Europe Market Open: APAC stocks suffer losses after Nasdaq’s worst day since 2022

11 Mar 2025, 06:50 by Newsquawk Desk

- APAC stocks took their cues from the tech-led sell-off stateside after the Nasdaq suffered its worst day since 2022.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market finished with losses of 1.5% on Monday.

- US equity futures (ES +0.2%, NQ +0.1%) regained some composure after the prior day's sell-off which saw the S&P 500 fall to a six-month low.

- DXY is steady after a choppy session yesterday with G10 majors broadly contained; antipodeans marginally lag.

- 10yr UST futures extended their advances amid a flight to quality, Bunds gradually rebounded and reclaimed the 128.00 level.

- Crude futures were lacklustre with demand hampered alongside the global risk-off sentiment.

- Looking ahead, highlights include US NFIB Business Conditions, US JOLTS, EIA STEO, ECB’s Lagarde, de Guindos, Lane, Villeroy & Escriva, Supply from Germany & US.

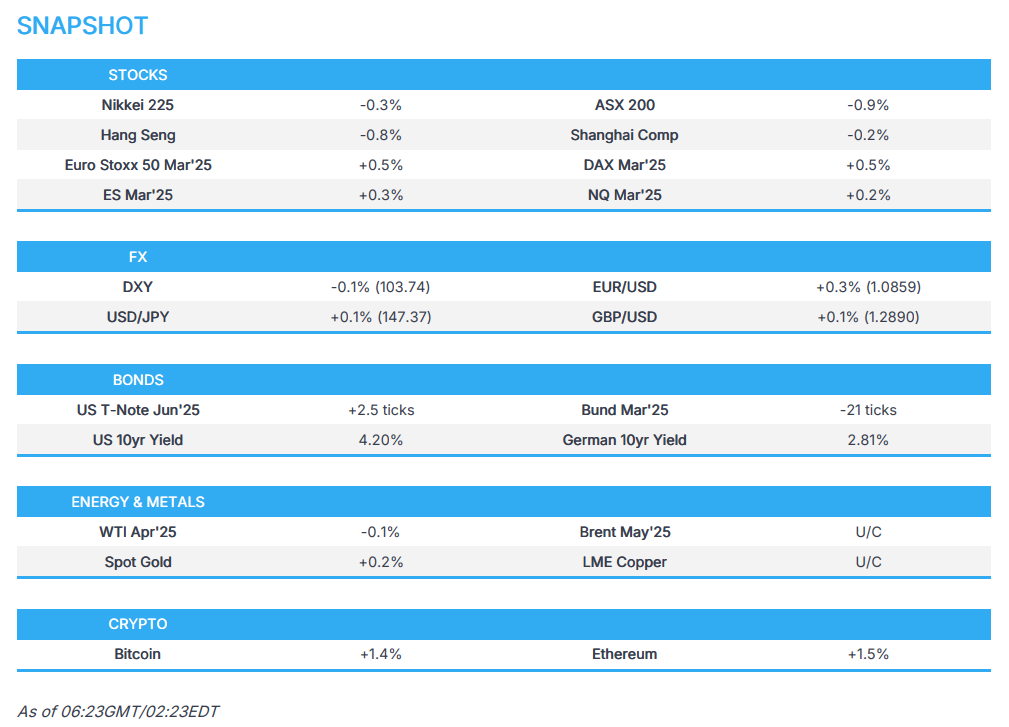

SNAPSHOT

US TRADE

EQUITIES

- US stocks slumped at the start of the week and wiped out Friday's rally to hit six-month lows as concerns over the economy, US tariffs and retaliatory measures by others, sapped risk appetite. All major indices suffered firm losses with the Nasdaq the worst hit as it posted its largest daily loss since 2022 amid underperformance in tech and Communications.

- SPX -2.7% at 5,615, NDX -3.81% at 19,431, DJI -2.08% at 41,912, RUT -2.72% at 2,019.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said on Truth Social that "Despite the fact that Canada is charging the USA from 250% to 390% Tariffs on many of our farm products, Ontario just announced a 25% surcharge on “electricity,” of all things, and your not even allowed to do that. Because our Tariffs are reciprocal, we’ll just get it all back on April 2. Canada is a Tariff abuser, and always has been, but the United States is not going to be subsidizing Canada any longer. We don’t need your Cars, we don’t need your Lumber, we don’t your Energy, and very soon, you will find that out".

- Japanese Trade Minister Muto said he asked that Japan be exempt from tariffs in talks with US officials and did not get any assurance from the US that Japan will be exempted from US tariffs due to come into force on Wednesday.

- South Korean acting President Choi said the time for negotiating with the US has begun ahead of reciprocal tariffs taking effect, while he added that President Trump's America First moves are targeting South Korea and the government will respond calmly and flexibly, considering only national interests.

- Taiwan is said to launch an anti-dumping probe related to certain Chinese steel products and an anti-dumping probe related to beer from China.

NOTABLE HEADLINES

- US President Trump was reportedly making calls to potential holdouts on a plan to avoid a government shutdown at the end of this week, according to Fox News.

- US House Minority Leader Jeffries said House Democrats will not be complicit in supporting the Republican government spending bill.

APAC TRADE

EQUITIES

- APAC stocks took their cues from the tech-led sell-off stateside after the Nasdaq suffered its worst day since 2022 amid recession fears and tariff-related concerns.

- ASX 200 was dragged lower by underperformance in tech and with most sectors in the red aside from energy and some defensives, while improved consumer confidence and mixed business surveys did little to inspire a rebound.

- Nikkei 225 retreated following disappointing Household Spending and revised Q4 GDP data from Japan.

- Hang Seng and Shanghai Comp conformed to the negativity amid light catalysts and as the NPC concludes today.

- US equity futures (ES +0.2%, NQ +0.1%) regained some composure after the prior day's sell-off which saw the S&P 500 fall to a six-month low.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market finished with losses of 1.5% on Monday.

FX

- DXY was uneventful after a choppy session yesterday alongside the risk-off mood which spurred haven flows albeit with upside capped owing to a light calendar and US recession fears. Participants continued to await the CPI release on Wednesday which is also the day that US steel and aluminium tariffs take effect.

- EUR/USD edged marginally higher but remained within a tight parameter at the 1.0800 territory.

- GBP/USD lacked firm conviction after having whipsawed back and forth of the 1.2900 level amid the downbeat mood.

- USD/JPY was choppy after disappointing Japanese data releases offset the haven demand for the yen.

- Antipodeans languished near Monday's lows amid the risk-off conditions and their high-beta characteristics.

- PBoC set USD/CNY mid-point at 7.1741 vs exp. 7.2597 (Prev. 7.1733).

FIXED INCOME

- 10yr UST futures extended their advances amid a flight to quality and with yields lower due to recession fears.

- Bund futures gradually rebounded and reclaimed the 128.00 level but with upside capped ahead of German supply.

- 10yr JGB futures rallied after weaker-than-expected Japanese revised GDP and Household Spending data.

COMMODITIES

- Crude futures were lacklustre with demand hampered alongside the global risk-off sentiment.

- US Energy Secretary Wright said he is looking at working with Congress on cancelling mandated sales from the oil reserve, while he noted working with Congress on the SPR takes time and refilling the reserve could take 5-7 years.

- Spot gold nursed some of the prior day's losses and retested the USD 2,900/oz level to the upside.

- Copper futures remained subdued after trickling lower amid the spooked risk sentiment.

- Chile's Cochilco Copper Production (Jan, tonnes): Codelco -4% Y/Y to 102.7k, Escondida +12% at 109.4k, Collahuasi -46.4% Y/Y at 28k.

CRYPTO

- Bitcoin recovered from an initial dip and gradually climbed back above the USD 80,000 level.

- US Senate Banking Chair Tim Scott is eyeing a Thursday Senate Banking vote on a stablecoin bill.

NOTABLE ASIA-PAC HEADLINES

- US and China began discussions about a potential Trump-Xi summit for June, according to WSJ.

DATA RECAP

- Japanese GDP Revised QQ (Q4) 0.6% vs. Exp. 0.7% (Prev. 0.7%)

- Japanese GDP Rev QQ Annualised (Q4) 2.2% vs. Exp. 2.8% (Prev. 2.8%)

- Japanese All Household Spending MM (Jan) -4.5% vs. Exp. -1.9% (Prev. 2.3%)

- Japanese All Household Spending YY (Jan) 0.8% vs. Exp. 3.6% (Prev. 2.7%)

- Australian Westpac Consumer Sentiment MM (Mar) 4.0% (Prev. 0.1%)

- Australian NAB Business Confidence (Feb) -1.0 (Prev. 4.0, Rev. 5)

- Australian NAB Business Conditions (Feb) 4.0 (Prev. 3.0)

GEOPOLITICS

MIDDLE EAST

- Israeli army said it targeted military headquarters and sites containing weapons in southern Syria.

- Yemen's Houthis said they will take military measures as soon as the Gaza aid four-day deadline ends.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine's position in Tuesday's talks with US officials will be "fully constructive" and a significant part of Monday's talks in Saudi Arabia was dedicated to security guarantees for Ukraine, while it was also reported that the Saudi Crown Prince underscored in a meeting with Ukrainian Zelensky his support for all international efforts aimed at resolving the crisis and achieving peace.

- Saudi Crown Prince and US Secretary of State Rubio discussed regional and international developments in Jeddah, while they also discussed the reconstruction of Gaza, Yemen and threats to navigation from Houthis Rubio also reiterated firm US commitment that any solution to the situation in Gaza must not include any role for Hamas.

- Flights were suspended at two airports serving Moscow and a fire broke out at a parking lot, while train services were also halted in Moscow's Domodedovo region following a drone attack. It was later reported that Russia downed 337 Ukrainian drones over Russian regions and defence units destroyed 73 Ukrainian drones that targeted Moscow.

- US Special Envoy Witkoff plans to visit Moscow for a meeting with Russian President Putin, according to a Bloomberg reporter on X cited by Reuters.

OTHER

- French President Macron said Moldova is facing increasingly blatant Russian threats.

- Norway’s armed forces said two Norwegian F-35 jets shadowed two Russian military aircraft in international airspace in a routine operation on Monday.

EU/UK

NOTABLE HEADLINES

- Barclays UK February Consumer Spending rose 1.0% Y/Y (prev. +1.9%) and UK Consumers' Confidence in household finance was the highest since the series began in 2015 at 75% (prev. 70%).

- Germany's Greens reportedly made their own proposal to loosen defence spending, according to Bloomberg.

DATA RECAP

- UK BRC Retail Sales YY (Feb) 0.9% (Prev. 2.5%)

- UK BRC Total Sales YY (Feb) 1.1% (Prev. 2.6%)