Europe Market Open: Equities and global bond yields sink after Trump’s tariff announcement, XAU at fresh highs

03 Apr 2025, 07:10 by Newsquawk Desk

- US President Trump unveiled individual reciprocal tariffs for each country which are essentially half of what countries were charging the US.

- The US is to apply a 20% tariff on imports from EU, 34% tariff on imports from China, 26% tariff on imports from India and 25% tariff on imports from South Korea.

- Trump also stated that the baseline tariff is 10% for all nations and announced 25% auto tariffs, while Canada and Mexico were not subject to reciprocal tariffs for now.

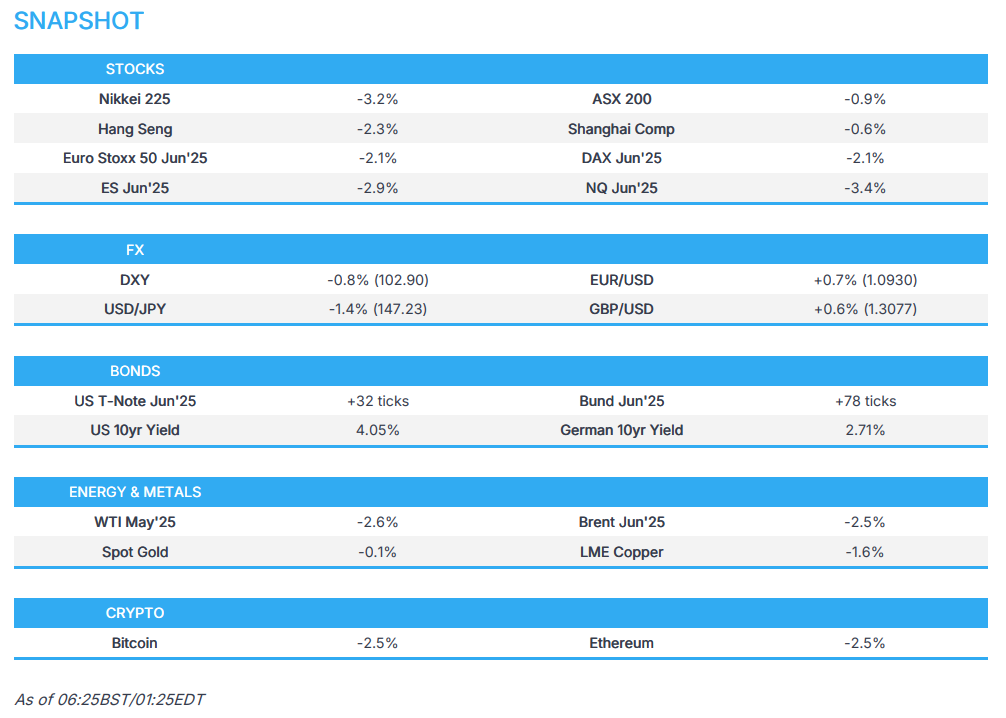

- US equity futures slumped in response to the tariff announcement (ES -2.6%, NQ -3.1%, RTY -3.9%). Europe is also marked lower with the Eurostoxx 50 future down 1.7%.

- USD is showing a mixed performance vs. peers but ultimately net lower (AUD, NZD weaker vs. the USD. JPY, EUR, GBP, CHF stronger).

- Global bond yields are lower with the inflation implications dwarfed by the mass risk-aversion in the market. Fed pricing looks for 82bps of easing by year-end vs. 76bps yesterday morning.

- Crude is lower as markets digest the global growth implications, whilst spot gold hit another record high.

- Looking ahead, highlights include Swiss CPI, EZ Producer Prices, US Weekly Claims, Challenger Layoffs & ISM Services, ECB Minutes & BoE DMP, Speakers including Fed’s Cook, Jefferson, US VP Vance, US Commerce Secretary Lutnick, ECB’s Schnabel & de Guindos, Supply from Spain, France, UK & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy heading into US President Trump's tariff announcement as markets reacted to source reports and ultimately finished in the green amid some positioning heading into the announcement, while futures then fluctuated after hours with an initial bullish reaction seen as reports noted the US is to apply a 10% baseline tariff to trading partners, although sentiment then soured as President Trump unveiled the individual reciprocal tariff amounts for each country which was essentially half of what countries were charging the US with a 20% tariff on EU, 34% tariff on China, 24% on Japan and 10% on the UK.

- SPX +0.67% at 5,671, NDX +0.75% at 19,582, DJI +0.56% at 42,225, RUT +1.65% at 2,045.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said for nations that treat the US badly, they will calculate the total rate charged, including non-monetary barriers and will charge them half of that rate and therefore won't be reciprocal. Accordingly, he announced the US is to apply a 20% tariff on imports from EU, 34% tariff on imports from China, 26% tariff on imports from India, 25% tariff on imports from South Korea, 10% tariff on imports from UK and 24% tariff on imports from Japan. Trump also stated that the baseline tariff is 10% and announced 25% auto tariffs, while Canada and Mexico were not subject to reciprocal tariffs for now.

- US President Trump's tariff order exempts gold, according to Reuters citing a White House fact sheet. It was also reported that Trump signed an order that aims to close "de minimus" loophole with a further amendment to duties addressing the synthetic opioid supply chain in China as applied to low-value imports. This follows earlier reports that the administration was considering revocation of tariff exemptions for cheap shipments from China, according to Reuters citing a source. CBS also reported that President Trump was considering announcing yesterday a plan for what he calls the “External Revenue Service" and is aiming to again charge tariffs on low-value merchandise shipped from China to individual US consumers, while it was noted that a US loophole had allowed duty-free shipments of Chinese goods worth less than USD 800.

- US Treasury Secretary Bessent said will have to wait and see on negotiations of tariffs and advised countries not to panic or retaliate, while he added the latest tariffs are at the high end of the number if there is no retaliation.

- US senior official said the baseline tariffs rate will go into effect on April 5th at 00:01EDT and reciprocal tariffs will go into effect on April 9th at 00:01EDT, while President Trump’s automobile tariffs took effect 00:01EDT on April 3rd, according to the Federal Register.

- White House senior official said US President Trump will respond to retaliation by other countries to ensure that the emergency order is not undermined.

- US Senate voted 51 to 48 to approve a bill that would terminate Trump's new tariffs on Canadian imports, although a House approval is seen as unlikely.

- Canadian PM Carney said US President Trump's tariff announcement has preserved a number of important elements of their relationship, but said they are going to fight these tariffs with countermeasures and will act with purpose and with force, while he added Canada will respond to US tariffs on Thursday.

- UK Business Secretary said their approach to Trump's tariff announcement is to remain 'calm and committed' to doing economic deals with the US, while they have a range of tools at their disposal and will not hesitate to act.

- European Commission President von der Leyen said US tariffs are a major blow to the world economy and the consequences will be dire for millions of people around the world. Von der Leyen added that they are prepared to respond and are preparing further countermeasures on US tariffs if negotiations fail.

- Italian PM Meloni said US tariffs are wrong and she hopes to work with the US and Europe to avoid a trade war that would weaken the West.

- China's Commerce Ministry said China firmly opposes US reciprocal tariffs and will resolutely take countermeasures to safeguard its rights and interests, while it urged the US to immediately cancel unilateral tariff measures and properly resolve differences with trading partners through equal dialogue.

- Australian PM Albanese said US tariffs are totally unwarranted and Australia will not impose reciprocal tariffs, while they will continue to make the case for these unjustified tariffs to be removed from exporters. Albanese added the free trade agreement with the US does have dispute resolution mechanisms and they want this to be resolved in a way that avoids those contests.

NOTABLE HEADLINES

- Fed Governor Kugler said the latest data indicates progress towards the 2% inflation target may have stalled and she supports keeping the current policy rate in place as long as upside risks to inflation continue, given stable activity and employment. Furthermore, she stated that inflation expectations have risen and upcoming policy changes hold upside risk, as well as noted that there may be reasons why tariffs have more prolonged effects.

- US President Trump reiterated that tax cuts will be passed in one big beautiful bill in Congress, while he added they need to get permanent tax cuts.

- US President Trump posted on Truth Social that "Speaker of the House Mike Johnson and Senate Majority Leader John Thune have been working tirelessly on taking the next step to pass the plan for our ONE, BIG, BEAUTIFUL BILL, as it is known, as well as getting us closer to the Debt Extension necessary to continue our great work. The Senate Budget plan gives us the tools that we need to get our shared priorities done, including certain PERMANENT Tax Cuts, Spending Cuts, Energy, Historic Investments in Defense, Border, and much more. We are going to cut Spending, and right-size the Budget back to where it should be. The Senate Plan has my Complete and Total Support. Likewise, the House is working along the same lines. Every Republican, House and Senate, must UNIFY. We need to pass it IMMEDIATELY!"

APAC TRADE

EQUITIES

- APAC stocks mostly tumbled in the aftermath of the 'Liberation Day' tariff announcements in which US President Trump unveiled reciprocal tariffs which were mostly set at around half of the rate that individual countries were charging the US with the actual baseline at 10%, while he also announced 25% auto tariffs.

- ASX 200 declined with the index dragged lower by underperformance in tech and energy, while there were comments from Australian PM Albanese who said they will not impose reciprocal tariffs and will continue to make the case for these unjustified tariffs to be removed from exporters.

- Nikkei 225 suffered heavy losses with the index firmly beneath the 35,000 level after the US announced 24% tariffs for Japan, while notable losses were seen in the financial sector and automakers were also hit by the 25% auto tariffs.

- Hang Seng and Shanghai Comp were pressured after US President Trump imposed a 34% tariff on China, on top of the existing 20% tariffs, for a total 54% tariff rate which saw the Hong Kong benchmark conform to the broad selling in the Asia-Pac region although the mainland initially showed some resilience with downside somewhat cushioned after stronger-than-expected Chinese Caixin Services PMI data.

- US equity futures slumped (ES -2.6%, NQ -3.1%, RTY -3.9%) in reaction to US President Trump's tariff announcement which were viewed as more harsher than many had hoped.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down by 1.7% after the cash market finished with losses of 0.3% on Wednesday.

FX

- DXY ultimately weakened in the aftermath of US President Trump's reciprocal tariff announcement as the latest salvo in the global trade war stoked growth concerns and boosted rate cut bets which saw near-even odds of a fourth Fed rate cut this year versus earlier pricing for three cuts.

- EUR/USD price action was volatile following the announcement that the US is to impose 20% reciprocal tariffs on the bloc and with auto tariffs set at 25%, although the single currency eventually took advantage of the dollar's demise to reclaim the 1.0900 status.

- GBP/USD strengthened after the US imposed a relatively light 10% tariff against the UK which is the actual baseline tariff rate.

- USD/JPY slid beneath the 148,00 handle due to haven demand amid the underperformance in Japanese stocks.

- Antipodeans traded choppy with early headwinds from the tariff chaos across markets but then rebounded off lows with the recovery helped by some initial resilience in China following better-than-expected Chinese Caixin Services PMI data.

- PBoC set USD/CNY mid-point at 7.1889 vs exp. 7.2532 (Prev. 7.1793).

FIXED INCOME

- 10yr UST futures rallied and climbed above the 112.00 level as haven assets jumped following US President Trump's tariff announcement.

- Bund futures gapped higher at the reopen and approached near the 130.00 level amid the tariff and trade war fears with the US to apply a 20% reciprocal tariff to the EU and 25% tariffs on all imported autos into the US.

- 10yr JGB futures rallied but was off today's initial highs after hitting resistance at the 140.00 level, while a stronger 10yr JGB auction had little effect.

COMMODITIES

- Crude futures tumbled with WTI briefly slipping beneath the USD 70/bbl level as US President Trump's tariff announcement spooked risk assets.

- Spot gold climbed to a fresh record high as the tariff turmoil triggered a flight to safety.

- Copper futures declined alongside the panic selling in equity futures triggered by the latest Trump tariff offensive.

CRYPTO

- Bitcoin partially nursed some losses overnight after slumping in the aftermath of President Trump's tariff announcement.

NOTABLE ASIA-PAC HEADLINES

- US President Trump was reported to outline a TikTok deal proposal with ByteDance retaining stake, according to The Information. It was separately reported that the Trump team weighed a deal to save TikTok, leaving the algorithm in Chinese ownership and the White House has examined a menu of options to avert a TikTok ban deadline set for Saturday. Furthermore, CNBC's Faber said AppLoving (APP) is a bidder for TikTok and a Trump administration official confirmed that Amazon (AMZN) has put in a bid to buy TikTok, although Fox's Gasparino noted that White House sources told him that the chances of the Amazon (AMZN) deal for TikTok are next to zero as Amazon wanted to buy TikTok's global operations and algo which the Chinese have said are not for sale.

DATA RECAP

- Chinese Caixin Services PMI (Mar) 51.9 vs. Exp. 51.5 (Prev. 51.4)

- Chinese Caixin Composite PMI (Mar) 51.8 (Prev. 51.5)

- Australian Balance on Goods (AUD)(Feb) 2.97B vs. Exp. 5.40B (Prev. 5.62B)

- Australian Goods/Services Exports (Feb) -3.60% (Prev. 1.30%)

- Australian Goods/Services Imports (Feb) 1.60% (Prev. -0.30%)

GEOPOLITICS

- US Treasury Secretary Bessent said the Ukraine deal is coming up and a team from Ukraine may be coming over as soon as this week, while he added that they could see more Iran sanctions.

EU/UK

NOTABLE HEADLINES

- ECB President Lagarde's speech noted that Europe’s reliance on external trade makes it vulnerable to trade headwinds.

- ECB's Villeroy said the latest EZ inflation data gives them the confidence to cut rates again soon and Trump tariffs shouldn't significantly impact disinflation in Europe, while he added that US tariffs shouldn't affect disinflation much.