US Market Open: Sentiment improves modestly after Monday’s hefty losses, and DXY hits fresh YTD low awaiting further Trump updates

11 Mar 2025, 10:50 by Newsquawk Desk

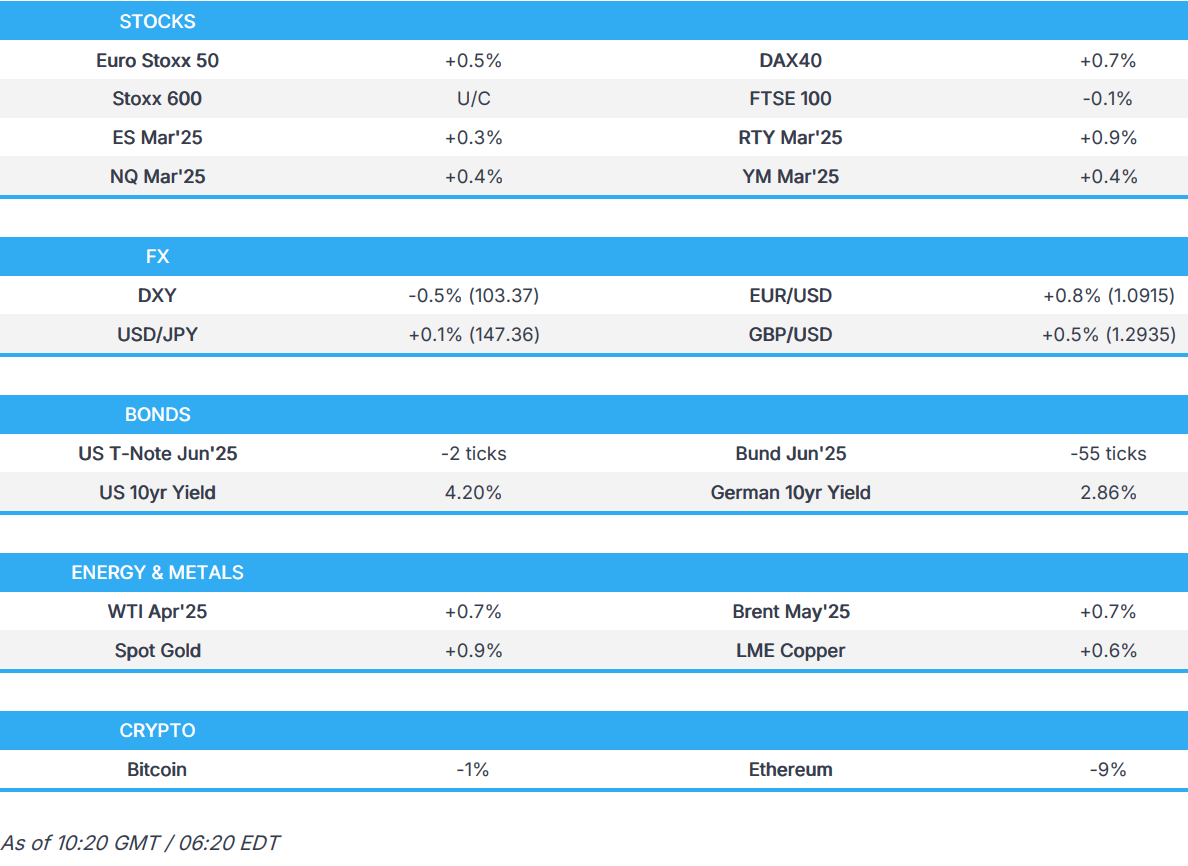

- European bourses are mixed; US futures are firmer attempting to consolidate following the prior day’s hefty losses.

- DXY hits a fresh YTD low as EUR/USD reclaimed 1.09 on German defence spending optimism.

- USTs hold near unchanged while Bunds slump on the latest fiscal updates.

- Commodities broadly supported by a diving Dollar; XAU back above USD 2.9k.

- Looking ahead, US JOLTS, EIA STEO Speakers including ECB’s Lagarde, de Guindos, Lane, Villeroy & Escriva, Supply from the US.

TARIFFS/TRADE

- US President Trump said on Truth Social that "Despite the fact that Canada is charging the USA from 250% to 390% Tariffs on many of our farm products, Ontario just announced a 25% surcharge on “electricity,” of all things, and your not even allowed to do that. Because our Tariffs are reciprocal, we’ll just get it all back on April 2. Canada is a Tariff abuser, and always has been, but the United States is not going to be subsidizing Canada any longer. We don’t need your Cars, we don’t need your Lumber, we don’t your Energy, and very soon, you will find that out".

- Japanese Trade Minister Muto said he asked that Japan be exempt from tariffs in talks with US officials and did not get any assurance from the US that Japan will be exempted from US tariffs due to come into force on Wednesday.

- South Korean acting President Choi said the time for negotiating with the US has begun ahead of reciprocal tariffs taking effect, while he added that President Trump's America First moves are targeting South Korea and the government will respond calmly and flexibly, considering only national interests.

- Taiwan is said to launch an anti-dumping probe related to certain Chinese steel products and an anti-dumping probe related to beer from China.

EUROPEAN TRADE

EQUITIES

- European bourses are mixed, with price action fairly rangebound thus far. The DAX 40 (+0.7%) outperforms, as the region reacts to optimism surrounding German defence spending plans, whilst the FTSE 100 (-0.1%) is a little lower.

- European sectors are mixed; Real Estate is propped up by post-earning strength in Persimmon (+4.2%); Autos benefits from post-earning strength in Volkswagen (+2.5%) which reported robust FY results, but its guidance was not so optimistic. Travel & Leisure is the clear underperformer, as the sector reacts to Delta Airlines (-10% pre-market) cutting guidance, amid weak demand.

- US equity futures are entirely in the green, with modest outperformance in the RTY (+0.9%), as US indices attempt to consolidate some of the hefty downside seen on Monday. There is no clear fundamental driver behind the pick up in equity performance.

- Meta Platforms (META) said to be testing its first AI training chip, according to sources cited by Reuters. Meta is working with TSMC (TSM) to produce the chipMeta plans wider deployment of the chip if its test is successful, sources say. Meta testing its first AI training chip is part of plan to reduce reliance on suppliers like Nvidia (NVDA). Chip aims to lower AI infrastructure costs, sources say. Meta plans to use chips for recommendations and generative AI.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is on the backfoot and trades towards the bottom end of a 103.40-92 range, with the trough for the session marking a fresh YTD low. The downside today stems from a slight unwinding of its haven appeal seen on Monday, but more pertinently, the resurgence in the EUR (discussed below). Ahead, markets will await US JOLTS Job Openings data.

- EUR is the best performing G10 currency today, with commentary via a German Green party co-leader the main driver for the upside; the politician said that they are hopeful of a defence deal occurring this week. This follows on from reporting overnight via Bloomberg, which suggested that the Greens had made their own proposal to loosen defence spending. The Single Currency topped 1.09 earlier in the session and now looks to test the 5 Nov 2024 high at 1.0936. On the policy front, ECB's Rehn said if the data indicates, the Bank would hold rates in April. Ahead, today sees a busy ECB speaker slate, including the likes of President Lagarde, VP de Guindos, Lane, Villeroy & Escriva

- JPY is the marginal underperformer today, alongside its haven peers CHF amid the modest improvement in sentiment. Overnight, USD/JPY was choppy owing to relatively disappointing Japanese GDP/Household spending metrics. The pair has been fairly unfazed by the Dollar weakness, currently trading in a 146.55-147.40 range.

- GBP is on a firmer footing, with upside largely a factor of the broader Dollar weakness rather than UK-specific newsflow. Overnight saw a downtick in Y/Y BRC retail sales and a Y/Y slowdown in the Barclays UK February Consumer Spending report. However, these prints had no follow-through into the pound. As it stands Cable sits at the top end of a 1.2873-1.2941 range.

- Antipodeans are both a little firmer, but to a lesser extent than the EUR and GBP, after marginal underperformance overnight.

- PBoC set USD/CNY mid-point at 7.1741 vs exp. 7.2597 (Prev. 7.1733).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are essentially flat, but do hold a downward bias, as sentiment continues to incrementally improve in today's session, and in tandem with the pressure seen in Bunds (see below). Focus for traders today will be on US JOLTS Job Openings, remarks from US White House Press Secretary Leavitt and then President Trump thereafter. But before those remarks, a 3yr auction; as a reminder, the prior outing was strong, which stopped through the when issued by 1.3bps. USTs currently trading towards the lower end of a 111-11 to 111-25 range. If the pullback continues then USTs have a little bit of clean air until the 111-00 mark.

- Bunds are pressured today and the underperformer amongst peers. Downside stems from comments via Germany's Green party co-leader who said they are hopeful of a defence deal occurring this week. This followed on from reporting overnight which that the Greens had made their own proposal to loosen defence spending. Bunds have been holding a bearish bias throughout the European session thus far, and currently at the day's trough at 127.04, just ahead of the 127.00 mark. Ahead, a 2027 Schatz tap and a slew of ECB speakers.

- Gilts are modestly lower, but to a much lesser extent than Bunds. UK-specific newsflow remains light, and will likely to remain-so up until the region's GDP figures on Friday; more broadly however, PM Starmer held a cabinet meeting early doors which Politico reports is set to be focussed on the domestic agenda. This aside, European defence officials are due to meet in France today. Gilts currently in a 92.07-92.46 range, which marks a marginal new WTD low.

- Guidance for the UK's 1.875% 2049 I/L Gilt benchmark reportedly +1.0 to +1.5bps, via Bloomberg citing sources. Orders for the UK 2049 I/L syndication are in excess of GBP 56bln, via Reuters citing a bookrunner; guidance +1.0 to +1.5bps.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing, after clambering off overnight lows which saw the complex modestly subdued. Upside today may stem from the a) weaker Dollar b) improvement in risk-tone (US indices look to open higher). Energy specific newsflow has been light this morning; more focus will be on Monday's remarks from US Energy Secretary Wright who said he is looking at working with Congress on cancelling mandated sales from oil reserve. Brent'May currently trades at the top end of a USD 68.63-69.72/bbl range. Energy traders will await the EIA STEO and then Private Inventory data thereafter.

- Spot gold is back on a firmer footing, continuing the upward bias seen in APAC trade and amidst the broader Dollar weakness. XAU tested USD 2.9k overnight, and firmly topped the figure as the European session commenced; currently trading at the upper end of a USD 2,880.40-2,910.95/oz range.

- Base metals hold a positive bias, given the slight improvement in risk sentiment seen in today's session, following a mostly subdued session overnight. 3M LME Copper is currently higher by just under USD 50/t, in a USD 9,460.95-9,602/t confine.

- BofA expects platinum to outperform Palladium going forward, expect a Platinum deficit and Palladium surplus for 2025. Lingering concerns over trade disputes may mean that PGMs get stranded in the US for a bit longer, potentially limiting liquidity in other markets.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Retail Sales YY (Feb) 0.9% (Prev. 2.5%); Total Sales YY (Feb) 1.1% (Prev. 2.6%)

- US NFIB Business Optimism Index (Feb) 100.7 (Prev. 102.8)

NOTABLE EUROPEAN HEADLINES

- Barclays UK February Consumer Spending rose 1.0% Y/Y (prev. +1.9%) and UK Consumers' Confidence in household finance was the highest since the series began in 2015 at 75% (prev. 70%).

- Germany's Greens reportedly made their own proposal to loosen defence spending, according to Bloomberg. Thereafter, the Green party co-leader says they are hopeful of a defence deal occurring this week.

- ECB's Rehn says Europe needs common solutions to boost defence, Eurosystem's forecast and indicators of core inflation suggest that it will align with the 2% target. Bank of Finland estimates US tariffs on the EU and China could reduce global output by over 0.5% this year and next. Defence investments must be increased at a time when EU countries already hold large public deficits.

- Riksbank's Thedeen says there are signs of a business cycle rebound, with GDP growth exceeding expectations in the second half of last year; early-year indicators remain mixed.

NOTABLE US HEADLINES

- US President Trump was reportedly making calls to potential holdouts on a plan to avoid a government shutdown at the end of this week, according to Fox News.

- US House Minority Leader Jeffries said House Democrats will not be complicit in supporting the Republican government spending bill.

- US President Trump has made calls to undecided House Republicans and will continue to work the phones today, via Punchbowl citing sources. Trump is reportedly "all in" and “Members can’t be on the wrong side of this.” said a House Republican. Punchbowl adds that Speaker Johnson has multiple holdouts. Rep. Massie (R) the only public no, although there are others on the fence. Reps. Cammack (R) and Duyne (R) raised concerns about the measure during a GOP whip meeting on Monday, sources said.

GEOPOLITICS

MIDDLE EAST

- Kremlin spokesman says the US will inform Russia about its talks with Ukraine in Saudi Arabia, via TASS. "Many rumours in Western media about Moscow's readiness for a six-month ceasefire"

- Israeli army said it targeted military headquarters and sites containing weapons in southern Syria.

RUSSIA-UKRAINE

- Saudi Crown Prince and Ukrainian President Zelensky discussed efforts to achieve sustainable peace, according to Saudi State news agency.

- Ukrainian President Zelensky said Ukraine's position in Tuesday's talks with US officials will be "fully constructive" and a significant part of Monday's talks in Saudi Arabia was dedicated to security guarantees for Ukraine, while it was also reported that the Saudi Crown Prince underscored in a meeting with Ukrainian Zelensky his support for all international efforts aimed at resolving the crisis and achieving peace.

- Saudi Crown Prince and US Secretary of State Rubio discussed regional and international developments in Jeddah, while they also discussed the reconstruction of Gaza, Yemen and threats to navigation from Houthis Rubio also reiterated firm US commitment that any solution to the situation in Gaza must not include any role for Hamas.

- Flights were suspended at two airports serving Moscow and a fire broke out at a parking lot, while train services were also halted in Moscow's Domodedovo region following a drone attack. It was later reported that Russia downed 337 Ukrainian drones over Russian regions and defence units destroyed 73 Ukrainian drones that targeted Moscow.

- US Special Envoy Witkoff plans to visit Moscow for a meeting with Russian President Putin, according to a Bloomberg reporter on X cited by Reuters.

CRYPTO

- Bitcoin is a little lower, but well off recent lows as sentiment attempts to stabilise; Ethereum remains pressured and sits below USD 2k.

APAC TRADE

- APAC stocks took their cues from the tech-led sell-off stateside after the Nasdaq suffered its worst day since 2022 amid recession fears and tariff-related concerns.

- ASX 200 was dragged lower by underperformance in tech and with most sectors in the red aside from energy and some defensives, while improved consumer confidence and mixed business surveys did little to inspire a rebound.

- Nikkei 225 retreated following disappointing Household Spending and revised Q4 GDP data from Japan.

- Hang Seng and Shanghai Comp conformed to the negativity amid light catalysts and as the NPC concludes today.

NOTABLE ASIA-PAC HEADLINES

- Nissan Motor (7201 JT) CEO Uchida is set to step down.

DATA RECAP

- Japanese GDP Revised QQ (Q4) 0.6% vs. Exp. 0.7% (Prev. 0.7%); QQ Annualised (Q4) 2.2% vs. Exp. 2.8% (Prev. 2.8%)

- Japanese All Household Spending MM (Jan) -4.5% vs. Exp. -1.9% (Prev. 2.3%); YY (Jan) 0.8% vs. Exp. 3.6% (Prev. 2.7%)

- Australian Westpac Consumer Sentiment MM (Mar) 4.0% (Prev. 0.1%)

- Australian NAB Business Confidence (Feb) -1.0 (Prev. 4.0, Rev. 5); Conditions (Feb) 4.0 (Prev. 3.0)