Europe Market Open: APAC stocks mostly higher after China's Politburo, RBA delivers a dovish hold

10 Dec 2024, 06:40 by Newsquawk Desk

- APAC stocks were mostly firmer following a negative Wall Street lead but with APAC players reacting to China easing its overall monetary policy stance.

- G10 FX was mostly flat, whilst the AUD was hit on a dovish hold by the RBA, Yuan saw gains.

- RBA maintained its cash rate at 4.35% as expected and suggested the Board is gaining some confidence that inflation is moving sustainably towards target.

- European equity futures are indicative of a lower cash open with the Euro Stoxx 50 future -0.5% after cash closed +0.2% on Monday.

- Looking ahead, highlights include German Final CPI, Norwegian CPI, US Unit Labor Costs Revision, EIA STEO, Supply from UK and US.

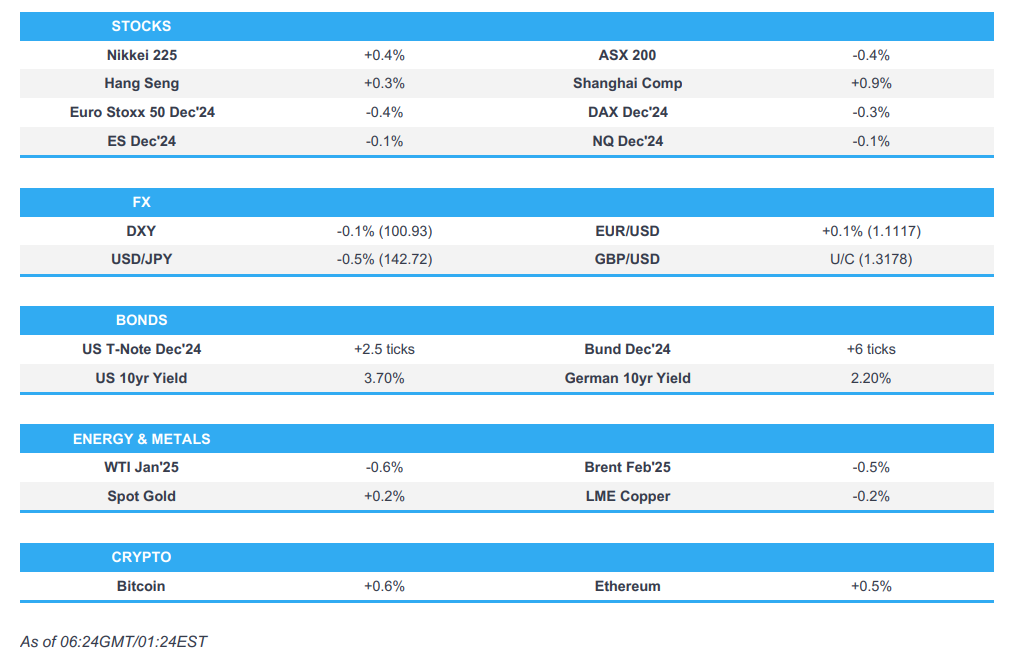

SNAPSHOT

US TRADE

EQUITIES

- US stocks ended the day lower on all major indices, with downside most notably in the NDX (-0.8%) as semiconductor weakness weighed on the tech-heavy index, due to China's regulators opening an investigation into NVIDIA (NVDA, -2.6%) over a violation of anti-monopoly law.

- Sectors were mainly in the red, where Utilities and Financials lagged, whereas Healthcare, Real Estate and Materials outperformed.

- SPX -0.61% at 6,053, NDX -0.84% at 21,441, DJIA -0.54% at 44,402, RUT -0.67% at 2,393

- Click here for a detailed summary.

NOTABLE HEADLINES

- Canadian PM Trudeau said Canada will respond if US President-elect Trump imposes 25% tariffs.

- Oracle Corp (ORCL) Q3 2024 (USD): Adj. EPS 1.47 (exp. 1.48), Revenue 14.06bln (exp. 14.12bln). Cloud revenue (IaaS plus SaaS) 5.9bln (exp. 6bln). Cloud Infrastructure revenue (IaaS) 2.4bln (exp. 2.42bln). Cloud Infrastructure revenue (IaaS) in constant currency +52% (exp. +50.9%). Shares fell 7.8 after hours.

DATA RECAP

- Atlanta Fed GDPNow (Q4 24): 3.3% (prev. 3.3%)

APAC TRADE

EQUITIES

- APAC stocks were mostly firmer following a negative Wall Street lead, but with APAC players reacting to China easing its overall monetary policy stance.

- ASX 200 was the regional laggard and failed to benefit from a net dovish RBA, with the index dragged by a poor performance in Tech.

- Nikkei 225 eked mild gains amid the recent JPY weakness, but with gains capped as the currency claws back some losses in APAC trade.

- Hang Seng and Shanghai Comp were the regional outperformers after Politburo said China's fiscal policy is to be more proactive next year, and monetary policy is to be moderately loose (prev. prudent), marking the first shift in the stance of monetary policy since 2011. Although bourses were off the best levels ahead of the Chinese Central Economic Work Conference.

- US equity futures were flat across the board following the prior day's losses, and with price action limited heading into tomorrow's US CPI ahead of next week's FOMC meeting.

- European equity futures are indicative of a lower cash open with the Euro Stoxx 50 future -0.5% after cash closed +0.2% on Monday.

FX

- DXY was flat and held onto 106.00 status. DXY briefly topped Monday's high (106.21). The next downside level is Monday's low (105.79). Upside levels include the 5th Dec high (106.37), and the 21 DMA (106.39).

- EUR/USD was relatively uneventful on either side of 1.0550 in a 1.0546-64 parameter heading into Thursday's ECB.

- GBP/USD was also flat overnight with sparse news flow on the UK front to drive price action, whilst the USD also saw little movement. GBP/USD in a 1.2736-57 range.

- USD/JPY gradually pulled back from a 151.55 overnight high to test 151.00 to the downside after the prior day's rise on the back of higher US yields.

- Antipodeans were on a softer footing throughout the session with the AUD also hit post-RBA after the central bank maintained its Cash Rate at 4.35% as widely expected, but struck a dovish tone as it expressed confidence that inflation is moving sustainably towards the target.

- Yuan narrowly outperformed amid optimism following China's change of monetary policy stance. USD/CNH briefly dipped under 7.25 from 7.27+ levels.

- PBoC set USD/CNY mid-point at 7.1876 vs exp. 7.2806 (prev. 7.1870)

FIXED INCOME

- 10yr UST futures saw uneventful trade amid a lack of news flow and after T-notes sold off throughout the US session with the curve bear steepening with attention turning to US CPI on Wednesday.

- Bund futures moved sideways around the 136.00 level with the contract taking a breather after yesterday's downside.

- 10yr JGB futures underperformed as the Japanese debt futures played catchup to the downside in the west, while a fleeting uptick in JGBs was seen after the stronger 5-year tap, although the move faded.

- Japan sold JPY 2.3tln 5-year JGB: b/c 4.42x (prev. 3.81x), average yield 0.7340% (prev. 0.7060%)

COMMODITIES

- Crude futures were subdued with the complex taking a breather after yesterday's rise facilitated by a couple of factors, namely the Chinese Politburo and geopolitical uncertainty in the Middle Eastern region after Syrian fighters toppled the Assad regime.

- Spot gold was slightly firmer but still within yesterday's range, with the yellow metal oscillating around its 50 DMA (USD 2,668.19/oz) in a USD 2,658.34-2,670.70/oz parameter.

- Copper futures gave up earlier gains with initial momentum emanating from China somewhat fading ahead of risk events. 3M LME copper resided within a narrow USD 9,197.50-9,250.50/t range.

CRYPTO

- Bitcoin was on the back foot and dipped further under the USD 100k level to levels under USD 96k at one point.

NOTABLE ASIA-PAC HEADLINES

- RBA maintained its cash rate at 4.35% as expected, and noted that some upside risks to inflation appear to have eased. RBA noted recent data on inflation and economic conditions are still consistent with these forecasts, and the Board is gaining some confidence that inflation is moving sustainably towards target. RBA also said wage pressures have eased more than expected in the November SMP, and while underlying inflation is still high, other recent data on economic activity have been mixed, but on balance softer than expected in November. Click here for the release.

- RBA Governor Bullock, at the post-meeting presser, said RBA needs to think carefully on policy, recent data have been mixed with some softening; need to see more progress on underlying inflation; the Board did not discuss rate cut or rate hike. She added that she does not know if the RBA will cut rates in February, will have to watch data - wages and demand are slowing. Click here for full comments.

- Australian Treasurer Chalmers said he is to consult with the Shadow Treasurer on the makeup of new RBA boards.

- Chinese President Xi said China has full confidence in achieving this year's economic growth target, via Xinhua.

- China's Politburo conducts a study session, according to Xinhua.

- South Korea Finance Ministry said recent market volatility is a bit excessive, and will respond with market stabilizing measures, according to Reuters.

- South Korean opposition leader Lee said they will pass the budget today, via Yonhap.

- Japanese Economy Minister Akazawa, when asked about revised Q3 GDP data, said while Japan has not emerged from deflation, a virtuous cycle of wage hikes and passing-through of prices has started, according to Reuters.

DATA RECAP

- Chinese Trade Balance USD (Nov) 97.44B vs. Exp. 95.0B (Prev. 95.72B)

- Chinese Imports YY (Nov) -3.9% vs. Exp. 0.3% (Prev. -2.3%)

- Chinese Exports YY (Nov) 6.7% vs. Exp. 8.5% (Prev. 12.7%)

- Australian NAB Business Confidence (Nov) -3.0 (Prev. 5.0)

- Australian NAB Business Conditions (Nov) 2.0 (Prev. 7.0)

GEOPOLITICS

MIDDLE EAST

- "Israeli forces are 20 km from Damascus, according to the Pro-Hezbollah Al Mayaden, as they seized more villages in southern Syria", according to journalist Elster.

- Israel hit major Syrian air bases across Syria, destroying infrastructure and dozens of helicopters and planes, via Reuters citing two Syrian security sources.

- Israel has received intelligence indicating that Hamas is ready to compromise on some of its conditions, according to five Israeli officials cited by NYT.

- "Loud explosions heard in Damascus", according to AFP journalists; details light.

OTHER

- Huawei suppliers to face further US limits under defence bill; firms with Huawei ties risk exclusion from Pentagon contracts, according to Bloomberg. House measures could put more pressure on Huawei's supply chain.

EU/UK

NOTABLE HEADLINES

- French Presidential office said President Macron is to convene Tuesday all political parties willing to compromise to form a Government, according to Reuters.