US Market Open: US equity futures mixed, DXY lower as China refrains from immediate retaliation for now

09 Apr 2025, 11:15 by Newsquawk Desk

- US President Trump’s reciprocal tariffs alongside the 104% levy on China came into effect; US President Trump said China is manipulating its currency in offset against tariffs, and added the US will be announcing tariffs on pharmaceuticals soon.

- China's top leaders are to hold a meeting as soon as Wednesday (today) to discuss measures to boost the economy after US trade tariffs, via Reuters citing sources.

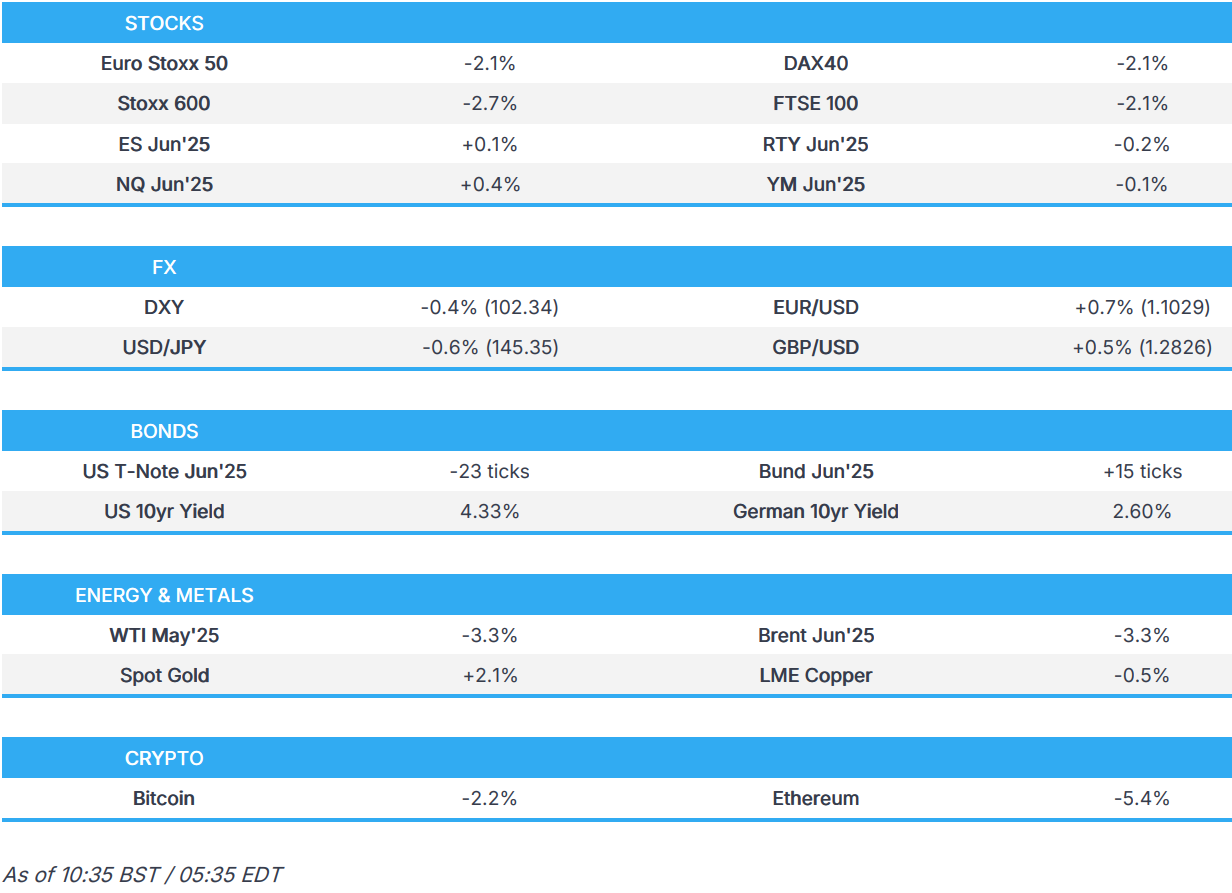

- Indices trade lower in Europe whilst US futures are mixed as China refrains from immediate retaliation.

- USD pressured as trade tensions continue to ratchet higher.

- A blockbuster session for fixed thus far ahead of the US 10yr tap.

- Demand hits crude but base metals trade mixed amid hopes of Chinese support.

- Looking ahead, US Wholesale Sales, FOMC Minutes, Speakers including Fed’s Barkin, Supply from US, Earnings from Delta & Constellation Brands.

TRADE/TARIFFS

US

- US President Trump said they have a lot of countries wanting to make a deal and noted that the tariff situation is a good situation, while he added it is very important to pass the big beautiful bill. Trump also stated that he respects Canada and Mexico but they cheat on trade, and noted that China is manipulating its currency to offset tariffs and he thinks China will make a deal at some point and wants to make a deal. Furthermore, Trump confirmed the 104% tariff on China takes effect from midnight (EDT) and said he will be announcing tariffs on pharmaceuticals soon.

- US President Trump said they are taking USD 2bln in a day from tariffs and are doing well on tailored tariff deals, while he added that Japanese officials are flying to the US to make a deal and so are South Korean officials. Furthermore, he reiterated that tariffs are on and that they have tariffs on cars, lumber and steel.

- White House Press Secretary said President Trump has tasked US Treasury Secretary and USTR Greer to lead talks and deals will be made if they benefit American workers and address trade deficits, while she said President Trump met with the trade team on Tuesday morning and directed the team to have tailor-made trade deals with every country that contacts the administration to strike a deal. Furthermore, she said reciprocal tariffs will continue to go into effect as deals are negotiated and all options are on the table for each country, as well as stated that phones have been ringing "off the hook" from nations trying to negotiate a trade deal.

- At least a dozen House Republicans are considering signing onto Rep. Don Bacon's bill to restrict the White House's ability to impose tariffs unilaterally, according to Axios.

APAC

- China's top leaders will hold a meeting as soon as April 9th to discuss measures to boost economy after US trade tariffs, via Reuters citing sources; leaders to discuss measures to stabilise capital markets, some measures could be implemented in coming weeks. Officials from PBoC, Finance Ministry, among others are to attend.

- China's Foreign Ministry, on US tariffs, says China's right to development cannot be deprived. Will continue to take resolute and effective measures to safeguard legitimate interests. US continues to abuse tariffs to pressure China, firmly oppose this. China has a firm will and abundant means, will resolutely counteract and fight to the end.

- China has released a White Paper on US trade and economic relations, via Xinhua; to take countermeasures to safeguard rights and interests. Firmly opposes unliteral/bullying restrictive measures. Have always believed the essence of China and US economic trade ties is mutually beneficial, a win-win. Willing to communicate with the US. US will not solve its own problems by raising tariffs.

- China's MOFCOM says "With firm will and abundant means, China will resolutely take countermeasures and fight till the end if the US insists on further escalating economic and trade restrictive measures", Via Global Times.

EUROPE/UK

- UK Culture Secretary Nandy says they will rule out changes to the Online Safety Act as part of US trade talks.

- French Industry Minister says they are analysing the likely impact from Trump's tariffs on jobs, aerospace and luxury, in order to determine the EU response. Reiterates language around a firm, proportionate response.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -3%) are entirely in the red, but off worst levels after sentiment improved around the European cash open which coincided with commentary from China’s Foreign Ministry, which avoided announcing any fresh retaliation to Trump's latest tariffs.

- European sectors are in negative territory, but display a more improved picture than opening levels. Healthcare is by far the clear laggard as markets digest the latest commentary from US President Trump who said that he will be announcing tariffs on pharmaceuticals soon. Energy is also amongst the underperformers, as underlying oil prices remain pressured.

- US equity futures are mixed in what has been a choppy morning thus far. A slight pick-up in sentiment was seen around the European cash open, which coincided with a readout from the Chinese Foreign Ministry.

- German regulator says Google (GOOG) has committed to ending competition in automotive services and Google Maps platforms; German regulator has ended proceedings

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer across the board as trade war tensions continue to ratchet up as reciprocal tariffs alongside the 104% levy on China came into effect. In response, China's Foreign Ministry defended the nation's right to development and vowed to continue to take resolute and effective measures to safeguard legitimate interests. On the domestic agenda, FOMC minutes are due for release later. DXY ventured as low as 101.91 but failed to test the YTD trough at 101.26; has since stabilised above the 102 mark.

- EUR remains underpinned vs. the USD with ING noting "The euro remains in a good position to benefit from any USD confidence crisis, being the second most liquid currency in the world and a preferred alternative to the dollar for FX reserves". Reuters sources have reported that the ECB says EZ growth is to take a bigger hit from US President Trump tariffs than earlier estimated; initial ECB estimate of 50bps hit to growth in first year under revision. EUR/USD has ventured as high as 1.1089.

- JPY is firmer vs. the broadly softer USD and underpinned by its safe haven status. There have been several updates out of Japan with overnight remarks from BoJ Governor Ueda who reiterated that the central bank remains open to further rate hikes if Japan’s economic recovery continues as projected. Thereafter, Japan's top currency Diplomat Mimumra stated that three party talks were held in response to US tariffs, discussed unstable moves in financial markets and agreed to do the upmost to maintain stability in global markets. USD/JPY has delved as low as 144.56 but stopped shy of the April 4th YTD low at 144.54.

- GBP is firmer vs. USD but to a lesser extent than peers. UK newsflow remains less prominent than elsewhere. However, UK Chancellor Reeves is to hold tariffs crisis talks with top city executives, according to Sky News. Cable is currently stuck between its 50 and 200DMAs at 1.2743 and 1.2812 respectively. UK PM Starmer is due to make remarks at 11:00BST.

- Antipodeans are both firmer vs. the USD but less to for NZD following the RBNZ rate decision which saw the central bank cut the OCR by 25bps to 3.50% (as unanimously forecast) and signalled further cuts ahead. AUD/USD is higher following recent Chinese stabilisation measures and expected policy support. Albeit, as a note of caution, China appears to remain resolute in pushing back against the US' trade practices.

- PBoC set USD/CNY mid-point at 7.2066 vs exp. 7.3348 (Prev. 7.2038).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Overnight action saw USTs slump to a 110-01 trough with downside of over a full point at worst. The pullback in USTs began after a weak 3yr note auction, the results showed a slump in direct bidders, a soft cover and an elevated tail. Also driving the move was the ramping up of trade tensions, as Trump made clear that the reciprocal tariffs would (and since have) be coming into effect. The European session has seen US paper clamber off lows, as the risk tone improves a touch - potentially as China avoided announcing any fresh retaliatory measures to the latest Trump tariffs. Given all this, the next litmus test for the market in the absence of a tariff/trade driver will be tonight’s 10yr Note auction; an auction which intersects Fed’s Barkin (2027 Voter) and the Minutes from March’s meeting.

- Bunds initially posted gains of around 30 ticks, in sharp contrast to USTs and feeds into the argument that the US benchmark’s haven status has been tarnished somewhat, as discussed above. Thereafter, a bout of significant pressure was seen around 07:00BST, where Bunds fell from 130.30 to the 129.13 trough - the move came alongside a slight pick up in the risk tone. This reversed soon after, and then Bunds took another leg higher after a Reuters source piece that the ECB is looking to revise its first-year tariff growth hit from the initially thought 50bps.

- Gilts gapped lower by around 40 ticks before extending to post downside of 104 ticks, notching a 91.08 WTD base. Newsflow for the UK has been very light as we await an update from the PM/Cabinet, with Chancellor Reeves set to hold crisis talks with business leaders and Starmer scheduled to speak with the press at around 11:00BST. Most recently, the DMO tapped GBP 4.5bln of its 2030 Gilt, results featured an elevated tail but the cover was still near-enough 3x even given a slightly lower accompanying yield.

- UK sells GBP 4.5bln 4.375% 2030 Gilt: b/c 2.95x (prev. 3.39x), average yield 4.142% (prev. 4.311%) & tail 1.0bps (prev. 0.3bps)

- Click for a detailed summary

COMMODITIES

- Crude is on a very weak footing, with Brent Jun'25 currently down by around USD 1.80/bbl. The complex remains pressured amid the broader risk-off mood and with a surprise draw in headline crude stockpiles unable to boost prices. Brent Jun'25 has been traded sideways throughout the European morning in a current USD 60.13-61.53/bbl range.

- Precious metals are broadly in the green; Spot gold is currently higher by around USD 61/oz and trading towards the upper end of a USD 2,970.12-3,052.29/oz range, owing to its haven status.

- Mixed trade across base metal futures with the complex indecisive as it reacts to Trump's tariffs coupled with hopes of Chinese stimulus to counteract the effect of the levies. 3M LME copper is subdued within a USD 8,461.67-8,728.00/t range awaiting further trade updates.

- US Private Inventory Data (bbls): Crude -1.1mln (exp. +1.4mln), Distillate -1.8mln (exp. +0.3mln), Gasoline +0.2mln (exp. -1.5mln), Cushing +0.6mln.

- CPC says it has resumed Black sea operations at two moorings.

- Reliance Industries is shutting one crude unit and some secondary units at the Jamnagar refinery (660k BPD) for 21 days, via Reuters citing sources.

- Click for a detailed summary

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is to hold tariffs crisis talks with top city executives, according to Sky News.

- Germany's CDU/CSU and SPD parties reached an agreement on a coalition, according to NTV; meeting this morning, aim to have a full agreement around midday Berlin time.

- EZ growth to take a bigger hit from US President Trump tariffs than ECB had earlier estimated, according to Reuters citing sources; initial ECB estimate of 50bps hit to growth in first year under revision A source estimates a growth hit in excess of 100bps in the first year.

- ECB's Escriva says US tariffs will have an impact on economic activity in Spain and other countries, "for now I will not talk about a recession"; one of the consequences could be the impact on business confidence and spending, its hard to measure Bank of Spain will have to revise down growth projections in Spain Any forecast is subject to high uncertainty The ECB will need to evaluate the new scenario regarding the impact of US tariffs on inflation There could be downward and upward impacts on inflation Depending on the impact, will have to take different actions.

- ECB's Knot says in the long term, a trade war is a negative supply shock; impact of the trade war is likely inflationary in the long term Risk is that we move to a supply-demand situation like in 2022; need to be vigilant on inflation. Disinflation is well on track. Rates are at the upper end of neutral range. So far, market functioning has been preserved. Reversal of bond markets needs to be monitored.

- ECB's Villeroy says estimates that a trade war will lower EZ growth by 0.25pp in 2025 Shock will not be negligible but will not be a recession. ECB monitors the financial system to ensure there is enough liquidity during times of market stress.

- ECB's Rehn says downside risks have materialised since the March meeting; case for continuing rate cuts at April meeting is supported by downside risks materialising Inflation appears to be stabilising at target and growth outlook has further weakened as result of the trade war. Large tariff increases will boost inflation in the US, but the effect in the EZ can be two-way. Overall, however, the effects of EZ inflation are apparently modest.

- German corporate tax to be lowered from 2028, according to Handelsblatt citing CDU head in internal meeting.

- Morgan Stanley expects the BoE to lower interest rates at every meeting until November; taking yr-end rate to 3.25% (currently 4.5%) vs. prev. forecast of 3.5%.

NOTABLE US HEADLINES

- US President Trump signed executive orders related to coal and later posted on Truth "Today, we took historic action to help American workers, miners, families and consumers. We're ending Joe Biden's war on beautiful, clean coal once and for all, and we're going to put the miners back to work!"

- US President Trump posted on Truth "I had a very good meeting today with the Speaker of the House and some of our more Conservative Members, all great people. I let them know that, I AM FOR MAJOR SPENDING CUTS! WE ARE GOING TO DO REDUCTIONS, hopefully in excess of $1 Trillion Dollars, all of which will go into “The One, Big, Beautiful Bill.” I, along with House Members and Senators, will be pushing very hard to get these large scale Spending Cuts done, but we must get the Bill approved NOW. MAKE AMERICA GREAT AGAIN!".

- China's CPCA says Tesla (TSLA) exported 4701 (prev. M/M 3911) China-Made vehicles in March.

GEOPOLITICS

- Israeli army reportedly blew up residential buildings northwest of the city of Rafah in the southern Gaza Strip, according to a correspondent cited by Al Jazeera.

- Hezbollah official said they are ready to discuss the future of their arsenal if Israel withdraws and ends strikes.

- North Korea said its status as a nuclear weapon state can never be reversed, according to KCNA.

CRYPTO

- Bitcoin is on the backfoot in-fitting with the broader hit in sentiment across markets.

- Over USD 2bln worth of Bitcoin shorts face liquidation if Bitcoin (BTC) reclaims USD 80k, according to Cointelegraph.

APAC TRADE

- APAC stocks were mostly lower following the dead cat bounce on Wall St and as reciprocal tariffs took effect overnight including a total 104% tariff on China.

- ASX 200 was dragged lower by underperformance in health care and miners with the former pressured after US President Trump stated that he will be announcing tariffs on pharmaceuticals soon.

- Nikkei 225 spearheaded the declines in Asia and fell beneath the USD 32,000 level amid currency strength and ongoing tariff woes with a report noting that tariffs could potentially reduce Japanese companies' earnings by up to 10%.

- Hang Seng and Shanghai Comp were mixed as the Hong Kong benchmark conformed to the losses in the region, while the mainland traded indecisively and was somewhat cushioned following recent stabilisation measures and expected policy support.

NOTABLE ASIA-PAC HEADLINES

- Chinese monetary and fiscal stimulus are unlikely to fully protect the Chinese economy from the severe downturn in global demand caused by tariffs, according to Reuters sources

- PBoC has asked major state banks to reduce USD purchases, according to Reuters sources; PBoC will not resort to immediate sharp CNY deprecation to counteract the impact from US tariffs PBoC asked state banks to without USD purchases for proprietary accounts, and ask state banks to strengthen checks executive orders for clients. Chinese state banks were seen selling USD and buying CNY aggressively to slow the pace of CNY declines in the onshore spot market on Wednesday.

- Japan top currency Diplomat Mimumra says three party talks were held in response to US tariffs, discussed unstable moves in financial markets; agreed to do the upmost to maintain stability in global markets Exchanging information with G7, Asian nations and the IMF Watching moves with a high sense of urgency The first step would be to work to remove these US tariffs Cooperation needs to be international given global impact Have been having various discussions with the US treasury Important for currencies to move in a stable manner reflecting fundamentals Current moves are very volatile, alarmed over the moves including those driven by speculators No comment on daily FX moves Market seems concerned about the risks of inflation and recession in the US Japan needs to negotiate with US without being either optimistic or pessimistic.

- Goldman Sachs said continued tariff escalation between the US and China presents a downside risk to its current 2025 full-year real GDP forecast of 4.5% for China, while it noted significant policy easing by the Chinese government in the coming months is to mitigate the impact and stabilise growth.

- BoJ Governor Ueda said they have been raising rates up till now on the view that keeping rates low for too long when the economy and prices are recovering, risks causing economic excesses and would force them to hike rates rapidly later. Ueda said they have been raising rates with a focus on underlying inflation, which is gradually heading towards 2% and noted that uncertainty surrounding domestic and overseas economies is heightening due to US tariffs.

- South Korea announced emergency measures for the auto industry hit by US tariffs in which it is to lower taxes on auto purchases and raise EV subsidies to boost domestic demand, while it raised policy financing support for automakers to KRW 15tln this year from KRW 13tln and vowed efforts to ensure that domestic automakers are not treated in a disadvantageous way.

- Fitch Downgrades Alibaba (9988 HK/BABA) and Tencent (0700 HK) to 'A', Tencent Music (TME) to 'A-', Following Sovereign Action

POLICY ANNOUNCEMENTS

- RBNZ cut the OCR by 25bps to 3.50%, as expected and said a further reduction in the OCR is appropriate, while it added that as the extent of tariffs becomes clearer, the Committee has scope to lower the OCR further. RBNZ stated that global trade barriers weaken the outlook for global growth and having CPI close to the middle of the band puts the Committee in the best position to respond to developments. Furthermore, the Minutes stated that future policy decisions will be determined by the outlook for inflationary pressure over the medium term and the Committee also commented that the preceding cuts to the OCR have yet to have their full effect on the economy.

- RBI cut the Repurchase Rate by 25bps to 6.00%, as expected with the decision unanimous, while it changed the policy stance to accommodative from neutral. RBI Governor Malhotra said the accommodative stance signals the intended direction of policy rates going forward and that going forward absent any shocks, MPC will only consider the status quo and a rate cut. Furthermore, he stated that the stance should not be seen with regard to liquidity and noted some trade frictions are coming through and unsettling the global community.