US Market Open: USD broadly firmer vs peers ahead of the FOMC; US futures edge higher

18 Dec 2024, 10:50 by Newsquawk Desk

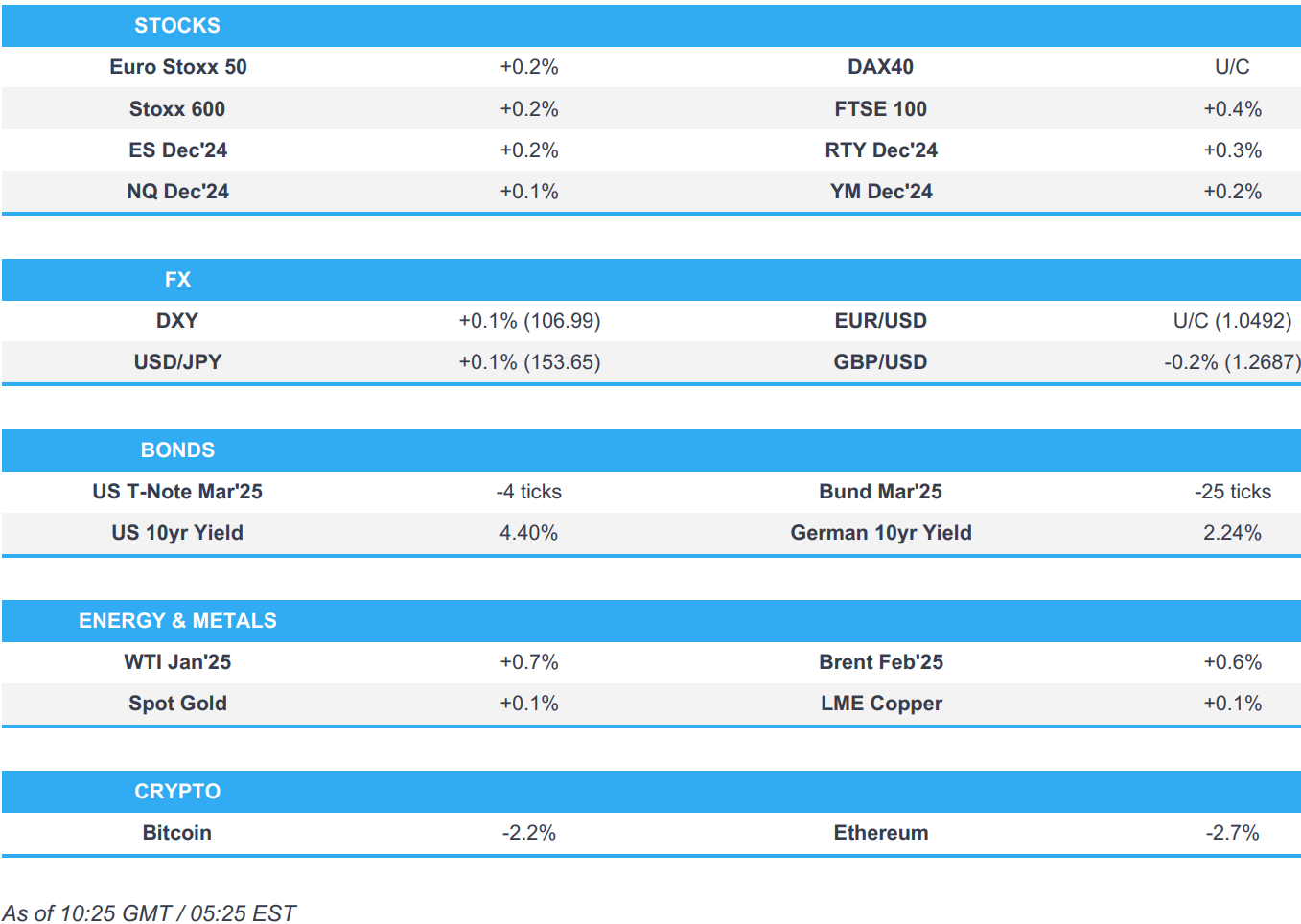

- European bourses are modestly on the front foot; US futures follow suit ahead of the FOMC decision.

- USD broadly firmer vs. peers ahead of FOMC, GBP lower post-inflation.

- USTs are contained, Bunds dip lower and reside at session lows.

- Crude recovers from Tuesday's pressure, metals contained.

- Looking ahead, US Building Permits, FOMC Announcement and Chair Powell's Press Conference, Earnings from General Mills, Jabil, Micron, and Lennar.

EUROPEAN TRADE

EQUITIES

- European bourses began the European session on either side of the unchanged mark to display a mixed open; since, sentiment has improved a touch with most indices managing to climb incrementally into the green.

- European sectors are mixed, in-fitting with the indecisive price action seen in the complex thus far. Energy takes the top spot, lifted by strength in underlying oil prices. In the banking sector, UniCredit (+0.5%) upped its stake in Commerzbank (+2.9%) to 28% (prev. 21%). Basic Resources is found at the foot of the sector list, with metals prices continuing to extend the losses seen in the prior session.

- US equity futures are very modestly in the green in-fitting with the price action seen in Europe, but also as traders eye the looming FOMC Policy Announcement.

- Novo Nordisk's (NOVOB DC) Ozempic faces EU review for potential eye disease connection.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is essentially flat and trading within a 106.82-107.03 range ahead of today's FOMC rate decision and Fed Chair Powell thereafter. The Fed is widely expected to cut rates by 25bps to 4.25-4.50%. Attention will be on any clues for future decisions given concerns on rising inflation risks, with inflationary pressures potentially set to rise due to President-elect Trump's proposed tariffs and tax cuts. The 2025 dot plot is expected to show 3 cuts vs. prev. 4 cuts.

- EUR/USD continues to linger around the 1.05 mark and is currently within yesterday's 1.0479-1.0534 range. ING is of the view that there is a good chance the pair will continue to hover around 1.05 for the rest of the year.

- JPY is softer vs. the USD and in-fitting with global peers. Markets await tomorrow's BoJ policy announcement. Expectations and recent source reports have been increasingly leaning towards the BoJ holding rates at 0.25% at the upcoming meeting. USD/JPY is currently caged within yesterday's 153.16-154.34 range.

- Cable is back below the 1.27 mark after the latest UK inflation data printed largely in-line / slightly cooler-than-expected. The release had little sway on pricing for tomorrow's announcement (currently around 2bps), however, around 57bps of easing is currently priced in vs. around 53bps pre-release as some of the readings were a touch below consensus.

- Antipodeans are both at the foot of the G10 leaderboard vs. the USD with both pairs hitting fresh YTD lows amid the broader cautious sentiment, weakness in base metals, and potential headwinds as Australia expects its budget deficit to increase in 2025/26.

- PBoC set USD/CNY mid-point at 7.1880 vs exp. 7.2838 (prev. 7.1891)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are relatively contained ahead of the FOMC. USTs are marginally in the red within a slim 109-25 to 109-30 band, which is entirely within Tuesday’s 109-17 to 109-31+ parameters. The FOMC is expected to deliver a 25bps cut; focus will be on the 2025 dot plots and forward guidance (FOMC Preview can be found at the top of the sheet).

- Bunds are in the red but off lows. Down to a 134.65 trough in the European morning, with catalysts driving it slim at the time. Since, lifted off this and back towards but yet to breach the 134.82 overnight peak. A slide and text release from ECB’s Chief Economist Lane spurred no sustained reaction, with the Chief Economist keeping his options open around the 2025 policy path.

- Gilts gapped higher by just over 10 ticks as markets digested the largely in-line to slightly cooler-than-expected release for some metrics. While a slight dovish reaction was seen at the open, this has pared with markets ascribing essentially no probability to a December BoE cut. Gilts currently trading around 93.10.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are in the green recouping almost all of the downside seen on Tuesday though action is fairly modest thus far as the risk tone remains tentative into the FOMC. Upside which has been helped by a larger than expected draw in the Private Inventory release. Brent'Feb 25 currently near session highs around USD 73.75/bbl.

- Spot gold is incrementally firmer but yet to deviate significantly from the unchanged mark with XAU posting a very narrow USD 2642-2651/oz band for the session.

- 3M LME Copper is contained, echoing the risk tone into the aforementioned risk events. Holding at the USD 9k mark but did briefly dip to an incremental fresh WTD low at USD 8.95k overnight.

- UBS retains its bullish view on Gold for the next 12-months, forecasts XAU hitting USD 2.9k/oz by end-2025

- Private inventory data (bbls): Crude -4.7mln (exp. -1.6mln), Distillate +0.7mln (exp. +0.7mln), Gasoline +2.4mln (exp. +2.1mln), Cushing +0.8mln (prev. -1.5mln).

- Qatar set Feb Al-Shaheen crude term price at USD 1.05/bbl (vs USD 0.73/bbl in Jan) above Dubai quotes.

- OPEC+ is reportedly wary of a renewed rise in US oil output when Trump returns as US President as more US oil would further erode OPEC+ market share, according to Reuters sources.

- Germany's BDEW says domestic NatGas usage +3.3% Y/Y.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Nov) 2.6% vs. Exp. 2.6% (Prev. 2.3%); MM 0.1% vs. Exp. 0.1% (Prev. 0.6%)

- UK Core CPI YY (Nov) 3.5% vs. Exp. 3.6% (Prev. 3.3%); MM 0.0% (Prev. 0.4%)

- UK CPI Services YY (Nov) 5.0% vs. Exp. 5.1% (Prev. 5.0%); MM -0.1% (Prev. 0.4%)

- UK House Price Index (Oct) 3.4% Y/Y (prev. 2.8%)

- EU HICP Final YY (Nov) 2.2% vs. Exp. 2.3% (Prev. 2.3%); HICP Final MM (Nov) -0.3% vs. Exp. -0.3% (Prev. 0.3%)

- EU HICP-X F&E Final YY (Nov) 2.7% vs. Exp. 2.8% (Prev. 2.8%)

- EU HICP-X F, E, A, T Final MM (Nov) -0.6% vs. Exp. -0.6% (Prev. -0.6%); HICP-X F,E,A&T Final YY (Nov) 2.7% vs. Exp. 2.7% (Prev. 2.7%); HICP-X F&E MM (Nov) -0.4% (Prev. 0.3%)

NOTABLE EUROPEAN HEADLINES

- ECB's Wunsch says tariff impact is dependent on FX moves. With EUR at parity, would not lose much competitiveness. Guess rates will land somewhere around 2%. Four cuts is a meaningful scenario that he feels relatively comfortable with. No longer consensus on QE working so well when economy is doing okay.

- ECB's Lane says incoming information and the latest staff projections indicate that the disinflation process remains well on track. While domestic inflation is still high, it should come down as services inflation dynamics moderate and labour cost pressures ease. Looking to the future, in the current environment of elevated uncertainty, it is prudent to maintain agility on a meeting-by-meeting basis and not pre-commit to any particular rate path. Monetary easing can proceed more slowly compared to the interest rate path embedded in the December projections in the event of upside shocks to the inflation outlook and/or to economic momentum. Equally, in the event of downside shocks to the inflation outlook and/or to economic momentum, monetary easing can proceed more quickly. Says argument for lowering rates by 50bps was to show that the ECB is no longer restrictive

NOTABLE US HEADLINES

- Mastercard (MA) announced a USD 12bln buyback and raised its quarterly dividend to USD 0.76/shr (prev. 0.66).

- NVIDIA (NVDA) GB200 server mass production & peak shipments face delays to Q2/Q3-2025, via TrendForce; as the supply chain is working towards fulfilling the higher design specification.

- Microsoft (MSFT) purchased 485k NVIDIA (NVDA) Hopper chips in 2024, over twice as many as the its largest rivals, via FT citing Amdia research.

- US graphite firms are reportedly seeking a 920% duty to thwart China on EV material, according to Bloomberg.

- US is reportedly considering a ban on Chinese router-manufacturer TP-Link in millions of American homes, according to the WSJ citing sources; Commerce, Defense and Justice departments have reportedly opened their own probes into TP-Link.

- Punchbowl reports, on the US fiscal situation, that the general consensus is the US House will take up the CR on Thursday, leaving just Friday for the Senate to clear it before the midnight funding deadline

GEOPOLITICS

- "The IDF has approved plans for major strikes in Yemen and is prepared to act pending government approval", via Open Source Intel citing N12 News.

- IRGC has reportedly tightened its control over Iran's oil industry, they now control as much as half of the exports, via Reuters citing sources.

CRYPTO

- Bitcoin is on the backfoot and paring some of the upside seen in the prior session; the digital-gold currently sits just above USD 104k, ETH slips below USD 3.9k.

APAC TRADE

- APAC stocks eventually traded mixed after the earlier upward bias somewhat abated, with sentiment cautious following the negative lead from Wall Street with eyes turning to the FOMC announcement and Chair Powell's presser.

- ASX 200 is currently flat as the upside in Real Estate, Tech, and Healthcare offset losses in Financials.

- Nikkei 225 was subdued but with ranges narrow in the run-up to Thursday's BoJ as expectations lean towards a hold. Meanwhile, Nissan shares surged 22% amid several source reports suggesting a potential merger with Honda, whose shares fell 3%.

- Hang Seng and Shanghai Comp saw positive trade with Chinese markets outperforming despite quiet newsflow but sentiment buoyed ahead of the PBoC's LPR setting on Friday.

NOTABLE ASIA-PAC HEADLINES

- Australia sees 2024/25 budget deficit at AUD 26.9bln (vs AUD 28.3bln projected in May); 2025/26 expected at AUD 46.9bln and 2026/27 at AUD 38.4bln.

- Honda Motor (7267 JT/HMC) and Nissan (7201 JT/NSANY) to begin merger talks amid EV competition, according to Nikkei. Honda and Nissan are considering operating under a holding company and soon will sign a memorandum of understanding. Their respective stakes in the new entity, as well as other details, will be decided later. "They also look to eventually bring Mitsubishi Motors, in which Nissan is the top shareholder with a 24% stake, under the holding company. This would create one of the world's largest auto groups, with combined sales among the three Japanese players topping 8 million vehicles." Bloomberg, Reuters, and the FT subsequently released similar reports.

- South Korean Finance Minister Choi said will utilise all available resources to manage the economy as stably as possible, according to Reuters.

- Indian Stock Exchanges to reportedly talk about keeping the market open on Saturday, Feb. 1, 2025, during the Union Budget, according to CNBC-TV18 citing sources.

DATA RECAP

- New Zealand Westpac Consumer Confidence (Q4): 97.5 (prev. 90.8)

- New Zealand Current Account- Annual (Q3) -26.994B vs. Exp. -26.918B (Prev. -27.762B)

- New Zealand Current Account/GDP (Q3) -6.4% vs. Exp. -6.5% (Prev. -6.7%)

- New Zealand Current Account - Qtrly (Q3) -10.581B vs. Exp. -10.399B (Prev. -4.826B)

- Japanese Trade Balance Total Yen (Nov) -117.6B vs. Exp. -688.9B (Prev. -461.2B, Rev. -462.1B)

- Japanese Imports YY (Nov) -3.8% vs. Exp. 1.0% (Prev. 0.4%)

- Japanese Exports YY (Nov) 3.8% vs. Exp. 2.8% (Prev. 3.1%)