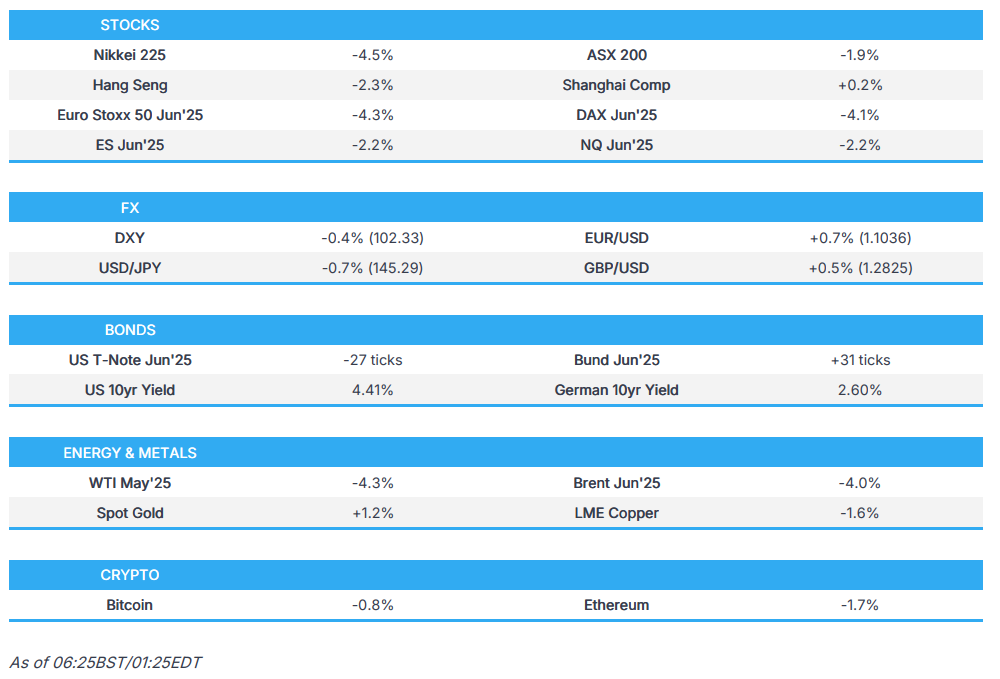

Europe Market Open: USTs & stocks slump as reciprocal tariffs begin, China fares better amid state support

09 Apr 2025, 07:00 by Newsquawk Desk

- US President Trump’s reciprocal tariffs alongside the 104% levy on China came into effect; US President Trump said China is manipulating its currency in offset against tariffs, and added the US will be announcing tariffs on pharmaceuticals soon.

- Shanghai Comp. (+0.2%) was somewhat cushioned following recent stabilisation measures and expected policy support; E-mini S&P futures fell (-2.2%); markets await China’s response.

- 10yr UST futures notably slumped amid a surge in yields due to trade war concerns and after a weak 3yr auction stateside.

- RBI and RBNZ both cut their respective rates by 25bps as expected - both central banks flagged trade uncertainty; Japan's BoJ, MOF, FSA hold meeting to discuss international financial markets at 08:00BST.

- European equity futures indicate a lower cash market open with EuroStoxx 50 futures down 4.3% after the cash market closed with gains of 2.5% on Tuesday.

- Looking ahead, highlights include US Wholesale Sales, FOMC Minutes, Trump Executive Orders, Speakers including BoJ’s Ueda, ECB’s Knot, Cipollone & Fed’s Barkin, Supply from UK & US, Earnings from Delta & Constellation Brands.

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished lower after another volatile session in which the early risk-on sentiment and advances were wiped out by the US close as sentiment deteriorated with US officials clear that reciprocal tariffs will come into force after midnight including the additional tariffs on China for a total 104% tariff rate.

- As such, the major indices were pressured with underperformance in the Nasdaq and small-cap Russell 2000, while the S&P 500 closed beneath the 5,000 level for the first time in almost a year to suggest the recent recovery in global risk assets was a mere dead cat bounce.

- SPX -1.57% at 4,983, NDX -1.95% at 17,090, DJI -0.84% at 37,646, RUT -2.57% at 1,764.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said they have a lot of countries wanting to make a deal and noted that the tariff situation is a good situation, while he added it is very important to pass the big beautiful bill. Trump also stated that he respects Canada and Mexico but they cheat on trade, and noted that China is manipulating its currency to offset tariffs and he thinks China will make a deal at some point and wants to make a deal. Furthermore, Trump confirmed the 104% tariff on China takes effect from midnight (EDT) and said he will be announcing tariffs on pharmaceuticals soon.

- US President Trump said they are taking USD 2bln in a day from tariffs and are doing well on tailored tariff deals, while he added that Japanese officials are flying to the US to make a deal and so are South Korean officials. Furthermore, he reiterated that tariffs are on and that they have tariffs on cars, lumber and steel.

- White House said US President Trump believes China has to and wants to make a deal with the US, while it was stated that if China makes a deal, Trump will be 'gracious'.

- White House Press Secretary said President Trump has tasked US Treasury Secretary and USTR Greer to lead talks and deals will be made if they benefit American workers and address trade deficits, while she said President Trump met with the trade team on Tuesday morning and directed the team to have tailor-made trade deals with every country that contacts the administration to strike a deal. Furthermore, she said reciprocal tariffs will continue to go into effect as deals are negotiated and all options are on the table for each country, as well as stated that phones have been ringing "off the hook" from nations trying to negotiate a trade deal.

- USTR Greer said they are willing to discuss how to implement a ban on imports of uranium from China and the Commerce Department is considering whether a Section 232 critical minerals investigation is needed.

- At least a dozen House Republicans are considering signing onto Rep. Don Bacon's bill to restrict the White House's ability to impose tariffs unilaterally, according to Axios.

- Canada said it has already announced 25% counter-tariffs against some US-made autos which will go into effect April 9th, while tariffs will remain in place until the US eliminates its tariffs against the Canadian auto sector.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said tariffs are much more than what the Fed had been modelling and the Fed has to take the longer view, not like the stock market, which is volatile. Goolsbee noted disagreement on how quickly or how much tariffs increase will get passed to consumers and said it could lead to bankruptcies of suppliers, while he added it is not obvious how Fed would react to negative supply shock, according to an Illinois Public Radio Interview.

- Fed's Daly (2027 voter) said CEOs feel uncertain and businesses are optimistic about growth, while she added that people move through uncertainty and there's resilience and agility. Furthermore, she said hard data is not a misread of solid growth and labour market, and noted she is a little concerned inflation may pick back up from tariffs.

- US President Trump signed executive orders related to coal and later posted on Truth "Today, we took historic action to help American workers, miners, families and consumers. We're ending Joe Biden's war on beautiful, clean coal once and for all, and we're going to put the miners back to work!"

- US President Trump posted on Truth "I had a very good meeting today with the Speaker of the House and some of our more Conservative Members, all great people. I let them know that, I AM FOR MAJOR SPENDING CUTS! WE ARE GOING TO DO REDUCTIONS, hopefully in excess of $1 Trillion Dollars, all of which will go into “The One, Big, Beautiful Bill.” I, along with House Members and Senators, will be pushing very hard to get these large scale Spending Cuts done, but we must get the Bill approved NOW. MAKE AMERICA GREAT AGAIN!"

APAC TRADE

EQUITIES

- APAC stocks were mostly lower following the dead cat bounce on Wall St and as reciprocal tariffs took effect overnight including a total 104% tariff on China.

- ASX 200 was dragged lower by underperformance in health care and miners with the former pressured after US President Trump stated that he will be announcing tariffs on pharmaceuticals soon.

- Nikkei 225 spearheaded the declines in Asia and fell beneath the USD 32,000 level amid currency strength and ongoing tariff woes with a report noting that tariffs could potentially reduce Japanese companies' earnings by up to 10%.

- Hang Seng and Shanghai Comp were mixed as the Hong Kong benchmark conformed to the losses in the region, while the mainland traded indecisively and was somewhat cushioned following recent stabilisation measures and expected policy support.

- US equity futures remained pressured after sentiment on Wall St gradually deteriorated which saw the S&P 500 close beneath the 5,000 level for the first time in almost a year.

- European equity futures indicate a lower cash market open with EuroStoxx 50 futures down 4.3% after the cash market closed with gains of 2.5% on Tuesday.

FX

- DXY extended on the prior day's losses amid a rebound in its major counterparts and as recession fears lingered amid the trade war with US reciprocal tariffs taking effect, while participants now await potential retaliation and the FOMC Minutes.

- EUR/USD ascended to back above the 1.1000 level as it benefitted from a weaker dollar, while there was a slew of ECB speakers but did little to shift the dial.

- GBP/USD broke out of the prior day's range after reclaiming the 1.2800 status as the dollar suffered overnight.

- USD/JPY retreated amid a weaker buck and haven flows into the yen as Japanese stocks underperformed.

- Antipodeans recouped some of the prior day's declines although NZD/USD somewhat lagged after the lack of surprises from the RBNZ which cut the OCR by 25bps to 3.50% as unanimously forecast and signalled further cuts ahead.

- PBoC set USD/CNY mid-point at 7.2066 vs exp. 7.3348 (Prev. 7.2038).

FIXED INCOME

- 10yr UST futures slumped notably amid a surge in yields due to trade war concerns and after a weak 3yr auction stateside.

- Bund futures attempted to rebound from yesterday's trough and briefly reclaimed the 130.00 status, while reports noted that Germany's CDU/CSU and SPD parties reached an agreement on a coalition.

- 10yr JGB futures were choppy and initially climbed back above the 141.00 level in a continuation of yesterday's intraday rebound but then faltered amid the sell-off in US counterparts.

COMMODITIES

- Crude futures remained pressured amid the broad risk-off environment in Asia-Pac and with prices not helped by mixed private sector inventory data despite the surprise draw in headline crude stockpiles.

- US Private Inventory Data (bbls): Crude -1.1mln (exp. +1.4mln), Distillate -1.8mln (exp. +0.3mln), Gasoline +0.2mln (exp. -1.5mln), Cushing +0.6mln.

- Keystone oil pipeline in North Dakota was reportedly shut after a rupture, according to AP.

- EU countries showed support for gas storage leeway before winter, while the EU may agree on a 10% leeway on the 90% storage goal on Friday, according to Bloomberg citing sources.

- Spot gold was underpinned by haven demand and reclaimed the key USD 3,000/oz level.

- Copper futures traded subdued amid the downbeat risk tone and as its largest buyer faces a 104% tariff rate stateside.

CRYPTO

- Bitcoin was indecisive and headed into the EU session relatively unchanged after oscillating through the USD 76,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japan's BoJ, MOF, FSA hold meeting to discuss international financial markets at 08:00BST.

- Goldman Sachs said continued tariff escalation between the US and China presents a downside risk to its current 2025 full-year real GDP forecast of 4.5% for China, while it noted significant policy easing by the Chinese government in the coming months is to mitigate the impact and stabilise growth.

- BoJ Governor Ueda said they have been raising rates up till now on the view that keeping rates low for too long when the economy and prices are recovering, risks causing economic excesses and would force them to hike rates rapidly later. Ueda said they have been raising rates with a focus on underlying inflation, which is gradually heading towards 2% and noted that uncertainty surrounding domestic and overseas economies is heightening due to US tariffs.

- South Korea announced emergency measures for the auto industry hit by US tariffs in which it is to lower taxes on auto purchases and raise EV subsidies to boost domestic demand, while it raised policy financing support for automakers to KRW 15tln this year from KRW 13tln and vowed efforts to ensure that domestic automakers are not treated in a disadvantageous way.

- RBNZ cut the OCR by 25bps to 3.50%, as expected and said a further reduction in the OCR is appropriate, while it added that as the extent of tariffs becomes clearer, the Committee has scope to lower the OCR further. RBNZ stated that global trade barriers weaken the outlook for global growth and having CPI close to the middle of the band puts the Committee in the best position to respond to developments. Furthermore, the Minutes stated that future policy decisions will be determined by the outlook for inflationary pressure over the medium term and the Committee also commented that the preceding cuts to the OCR have yet to have their full effect on the economy.

- RBI cut the Repurchase Rate by 25bps to 6.00%, as expected with the decision unanimous, while it changed the policy stance to accommodative from neutral. RBI Governor Malhotra said the accommodative stance signals the intended direction of policy rates going forward and that going forward absent any shocks, MPC will only consider the status quo and a rate cut. Furthermore, he stated that the stance should not be seen with regard to liquidity and noted some trade frictions are coming through and unsettling the global community.

GEOPOLITICS

MIDDLE EAST

- Israeli army reportedly blew up residential buildings northwest of the city of Rafah in the southern Gaza Strip, according to a correspondent cited by Al Jazeera.

- Hezbollah official said they are ready to discuss the future of their arsenal if Israel withdraws and ends strikes.

- Iran will be allowed to maintain a civilian nuclear program for electricity generation, such as the Bushehr reactor, even if it must completely dismantle its current nuclear program, according to the Jerusalem Post.

RUSSIA-UKRAINE

- US State Department said Russian and US delegations will meet in Istanbul for a second time on April 10th, while there are no political and security issues on the agenda for the US-Russian meeting.

OTHER

- North Korea said its status as a nuclear weapon state can never be reversed, according to KCNA.

EU/UK

NOTABLE HEADLINES

- BoE Deputy Governor Lombardelli said tariffs are likely to depress activity and the CPI impact of tariffs will depend on other countries' actions and can't take a position on this now.

- UK Chancellor Reeves is to hold tariffs crisis talks with top city executives, according to Sky News.

- Germany's CDU/CSU and SPD parties reached an agreement on a coalition, according to NTV.