Europe Market Open: APAC stocks subdued, South Korea underperformed after the martial law declaration and backtrack

04 Dec 2024, 07:06 by Newsquawk Desk

- APAC stocks were mostly subdued with underperformance in South Korea following the martial law declaration and backtrack.

- South Korean President Yoon announced on Tuesday the lifting of martial law after parliament voted to block it.

- European equity futures are indicative of a quiet cash open with the Euro Stoxx 50 future flat after the cash market closed higher by 0.7% on Tuesday.

- USD is mixed vs. peers, AUD lags post-Australian GDP data, EUR/USD lingers just above 1.05.

- Looking ahead, highlights include US ADP, ISM Services PMI & Factory Orders, Fed Discount Rate Minutes, French Government No Confidence Motion, BoE’s Bailey, ECB’s Lagarde & Cipollone, Fed’s Powell & Musalem, Supply from UK & Germany.

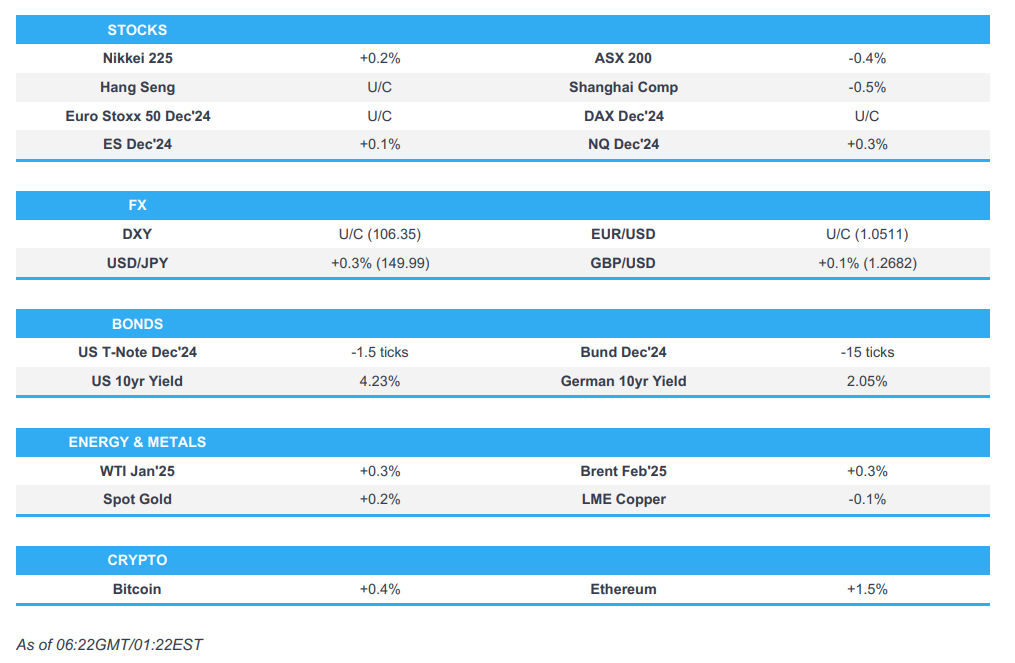

SNAPSHOT

US TRADE

EQUITIES

- US stocks finished mixed with price action in futures choppy as there was initial pressure in the US morning and T-notes caught a bid after South Korean President Yoon declared martial law to clear out pro-North Korean elements, although the moves in both stocks and bonds were later pared as South Korea's President and Cabinet ultimately reversed the decision.

- SPX +0.05% at 6,050, NDX +0.31% at 21,229, DJIA -0.17% at 44,706, RUT -0.73% at 2,416.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (2024 voter) said the US economy is in a really good place and a December rate cut is absolutely not off the table, while she added the timing of a rate cut is up for debate and they need to keep moving the policy rate down, as well as keep an open mind. Daly said they knew inflation would be a bumpy ride and it is moving down gradually, but there is more work to do. Furthermore, she said even if the Fed does another rate cut, policy will remain restrictive.

- Fed’s Kugler (voter) said current Fed policy is well-positioned to deal with uncertainties and will vigilantly monitor for risks and negative supply shocks that may undo progress in reducing inflation. Furthermore, she said policy is not on a pre-set course and will make decisions meeting by meeting.

- Fed's Goolsbee (2025 voter) said inflation data is a noisy series, over the next year, and rates should come down a fair amount from where they are now, while his belief that rates will and should come down is rooted in the read that inflation is coming down.

- US President-elect Trump is considering Florida Governor Desantis as a possible replacement for Pete Hegseth as his pick for Defence Secretary. It was later reported that Senator Earnst of Iowa is among the names under consideration to replace Hegseth as pick to lead the Pentagon, while other Trump allies are floating Senator Hagerty of Tennessee for the role, according to CNN.

- US Senate Majority Leader Schumer said he is confident funding will be done by the deadline.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued with underperformance in South Korea following the martial law declaration and backtrack.

- ASX 200 was led lower by underperformance in real estate, defensives and financials, while Australian GDP data disappointed.

- Nikkei 225 swung between gains and losses with price action indecisive amid the lack of Japan-specific catalysts.

- KOSPI underperformed following South Korean President Yoon's martial law declaration and subsequent backtracking which has led to calls from within the party to step down and an effort by opposition parties to impeach him for treason.

- Hang Seng and Shanghai Comp lacked conviction after somewhat mixed PMI data in which Chinese Caixin Services PMI missed forecasts but Caixin Composite PMI accelerated, while trade frictions also lingered after China's MOFCOM banned the export of "dual-use items" relating to gallium, germanium, antimony and super-hard materials to the US.

- US equity futures (ES +0.2%) steadily edged higher after whipsawing during the prior session alongside South Korea's martial law fiasco.

- European equity futures are indicative of a quiet cash open with the Euro Stoxx 50 future flat after the cash market closed higher by 0.7% on Tuesday.

SOUTH KOREA

- South Korean President Yoon announced on Tuesday the lifting of martial law after parliament voted to block it.

- South Korean ruling party leaders urged President Yoon to resign from the party and the ruling party leader saw the need to oust the defence chief and suggested that Yoon be kicked out of the party although ruling party lawmakers had various views and were undecided on Yoon's departure from the party. Furthermore, the main opposition party announced it would seek to impeach President Yoon and it was also reported that South Korea's Cabinet offered mass resignation.

- BoK said it will increase short-term liquidity measures starting Wednesday and will loosen collateral policies in the repo operation to ease any bond market jitters, while it will deploy various measures to stabilise FX as needed and will make any special loans available to inject funds into the market if required.

- South Korea's regulator said it is ready to deploy the KRW 10tln stock market stabilisation fund anytime, according to Yonhap.

- South Korean main labour union group called for a general strike until South Korean President Yoon resigns, according to AFP.

FX

- DXY was rangebound despite the recent higher-than-expected JOLTS data and as Fed rhetoric continued to allude to further cuts ahead, while the attention turns to a slew of data releases including ADP, ISM Services and Factory Orders, as well as comments from Fed Chair Powell.

- EUR/USD lingered around the 1.0500 level with gains limited as French PM Barnier faces a no-confidence vote later today.

- GBP/USD slightly edged higher and eyes another attempt to reclaim the 1.2700 level ahead of comments from BoE Governor Bailey.

- USD/JPY continued its rebound from yesterday's trough and briefly reclaimed the 150.00 status but with gains capped by the indecisive risk sentiment in Japan and the lack of pertinent catalysts.

- Antipodeans retreated with underperformance in AUD/USD following weaker-than-expected Australian GDP data for Q3 which saw money markets fully price an RBA rate cut for the April 2025 meeting.

- PBoC set USD/CNY mid-point at 7.1934 vs exp. 7.2821 (prev. 7.1996)

FIXED INCOME

- 10yr UST futures struggled for direction following the prior day's choppy mood after South Korean President Yoon declared martial law but later rescinded the decision, while participants now await a slew of incoming data and comments from Fed Chair Powell.

- Bund futures pulled back from a monthly high but with downside stemmed by support around 135.00 and ahead of a bund auction.

- 10yr JGB futures were initially indecisive amid a lack of catalysts from Japan but were then boosted on return from the Tokyo lunch break and broke through resistance around the 143.00 level.

COMMODITIES

- Crude futures took a breather and remained afloat after gaining yesterday on several bullish factors including concerns surrounding the Israel/Hezbollah truce, expectations of OPEC+ extending supply cuts, refinery outages and fresh Iranian sanctions, while price action was not helped by the latest private sector inventory data which showed a surprise build in headline crude stockpiles.

- US Private Inventory Data: Crude +1.2mln (exp. -0.7mln), Distillates +1.0mln (exp. +0.9mln), Gasoline +4.6mln (exp. +0.6mln), Cushing +0.1mln.

- Spot gold eked slight gains in quiet trade with price action restricted by an uneventful dollar.

- Copper futures were subdued by the cautious risk appetite and following softer-than-expected Services PMI data from China.

CRYPTO

- Bitcoin was ultimately flat after failing to sustain an early surge to back above the USD 96,000 level.

NOTABLE ASIA-PAC HEADLINES

- US State Department said the US last month renewed a 120-day waiver allowing Iraq to purchase Iranian electricity.

DATA RECAP

- Chinese Caixin Services PMI (Nov) 51.5 vs. Exp. 52.5 (Prev. 52.0)

- Chinese Caixin Composite PMI (Nov) 52.3 (Prev. 51.9)

- Australian Real GDP QQ SA (Q3) 0.3% vs. Exp. 0.4% (Prev. 0.2%)

- Australian Real GDP YY SA (Q3) 0.8% vs. Exp. 1.1% (Prev. 1.0%)

GEOPOLITICS

MIDDLE EAST

- Hamas said they have not received any new offer regarding the ceasefire in Gaza, according to Al-Arabiya.

- Syrian army announced the entry of the largest military convoy to the countryside of Hama to support the forces deployed on the fronts, according to Al Arabiya.

RUSSIA-UKRAINE

- Russian defence units were reportedly engaged in repelling a Ukrainian drone attack on Russia's Novorossiisk, while the report added that the Black Sea port of Novorossiisk is one of Russia's most important oil export gateways.

OTHER

- US and South Korea postponed planned defence talks and joint military exercises that were scheduled this week.

- China's Coast Guard said four Philippine Coast Guard ships attempted to enter China's territorial waters around Scarborough Shoal and the ships dangerously approached China's normal law enforcement patrol vessels, while it stated that China exercised control over the Philippine ships in accordance with the law. However, Philippine's Coast Guard said Philippine vessels encountered aggressive actions from several Chinese Coast Guard vessels and the Chinese Coast Guard fired a water cannon against Philippine vessels, as well as "intentionally sideswiped" a Philippine vessel on the starboard side.

EU/UK

NOTABLE HEADLINES

- ECB's Holzmann sees the likelihood of a moderate rate cut in December. It was separately reported that Holzmann said a 25bps rate cut is conceivable in December and not more, while he added nothing is decided on the next rate move and it will depend on data available at the December meeting. Furthermore, he stated that US President-elect Trump is casting a shadow over inflation in Europe and will probably drive up the inflation forecast.

- ECB policymaker and Bundesbank President Nagel said the German economy faces a weak outlook and 2025 is likely to be another year of weak growth, while he also called for a softer debt brake to ramp up investment, according to FT.

- French President Macron said he will not resign before his mandate ends in 2027 and believes Le Pen will not join the left to topple the government.