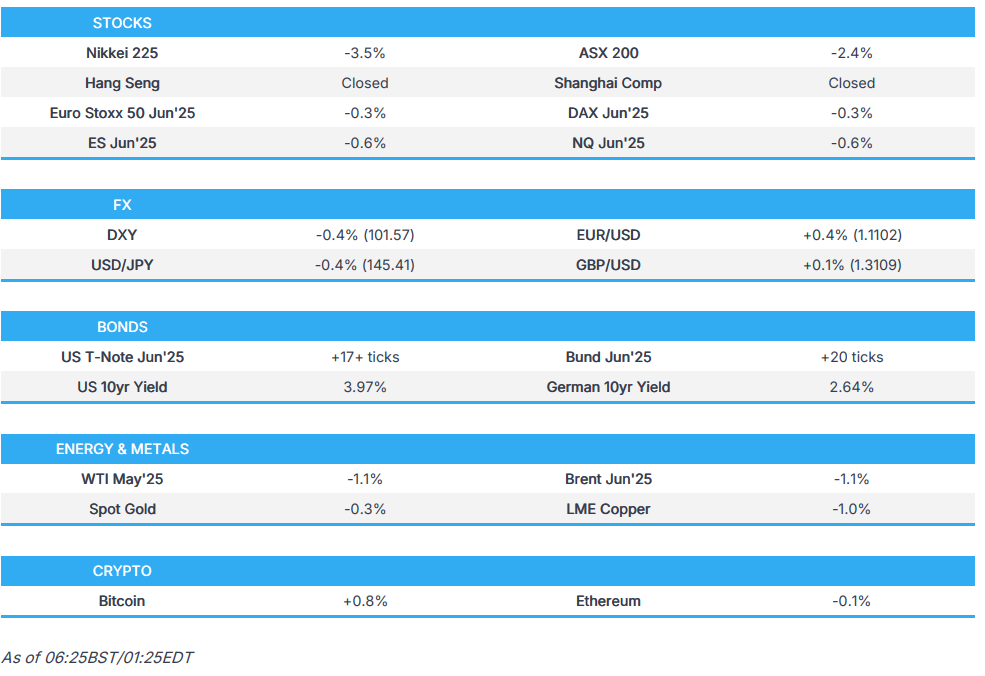

Europe Market Open: APAC stocks continue sell off after Wall St.’s worst session since 2020; DXY tests 101.50 ahead of Powell

04 Apr 2025, 06:50 by Newsquawk Desk

- US President Trump, when asked about the market response, said "now it settles in" and added he is open to negotiating if "other countries offer something phenomenal."

- Fed's Jefferson said there is no need to be in a hurry on policy adjustments, Cook said the Fed needs to be "patient but attentive".

- APAC stocks continued the sell-off after Wall Street experienced its worst session since 2020.

- DXY down to near 101.50, EUR held onto Thursday's strength, USD/JPY fell below 146.00 as haven flows resumed.

- Fixed benchmarks remained underpinned by the risk tone, crude subdued, and XAU rangebound

- Looking ahead, highlights include German Industrial Orders, Swedish CPIF, US & Canadian Labour Market Reports, Moody's to review the EU's sovereign rating, Speakers including Fed’s Powell, Barr, Waller & ECB’s de Guindos.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks tumbled in the wake of Liberation Day after President Trump announced more aggressive tariffs than expected which resulted in the largest losses on Wall Street since 2020 and saw the S&P 500 slip into correction territory with its constituents wiping out USD 2.4tln in value, while the vast majority of sectors were pressured with Energy, Tech, Consumer Discretionary and Industrials down by more than 5% on the day.

- SPX -4.84% at 5,397, NDX -5.41% at 18,521, DJI -3.98% at 40,546, RUT -6.59% at 1,911.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said the world is the world is looking for ways to make a deal on tariffs. Trump separately commented that the operation is over and now it settles in when asked about tariffs and the market response, while he also stated he is open to tariff negotiations if other countries offer something phenomenal. Furthermore, he stated the market response to tariffs was expected and he would consider a deal where China approves the TikTok sale in exchange for tariff relief.

- US Commerce Secretary Lutnick said there is no chance US President Trump will back off tariffs, while he added that Trump will negotiate only if other countries fix their tariffs and non-tariff barriers.

- US Trade Advisor Navarro said the WTO is institutionalising a world of unfair trade against the US, while he said tariffs are not a negotiation and defended tariffs as a 'national emergency' which are here to protect Americans and raise revenue.

- White House is floating the idea of potentially launching a tariff investigation into critical minerals imports.

- Washington Post's Stein posted on X that sources said "The White House's internal talking points tell surrogates that Trump's new global tariff regime should NOT be characterized as a starting point for negotiations" and that President Trump is also telling advisers they're not about setting up talks.

- US President Trump's tariffs have reportedly opened a rift among top Republicans in Washington and drew criticism from some Senators and large donors, according to FT.

- Canadian PM Carney said Canada will impose 25% tariffs on all vehicles imported from the US that are not compliant with the USMCA trade deal and they will fight US tariffs until they are removed. Carney stated that previously announced retaliatory tariffs will remain in effect and they would react energetically to any new US tariffs, while he also said that they need to reset their overall relationship with the US. Furthermore, a Canadian government official said tariffs on US autos will apply to CAD 35.6bln worth of imports.

- Mexican Deputy Economy Minister Gutierrez said Mexico is to continue a 'cool-headed' approach to Trump's tariffs and Mexican officials are to meet with Commerce Secretary Lutnick and USTR Greer next week to review autos, metals tariffs and USMCA trade agreement

- Brazil's Vice President Alckmin said he thinks the tariffs scenario will accelerate the Mercosur-EU deal and noted that technical teams from Brazil and the US will meet next week to discuss tariffs.

- US officials told the UK that they're open to talking about Britain's proposal to reduce tariffs below 10%, according to a Bloomberg reporter via social media platform X.

- Eurasia Group said French President Macron calls on big European businesses to freeze all investments in the US in retaliation for the "brutal and unjustified" import duties imposed by US President Trump.

- China's Vice Commerce Minister said they are willing to work with the EU to maintain a rules-based multilateral trading system and provide stability for global trade.

- WTO chief said estimates suggest that US tariffs, coupled with those introduced since the start of the year, could lead to an overall contraction of around 1% in global merchandise trade volumes this year, while the WTO chief is deeply concerned about this decline and the potential for escalation into a tariff war.

NOTABLE HEADLINES

- Fed Vice Chair Jefferson (voter) said there is no need to be in a hurry on policy rate adjustments and the current policy rate is well-positioned to deal with risks and uncertainties. Jefferson said they could retain current policy restraint for longer, or ease policy, depending on inflation progress and the job market, while the policy rate is now somewhat restrictive. Jefferson also said there is still substantial uncertainty around trade and uncertainty can weigh on spending and investment decisions, while he added it will be important to take their time and think about the impact.

- Fed's Cook (voter) said it is appropriate to maintain current policy for now while watching data and now is the time for the Fed to be ‘patient but attentive’. Cook also said the economy has entered a period of uncertainty, while she added that reduced uncertainty and easing inflation would facilitate rate cuts.

APAC TRADE

EQUITIES

- APAC stocks resumed the post-Liberation Day selling after Wall St suffered its worst loss since 2020, while fresh drivers are light amid the Greater China holiday closures and with participants now awaiting US jobs data.

- ASX 200 re-entered correction territory with the declines led by heavy losses in tech and energy in which the latter was pressured after oil prices fell by around 7% amid tariff turmoil and news that OPEC+ decided to increase output by a larger-than-scheduled 411k barrels per day in May.

- Nikkei 225 sold off again and fell below the USD 34,000 level with better-than-expected Household Spending data doing little to spur a recovery.

- KOSPI was initially choppy but ultimately weakened after the Constitutional Court upheld President Yoon's impeachment which sparked some angry protests and triggered an election to be held within 60 days.

- US equity futures trickled lower overnight as selling persisted following Wall St's largest one-day loss since the Covid-era.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.6% after the cash market closed with losses of 3.6% on Thursday.

FX

- DXY was pressured after tumbling yesterday as the latest tariffs stoked growth concerns with BofA warning that tariffs could push the US economy to "the precipice of recession", while Barclays sees a "high risk" of the US economy falling into a recession this year. There were also a slew of data releases including the large miss on ISM Services although the data releases took a back seat to the tariff-related turmoil and with participants now awaiting the latest NFP report and comments from Fed Chair Powell later today.

- EUR/USD held on to the prior day's spoils after benefitting from the slump in the greenback, while recent Services PMI data from the bloc topped forecasts and there were several comments from officials regarding the Trump tariffs including from Spain's PM who asked the European Commission for reinforcement of trade links with the rest of the world and is responding to US tariffs with a EUR 14.1bln plan to protect the Spanish economy.

- GBP/USD flatlined amid a lack of fresh catalysts and after the recent pullback from resistance at the 1.3200 level.

- USD/JPY attempted to nurse some losses but then faltered and reverted to beneath 146.00 owing to haven flows.

- Antipodeans underperformed amid their high-beta statuses and recent slump in commodities.

FIXED INCOME

- 10yr UST futures remained underpinned after surging as Trump tariffs sparked mass risk-off trade.

- Bund futures breached the prior day's highs and climbed above 130.00 as Trump's tariffs roiled markets.

- 10yr JGB futures tracked the gains in global peers amid haven demand and as tariff woes dragged yields lower.

COMMODITIES

- Crude futures were subdued after tumbling on the tariff turmoil and OPEC+ decision to speed up production hikes.

- Spot gold was rangebound following the prior day's two-way price action and with participants now awaiting US jobs data.

- Copper futures extended on its declines owing to the risk-off mood and absence of its largest buyer, China.

CRYPTO

- Bitcoin gradually retreated beneath the USD 83,000 level as risk sentiment continued to suffer on Trump tariffs.

NOTABLE ASIA-PAC HEADLINES

- White House is eyeing a TikTok deal announcement for Friday morning, according to FBN's Gasparino citing sources.

- BoJ Governor Ueda said US tariffs are likely to exert downward pressure on Japan and global economies, while he added it is hard to say now how US tariffs will affect Japan's price moves and they will closely monitor US tariff impact on Japan, overseas economic and price developments in deciding monetary policy. Ueda said they will scrutinise data, including from hearings, available at the time of each policy meeting to gauge the US tariff impact on Japan's economy and prices.

- BoJ Deputy Governor Uchida said they will raise interest rates if underlying inflation heightens against the background of continued improvements in the economy. Uchida said they will examine, without any preset idea if economic and price forecasts laid out in the quarterly report will be achieved, as well as scrutinise at each meeting economic, and price developments and risks including the impact from US tariffs.

- South Korean Constitutional Court ruled to oust impeached President Yoon with the decision made unanimously.

DATA RECAP

- Japanese All Household Spending MM (Feb) 3.5% vs. Exp. 0.5% (Prev. -4.5%)

- Japanese All Household Spending YY (Feb) -0.5% vs. Exp. -1.7% (Prev. 0.8%)

GEOPOLITICS

MIDDLE EAST

- Israeli media reported that the Israeli army launched raids on large areas in the Gaza Strip, according to Al Jazeera

- Houthi-affiliated media reports US aggression on the Kahlan area, east of Saada city, northern Yemen, according to Al Jazeera.

- Iran reportedly abandons Houthis under relentless US bombardment and ordered its military personnel to leave Yemen, according to The Telegraph.

- US President Trump said he spoke with Israeli PM Netanyahu on Thursday who may visit the US next week, although it was separately reported that Israeli PM Netanyahu's visit to the White House will likely take place in a few weeks.

- Turkey said Israel's attacks on regional countries have made Israel the biggest threat to regional security, while it added that Israel is a regional destabiliser and is feeding chaos and terror.

- Saudi Crown Prince received a phone call from Iran's President during which they discussed developments in the region and issues of common interest.

RUSSIA-UKRAINE

- US President Trump's inner circle advises against a call with Russian President Putin until he commits to a full ceasefire.

- Ukrainian Foreign Minister Sybiha met US Secretary of State Rubio in Brussels and informed him of Russian violation of the energy site ceasefire, while he reaffirmed Kyiv's commitment to mineral resources cooperation.

- Russian envoy Dmitriev said lots of differences remain, but a diplomatic solution is possible and there is already some progress on trust-building measures, while he sees a positive dynamic in US-Russian relations and said Several meetings are needed to sort out differences. Dmitriev also stated that a long-term solution that takes into account Russian security concerns is what is needed, as well as commented that they are not asking for a lifting of sanctions and that they can do a deal with the US on rare earths.

- Moscow's mayor said Russian air defences repelled drones approaching Moscow and specialists are examining fallen fragments.

EU/UK

NOTABLE HEADLINES

- UK government said almost GBP 14bln of R&D funding is allocated to bolster life sciences, green energy, space and beyond to improve lives and grow the economy.