Europe Market Open: French PM Barnier loses confidence vote, Bitcoin climbs past $100,000 following SEC nomination

05 Dec 2024, 06:55 by Newsquawk Desk

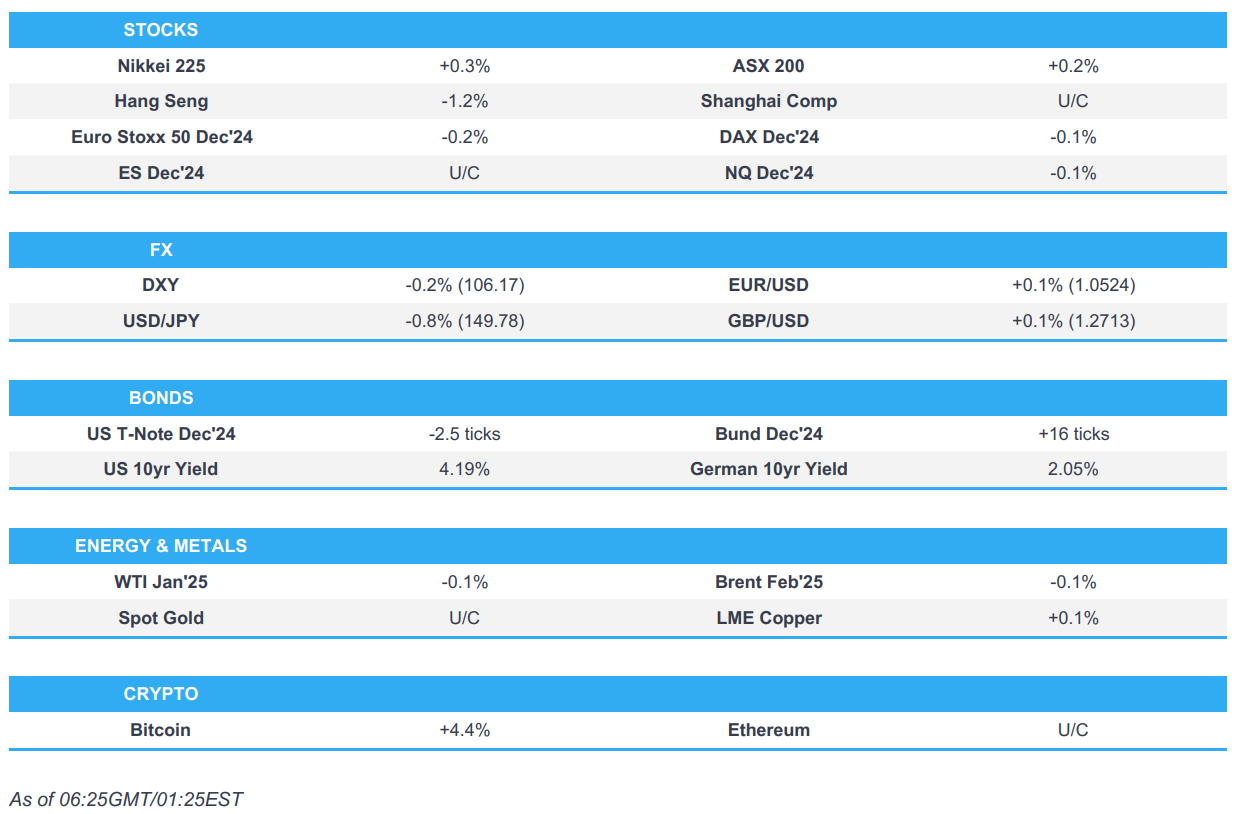

- APAC stocks traded mixed and partially sustained the momentum from the fresh record levels on Wall St where tech led the advances; European equity futures are indicative of a flat/subdued cash open.

- Fed Chair Powell said they are on a path to more neutral rates over time and though downside risks are less than thought, the Fed can afford to be cautious in finding neutral.

- French government lost a no-confidence motion as lawmakers voted 331 out of 574 current members in support of the no-confidence motion; French PM Barnier will submit his resignation today and is expected at the Elysee Palace at 09:00 GMT.

- Chinese state media warned against blindly pursuing faster growth and signalled more focus on supporting consumption in a flurry of articles ahead of the Central Economic Work Conference, according to Bloomberg.

- Bitcoin climbed above the psychological USD 100k level for the first time ever and continued to advance with prices underpinned after US President-elect Trump picked crypto-backer Paul Atkins to lead the SEC.

- Looking ahead, highlights include Swiss Unemployment, US Challenger Layoffs & Weekly Jobless Claims, OPEC+ Meeting, BoE DMP, Speakers including Fed’s Barkin, BoE’s Greene & ECB’s Patsalides, Supply from Spain, France & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks gained and the major indices printed fresh record highs with the Nasdaq leading advances amid outperformance in Tech and Consumer Discretionary and Communication names.

- Tech was buoyed by the strong Salesforce (CRM) and Marvell (MRVL) earnings, while Energy, Materials and Financials lagged. T-notes were bid with upside primarily supported by a big miss on the ISM Services PMI which printed beneath all analyst forecasts.

- SPX +0.61% at 6,086, NDX +1.24% at 21,492, DJIA +0.69% at 45,014, RUT +0.42% at 2,427.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Chair Powell said the US economy is in remarkably good shape and he feels very good about where monetary policy is, while he added they are not quite there on inflation but are making progress. Powell said they are on a path to more neutral rates over time and though downside risks are less than thought, the Fed can afford to be cautious in finding neutral.

- Fed's Daly (2024 voter) said they do not need to be urgent and need to carefully calibrate policy, while she will wait until the December meeting to make her decision. Daly also stated that inflation is still the number one challenge people are facing and there's a lot more work to deliver on 2% inflation and durable expansion.

- Fed Beige Book stated economic activity rose slightly in most Districts and employment levels were flat or up only slightly, while prices rose only at a modest pace across Districts.

- US President-elect Trump picked Paul Atkins for SEC Chair, while he picked Faulkender for Deputy US Treasury Secretary and Gail Slater as assistant AG for the antitrust division at the Department of Justice. Trump also named former Senator Kelly Loeffler to serve as Administrator of the Small Business Administration and Frank Bisignano to serve as the Commissioner of the Social Security Administration, while he named former Congressman Billy Long of Missouri to serve as the Commissioner of the Internal Revenue Service.

APAC TRADE

EQUITIES

- APAC stocks traded mixed and partially sustained the momentum from the fresh record levels on Wall St where tech led the advances with the help of earnings releases and softer yields following weak ISM Services data.

- ASX 200 eked slight gains with tech stocks taking inspiration from the outperformance stateside, while there was also an improvement in the latest trade and household spending data.

- Nikkei 225 gapped higher at the open but then gave back some of the initial spoils amid a choppy currency, while there was some intraday support seen after cautious rhetoric from BoJ's Nakamura although the momentum waned shortly after.

- Hang Seng and Shanghai Comp were mixed with sentiment clouded after the PBoC's operations resulted in another net liquidity drain and with a recent article in Chinese state media downplaying the pursuit of fast growth ahead of next week's Central Economic Work Conference.

- US equity futures were little changed and took a breather after yesterday's rally.

- European equity futures are indicative of a flat/subdued cash open with the Euro Stoxx 50 future -0.2% after the cash market closed with gains of 0.8% on Wednesday.

FX

- DXY traded little changed at the 106.00 level following recent data releases including a weak ISM Services PMI report and disappointing ADP jobs data, while there were several Fed comments including from Powell although the latest rhetoric provided very little incrementally.

- EUR/USD eked marginal gains but with the upside capped amid political uncertainty in France where PM Barnier lost the no-confidence vote, while the next course of action is on President Macron who was previously said to aim to name a new prime minister ahead of Saturday.

- GBP/USD was stuck near the 1.2700 focal point after rebounding from yesterday's initial BoE Governor Bailey-triggered selling pressure.

- USD/JPY was choppy with brief support seen following dovish-leaning comments from BoJ's Nakamura who said he was not confident about the sustainability of wage growth and they must cautiously adjust the degree of monetary support in accordance with improvement in the economy. However, the gains in USD/JPY gradually faded and there was late pressure after Nakamura separately commented in a press conference that he is not against a rate hike but believes it should be data-dependent which dragged USD/JPY to sub-150.00.

- Antipodeans were marginally higher with slight outperformance in NZD/USD, while price action in AUD/USD was contained with an improvement in Australian trade and household spending data failing to spur a boost.

FIXED INCOME

- 10yr UST futures mildly pulled back after climbing yesterday in the aftermath of the soft ISM Services data which fell short of even the most pessimistic of analysts' forecasts, while comments from Fed officials including Chairman Powell did little to shift the dial.

- Bund futures remained afloat in quiet trade after the prior day's intraday rebound and with German Factory Orders scheduled later.

- 10yr JGB futures were lacklustre in the absence of any tier-1 data releases and after a somewhat mixed 30yr JGB auction.

COMMODITIES

- Crude futures were rangebound and languished around the prior day's lows after selling off in the US afternoon, which was later attributed to a bank offloading a large volume of US oil futures contracts ahead of today's OPEC+ meeting.

- Spot gold traded sideways amid a lack of major pertinent catalysts and an uneventful dollar.

- Copper futures were lacklustre owing to the mixed risk appetite in the region and with Chinese media downplaying fast GDP growth.

CRYPTO

- Bitcoin climbed above the psychological USD 100k level for the first time ever and continued to advance with prices underpinned after US President-elect Trump picked crypto-backer Paul Atkins to lead the SEC.

NOTABLE ASIA-PAC HEADLINES

- Chinese state media warned against blindly pursuing faster growth and signalled more focus on supporting consumption in a flurry of articles ahead of the Central Economic Work Conference, according to Bloomberg.

- BoJ board member Nakamura said he is not confident about the sustainability of wage growth, while he added they are at a critical phase and must check many data and cautiously adjust the degree of monetary support in accordance with an improvement in the economy. Nakamura said that he sees a chance inflation may miss 2% from fiscal 2025 onward and noted that Japan's economy has yet to move on course for a stable growth path. Furthermore, he said structural changes in Japan's economy are required for inflation to stably hit 2% which will take a significant amount of time but also stated the adjustment of easy monetary policy will proceed gradually as the economy is expected to head toward a growth path. BoJ Board Member Nakamura later commented during a press conference that they will decide policy by examining data and he is not against a rate hike but believes it should be data-dependent.

- Japanese PM Ishiba said the government should mull what's an appropriate FX level and there are no plans to change the government-BoJ joint stance.

- South Korean ruling party leader Han said the party will try to stop the impeachment motion from passing parliament but demanded that President Yoon leave the party, according to Yonhap. Furthermore, the opposition party said it plans to vote to impeach President Yoon at 7pm local time on Saturday.

DATA RECAP

- Australian Balance on Goods (Oct) 5,953M vs. Exp. 4,550M (Prev. 4,609M)

- Australian Goods/Services Exports (Oct) 3.6% (Prev. -4.3%)

- Australian Goods/Services Imports (Oct) 0.1% (Prev. -3.1%)

- Australian Household Spending MM (Oct) 0.8% vs Exp. 0.3% (Prev. -0.1%)

- Australian Household Spending YY (Oct) 2.8% vs Exp. 2.2% (Prev. 1.3%)

GEOPOLITICS

MIDDLE EAST

- US President-elect Trump's Middle East envoy met the Qatari and Israeli PMs in a push to reach a Gaza ceasefire deal before inauguration, while Qatar has resumed its role as a key Gaza mediator and the Hamas negotiating team is expected to return to Doha to facilitate talks. It was separately reported that Trump's adviser cited by Axios said Trump wants to implement a Gaza ceasefire deal ASAP without delay and before January 20th.

- Russia reportedly fired missiles from its bases in Tartus, targeting Syrian rebels near Hama, according to a journalist via X.

RUSSIA-UKRAINE

- North Korea-Russia comprehensive strategic partnership treaty came into force, according to KCNA.

OTHER

- US senior cyber security official said there is a risk of ongoing compromise from ‘Salt Typhoon’ hackers and the White House made tackling the hackers a priority of the federal government, while the official noted that Chinese access to Americans’ telecommunications was potentially broad.

EU/UK

NOTABLE HEADLINES

- ECB's Nagel said he has no objection now to a rate cut next week but will reserve judgement until the meeting and favours a gradual, cautious approach to rate cuts. Furthermore, he does not forecast a significant risk of inflation undershooting and said the ECB should not cut rates below neutral.

- French government lost a no-confidence motion as lawmakers voted 331 out of 574 current members in support of the no-confidence motion.

- French PM Barnier will submit his resignation today and is expected at the Elysee Palace at 09:00 GMT, according to Sky News; French President Macron will address the nation on Thursday evening in a televised speech at 18:00 GMT.

- French Far-right leader Marine Le Pen said they have some requirements for backing the next PM and will contribute to crafting a budget, while she is not calling for President Marcon's resignation but noted that the pressure is piling up.

- Four South America Mercosur members support the new terms of an EU trade deal and are waiting on EU approval, according to Reuters sources.