Europe Market Open: Mixed trade in APAC as participants bide time ahead of US CPI

11 Dec 2024, 06:45 by Newsquawk Desk

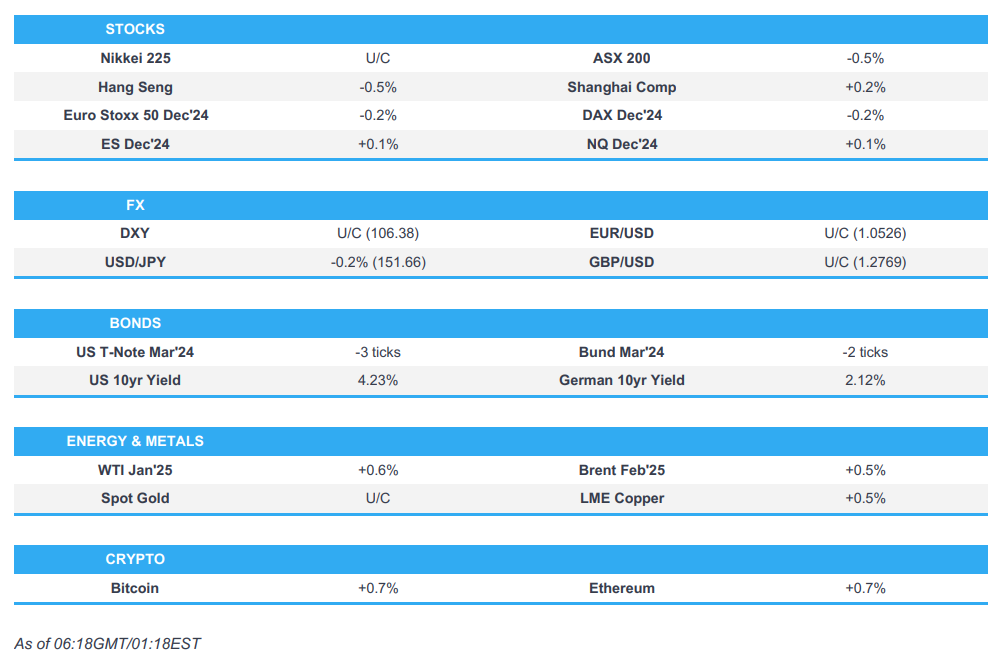

- APAC stocks traded mixed following a soft US handover, although Chinese markets continued to benefit from the easing in China's overall monetary policy stance.

- DXY and UST futures were flat within a tight range as traders look towards the US CPI release ahead of next week's FOMC meeting.

- Crude futures were firmer in a continuation of the China optimism; upside was experienced following reports that the US is weighing harsher oil sanctions against Russia weeks before Trump returns to office.

- European equity futures are indicative of a subdued cash open with the Euro Stoxx 50 future -0.1% after cash closed -0.7% on Tuesday.

- Looking ahead, highlights include US CPI, BoC & BCB Policy Announcement, BoC Governor Macklem, Rogers, supply from UK and US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks trundled lower throughout the US session with SPX, NDX, DJIA, and RUT all seeing weakness of similar magnitudes.

- Sectors were almost exclusively in the red with only Communication Services and Consumer Staples in the green as the former was the distinct gainer and buoyed by gains in Alphabet (GOOGL) (+5.7%). Real Estate and Technology lagged with the latter hit by Nvidia (NVDA) (-2.5%), Micron (MU) (-4.7%), and AMD (AMD) (-2.3%) weakness, albeit with a lack of headline newsflow.

- SPX -0.30% at 6,035, NDX -0.34% at 21,368, DJIA -0.35% at 44,248, RUT -0.42% at 2,383.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump's Treasury pick Bessent said Fed Chair Powell can serve the remainder of his term, via CNBC. Trump said he picked FTC Commissioner Andrew Ferguson to chair the FTC. Trump said he picked Ron Johnson to serve as the United States Ambassador to Mexico

- Google (GOOG) reportedly asked FTC to block Microsoft's (MSFT) exclusive cloud deal with OpenAI, according to The Information.

- Citi (C) CFO bank will be at the high end of guidance for 2024; says global economy is proving to be resilient; China is starting to show stabilisation and a rebound from the bottom; general sentiment is pro-growth to 2025

- JPMorgan (JPM) exec says NII outlook has firmed up and expects 2025 NII to be about USD 2bln higher. Systemwide deposits could be neutral to higher next year. Sees Q4 NII and expenses a little bit better than consensus. IB fees will increase by about 45% vs. last year in Q4. Markets revenue in Q4 +15% Y/Y.

- Walgreens (WBA) reportedly in talks to sell itself to Sycamore Partners, via WSJ.

- US President Biden plans to formally block the USD 14.1bln sale of United States Steel (X) to Nippon Steel (5401 JT) on national security grounds once the deal is referred back to him later this month, according to Bloomberg citing sources.

APAC TRADE

EQUITIES

- APAC stocks traded mixed following a soft US handover as participants brace for the US CPI data, although Chinese markets continued to benefit from the easing in China's overall monetary policy stance.

- ASX 200 was on a softer footing with almost all of its sectors in the red, whilst IT lagged following a similar sectoral performance stateside.

- Nikkei 225 was subdued but within narrow parameters whilst Japanese PPI topped expectations, with eyes on next week's BoJ.

- Hang Seng and Shanghai Comp both initially traded firmer in a continuation of the optimism from Politburo on Monday revising its overall monetary policy stance. Upside for the indices however were modest and capped ahead of the Central Economic Work Conference, whilst the China A50 faded earlier gains and dipped into the red and was later joined by the Hang Seng.

- US equity futures traded flat across the board in the run-up to the US CPI report which will be viewed to further cement expectations for the FOMC December meeting, where a 25bps rate cut is expected.

- European equity futures are indicative of a subdued cash open with the Euro Stoxx 50 future -0.1% after cash closed -0.7% on Tuesday.

FX

- DXY was flat within a tight range for most of the session before gradually moving towards highs in late APAC trade as traders look towards Wednesday's US CPI release.

- EUR/USD was uneventful in a 1.0521-39 parameter with newsflow for the EUR on the quieter side ahead of Thursday's ECB.

- GBP/USD saw little notable action with UK newsflow on the lighter side, with Cable printing an APAC range between 1.2769-81.

- USD/JPY digested above forecast Japanese PPI data, with the pair trimming some of yesterday's gains and falling back under 152.00 and then briefly under 151.50.

- Antipodeans saw flat trade for most of the session amid a lack of pertinent catalysts and in the run-up to risk events.

- Yuan saw mild gains in early trade amid continued optimism surrounding China, but gains were capped as traders await the Central Economic Work Conference.

- PBoC set USD/CNY mid-point at 7.1843 vs exp. 7. 2379 (prev. 7.1876)

- RBI likely selling USD to limit INR fall, according to Reuters citing traders.

FIXED INCOME

- 10yr UST futures traded sideways with a downward bias following the prior day's bear steepening ahead of CPI and further supply.

- Bund futures saw minimal price action with the March contract meandering just under the 136.00 level, with traders looking ahead to Thursday's ECB.

- 10yr JGB futures held a downward bias following the hotter-than-expected Japanese PPI, but with downside limited ahead of US CPI.

- US sold USD 58bln of 3yr notes; tails 0.1bps; High Yield: 4.117% (prev. 4.152%, six-auction average 4.056%). WI: 4.116%. Tail: 0.1bps (prev. 0.9bps, six-auction avg. 0.0bps). Bid-to-Cover: 2.58x (prev. 2.6x, six-auction avg. 2.56x). Dealers: 15.1% (prev. 19.8%, six-auction avg. 16.6%). Directs: 20.7% (prev. 9.6%, six-auction avg. 17.1%). Indirects: 64.2% (prev. 70.6%, six-auction avg. 66.4%).

COMMODITIES

- Crude futures were firmer in a continuation of the China optimism upside was experienced following reports that the US is weighing harsher oil sanctions against Russia weeks before Trump returns to office. The private inventory data did little to impact prices at the time of release.

- Spot gold briefly topped USD 2,700/oz in late US/early APAC trade before fading back under the level and then some more despite a lack of newsflow but ahead of risk events, whilst spot silver lagged.

- Copper futures saw gains driven by the ongoing optimism surrounding China's easing of overall monetary policy stance, with eyes turning to the Central Economic Work Conference for fiscal announcements.

- EIA STEO: 2024 world oil demand forecast at 103.03mln BPD (prev. forecast of 102.6mln BPD), 2025 at 104.32mln BPD (prev. 104.7mln BPD).

- Private inventory data (bbls): Crude +0.499mln (exp. -0.9mln), Distillate +2.452mln (exp. +1.4mln), Gasoline +2.852mln (exp. +1.7mln), Cushing -1.517mln (prev. +0.1mln).

- El Paso Natural Gas Co. declares initial force majeure – Line 1200, according to Reuters.

- Goldman Sachs pushes back on the argument that gold cannot rally to USD 3,000/oz by end-2025 "in a world where the dollar stays stronger for longer." "Fewer Fed cuts are a key downside risk to our USD 3,000 end-2025 gold price forecast (not a stronger dollar).".

CRYPTO

- Bitcoin was steady and moved back above USD 97k after its recent fall below 100k.

NOTABLE ASIA-PAC HEADLINES

- South Korea Finance Ministry said will make ample responses to curb any excessive volatility in the FX market, according to Reuters.

- South Korea's economy and finance minister spoke to US Treasury Secretary Yellen, according to Reuters.

- South Korean police raid presidential office over martial law, according to Yonhap.

- Japan reportedly plans a 4% corporate tax surtax from 2026 to fund defence, according to Kyodo.

- Monetary Authority of Singapore survey: Singapore 2024 GDP growth at 3.6% (vs prev. 2.6%); 2024 core inflation seen at 2.9% (vs prev. 3.0%).

- ADB trimmed developing Asia 2024 growth forecast to 4.9% (prev. 5.0%), trimmed 2025 to 4.8% (prev. 4.9%); says growth outlook faces downside risks from the magnitude and speed of expected US policy shifts under Trump.

DATA RECAP

- Japanese Corp Goods Price YY (Nov) 3.7% vs. Exp. 3.4% (Prev. 3.4%, Rev. 3.6%)

- Japanese Corp Goods Price MM (Nov) 0.3% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%)

- South Korean Unemployment Rate (Nov) 2.7% (Prev. 2.7%)

- New Zealand Manufacturing Sales (Q3) -1.2% (Prev. 0.6%)

GEOPOLITICS

MIDDLE EAST

- Israel to react strongly if new Syria regime lets Iran back in, according to Israeli PM Netanyahu.

- Two US Navy destroyers successfully defeated Houthi-launched weapons while transiting the Gulf of Aden, according to the US military.

RUSSIA-UKRAINE

- US is weighing harsher oil sanctions against Russia weeks before Trump returns to office, according to Bloomberg.

- Russian Deputy Foreign Minister says Russia will "definitely be prepared to consider" another prisoner swap with the US, according to NBC.

OTHER

EU/UK

NOTABLE HEADLINES

- French President Macron aims to avoid new French parliament election before 2027; Macron told party leaders he would appoint a PM within 48 hours, via Macron aides.

LATAM

- Brazil's government published regulations on Congress amendments, according to the Official Gazette.

- Brazil Lower House Speaker Lira said spending cut proposals could even be voted on this week; "we have time to reach agreements", according to Reuters.