US Market Open: DXY bid on reports that China is considering allowing the Yuan to weaken in 2025; US CPI due

11 Dec 2024, 11:08 by Newsquawk Desk

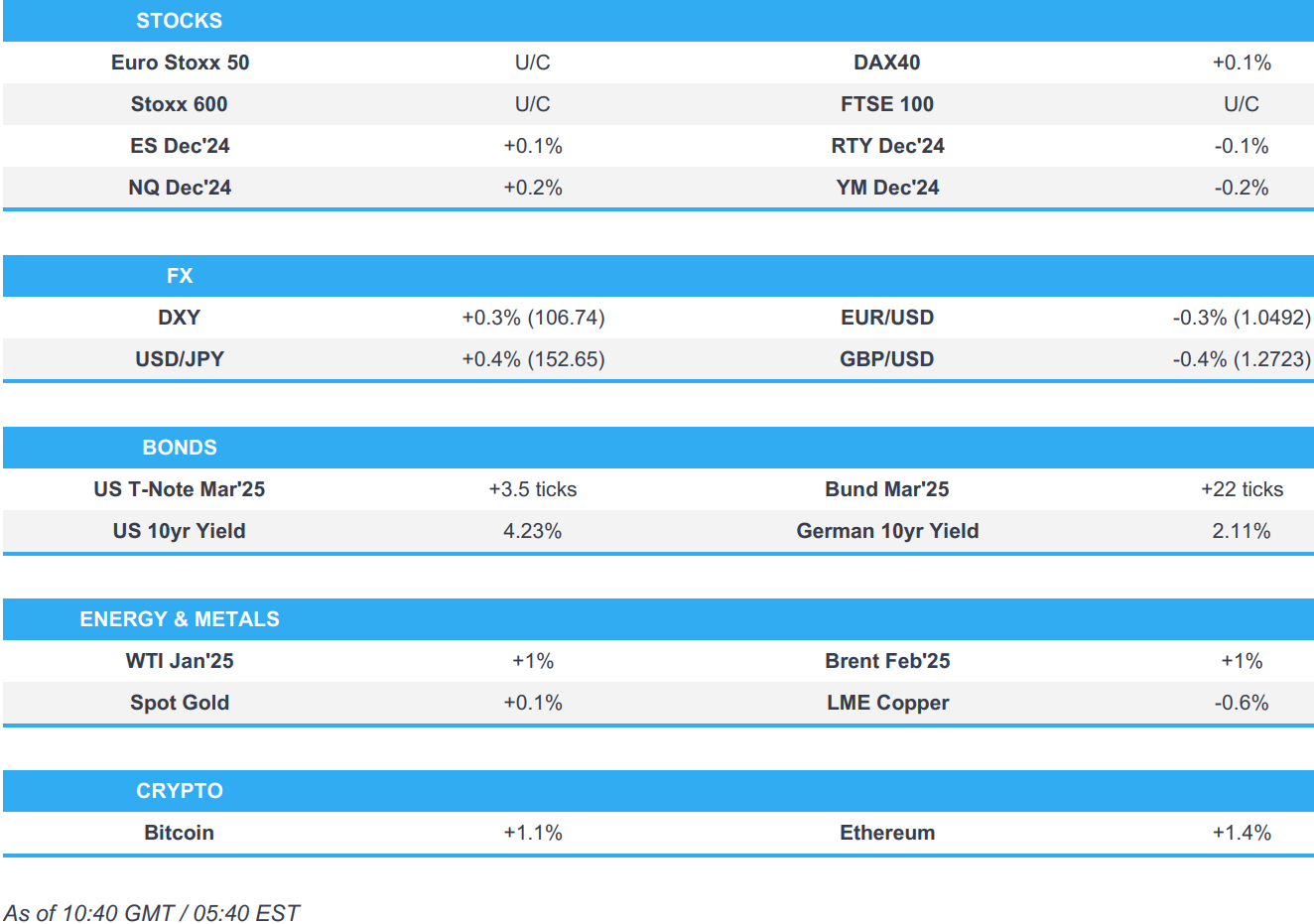

- European bourses began the session entirely in the red, but sentiment has improved to display a mixed picture; NQ incrementally outperforms in the US.

- Dollar bid as markets digest reports of China allowing a weaker yuan, JPY choppy amid BoJ sources.

- China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms, via Reuters citing sources

- Mixed performance for paper, US 10yr supply looms.

- Crude initially hampered by Yuan-reports, but has since pared with crude now at session highs; metals on the backfoot.

- Looking ahead, US CPI, BoC & BCB Policy Announcement, BoC Governor Macklem, Rogers, supply from the US, Earnings from Macy's, and Adobe.

EUROPEAN TRADE

EQUITIES

- European bourses opened almost entirely in the red, but now display more of a mixed picture as sentiment gradually improves in the complex. Price action has been modest in nature, with traders mindful of the looming US CPI.

- European sectors opened with a strong negative bias, but sentiment has improved a touch as the morning progressed to display a mixed picture. Optimised Personal Care tops the pile alongside Media. Retail is by far and away the clear underperformer in Europe, hit by a double whammy of losses from Inditex and Zalando.

- US equity futures are mixed, with the NQ outperforming slightly, attempting to pare back some of the losses seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The USD was lent a helping hand in early trade following a Reuters sources report that China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms. This sent DXY to a new high for the week at 106.68, stopping shy of last week's MTD high at 106.73 (which has since been breached in recent trade). Today's sees the release of November CPI data which is expected to see a +0.3% M/M outturn for core CPI.

- EUR/USD briefly dipped below 1.05 following a pick-up in the USD after reports of China looking to devalue the yuan next year. EUR/USD went as low as 1.0489 but stopped shy of the December low at 1.0460.

- JPY was firmer vs. the USD during APAC hours following two consecutive sessions of losses as markets digested above forecast Japanese PPI data; the Yuan reporting also supported. Thereafter, JPY gained further ground vs. the USD after a Bloomberg sources piece noted that the BoJ sees little cost in waiting for the next rate hike. This move was then subsequently reversed after markets digested another aspect of the report which noted that the BoJ sees less risk of a softer JPY boosting inflation (i.e less pressure to intervene). USD/JPY is back above its 200DMA at 152.00 with a session peak at 152.65.

- GBP is softer vs. the USD with UK catalysts on the light side. Friday's monthly GDP print unlikely to be a gamechanger for the BoE. Cable went as high as 1.2781 overnight before returning to within yesterday's 1.2724-1.2778 range.

- CNH was knocked lower in early European trade after source reporting via Reuters noted that China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms.

- CAD is steady vs. the USD ahead of today's BoC rate decision. The BoC is widely expected to cut rates with the consensus looking for another 50bps reduction, but with a risk of a smaller 25bp move.

- PBoC set USD/CNY mid-point at 7.1843 vs exp. 7. 2379 (prev. 7.1876)

- RBI likely selling USD to limit INR fall, according to Reuters citing traders.

- BoJ reportedly sees little cost in waiting for the next rate hike, according to Bloomberg; cites current prices. Next rate increase is seen as a "matter of time". View is that there is less risk of a soft JPY boosting inflation.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are back in negative territory after support from a Reuters report noting that China could be willing to let the Yuan devalue next year, proved to be short-lived. Mar'25 contract is currently tucked within yesterday's 110.26-111.09 range, ahead of US CPI.

- Today is seeing a minor reversal of the recent outperformance of French paper over its German counterpart. European paper was dealt some minor support in early trade following the aforementioned Reuters source report on China. Bunds are back above 136 and towards the top end of yesterday's 135.75-136.26 trading range.

- Gilts are reversing some of yesterday's selling which didn't appear to be driven by an obvious catalyst at the time. Mar'25 Gilt is currently towards the bottom end of yesterday's 95.13-73 trading range. Modest pressure was seen in Gilt prices following the 2034 auction, given the relatively wider tail.

- UK sells GBP 4bln 4.25% 2034 Gilt: b/c 2.87x (prev. 2.81x), avg yield 4.332% (prev. 4.475%) & tail 1.3bps (prev. 0.8bps).

- Click for a detailed summary

COMMODITIES

- WTI and Brent are on a firmer footing, and has pared initial pressure which was sparked by Reuters reporting, which noted that China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms. Overnight trade saw oil prices propped up as traders digested reports that the US is weighing harsher oil sanctions against Russia weeks before Trump returns to office.

- Spot gold spent most of the European morning in modest negative territory, but has since climbed into the green. XAU has traded in a tight range of USD 2675.89-2704.35/oz range.

- Base metals traded on a firmer footing throughout overnight trade, with gains driven by the ongoing optimism surrounding China's easing of overall monetary policy stance. Into the European morning, prices began to dive lower on the aforementioned Yuan-related reports.

- Private inventory data (bbls): Crude +0.499mln (exp. -0.9mln), Distillate +2.452mln (exp. +1.4mln), Gasoline +2.852mln (exp. +1.7mln), Cushing -1.517mln (prev. +0.1mln).

- El Paso Natural Gas Co. declares initial force majeure – Line 1200, according to Reuters.

- Goldman Sachs pushes back on the argument that gold cannot rally to USD 3,000/oz by end-2025 "in a world where the dollar stays stronger for longer." "Fewer Fed cuts are a key downside risk to our USD 3,000 end-2025 gold price forecast (not a stronger dollar).".

- UBS forecasts Brent rising to USD 80/bbl and WTI rising to USD 75/bbl in 2025. UBS says for 2025, it holds a constructive natgas price outlook (see NatGas at USD 3.50/mmbtu in June 2025, rising to USD 3.60/mmbtu by September).

- Ukraine's military says it struck an oil depot in Russia's Bryansk region; military says the attack caused a 'massive fire'. Attack on an oil depot in Russia's Bryansk region did not affect oil transit to Europe via Ukraine, according to Reuters citing a industry source. Kazakhstan says Druzhba oil pipeline in Russia is not damaged by Ukrainian overnight strikes.

- Click for a detailed summary

NOTABLE US HEADLINES

- US President-elect Trump's Treasury pick Bessent said Fed Chair Powell can serve the remainder of his term, via CNBC. Trump said he picked FTC Commissioner Andrew Ferguson to chair the FTC. Trump said he picked Ron Johnson to serve as the United States Ambassador to Mexico.

- US President Biden is to hit Chinese cleantech imports with more tariffs, in an effort to protect US manufacturing, according to the FT.

GEOPOLITICS

MIDDLE EAST

- Sky News Arabia reports that it is monitoring the advance of Israeli tanks in the Golan.

- Two US Navy destroyers successfully defeated Houthi-launched weapons while transiting the Gulf of Aden, according to the US military.

RUSSIA-UKRAINE

- US is weighing harsher oil sanctions against Russia weeks before Trump returns to office, according to Bloomberg.

- Russian Deputy Foreign Minister says Russia will "definitely be prepared to consider" another prisoner swap with the US, according to NBC.

CRYPTO

- Bitcoin is back on a firmer footing and tops USD 98k once again.

APAC TRADE

- APAC stocks traded mixed following a soft US handover as participants brace for the US CPI data, although Chinese markets continued to benefit from the easing in China's overall monetary policy stance.

- ASX 200 was on a softer footing with almost all of its sectors in the red, whilst IT lagged following a similar sectoral performance stateside.

- Nikkei 225 was subdued but within narrow parameters whilst Japanese PPI topped expectations, with eyes on next week's BoJ.

- Hang Seng and Shanghai Comp both initially traded firmer in a continuation of the optimism from Politburo on Monday revising its overall monetary policy stance. Upside for the indices however were modest and capped ahead of the Central Economic Work Conference, whilst the China A50 faded earlier gains and dipped into the red and was later joined by the Hang Seng.

NOTABLE ASIA-PAC HEADLINES

- China's watchdog orders PDD (PDD) to fix controversial refunds policy, according to Bloomberg

- RBA's Hauser says Australian inflation could move in either direction. The data needs to come in line with forecasts for the central bank to change policySays there is no particular trigger figure for inflation for the RBA to ease policy.

- Japan auto worker's union calls for monthly pay increase of more than JPY 12,000 in annual labour talks next year.

- China's top policymakers are considering allowing the Yuan to weaken in 2025 as Trump tariff looms, via Reuters citing sources.

- South Korea Finance Ministry said will make ample responses to curb any excessive volatility in the FX market, according to Reuters.

- South Korea's economy and finance minister spoke to US Treasury Secretary Yellen, according to Reuters.

- South Korean police raid presidential office over martial law, according to Yonhap.

- Japan reportedly plans a 4% corporate tax surtax from 2026 to fund defence, according to Kyodo.

- Monetary Authority of Singapore survey: Singapore 2024 GDP growth at 3.6% (vs prev. 2.6%); 2024 core inflation seen at 2.9% (vs prev. 3.0%).

- ADB trimmed developing Asia 2024 growth forecast to 4.9% (prev. 5.0%), trimmed 2025 to 4.8% (prev. 4.9%); says growth outlook faces downside risks from the magnitude and speed of expected US policy shifts under Trump.

DATA RECAP

- Japanese Corp Goods Price YY (Nov) 3.7% vs. Exp. 3.4% (Prev. 3.4%, Rev. 3.6%)

- Japanese Corp Goods Price MM (Nov) 0.3% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%)

- South Korean Unemployment Rate (Nov) 2.7% (Prev. 2.7%)

- New Zealand Manufacturing Sales (Q3) -1.2% (Prev. 0.6%)