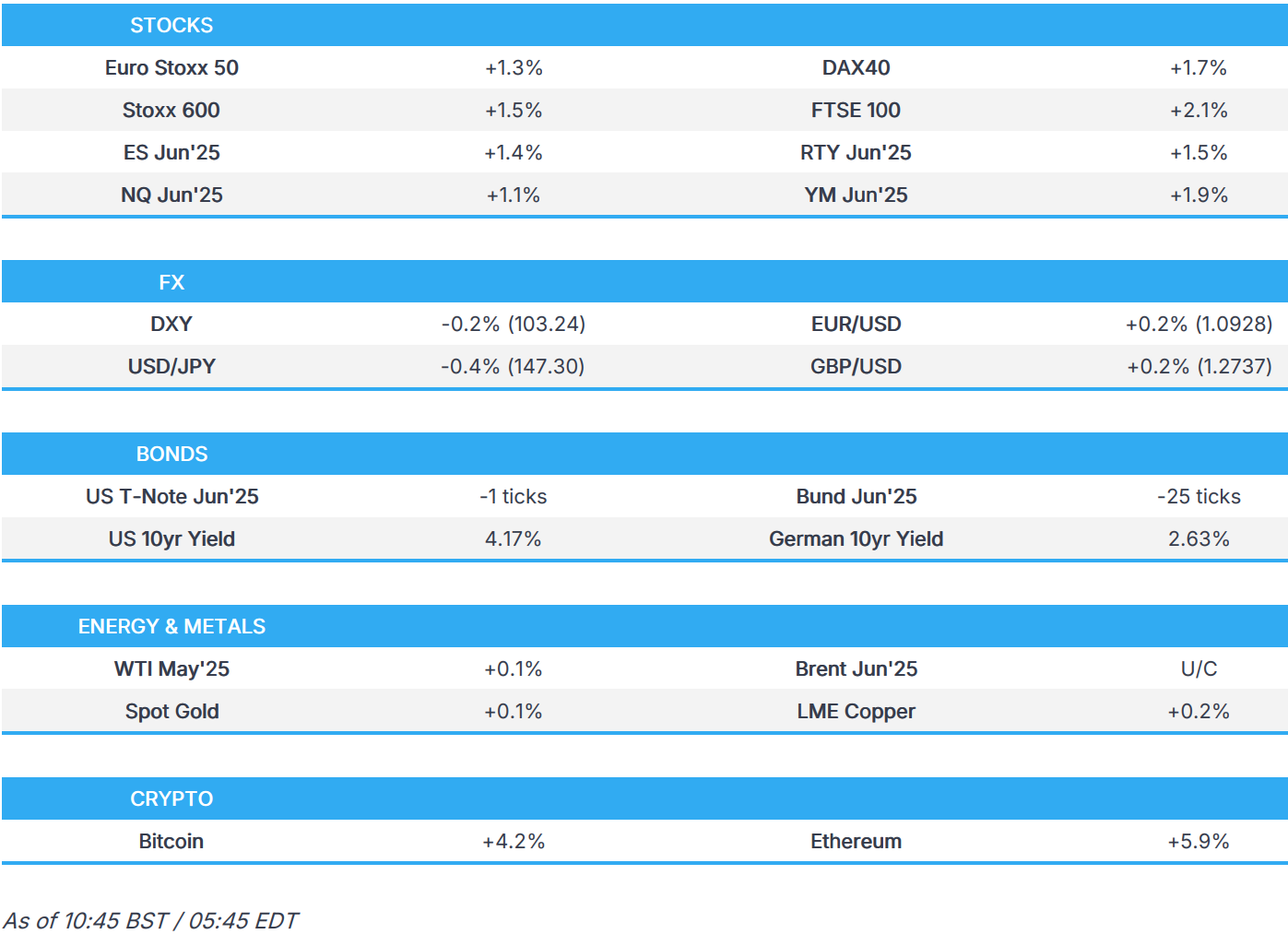

US Market Open: Risk sentiment improves with ES +1.3% whilst USD dips awaiting trade updates

08 Apr 2025, 11:15 by Newsquawk Desk

- China MOFCOM says China strongly opposes 50% additional tariffs and urges resolution of disputes with United States via dialogue.

- European bourses are on a firmer footing with US futures also in the green; ES +1.5%.

- USD softer vs. most major peers, antipodeans lead, EUR/USD remains on a 1.09 handle.

- Bonds were initially contained but has recently given way to pressure as the risk tone recovers.

- Crude choppy in a tight range while metals benefit from a softer Dollar ahead of trade updates.

- Looking ahead, ECB’s Cipollone, BoE’s Lombardelli & Fed’s Daly, Supply from the US, Earnings incl. Walgreens Boots Alliance.

TRADE/TARIFFS

US REMARKS

- US Treasury Secretary Bessent said he has not seen a trade offer from Japan and expects Japan to get priority in negotiations because they came forward early, while he added that maybe 70 countries have approached the US by now on trade and that Japan's non-tariff trade barriers are quite high, according to an FBN interview. Furthermore, Bessent said tariffs depend on negotiations which will be tough and the US will not likely have any trade deals in place by April 9th to avoid the retaliatory tariffs going into place, as well as commented that China has chosen to isolate itself by retaliating and doubling down on previous negative behaviour.

- US Treasury Secretary Bessent flew to Florida Sunday to encourage President Donald Trump to focus his message on negotiating favourable trade deals. Otherwise, Trump would risk the stock market cratering further, according to Politico.

- US Secretary of State Rubio discussed US reciprocal tariffs on India and how to make progress towards a fair trade relationship in a call with his Indian counterpart, according to the State Department.

- US tariffs reportedly threaten almost USD 2tln of investment pledges by global companies, according to FT.

APAC REMARKS

- Chinese Foreign Ministry says US acts did not show willingness for serious talks; if US wants to talk, it should show attitude for equality and respect

- China's MOFCOM said China strongly opposes 50% additional tariffs and urges resolution of disputes with the US via dialogue, while it said it will fight to the end if the US insists on measures and that China will never accept the "blackmail nature" of the US. Furthermore, China urged the US to immediately rectify its 'wrong practice' and cancel all unilateral tariff measures against China.

- Japan will reportedly send Economy Minister Akazawa to the US for tariff talks with US Treasury Secretary Bessent soon, according to Mainichi. However, Akazawa earlier stated that he was not aware of a report that he would be appointed by PM Ishiba as negotiator for trade talks with the US and has not been approached by PM Ishiba when asked about if he would be appointed as Japan's negotiator with the US on trade.

- Japan's Chief Cabinet Secretary Hayashi says PM Ishiba is considering visiting the US to meet with US President Trump while watching ministers' talks.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +1.5%) opened entirely in the green but some slight downward pressure has been seen in early morning trade with a couple of indices falling into negative territory.

- European sectors hold a strong positive bias, in-fitting with the risk tone. Industrials takes the top spot, followed closely by Travel & Leisure which continues to benefit from the lower oil prices and better risk appetite. Telecoms is lagging today; Banks and Real Estate also find themselves in the red.

- US equity futures (ES +1.5%, NQ +1.1%, RTY +1.5%) are entirely in the green, with complex continuing the strength seen in APAC/European trade.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is currently softer vs. all peers after benefiting on Monday from a jump in US yields. The trade narrative remains at the forefront of investor sentiment after US President Trump showed no signs of easing up on his aggressive approach to trade as he threatened an additional 50% tariff on China. Furthermore, Trump added that the US is not looking at pausing tariffs; tariffs could be permanent and there could also be talks. DXY sits towards the top end of Monday's 102.18-103.54 range, ahead of US NFIB small business optimism and Fed's Daly.

- EUR is firmer vs. the USD but to a lesser extent than some peers. Monday saw EUR/USD close higher but a long way off the earlier session peak at 1.1050 with the pair dragged lower by upside in US yields. ING posits that the EUR remains underpinned by its liquidity premium. Today's EZ docket is light in terms of data and as such, broader macro conditions and developments on the trade front will likely remain the focus for the pair. EUR/USD is currently contained on a 1.09 handle within a 1.0905-91 range.

- JPY is firmer vs. the USD despite the pick-up in risk sentiment we have seen thus far (albeit stocks have pulled away from best levels). In terms of updates out of Japan, Chief Cabinet Secretary Hayashi says PM Ishiba is considering visiting the US to meet with US President Trump. Additionally, US Treasury Secretary Bessent said he has not seen a trade offer from Japan and expects Japan to get priority in negotiations because they came forward early. Updates which explain some of the modest strength vs the Dollar. USD/JPY has delved as low as 146.98 but is some way off Monday's low at 144.82.

- GBP is firmer vs. the broadly softer USD but once again to a lesser extent than the EUR on account of the Euro's greater liquidity premium. UK specific drivers for the UK are on the light side. As we mentioned yesterday, desks are looking to see how the UK positions itself between the US and EU with Starmer noting last week that discussions on an economic deal with the US are "well advanced". BoE's Lombardelli is due later.

- Antipodeans firmer vs. the USD and top of the G10 leaderboard on account of the pick-up seen in risk sentiment. This comes despite both nation's exposure to China and the threat by US President Trump on Monday over an additional 50% tariff on the name. The CNY has come under particularly attention today after the PBoC set its daily fixing above 7.20 for the first time since September 2023.

- PBoC set USD/CNY mid-point at 7.2038 vs exp. 7.3321 (Prev. 7.1980); weakest fix since September 2023.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are relatively contained after a blockbuster Monday. Thus far, USTs are in relatively narrow 111-21+ to 112-08 parameters and entirely within, but at the lower-end of, Monday’s standout 111-15+ to 114-10 band. As it stands, markets are essentially just waiting for the next major update with the risk tone taking a slight breather from Monday’s marked pressure. Focus primarily on how Trump responds to China. Docket ahead includes US NFIB small business optimism and Fed's Daly.

- Bunds began firmer, at the top-end of a 129.81 to 130.58 band which is entirely within but at the lower end of Monday’s chunky 129.11 to 132.03 range. As the morning progressed and the European tone remained relatively robust the benchmark slipped into the red and back below 130.00. A German 2035 Green outing garnered quite weak demand which fuelled some modest pressure in German paper.

- Gilts are outperforming and towards the top-end of a 91.81 to 92.63 band. Strength is a function of the relative underperformance seen in Gilts on Monday rather than any specific factor underpinning it and with no real concession emerging into strong DMO supply that seemingly sparked a c. 15 tick bounce in Gilts. While firmer, today’s 92.63 high point is just under 200 ticks shy of Monday’s 94.50 high and leaves the benchmark lower by over 150 ticks WTD.

- UK sells GBP 2.25bln 4.375% 2054 Gilt: b/c 3.04x (prev. 2.85x), average yield 5.357% (prev. 5.104%) & tail 0.2bps (prev. 0.2bps)

- Netherlands sells EUR 2.095bln vs exp. EUR 2.0-2.5bln 0.50% 2032 DSL: average yield 2.567%

- Germany sells EUR 2.386bln vs exp. EUR 3bln 2.50% 2035 Green Bund: b/c 1.3x, average yield 2.62% & retention 20.47%

- Click for a detailed summary

COMMODITIES

- Crude is choppy and currently around the unchanged mark. Overnight the complex was boosted by the improvement in risk appetite, but some of this optimism has dissipated a touch within the complex. Around the cash open the complex was towards the day's peak at USD 61.75/bbl, before venturing to a fresh low at USD 60.17/bbl vs current USD 60.85/bbl. Energy specific updates have been light thus far.

- Precious metals are on a firmer footing today. Spot gold is higher by around a percent, having clambered above the USD 3,000/oz mark in overnight trade. The upside continued into the European session, taking the yellow metal to a fresh high of USD 3,015.91/oz. Bloomberg reported that gold held in London vaults increased by 372,000 ounces in March, marking the first monthly rise since October. It comes as the lucrative arbitrage trade, which had moved billions of dollars' worth of bullion to the US, ended after precious metals were exempted from recent tariffs.

- Base metals hold a positive bias amid the recovery in risk appetite. 3M LME Copper gains by around 0.6% and currently trades in a USD 8,734.1-8,846/t range.

- Click for a detailed summary

NOTABLE DATA RECAP

- French Trade Balance, EUR, SA (Feb) -7.87B vs. Exp. -5.85B (Prev. -6.54B, Rev. -6.49B); Imports, EUR (Feb) 57.54B (Prev. 56.376B, Rev. 56.18B); Exports, EUR (Feb) 49.67B (Prev. 49.836B, Rev. 49.69B); Current Account (Feb) -1.9B (Prev. -2.2B, Rev. -1.3B)

NOTABLE EUROPEAN HEADLINES

- ECB's Simkus says a 25bps cut is needed in April, via Econostream; US Tariff announcement warrants a more accommodative monetary policy, and "we need to move to a less restrictive stance".

- ECB's de Guindos says he is optimistic that the US tariffs are a wake up call for Europe

- ECB's Stournaras says negative impact from Trump tariffs on Greek economy will be limited.

- UBS Global Research cuts 2025 EZ GDP forecast to 0.5% (vs prior forecast 0.9%)

- UBS Global Research cuts UK 2025 GDP growth forecast by 0.4ppts to 0.7%

NOTABLE US HEADLINES

- Report commissioned by US Chamber of Commerce Foundation showed that many of the ~200 US firms surveyed in the past couple of years plan to hold onto or increase ties with China, according to WSJ.

- Morgan Stanley cuts US 2025 GDP growth forecast to 0.8% Q/Q (prev. 1.5%); not forecast a US recession, but the gap between sluggish growth outlook and a downturn has narrowed.

- US President Trump's order tonight reportedly seeks to tap coal power in a bid to dominate AI, according to Bloomberg.

- US President Trump posted on Truth "The Budget Plan just passed by the United States Senate has my Complete and Total Endorsement and Support. All of the elements we need to secure the Border, enact Historic Spending Cuts, and make Tax Cuts PERMANENT, and much more, are strongly covered and represented in the Bill."

- US Department of Homeland Security employees on Monday evening were asked to consider voluntarily resigning, retiring or taking a buyout, according to Bloomberg.

- Fed's Goolsbee (2025 voter) says almost unprecedented situation where hard US economic data looks good, but lots of dust in the air, adds Fed policymakers are hearing anxiety. Anxiety is if tariffs are as big as announced, with counter-tariffs, might send the us back to supply disruptions and high inflation. If the world erupts into a global trade war, likely to see consumers change behaviour. If this becomes a global age of trade, and don't actually put big tariffs on each other, it won't have this negative impact. Fed's job is to look at hard data.

GEOPOLITICS

MIDDLE EAST

- Israel received Egypt's new proposal, which involves the release of 8 hostages in exchange for a 40- to 70-day ceasefire although a source said it will be difficult to accept the proposal, according to Jerusalem Post.

- Iran's Foreign Minister Araqchi confirmed Iran and the US will meet in Oman on Saturday for indirect high-level talks, while official media reported Iran's Foreign Minister Araqchi and US envoy Witkoff will lead the US-Iran talks in Oman.

- Iran's Nournews said the latest statements by US President Trump regarding holding direct talks with Iran is a complex and designed psychological operation to influence domestic and international public opinion.

- Houthi-affiliated media reported US raids on Hodeidah and Sanaa governorates in Yemen, according to Sky News Arabia.

RUSSIA-UKRAINE

- Senior US Defense Department officials are considering withdrawing as many as 10k troops from Eastern Europe, according to NBC officials.

- US President Trump said they are meeting with Russia and Ukraine, and are getting sort of close, while he is not happy with Russia's bombing.

CRYPTO

- Bitcoin is back on a firmer footing after the hefty losses seen in the prior session; BTC currently hovering around USD 79k.

APAC TRADE

- APAC stocks were mostly positive as markets regained some composure and bounced back from the recent tariff turmoil.

- ASX 200 advanced with tech and energy leading the broad-based gains across sectors which helped participants shrug off the weaker-than-previous consumer sentiment and business confidence surveys.

- Nikkei 225 surged at the open and reclaimed the 33,000 level after the recent aggressive selling and with Japan said to get priority in trade talks following a call between Japanese PM Ishiba and US President Trump.

- Hang Seng and Shanghai Comp conformed to the improved risk appetite as Chinese state-owned funds and regulators announced efforts to stabilise markets, although gains were capped after US President Trump threatened an additional 50% tariff on China if it doesn't withdraw its 34% tariff increase against the US by today.

NOTABLE ASIA-PAC HEADLINES

-

Citi cuts China's 2025 GDP growth forecast to 4.2% (prev. 4.7%)

- China's Social Security Fund says it has actively increased holdings of domestic stocks and plans to further increase investments in the near term.

- PBoC said it will provide lending support to China state fund Huijin if needed and it firmly supports Huijin increasing its holdings in stock market index funds, while Huijin said it will play its role as a market stabiliser and act decisively when needed, as well noted it has healthy balance sheets, ample liquidity and smooth funding channels.

- China’s financial regulator said it will increase the proportion of insurance funds invested in the stock market and raise the upper limit of equity asset allocation ratio, while it will optimise the regulatory policy on the proportion of insurance funds.

- China state holding company China Guoxin said it will buy CNY 80bln of stocks and ETFs. It was also reported that state investment firm China Chengtong will increase holdings in stocks and ETFs to safeguard market stability and will buy CNY 80bln of stocks and ETFs.

- China Electronics Technology Group said it will step up share buybacks to bolster investor confidence.

DATA RECAP

- Australian Westpac Consumer Sentiment (Apr) 90.1 (Prev. 95.9)

- Australian NAB Business Confidence (Mar) -3.0 (Prev. -1.0); Conditions (Mar) 4.0 (Prev. 4.0)