip supply resumes, according to Bloomberg.

- China has begun working on rules to ease rare earth export curbs, according to Reuters citing industry sources.

- China's Commerce Ministry suspends more rare earths related export control measures.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.3%) opened with a slight positive bias, but slipped soon after the cash open to display a mostly negative picture in Europe. Initial strength perhaps a cooling from the prior day's pressure, but ultimately conformed to the subdued APAC session overnight.

- European sectors began the day with a positive bias, but now mixed. Autos takes the top spot, following modest post-earning upside in Daimler Truck (+0.9%, poor results but sees strong EBIT). Moreover, Netherlands is said to be ready to drop control of Nexperia if chip supply resumes, according to Bloomberg - further boosting sentiment for the sector. To the downside, IAG (-7%) tumbles after it noted that Transatlantic weakness hit sales.

- US equity futures (ES -0.1% NQ -0.1% RTY -0.1%) were initially modestly firmer across the board, attempting to pare back some of the hefty losses seen in the prior session, sparked by poor private labour market figures and AI-related fears. However, more recently, sentiment has waned a touch with contracts now broadly in negative territory, conforming to the downbeat mood seen in Europe. On NVIDIA (-0.5% pre-market), traders will digest a piece via The Information which suggested that the US is to block NVIDIA's scaled-back AI chips to China.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has recovered a portion of the prior session’s losses but remains capped below the 100.00 handle, with the rebound tempered by a combination of soft US data and renewed trade-related concerns. The greenback came under pressure yesterday following a trifecta of weak labour market proxies, underscoring signs of cooling momentum in the US economy. Additionally, reports that Washington is set to block NVIDIA’s sale of scaled-back AI chips to China introduced a fresh layer of trade-related risk. On the Fed, Williams avoided remarks on near-term policy. Ahead, on the data front, Prelim University of Michigan sentiment data for November is likely to see the headline slip to 53.2 from 53.6, conditions rise to 59.2 from 58.6. DXY is consolidating modestly above recent lows, with the index last around the 99.85 mark and well within Thursday's hefty 99.67-100.11 range.

- EUR/USD found resistance at 1.1550 but is holding above the 1.15 handle, retaining the bulk of its recent gains following the USD’s broader retracement. Germany's trade surplus this morning narrowed to EUR 15.3bln in September (exp. 16.8bln, prev. 17.2bln), with no notable move seen in the EUR. EUR/USD remains marginally within Thursday's 1.1490-1.1552 range in a current 1.1530-1.1551 band.

- JPY is the clear laggard across the G10 space, retracing a portion of yesterday’s haven-driven gains. Overnight price action was choppy, with USD/JPY oscillating around the 153.00 mark amid a mix of lingering safe-haven demand and softer domestic data, as Japan’s Household Spending figures disappointed expectations. The pair now trades toward the upper end of a relatively contained 152.81–153.54 intraday range, compared to Thursday’s broader 152.83–154.14 parameters. Overall, price action suggests consolidation rather than fresh directional impetus.

- GBP/USD has eased modestly after yesterday’s advance, which came despite the BoE’s dovish hold and was largely driven by broader USD weakness. The pair briefly dipped below the 1.31 handle (low at 1.3097) after touching a session high of 1.3142, marking a retracement from yesterday’s BoE-day range of 1.3042–1.3142. On the domestic front, Halifax data painted a firmer picture of the UK housing market, with prices rising +0.6% M/M in October (exp. +0.1%, prev. -0.3%), pushing annual growth to +1.9% Y/Y (prev. +1.3%). Fiscal headlines also drew attention, with reports that Chancellor Reeves told the Budget watchdog she intends to raise income tax as part of efforts to repair the public finances. Further speculation points to a potential 2p income tax increase paired with a targeted 2p National Insurance cut, alongside consideration of narrowing NI relief above GBP 50,270 and a possible reduction in the annual cash ISA allowance to GBP 12,000 (previously touted GBP 10,000 and from current GBP 20,000).

- Antipodeans are mixed today with the Aussie winning on the AUD/NZD cross, benefiting from stronger copper prices despite weak Chinese trade data. In brief, Chinese exports unexpectedly slipped for the first time since October; but it is worth caveating that the prior month surprised to the upside which captured some front-loading ahead of the Trump-Xi meeting, which has since passed without issue.

- PBoC set USD/CNY mid-point at 7.0836 vs exp. 7.1131 (Prev. 7.0865)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A contained start to the session for USTs but there is a modest bearish bias owing to the slightly constructive trade in US equity futures, though magnitudes are modest. A lot of Fed speak in recent trade. This morning, Williams spoke at an ECB conference, discussing reserve management bond buying as a technical operation. Ahead, we have remarks from Miran (voter) once again and Jefferson (voter). Jefferson, the more interesting of the two, as he generally has a dovish stance, so it will be pertinent to determine if his bias remains the same or has moderated, in the context of Powell’s hawkish press conference. Jefferson last spoke at the start of October and said that while not having BLS data was less than ideal, there was enough information to do the job and was confident in reaching the inflation target. Thus far, USTs in a 112-22 to 112-28 band notching downside of just 4+ ticks at most, comfortably within Thursday’s 112-10 to 112-30 confines.

- Bunds also experienced a slightly softer start to the day, as outlined above. Early doors, a strong set of German trade data for September sent Bunds to a 129.02 low. A strong series that bodes well for the German recovery narrative and follows on from a rebound in industrial production data for the September period (as expected). Nonetheless, the narrative for Germany remains one of structural weakness, but with some signs of a recovery emerging. Since, the move has extended marginally to a 128.99 base, matching the trough from Thursday and in reach of Wednesday’s WTD 128.96 low.

- Gilts opened on the backfoot, posting losses of just over 10 ticks before slipping further to a 93.10 low. If the move continues, we look to Thursday’s 93.03 WTD base. The pullback today comes after the upside seen on Thursday by the BoE, as while desks are aligning around a December cut as being the emerging base case, that view is contingent on the two sets of data and budget due before the December meeting. BoE’s Bailey due to speak once again today, though he is unlikely to add much vs his presser and subsequent media rounds on Thursday; full Newsquawk review available on the headline feed. Elsewhere, the budget remains in focus and an increase to income tax is now very likely following a Times article that Chancellor Reeves has reportedly told the watchdog she intends to increase the measure. She is reportedly considering a 2p increase to income tax and a 2p cut to NI, echoing reports on the weekend that suggested as much, in a bid to move the burden away from workers and onto other groups.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have reversed Thursday’s losses as risk sentiment continues to shift amid AI concerns and weak US labour market. WTI and Brent oscillated in a tight c. USD 0.20/bbl for the majority of the APAC session before bidding higher and remaining near session highs as European trade continues.

- After Thursday’s choppy price action, spot XAU has continued to grind higher throughout APAC trade and into the European session. XAU started the day at USD 3977/oz and bid higher straight from the open to a peak of USD 4003/oz before pulling back slightly to a low of USD 3985/oz. As the European session got underway, the yellow metal has extended higher and is currently trading at session highs at USD 4010/oz.

- Base metals are trading rangebound as the European session gets underway, and as it steadies from Thursday’s risk-off environment. 3M LME Copper continues to oscillate in a tight USD 10.68k-10.75k/t band as the market awaits a new catalyst.

- Chinese Securities Regulator approved registration of platinum and palladium futures and options.

- Morgan Stanley says new projects successfully coming online in H1-2026 will be the catalyst for Dutch TTF to move below EUR 30/MWh by H2-2026.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Trade Balance, EUR, SA (Sep) 15.3B vs. Exp. 16.8B (Prev. 17.2B)

- German Exports MM SA (Sep) 1.4% vs. Exp. 0.5% (Prev. -0.5%, Rev. -0.8%); Imports (Sep) 3.1% vs. Exp. 0.5% (Prev. -1.3%, Rev. -1.4%)

- French Trade Balance, EUR, SA (Sep) -6.58B (Prev. -5.53B, Rev. -5.19B)

NOTABLE EUROPEAN HEADLINES

- Citi on the BoE, after November's meeting, cautiously brings back the call for a December cut, but highlights the two sets of data and the budget before then as points of uncertainty.

NOTABLE US HEADLINES

- Fed's Musalem (2025 voter) said the economy has been resilient in the face of uncertainty and the job market has softened of late, but has been around full employment. Musalem expects the economy to pick up next year after a soft fourth quarter, while he also commented that the Fed’s two mandates are somewhat in tension and that monetary policy is between modestly restrictive and neutral.

- Fed's Williams (voter) says Fed may soon embark on reserve management bond buying, which is technical, not signal on monetary policy; Fed rate control tool kit has been working well. Expects standing repo facility to see active use as needed.

- US President Trump's administration moved to appeal the judgement requiring full SNAP benefits to be paid by Friday.

- US President Trump's administration finalised flight cuts to start at 4% on Friday and will ramp up to 10% on November 14th.

- US Vice President Vance said Americans are about to start suffering some very real consequences because of the government shutdown.

- US Justice Department is said to be investigating the DC mayor over a foreign trip, according to The New York Times.

GEOPOLITICS

MIDDLE EAST

- US President Trump said Iran has been asking if US sanctions can be lifted, while he responded 'very soon', when asked when the international stability force for Gaza will be on the ground.

- US President Trump said he held a great call with Israeli PM Netanyahu and Kazakhstan's President Tokayev, while Trump noted that Kazakhstan is the first country of his second term to join the Abraham Accords and the first of many, with more nations lining up to embrace peace and prosperity through my Abraham Accords.

RUSSIA-UKRAINE

- Ukrainian ambassador said her country is engaged in “positive” talks about buying Tomahawk missiles and other long-range weapons

OTHER

- US Senate voted 51-49 to block a measure barring US President Trump from launching war on Venezuela.

- Japan's government said North Korea fired what could be a ballistic missile which fell shortly after, while Japanese PM Takaichi said North Korea's missile likely fell outside of Japan's exclusive economic zone.

CRYPTO

- Bitcoin is a little weaker today and trades just above USD 101k, whilst Ethereum underperforms a touch and down to USD 3.3k.

APAC TRADE

- APAC stocks were mostly lower as the region took its cue from the risk-off mood stateside, where sentiment was weighed on by weak US labour market proxies and AI concerns, while sentiment was also not helped by weak Chinese trade data.

- ASX 200 was led lower by weakness in tech and the top-weighted financial industry, with the latter pressured as Macquarie shares retreated on earnings disappointment.

- Nikkei 225 briefly fell beneath the 50,000 level after recent tech woes, currency strength and disappointing Household Spending data.

- Hang Seng and Shanghai Comp conformed to the downbeat mood after the PBoC's open market operations resulted in the largest weekly drain since early 2024 and as participants awaited Chinese trade data which ultimately showed a surprise contraction in exports, while it was also reported that the US is to block NVIDIA's sale of scaled-back AI chips to China.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 141.7bln via 7-day reverse repos with the rate kept at 1.40%, while its operations resulted in a weekly net drain of CNY 1.57tln which is the largest fund withdrawal since January 2024.

DATA RECAP

- Chinese Trade Balance (USD)(Oct) 90.07B vs. Exp. 95.6B (Prev. 90.45B)

- Chinese Exports YY (USD)(Oct) -1.1% vs. Exp. 3.0% (Prev. 8.3%); Imports YY (USD)(Oct) 1.0% vs. Exp. 3.2% (Prev. 7.4%)

- Chinese Trade Balance (CNY)(Oct) 640.49B (Prev. 645.47B)

- Chinese Exports (CNY)(Oct) -0.8% (Prev. 8.4%)

- Chinese Imports (CNY)(Oct) 1.4% (Prev. 7.5%)

- Japanese All Household Spending MM (Sep) -0.7% vs. Exp. -0.1% (Prev. 0.6%); YY (Sep) 1.8% vs. Exp. 2.5% (Prev. 2.3%)