Europe Market Open: APAC stocks lower, EUR unfazed after Moody's downgrades France ahead of EZ PMIs

16 Dec 2024, 06:50 by Newsquawk Desk

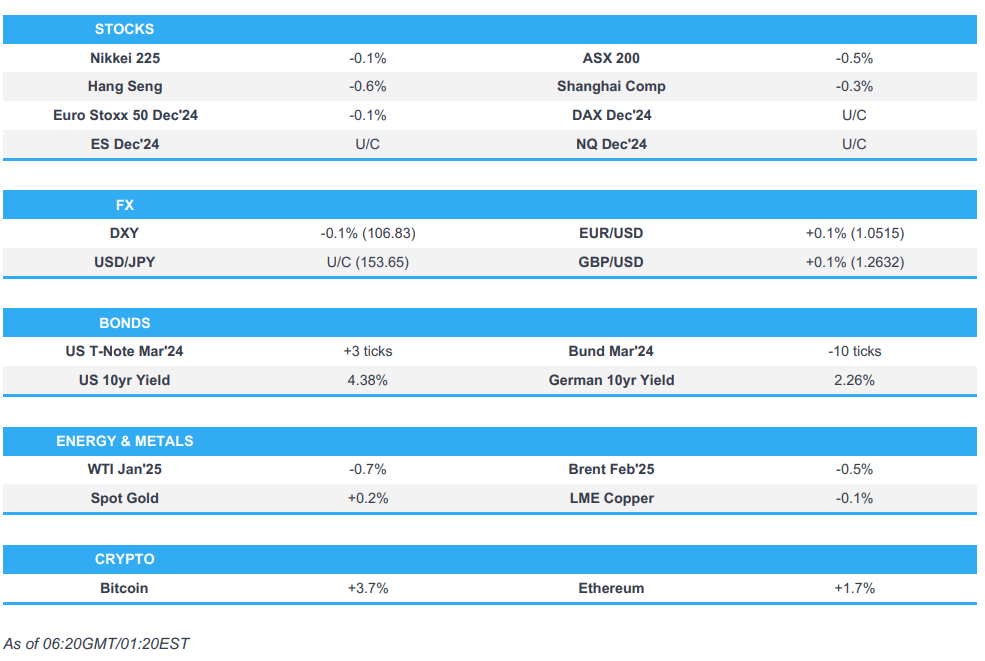

- APAC stocks saw an uninspiring start to the week following the mixed session on Wall Street on Friday and ahead of this week's risk events including the final FOMC, BoJ, and BoE meetings of the year.

- Moody's cut France’s rating to "Aa3" from "Aa2", outlook stable, in an unscheduled rating revision, citing political fragmentation.

- South Korean MPs have successfully voted to impeach President Yoon in their second attempt. Yoon was suspended from official duties on Saturday while PM Han is to continue as acting president, according to Yonhap.

- Bitcoin surged to fresh all-time highs above USD 106,000 and propped up the broader crypto market, with Ethereum rising above USD 4,000.

- Looking ahead, highlights include EZ, UK, US Flash PMIs, EZ Labour Costs, ECB President Lagarde, de Guindos, Schnabel, and BoC’s Macklem.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were mixed on Friday with notable outperformance in the Nasdaq as the Tech sector was supported by a strong earnings report from Broadcom (AVGO), which rallied 24%.

- Consumer Discretionary also performed well amid continued upside in Tesla (TSLA) shares while other sectors were flat or in the red, with underperformance in Communication Services, Materials and Energy.

- SPX U/C at 6,051, NDX +0.76% at 21,780, DJI -0.20% at 43,828, RUT -0.60% at 2,347.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Tesla (TSLA) has raised the price of the Model S to USD 79,990 from USD 74,990 in the US and the price of the Model S Plaid to USD 94,990 from USD 89,990, according to its website.

- Meta (META) has urged the California Attorney General to stop OpenAI (MSFT) from becoming for-profit, according to WSJ.

- Nasdaq announced that Palantir Technologies (PLTR), MicroStrategy (MSTR), and Axon Enterprise (AXON) will be added to the index, while Illumina (ILMN), Super Micro Computer (SMCI), and Moderna (MRNA) will be removed as part of the annual reconstitution of the Nasdaq-100 Index, which will become effective prior to market open on Monday, December 23rd, according to Reuters.

- US to empower companies like Google (GOOGL) and Microsoft (MSFT) to act as gatekeepers for access to AI chips, via Reuters citing sources.

APAC TRADE

EQUITIES

- APAC stocks saw an uninspiring start to the week following the mixed session on Wall Street on Friday and ahead of this week's risk events including the final FOMC, BoJ, and BoE meetings of the year.

- ASX 200 saw gold miners pressured by the recent pullback of the yellow metal towards USD 2,650/oz levels, with sentiment also weighed on by the downticks in prelim. Aussie PMIs.

- Nikkei 225 swung between modest positive and negative territory throughout the session as the index oscillated the 39,500 level, whilst the Japanese Flash PMI highlighted "stubborn inflation" with "anecdotal evidence placing particular emphasis on the impact of the weakness of the yen in relation to inputs sourced from abroad."

- KOSPI conformed to the broader risk tone with little sustained move after South Korean MPs successfully voted to impeach President Yoon in their second attempt.

- Hang Seng and Shanghai Comp fluctuated between modest gains and losses with little initial reaction seen to the Chinese activity data, which saw a marked miss in Retail Sales whilst Industrial Output saw a modest surprise uptick. Furthermore, Chinese markets failed to garner much support from weekend reports that China has room to further cut the RRR, according to PBoC officials on Saturday via CCTV.

- US equity futures held a modest positive bias, albeit with price action limited ahead of the FOMC and Fed Chair Powell's presser on Wednesday.

- European equity futures are indicative of a flat cash open with the Euro Stoxx 50 future +0.1% after cash closed flat on Friday.

FX

- DXY saw little action as the index resided within a narrow 106.81-89 range ahead of this week's risk events. For reference, Friday's range was 106.72-107.18.

- EUR/USD was modestly firmer and unfazed by Moody's unscheduled downgrade of France's credit rating, with the pair back on a 1.0500 handle as it tested levels near Friday's 1.0524 high, with the 21 DMA at 1.0525 and the 12th December peak at 1.0530.

- GBP/USD held an upward bias after Friday's fall from 1.2681 highs with traders looking ahead to the BoE announcement with expectations for the MPC to hold the Base Rate at 4.75%.

- USD/JPY was on a firmer footing as APAC players reacted to the rise in US yields on Friday, with USD/JPY finding overnight resistance at 153.97 (vs 153.33 low) and with expectations leaning towards the BoJ maintaining rates this week, albeit contingent on the FOMC's aftermath.

- Antipodeans held a firmer bias with an uptick in Chinese Industrial Output supportive for the currencies, whilst the Chinese Stats Bureau said the economy was generally stable in November and sees increasing positive changes.

- PBoC set USD/CNY mid-point at 7.1882 vs exp. 7.2769 (prev. 7.1876)

FIXED INCOME

- 10yr UST futures were flat in APAC trade after the continued pressure and bear-steepening on Friday with attention turning to the Federal Reserve rate decision and Summary of Economic projections this Wednesday.

- Bund futures fluctuated on either side of 134.50 in relatively uneventful trade, whilst focus turns to French debt following Moody's surprise rating downgrade of France.

- 10yr JGB futures played catch-up to some of Friday's price action across Western counterparts with the focus for Japanese debt traders turning to the FOMC ahead of the BoJ.

COMMODITIES

- Crude futures were subdued with price action in fitting with the broader risk tone, whilst prices were unfazed by constructive commentary from China's Stats Bureau.

- Spot gold briefly dipped under the USD 2,650/oz level before regaining some composure, albeit within tight ranges ahead of this week's risk events. For reference, spot gold on Friday fell under its 50 DMA (at USD 2,670/oz today).

- Copper futures were lacklustre amid the broader market risk tone but with downside somewhat limited by the resilient Chinese Industrial Output data and alongside constructive commentary from China's Stats Bureau.

- Marathon's Detroit refinery (140k BPD) union workers voted to ratify a pay deal following a three-month strike, according to a union post on X.

- Damage to two tankers in the Black Sea caused an oil products spill, according to Interfax.

- Nigeria's maritime agency reported an oil spill at the Shell loading terminal in Nigeria's Delta region after a pipeline ruptured, according to Reuters.

- Libya's NOC declared force majeure at its Zawiya facility following clashes, according to Bloomberg.

- Nornickel CEO Potanin said the company will move to positive free cash flow in 2025 and, until then, shareholders will need to be patient with dividends, according to Russian media RBC.

- Some Japanese aluminium buyers agree to a January-March premium of USD 228/t, +30% from the current quarter, according to Reuters sources.

CRYPTO

- Bitcoin surged to fresh all-time highs above USD 106,000 and in turn propped up the broader crypto market, with Ethereum rising above USD 4,000. The market has since pulled back with Bitcoin back under USD 105,000.

SOUTH KOREAN NEWS

- South Korean MPs have successfully voted to impeach President Yoon in their second attempt, amid backlash following his brief move to impose martial law, according to BBC. Yoon was suspended from official duties at 19:24 local time on Saturday while PM Han is to continue as acting president, according to Yonhap.

- South Korea's acting president Han vowed to leave no vacuum in state affairs, build a solid security posture, and ensure the cabinet works hard to maintain trust with the US, Japan, and other partners. He also pledged efforts to operate financial and forex markets smoothly, according to Yonhap. Acting President Han said the country will maintain preparedness to prevent North Korea from stirring up provocations, secure national interests ahead of the new US administration, and prioritise national security above all else, according to News1 and Yonhap.

- South Korea's opposition leader Lee Jae-myung said the party has decided not to proceed with the impeachment of acting president Han, according to Reuters.

- Bank of Korea stated it is necessary to respond more actively to the economic impact compared with past impeachment periods, given heightened challenges in external conditions. It also said it will use all available policy instruments, in conjunction with the government, to respond to and avert escalation of volatility in financial and forex markets, according to Reuters.

- South Korea's Finance Minister said the government will continue to swiftly deploy market-stabilising measures as needed, seek more support measures for vulnerable sectors, and actively communicate with parliament to keep the economy stable. The minister also confirmed that the bi-annual economic policy plan will be announced before the end of the year, according to Reuters.

- South Korea's financial regulator said it will expand market-stabilising funds if needed to boost liquidity in bond and short-term money markets and expects financial markets to stabilise as recent political events are temporary shocks, according to Reuters.

OTHER NOTABLE ASIA-PAC HEADLINES

- China has room to further cut the reserve requirement ratio (RRR), according to PBoC officials on Saturday via CCTV.

- China's Central Financial and Economic Affairs Commission deputy director said the country's GDP is expected to grow by about 5% this year, with foreign exchange reserves remaining above USD 3.2tln. He added that China's contribution to global economic growth is expected to be close to 30% and that employment and prices in China are expected to remain stable, according to Reuters.

- Chinese Stats Bureau stated that China is on track to achieve key economic targets in 2024, but more efforts are needed to promote continued economic recovery in 2025. It added the trend of recovery in consumption remained unchanged and that more policies would be implemented to expand domestic demand. It noted that while new policies had gained more traction, the external situation had become more complex and severe. The Bureau expects further improvement in the property market, emphasises the need to stabilise employment and increase incomes to boost consumption capacity, and anticipates that China's CPI will maintain modest increases. It also noted that China's economy is generally stable in November and sees increasing positive changes, according to Reuters.

- PBoC injected CNY 753.1bln via 7-day reverse repos with the rate maintained at 1.50%.

- Moody's raised China's 2025 GDP growth forecast to 4.2% from 4.0%, according to Reuters.

- The US Treasury has told Nippon Steel (5401 JT) that the panel vetting its proposed acquisition of US Steel (X) has not reached a consensus on how to mitigate security risks, according to the FT.

- New Zealand NZIER Consensus Forecasts show that the economic growth outlook remains broadly unchanged relative to the previous release; GDP forecasts continue to suggest sluggish growth in the year to March 2025 before picking up to 2.2% in the following year.

DATA RECAP

- Chinese Retail Sales YY (Nov) 3.0% vs. Exp. 4.6% (Prev. 4.8%)

- Chinese Industrial Output YY (Nov) 5.4% vs. Exp. 5.3% (Prev. 5.3%)

- Chinese Urban Investment (YTD)YY (Nov) 3.3% vs. Exp. 3.4% (Prev. 3.4%)

- Chinese Surveyed Jobless Rate (Nov): 5.0% vs Exp. 5.0% (Prev. 5.0%)

- Chinese FDI (YTD) (Nov) -27.9% (Prev. -29.8%)

- Australian Manufacturing PMI Prelim (Dec) 48.2 (Prev. 49.4)

- Australian Services PMI Prelim (Dec) 50.4 (Prev. 50.5)

- Australian Composite PMI Prelim (Dec) 49.9 (Prev. 50.2)

- New Zealand Food Price Index (Nov) -0.1% (Prev. -0.9%)

- South Korean Trade Balance Revised (Nov) 5.59B (Prev. 5.61B)

- South Korean Import Growth Revised (Nov) -2.4% (Prev. -2.4%)

- South Korean Export Growth Revised (Nov) 1.4% (Prev. 1.4%)

- Indian HSBC Composite PMI (Dec) 60.7 vs Exp. 58.8 (Prev. 58.6)

- Indian HSBC Manufacturing PMI (Dec) 57.4 vs Exp. 56.9 (Prev. 56.5)

- Indian HSBC Services PMI (Dec) 60.8 vs Exp. 58.9 (Prev. 58.4)

- Japanese Machinery Orders YY (Oct) 5.6% vs. Exp. 0.7% (Prev. -4.8%)

- Japanese Machinery Orders MM (Oct) 2.1% vs. Exp. 1.2% (Prev. -0.7%)

- Japanese JibunBK Services PMI Flash SA (Dec) 51.4 (Prev. 50.5)

- Japanese JibunBK Manufacturing PMI Flash SA (Dec) 49.5 (Prev. 49.0)

- Japanese JibunBK Composite Op Flash SA (Dec) 50.8 (Prev. 50.1): The release noted "Stubborn inflation held back a stronger expansion of the Japanese private sector in December. Average input prices rose markedly again, and at the steepest rate for four months, with anecdotal evidence placing particular emphasis on the impact of the weakness of the yen in relation to inputs sourced from abroad. As such, the pace of selling price inflation also quickened on the month and was the fastest since May.".

GEOPOLITICS

MIDDLE EAST

- "Progress in the negotiations of the exchange deal and may be completed after the Jewish holidays at the end of this month", according to Al Jazeera citing an informed source via Israeli press.

- Israeli estimates indicate that a deal with Hamas can be reached within a month, according to Sky News Arabia citing Israel's Channel 12.

- US President-elect Trump and Israeli PM discussed the Gaza hostage deal bid and Syria on Sunday, according to Reuters.

- Israeli PM Netanyahu’s government approved a plan to expand settlements on Israeli-occupied Golan Heights. The statement said Netanyahu acted “in light of the war and the new front facing Syria” and out of a desire to double the Israeli population on the Golan, according to Reuters.

- Russia is pulling back its military in Syria but is not withdrawing from its main military bases, Syrian sources say, according to Reuters.

- Trump's Middle East envoy has met with the Saudi crown prince, according to Axios.

- "Syrian media: Strong explosions in the countryside of Tartous and Latakia resulting from an Israeli attack" according to Asharq News. Note: Russia has two bases in Syria – a naval base in Tartous and the Khmeimim Air Base near the port city of Latakia..

- "US sources to Alarabiya English: US army carried out strikes against Houthi sites in Yemen", according to Al Arabiya.

US-CHINA

- US Treasury Secretary Yellen said the Treasury continues to warn China about the potential for bank sanctions over transactions aiding Russia's war effort in Ukraine and will not rule out sanctions on Chinese banks. She noted that the largest Chinese banks are wary of the consequences. Yellen also said the US aims to reduce Russia's energy revenues, with options such as lowering the oil price cap and imposing more sanctions on 'dark fleet' tankers being considered. She emphasised the need for clear communication channels at all levels between the US and China, stating that leader-to-leader discussions alone are insufficient. Yellen added that the next US Treasury Secretary is likely to continue pushing back on currency manipulation if evidence is found.

- The US is preparing rules that would restrict the sale of advanced artificial intelligence chips in certain parts of the world in an attempt to limit China’s ability to access them, according to WSJ citing sources.

OTHER

EU/UK

NOTABLE HEADLINES

- Moody's cut France’s rating to "Aa3" from "Aa2", outlook stable, in an unscheduled rating revision, citing political fragmentation. Moody's said its view is that France's public finances will be substantially weakened over the coming years. The agency noted that France's political fragmentation is more likely to impede meaningful fiscal consolidation and said there is now a very low probability that the next French government will sustainably reduce the size of fiscal deficits beyond next year. However, France's local- and foreign-currency ceilings remain unchanged at AAA, according to Moody's.

- ECB Holzmann said it would be wrong to cut rates just to help the economy, according to Reuters.

- EU reportedly presses for new powers to combat threat of Chinese import surge and amid fears Brussels will struggle to fight back in a global trade war, according to FT.

DATA RECAP

- UK Rightmove House Prices (Dec) M/M: -1.7% (Prev. –1.4%); Y/Y 1.4% (Prev. 1.2%).

LATAM

- S&P affirmed Mexico "BBB" foreign currency and "BBB+" local currency long-term rating; Outlook remains stable.

- Brazilian President Lula has been discharged from the hospital and has recovered well and can resume normal work activities but is to avoid long-haul flights, according to the medical team.