European Opening News: Lecornu to hold final talks, US shutdown ongoing & trade in focus

07 Oct 2025, 06:42 by Newsquawk Desk

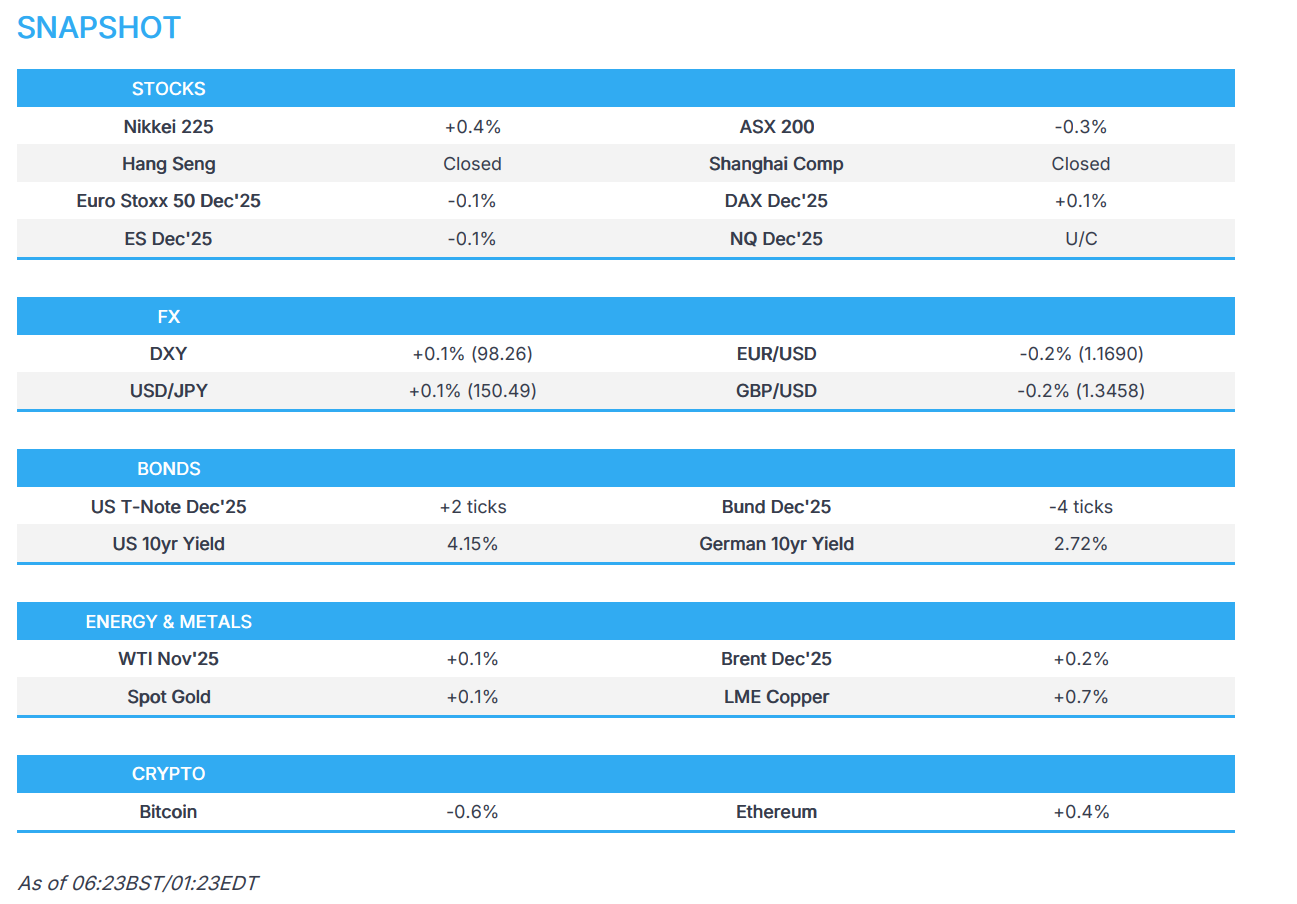

- APAC stocks traded mixed despite the tech-led advances on Wall St, with several holiday closures, Japanese stocks rallied again as the post-LDP election euphoria persisted.

- Democrat and Republican bills to end the US government shutdown failed to secure sufficient votes for passage in the Senate, as expected.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 future flat after the cash market closed with losses of 0.4% on Monday.

- DXY held onto yesterday's gains, which were triggered by JPY and EUR selling. USD/JPY remains above 150.

- French President Macron said he has asked outgoing PM Lecornu to hold final talks with political partners to stabilise the country.

- Looking ahead, highlights include German Industrial Orders (Aug), US RCM/TIPP Economic Optimism, NY Fed SCE, Atlanta Fed GDP, Canadian Trade Balance (Aug), Ivey PMI (Sep), (Suspended Releases: US International Trade, Consumer Credit), EIA STEO, Fed’s Bostic, Bowman, Miran, Kashkari, ECB’s Lagarde & Nagel, Supply from UK, Germany & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were mostly in the green with outperformance in the Nasdaq thanks to the rally in AMD shares after it signed a deal with OpenAI in which the latter is to deploy 6 gigawatts of AMD GPUs based on a multi-year agreement, while US macro updates were light, given the US government shutdown entering its second week and with little sign of progress on a reopening so far. Nonetheless, the sectors were predominantly firmer, with Consumer Discretionary, Tech and Utilities leading the gains, while Real Estate, Consumer Staples and Health Care underperformed.

- SPX +0.36% at 6,740, NDX +0.78% at at 24,979, DJI -0.14% at 46,695, RUT +0.41% at 2,486.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said all medium and heavy-duty trucks coming into the US from other countries will be tariffed at 25%, beginning Nov. 1st. In relevant news, Japan's Chief Cabinet Secretary Hayashi said he is aware of US President Trump's comments on truck tariffs, while he added that they will assess the details once clarified and will respond appropriately.

- US President Trump said he had a very good phone call with Brazilian President Lula, while he added they discussed the economy and trade, and will be having further discussions. Trump later said he had a great call with Brazil's President Lula and will travel to Brazil at some point.

- White House said US President Trump is to host Canadian PM Carney on Tuesday, and to host the President of Finland on Thursday, while it stated that trade will be a topic of talks with Carney. It was later reported that Trump will meet with Carney at 11.45EDT/16:45BST on Tuesday.

- White House said that tariff rebates are an idea that is being discussed, but no decision has been made.

- White House crypto and AI czar Sacks sees a strong case for not selling the latest AI chips to China and sees Nvidia (NVDA) CEO Huang as a strategic asset in the AI race.

- European Commission intends to propose tariffs of 50% on steel imports worldwide above a quota set at 2013 levels on Tuesday, according to FT, citing a document.

NOTABLE HEADLINES

- Fed's Schmid (2025 voter) said the Fed must maintain inflation credibility, while he noted inflation is too high, and it is worrying that price increases are becoming more widespread. Schmid also commented that monetary policy is appropriately calibrated and is only slightly restrictive, while he stated that the labour market is cooling but remains healthy and that tariffs are expected to have a muted effect on inflation.

- US President Trump said layoffs could be triggered if the Senate vote on the shutdown fails, while he added that negotiations are ongoing with Democrats and he would make a deal on Affordable Care Act subsidies. Trump later posted "Democrats have SHUT DOWN the United States Government right in the midst of one of the most successful Economies, including a Record Stock Market, that our Country has ever had...I am happy to work with the Democrats on their Failed Healthcare Policies, or anything else, but first they must allow our Government to re-open."

- US Senate Democrat Leader Schumer said Democrats will be at the table if President Trump is ready to work with Democrats on ending the government shutdown and get something done on health care for American families, while Schumer stated that Trump is not yet negotiating with US Congress Democratic leaders. Furthermore, he separately commented that they are making progress on the government shutdown.

- Democrat and Republican bills to end the US government shutdown failed to secure sufficient votes for passage in the Senate, as expected.

- White House said the OMB is continuing to work with agencies on layoffs of federal workers.

- US President Trump said he would invoke the Insurrection Act if people were being killed, and courts and local officials were holding us up, while it was later reported that Trump said what's happening in Portland is insurrection, according to a Newsmax interview. Furthermore, Trump said he called into federal service at least 300 members of the Illinois National Guard until the governor consents to a federally funded mobilisation.

- US federal judge declined to immediately block President Trump's deployment of National Guard troops to Illinois, according to the New York Times.

APAC TRADE

EQUITIES

- APAC stocks traded mixed despite the tech-led advances on Wall St with several holiday closures including Mainland China, Hong Kong and South Korea, while Japanese stocks rallied again as the post-LDP election euphoria persisted.

- ASX 200 was subdued amid losses in Telecoms, Consumer Discretionary and Tech, with sentiment also not helped by weaker Consumer Confidence.

- Nikkei 225 printed fresh record highs once again amid ongoing tailwinds from the dovish expectations associated with the incoming Takaichi government, while Japanese Household Spending also topped forecasts.

- US equity futures (ES -0.1%, NQ U/C) pared some of the recent tech-led advances with risk sentiment clouded by the government shutdown.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 future flat after the cash market closed with losses of 0.4% on Monday.

FX

- DXY held on to the prior day's gains which were largely due to the recent heavy JPY selling, although further upside in the dollar was capped as Democrats and Republicans remained at an impasse regarding the government shutdown. There were comments from Fed's Schmid, but had little impact as he noted inflation is too high and it is worrying that price increases are becoming more widespread, while he added that monetary policy is appropriately calibrated and is only slightly restrictive.

- EUR/USD was contained with demand hampered amid the political uncertainty in France owing to the PM's resignation after recent appointments to the new cabinet were met with heavy disapproval from opposing parties, while President Macron asked outgoing PM Lecornu to hold final talks with political partners to stabilise the country.

- GBP/USD struggled for direction after yesterday's indecisive performance and amid the absence of UK-specific drivers.

- USD/JPY remained north of the 150.00 level following Takaichi's LDP election victory, while the recent moves prompted some jawboning in which outgoing Japanese Finance Minister Kato stated it is important for currencies to move in a stable manner, reflecting fundamentals, and they will thoroughly monitor for excessive fluctuations and disorderly FX movements.

- Antipodeans kept to within tight parameters amid the mixed risk appetite and ahead of the RBNZ rate decision on Wednesday, where there are split views between a 25bps and 50bps cut.

FIXED INCOME

- 10yr UST futures were little changed after settling lower yesterday amid the government shutdown and with supply ahead.

- Bund futures lacked demand following the prior day's whipsawing and as German Industrial Orders data looms, while participants also await issuances including EUR 4.5bln of Bobls scheduled later and EUR 2.0bln of Bunds tomorrow.

- 10yr JGB futures initially declined amid upside in long-term yields and as participants braced for a 30yr JGB auction, although prices were later supported after the results of the auction showed stronger-than-previous demand, higher accepted prices and a narrower tail in price.

COMMODITIES

- Crude futures were rangebound with little fresh energy-related catalysts seen after the OPEC+ decision over the weekend and with Saudi Arabia maintaining its OSP premiums to Asian buyers for November.

- Spot gold kept afloat near record highs as the US government shutdown extended into a second week, while Goldman Sachs raised its December 2026 gold price forecast to USD 4,900/oz vs prev. USD 4,300/oz and sees risks to its upgraded gold price forecast as still skewed to the upside.

- Copper futures eventually gained but with price action contained amid the mixed risk appetite and continued absence of its largest buyer.

CRYPTO

- Bitcoin gradually retreated overnight after hitting a record high yesterday above the USD 126k level.

NOTABLE ASIA-PAC HEADLINES

- Japanese LDP chief Takaichi said she is truly hoping to work together with US President Trump to make their alliance even stronger and more prosperous, as well as advance a free and open Indo-Pacific.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner, reflecting fundamentals, while he added they are closely watching FX moves and will thoroughly monitor for excessive fluctuations and disorderly movements in the forex market. Furthermore, he said the new LDP leader Takaichi will make appropriate policies given Japan's fiscal situation.

- US FCC is to vote this month to tighten restrictions on Chinese equipment posing a national security risk, according to the FCC Chair.

- RBNZ is establishing a new Financial Policy Committee which will be given authority to make key policy decisions relating to financial stability.

DATA RECAP

- Japanese All Household Spending MM (Aug) 0.6% vs. Exp. 0.1% (Prev. 1.7%)

- Japanese All Household Spending YY (Aug) 2.3% vs. Exp. 1.2% (Prev. 1.4%)

- Australian Consumer Sentiment Index (Oct) 92.1 (Prev. 95.4)

- Australian Consumer Sentiment MM (Oct) -3.5% (Prev. -3.1%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said he did not tell Israeli PM Netanyahu to stop being negative about a deal, while he added that Hamas has been agreeing to things that are very important and he expects a Gaza deal soon. Trump said that he spoke with Turkish President Erdogan and noted a strong signal from Iran that they'd like to see this done, while Jordan's King also discussed the Gaza plan with President Trump.

- White House said technical talks are happening now on the Gaza plan, and the administration is working to move ahead as quickly as they can.

- Egyptian media reported that the round of negotiations between Hamas and the mediators ended amid a positive atmosphere, according to Al Arabiya.

RUSSIA-UKRAINE

- US President Trump said he has made a decision on sending Tomahawk missiles to Ukraine, but wants to make sure what they are doing with them first, while Trump added that he is not looking to see an escalation regarding Russia-Ukraine.

- EU governments agreed to limit travel of Russian diplomats within the bloc following a surge in sabotage attempts that intelligence agencies say are often led by spies operating under diplomatic cover, according to FT.

OTHER

- US President Trump called off the diplomatic outreach to Venezuela, according to The New York Times.

EU/UK

NOTABLE HEADLINES

- French President Macron said he has asked outgoing PM Lecornu to hold final talks with political partners to stabilise the country, while Lecornu said he has accepted President Macron's request for last-ditch talks and will tell him by Wednesday evening if it is possible or not, so he can draw the appropriate conclusions.

- ECB President Lagarde reiterated that the disinflationary process is over and noted that despite heightened uncertainty, the euro area economy has held up well. Lagarde reiterated they will continue to determine the appropriate monetary policy stance by following a data-dependent and meeting-by-meeting approach, while she added they are not pre-committing to a particular rate path.