Europe Market Open: APAC stocks resume heavy selling with Hang Seng down double digits, European futures down over 4%

07 Apr 2025, 07:00 by Newsquawk Desk

- US Commerce Secretary Lutnick said there is no postponing tariffs and April 9th tariffs are coming; tariffs are going to stay in place for days and weeks.

- US NEC Director Hassett said more than 50 countries have reached out to the White House to begin trade negotiations.

- Fed Chair Powell said on Friday that it feels like the Fed does not need to be in a hurry and has time; it is not clear what the path of monetary policy should be.

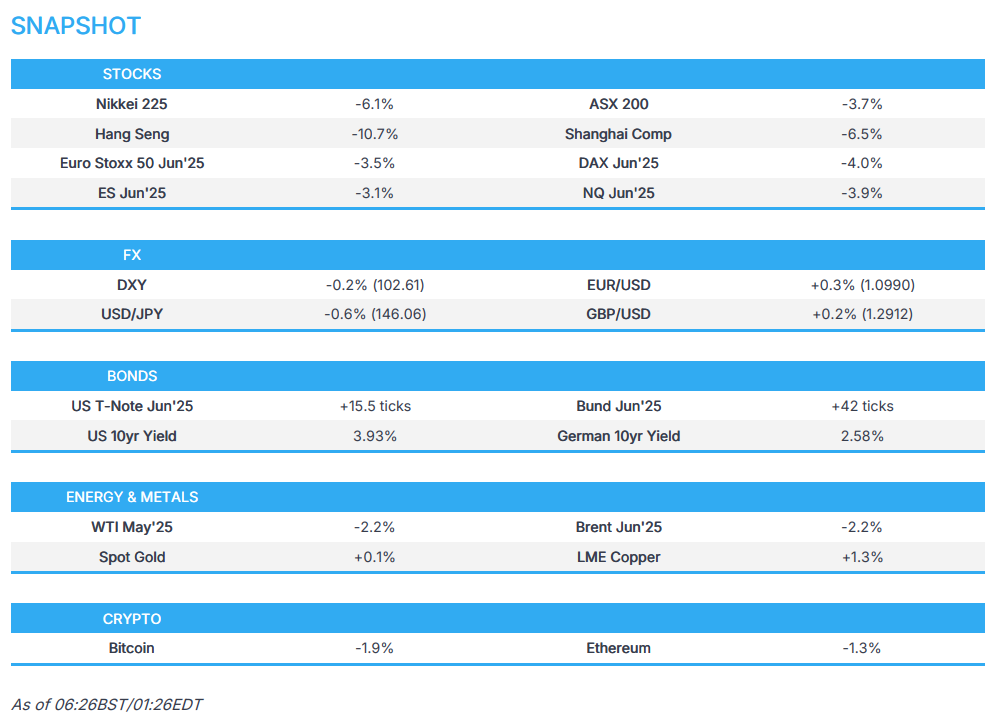

- APAC stocks resumed last week's heavy selling, US equity futures (ES -3.5%, NQ -4.3%, RTY -3.7%) have slumped, Europe set to open lower (Eurostoxx 50 future -4.1%).

- DXY remains on the backfoot, EUR/USD hit resistance at the 1.10 mark, Cable sits around the 1.29 level, CHF and JPY outperform.

- US yields are lower once again and in bull-steepening mode, crude prices continue to feel the squeeze.

- Looking ahead, highlights include German Industrial Output, EZ Sentix Index, Retail Sales, US Employment Trends, ECB’s Cipollone.

SNAPSHOT

US TRADE

EQUITIES

- US stocks sold off again on Friday whereby the major indices suffered another drop of around 6% as tariff fears continued to dominate with the trade war escalating following the response from China which announced a 34% tariff on the US (matching the US rate on China) and traders were also fearful of equities approaching circuit breaker levels. Furthermore, T-notes initially rallied to north of 114.00 at the peaks which coincided with a 10yr yield of 3.86%, the lowest since October 2024, although the moves in the Treasury complex gradually reversed after the strong NFP report and a hawkish leaning Fed Chair Powell.

- SPX -5.97% at 5,074, NDX -6.07% at 17,398, DJI -5.50% at 38,315, RUT -4.37% at 1,827.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said China has been hit much harder than the US and that it is not even close, while he told Americans to ‘hang tough’ and it won’t be easy, but the end result will be historic. Trump separately commented that unless they solve the trade deficit with China, he is not making a deal, while he noted the Chinese trade surplus is unsustainable and he was not intentionally engineering a market selloff. Furthermore, he said he has spoken to European and Asian leaders on tariffs.

- US President Trump posted on Truth "We have massive Financial Deficits with China, the European Union, and many others. The only way this problem can be cured is with TARIFFS, which are now bringing Tens of Billions of Dollars into the U.S.A. They are already in effect, and a beautiful thing to behold. The Surplus with these Countries has grown during the “Presidency” of Sleepy Joe Biden. We are going to reverse it, and reverse it QUICKLY. Some day people will realize that Tariffs, for the United States of America, are a very beautiful thing!"

- US Commerce Secretary Lutnick said there is no postponing tariffs and April 9th tariffs are coming, while he stated tariffs are going to stay in place for days and weeks, according to CBS News.

- US NEC Director Hassett said he would expect that job numbers are going to go up back and forth now that tariffs are in place, while he added that more than 50 countries have reached out to the White House to begin trade negotiations. Hassett also stated that President Trump decided not to apply tariffs to Russia due to continuing negotiations over the war in Ukraine, according to ABC News.

- UK PM Starmer spoke with Canadian PM Carney and they agreed on the importance of free and open trade between like-minded nations, while Carney reaffirmed his commitment to Canada playing a role in the coalition of the willing and they both agreed that an all-out trade war is in no-one’s interest.

- UK PM Starmer and French President Macron agreed a trade war was in nobody’s interests but added nothing should be off the table, while they shared their concerns about the global economic and security impact, particularly in Southeast Asia.

- Economists believe the UK is well-placed to secure a trade deal with the US which could further reduce tariffs and boost the economy, according to Bloomberg.

- EU’s Von der Leyen said following a phone call with UK PM Starmer that US tariffs harm all countries and the EU is committed to negotiations with the US and is ready to defend itself with proportionate countermeasures.

- France suggested targeting Big Tech’s data use in response to US tariffs and is also considering taxing digital services, according to POLITICO citing French Economy and Finance Minister Eric Lombard.

- India is unlikely to immediately retaliate against US President Trump’s reciprocal tariffs and is focusing efforts on negotiating a bilateral trade deal with the US to bring down duties, according to a government official cited by Economic Times.

- China’s government said China has taken and will continue to take resolute measures to safeguard its sovereignty, security and development interests, while it added there are no winners in trade wars and added the US should stop using tariffs as a weapon, according to Xinhua.

- China is reportedly considering frontloading stimulus in order to counter the tariff hit, via Bloomberg.

- Taiwan pledged more investment in the US and the removal of trade barriers after Trump tariffs, while it said it will proactively resolve non-tariff trade barriers that have existed for many years and has no plans of tariff retaliation.

- Japanese PM Ishiba said they are looking into non-tariff barriers pointed out by the US, while he added that Japan has created the biggest investment and jobs in the US and has never done anything unfair.

- South Korea's Trade Minister is to visit the US on Tuesday-Wednesday and will meet with US Trade Representative Greer to discuss lowering 25% US tariff rates.

NOTABLE HEADLINES

- Fed Chair Powell said on Friday that it feels like the Fed does not need to be in a hurry and has time, while he added that inflation is going to be moving up and growth slowing but noted it is not clear what the path of monetary policy should be.

- US Treasury Secretary Bessent sees no reason to anticipate a recession based on Trump tariffs and downplayed the stock market drop which he said was a short-term reaction, according to NBC News.

- US Senate passed the budget blueprint for US President Trump’s tax cuts and border agenda, sending the measure to the House.

- JP Morgan now expects real US GDP to contract under the weight of the tariffs, and for the full year (4Q/4Q), JPM now looks for real GDP growth of -0.3%, down from 1.3% previously. The recession in economic activity is projected to push the unemployment rate up to 5.3%.

- Goldman Sachs expects the Federal Reserve to begin a series of interest rate cuts in June (previously, it saw cuts in July, September, November). Under its base case, which assumes the US avoids a recession, GS now sees the Fed delivering three consecutive 25bps cuts, bringing the federal funds rate down to a range of 3.5-3.75%. GS also lifted its probability of a US recession to 45% from 35%

APAC TRADE

EQUITIES

- APAC stocks resumed last week's heavy selling as the trade war and growth concerns continued to unhinge investor sentiment, while Chinese markets slumped as the broad selling pressure rolled over into Greater China following the extended weekend and Beijing's tariff retaliation.

- ASX 200 declined heavily amid notable losses across all sectors with energy and mining stocks the worst hit owing to demand and growth-related concerns.

- Nikkei 225 slumped after futures triggered circuit breakers heading into the Tokyo open although the index was slightly off today's worst levels amid currency moves.

- Hang Seng and Shanghai Comp were hit on return from the long weekend with the former suffering double-digit losses as participants reacted to Beijing's retaliation against Trump's reciprocal tariffs in which China announced to impose tariffs of 34% on all US goods from April 10th.

- US equity futures (ES -3.5%, NQ -4.3%, RTY -3.7%) suffered a heavy drop at the reopening as the panic selling resumed but have since moved off today's lows.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 4.1% after the cash market closed with losses of 4.6% on Friday.

FX

- DXY remained pressured as the tariff turmoil continued into the new trading week after US officials suggested an unwillingness to back down on tariffs with President Trump telling Americans to 'hang tough', while Commerce Secretary Lutnick said there’s no postponing tariffs and that April 9th tariffs are coming. Aside from the ongoing tariff rhetoric and potential retaliation, participants will also look ahead to FOMC Minutes and the latest CPI data scheduled this week.

- EUR/USD attempted to nurse some losses although its efforts were thwarted by resistance at the 1.1000 handle.

- GBP/USD failed to sustain early upward momentum and reverted to sub-1.2900 territory to print a monthly low.

- USD/JPY gapped lower and tested the 145.00 level to the downside amid haven flows into the Japanese currency although the pair then bounced off lows after support held at the aforementioned level and as Japanese stocks partially clawed back some lost ground from the earlier extremes.

- Antipodeans remained pressured owing to the trade war and recession fears, with little data or catalysts to spur a recovery.

- PBoC set USD/CNY mid-point at 7.1980 vs exp. 7.3162 (Prev. 7.1889).

FIXED INCOME

- 10yr UST futures rallied at the open and briefly climbed above the 114.00 level as the selling in risk assets persisted after US officials signalled they remained unwavering on tariffs, although T-note futures have pulled back from opening highs as US equity futures attempted to nurse some of the deep initial losses.

- Bund futures gapped higher but pared some of the earlier gains after failing to sustain the 131.00 level and as participants look ahead to German Industrial Production.

- 10yr JGB futures traded higher although are well off today's best levels after pulling back from resistance just shy of the 143.00 territory.

COMMODITIES

- Crude futures suffered a double whammy from the ongoing tariff turmoil and after Saudi Arabia cut oil prices to Asia to their lowest in four months.

- OPEC+ JMMC meeting made no changes to oil output policy and stressed the need to ensure full compliance.

- Saudi Arabia cut oil prices to Asia to their lowest in four months with May Arab Light Crude set at a premium of USD 1.20/bbl vs Oman/Dubai, while it set May Arab Light Crude official selling price NW Europe at + USD 2.55/bbl vs ICE Brent and to US at + USD 3.60/bbl vs ASCI

- Qatar set May marine crude OSP at a premium of USD 0.60/bbl vs Oman/Dubai and set land crude at a premium of USD 0.50/bbl vs Oman/Dubai.

- Spot gold saw two-way price action with initial declines at the open after recent profit taking and touted liquidation although the precious then rebounded off lows and returned to above the USD 3,000/oz level owing to its haven appeal.

- Copper futures retreated alongside the broad risk-off sentiment in Asia-Pac but with the losses stemmed after its largest buyer returned to the market.

- Chile’s government plans to cut the 2025 estimated average price of copper to USD 3.90-4.00/lb from the current USD 4.25/lb projection. It was also reported that the Chilean Mining Minister said copper could reach a technical support price at USD 3.90/lb amid uncertainty.

- US is reportedly closing in on a critical mineral deal with the Democratic Republic of the Congo.

CRYPTO

- Bitcoin declined over the weekend with prices back beneath the USD 78,000 level amid the bloodbath in risk assets.

NOTABLE ASIA-PAC HEADLINES

- Taiwan’s financial regulator announced limits on the number of short-selling of stocks and will raise the minimum short-selling margin ratio to 130% from 90%.

DATA RECAP

- Chinese FX Reserves (Mar) 3.241T vs. Exp. 3.252T (Prev. 3.227T)

- Japanese Overall Labour Cash Earnings (Feb) 3.1% vs. Exp. 3.0% (Prev. 2.8%)

GEOPOLITICS

MIDDLE EAST

- Israel and UAE foreign ministers met in Abu Dhabi and discussed efforts to achieve a ceasefire in Gaza and secure the release of hostages.

- White House official said Israeli PM Netanyahu is visiting Washington on Monday.

RUSSIA-UKRAINE

- Russia reportedly launched its biggest attack on Kyiv in weeks. It was separately reported that Russian troops were pushing into Ukraine’s Sumy region and troops captured Basivka in Eastern Ukraine. Furthermore, Russia's Defence Ministry said Ukraine attacked Russian energy infrastructure.

- Poland scrambled an aircraft to ensure airspace security after Russia launched strikes over Ukraine.

- Russian court cut the sentence of a jailed US soldier to three years and two months from nearly four years, according to RIA.

OTHER

- G7 Foreign Ministers expressed deep concern about China’s provocative actions, particularly recent large military drills around Taiwan.

EU/UK

NOTABLE HEADLINES

- French PM Bayrou warned that Trump tariffs could cut France’s GDP growth by 0.5 percentage points.

- German Chancellor-in-waiting Merz’s key ally voiced optimism regarding talks with the SPD on forming the next government.

- ECB’s Schnabel said some people had the view that ‘Liberation Day” could be the day of peak uncertainty although she is not entirely sure that is the case and noted that they face a dramatic surge in uncertainty.

- ECB's Stournaras said Trump tariffs risk large Euro-area demand shock and warned the looming global trade war was likely to weigh heavily on Europe's economic growth, while he added the negative impact on Euro-area growth could be anything between 0.5 and 1ppt, according to FT.

- Fitch affirmed Italy at BBB; with Outlook Positive and affirmed Slovenia at A; Outlook Revised to Positive from Stable.