Europe Market Open: Choppy trade amid tariff updates & Ukraine ceasefire talks

12 Mar 2025, 06:55 by Newsquawk Desk

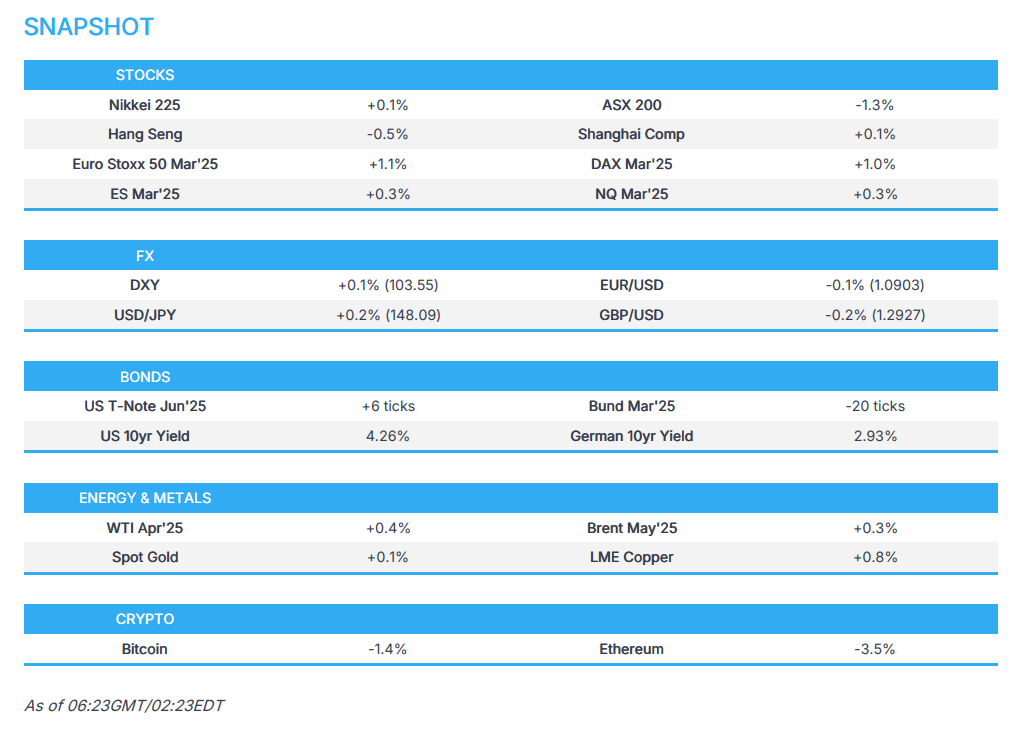

- APAC stocks traded mixed following the choppy performance stateside where the focus was centred on tariff rhetoric and Ukraine ceasefire talks.

- US President Trump's 25% tariffs on steel and aluminium took effect with no exemptions; cancelled 50% tariff on Canada.

- Ukraine expressed readiness to accept the US proposal to enact an immediate and interim 30-day ceasefire.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 1.2% after the cash market closed with losses of 1.4% on Tuesday.

- FX markets are broadly contained, DXY lingers around 103.50, EUR/USD is holding just above the 1.09 mark, JPY marginally lags.

- Looking ahead, highlights include ECB Wage Tracker, US CPI, BoC & NBP Policy Announcements, OPEC MOMR, RBA's Jones, ECB's Lagarde, Villeroy, Escrivá, Nagel, Lane & BoC's Macklem, Supply from UK, Germany & US, Earnings from Adobe, Brenntag, Puma, Rheinmetall, Porsche & Inditex.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy and most indices closed in the red albeit off their earlier lows in what was a headline-intensive day with the attention on President Trump's tariff threats in which he initially instructed the Commerce Secretary to impose an additional 25% tariff, to 50%, on all steel and aluminium coming into the US from Canada from March 12th although he later backed down from this threat after Ontario's Premier announced they are suspending the 25% surcharge on exports of electricity. Furthermore, there was a slight improvement in risk sentiment during the US afternoon following the joint US/Ukraine statement on a ceasefire proposal with Ukraine willing to accept a 30-day US-brokered ceasefire.

- SPX -0.76% at 5,572, NDX -0.28% at 19,377, DJI -1.14% at 41,433, RUT +0.22%.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump's 25% tariffs on steel and aluminium took effect with no exemptions.

- US President Trump said he respects Ontario's decision to suspend the 25% energy surcharge, while he said he was looking at backing down on the 50% duties on Canada and may back off doubling steel and aluminium Canada tariffs. Trump separately commented that tariffs are having and will have a tremendously positive impact, while he also suggested tariffs may go higher than 25% but did not specify which tariffs.

- US White House trade advisor Navarro said no 50% steel and aluminium tariffs on Canada tomorrow and that cooler heads prevailed with the Ontario Premier, according to CNBC.

- Ontario Premier Ford said they are suspending the 25% surcharge on exports of electricity and that US Commerce Secretary Lutnick agreed to meet with Ford on Thursday and will discuss a renewed USMCA ahead of the April 2nd deadline.

- Canadian PM-designate Carney said US President Trump's escalation is an attack on the country's workers and he will ensure its response has maximum impact in the US, while he reiterated that he would maintain tariffs on the US until Americans show them respect.

- Canadian Finance Minister spokesperson said if the US moves ahead with imposition of tariffs on March 12th, they will be ready to respond firmly and proportionately.

- Canada's Energy Minister said at CERAWeek that Canada may implement non-tariff measures such as restricting oil exports if the trade war with the US escalates and that ethanol is absolutely on the list of potential retaliatory tariffs being considered. Canada's Energy Minister also said Canada will respond shortly if tariffs come into play and will wait and see on tariffs, as well as noted that Canada does not want to provoke or escalate and seeks a positive outcome.

- EU Commission launched countermeasures on US imports in which it will allow the suspension of existing 2018 and 2020 countermeasures against the US to lapse on April 1st, while it is putting forward a package of new countermeasures on US exports. Furthermore, it stated that EU countermeasures could apply to US goods exports worth up to EUR 26bln to match the economic scope of the US tariffs but added the EU remains ready to work with the US administration to find a negotiated solution.

- UK Business and Trade Secretary Reynolds said it is disappointing the US has imposed global tariffs on steel and aluminium, while he stated that negotiations are ongoing for a wider economic agreement with the US to eliminate additional tariffs.

- Australian PM Albanese reiterated they will not impose reciprocal tariffs on the US and will continue to engage with the US on tariffs.

- Brazil asked the US to postpone the deadline for the 25% tariff on Brazilian steel and aluminium imports, which is scheduled to take effect this Wednesday, according to O Globo sources.

NOTABLE HEADLINES

- US President Trump said the US economy is going to 'blow it away' and said the US 'had to do this' referring to tariffs and have to get workers back and factories open, while he added markets are going to go up and down but have to rebuild the country. Trump also said he does not see a recession at all and the country is going to boom, while the market sell-off doesn't concern him. Furthermore, he thinks “some people are going to make great deals by buying stocks and bonds and all the things they're buying.”

- US President Trump posted "The price of eggs have come down, interest rates have come down, gasoline prices have come down—It's all coming down! We're doing it the right way, and I have tremendous confidence in this Country and in the people of this Country…", via Truth Social.

- US President Trump's administration is considering cutting the size of the Justice Department's public corruption unit.

- US Department of Education said it initiated a reduction in force impacting nearly 50% of the department's workforce with impacted staff to be placed on administrative leave beginning March 21st.

- Elon Musk has signalled to President Trump’s advisers in recent days that he wants to put USD 100mln into groups controlled by the Trump political operation, according to NYT.

- US House passed the spending bill to avert a government shutdown and sent it to the Senate.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the choppy performance stateside where the focus was centred on tariff rhetoric and Ukraine ceasefire talks, while the US's 25% tariffs on steel and aluminium took effect overnight.

- ASX 200 underperformed with firm losses in consumer discretionary, industrials and financials, while risk sentiment was also pressured after Australia failed in its efforts to get an exemption from looming tariffs.

- Nikkei 225 remained afloat but with price action choppy after mixed PPI and BSI Manufacturing data.

- Hang Seng and Shanghai Comp were ultimately mixed with the mood indecisive in both the mainland and Hong Kong amid light fresh catalysts although China’s securities regulator recently pledged to consolidate the momentum of market stabilisation.

- US equity futures (ES +0.3%, NQ +0.4%) were marginally higher after rebounding from yesterday's trough but with the recovery limited as participants now brace for the approaching US CPI data.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 future up 1.2% after the cash market closed with losses of 1.4% on Tuesday.

FX

- DXY eked mild gains after weakening yesterday as EUR strength, growing trade tensions, and fears over the economy weighed with tariffs remaining a key focus as the US's 25% tariffs on steel and aluminium took effect. Furthermore, President Trump backtracked on his threat to increase steel and aluminium tariffs on Canada to 50% after the Ontario Premier announced to suspend the 25% surcharge on exports of electricity to the US, while participants now await any further retaliatory announcements and US CPI data.

- EUR/USD trickled lower from a YTD peak after its recent outperformance but is holding above the 1.09 mark, while there was little reaction to the news that Portugal's government collapsed following a no-confidence vote and neither from the European Commission's announcement of measures to respond to the latest US tariffs.

- GBP/USD marginally eased back overnight after advancing the prior day on the back of the dollar weakness and amid light UK-specific catalysts.

- USD/JPY extended on gains and breached the 148.00 level to the upside after having been propelled by widening yield differentials.

- Antipodeans were uneventful amid the mostly subdued risk appetite and in the absence of any major data releases.

- PBoC set USD/CNY mid-point at 7.1696 vs exp. 7.2324 (Prev. 7.1741).

FIXED INCOME

- 10yr UST futures attempted to nurse some losses after slipping on mixed tariff messaging and Russia-Ukraine ceasefire hopes but with the recovery constrained by recent and looming supply.

- Bund futures rebounded from contract lows after suffering amid hopes of a German defence spending deal.

- 10yr JGB futures followed suit to the recent downside in peers as Japanese yields edged higher and with demand also contained after weaker results from the latest 20yr JGB auction.

COMMODITIES

- Crude futures were marginally higher but with gains capped following yesterday's choppy performance and flimsy risk appetite, while the latest private sector inventory data was mixed which showed a larger-than-expected build for headline crude and a wider-than-forecast drawdown in gasoline stockpiles.

- US Private Inventory Data (bbls): Crude +4.2mln (exp. +2.0mln), Distillate +0.4mln (exp. -0.8mln), Gasoline -4.6mln (exp. -1.9mln), Cushing -1.2mln.

- EIA STEO stated EIA sees 2025 world oil demand of 104.1mln BPD (prev. 104.1mln BPD) and sees 2026 demand of 105.3mln BPD (prev. 105.2mln).

- Kazakhstan has yet to deliver oil output and CPC blend crude export cuts in March, according to sources cited by Reuters.

- Spot gold traded sideways and held on to the prior day's spoils with the dollar steady as US CPI looms.

- Copper futures remained underpinned after the prior day's resurgence and was unfazed by the recent tariff-related to and fro.

CRYPTO

- Bitcoin failed to sustain early gains and retreated to beneath the USD 82,000 level.

NOTABLE ASIA-PAC HEADLINES

- Hitachi (6501 JT), Toyota (7203 JT) and NEC (6701 JT) agreed to fully meet unions' wage hike demands for 2025, while Nissan (7201 JT), Mitsubishi Electric (6503 JT), Honda (7267 JT), Nippon Steel (5401 JT) and Panasonic (6752 JT) agreed to average monthly wage increases below unions' demands.

DATA RECAP

- Japanese Corp Goods Price MM (Feb) 0.0% vs. Exp. -0.1% (Prev. 0.3%)

- Japanese Corp Goods Price YY (Feb) 4.0% vs. Exp. 4.0% (Prev. 4.2%)

- Japanese Business Survey Index* (Q1) -2.4% (Prev. 6.3%)

GEOPOLITICS

MIDDLE EAST

- Yemen's Houthis said they will resume blocking ships passing through the Red Sea, Arabian Sea, and Bab al-Mandab Strait after a four-day deadline to lift the Gaza aid blockade ended.

- Iran’s President said he won’t negotiate with US President Trump under threats and stated 'do whatever the hell you want', according to state media.

- US Secretary of State Rubio said the US welcomes an agreement between Syrian interim authorities and Syrian democratic forces to integrate northeast into unified Syria, while the US will continue to watch decisions made by interim authorities.

RUSSIA-UKRAINE

- US State Department said regarding the Jeddah meeting that the US and Ukraine took important steps toward restoring durable peace for Ukraine and Ukraine expressed readiness to accept the US proposal to enact an immediate and interim 30-day ceasefire. Furthermore, the US will immediately lift the pause on intelligence sharing and resume security assistance to Ukraine.

- US President Trump said regarding Ukraine that they now have to talk to Russia and hopefully Russian President Putin will agree on the plan, while he said they are going to meet with Russia later on today or tomorrow and would invite Zelensky back to the White House. Furthermore, Trump said he will talk to Russian President Putin, but added it takes "two to tango" and thinks he will talk with him this week, while he hopes to have a total ceasefire in the coming days.

- US Secretary of State Rubio said the ball is now in Russia's court on Ukraine peace, while he added that Ukraine has taken a positive step and hopes Russians will reciprocate.

- US National Security Adviser Waltz said Ukraine has made concrete proposals and talks got into substantive details on how the Ukraine war will end, while he will speak to his Russian counterpart in the coming days.

- Ukrainian President Zelensky thanked the US team for constructive talks in Saudi Arabia and said the ceasefire proposal covers the frontline, not just air and sea exclusively.

- Ukrainian President Zelensky's top aide said a ceasefire proposal will show if Russia wants peace or not and different options for security guarantees were discussed with the US.

- Russian lawmaker stated that any potential ceasefire agreement in Ukraine will be under Moscow's terms and not those set by Washington.

- Russia conducted an air strike on Ukraine’s capital of Kyiv, according to the Mayor. It was also reported that a Russian missile attack killed four people and damaged a grain vessel in Ukraine's Black Sea port of Odesa, while Russian air defence units reportedly destroyed 21 Ukrainian drones overnight, according to Russian agencies.

- Russia's Foreign Ministry does not rule out contacts with US representatives over the next few days, according to RIA. It was earlier reported that the Russian Foreign Ministry said Ukraine's drone attack on Russia was preplanned and was timed to coincide with US-Ukraine talks in Saudi Arabia, while it added that all countries that continue to pump Ukraine with weapons are to blame for this attack.

OTHER

- Russian, Chinese and Iranian ships practised artillery fire in the Gulf of Oman, according to Russian agencies.

- Polish Defence Minister said Poland is open to the French offer of extending the nuclear umbrella but needs details.

- North Korea said a recent misfire by South Korean fighter jets during training shows an accident could trigger armed conflict on the Korean Peninsula and US-South Korean military drills can start the world's first nuclear war, according to KCNA

EU/UK

NOTABLE HEADLINES

- UK's pension minister is in ‘active discussions’ with pension funds to invest more in private markets, according to FT.

- Portugal's Parliament rejected the motion of confidence in the centre-right government, causing its collapse.