US Market Open: US yield curve steepens and Dollar is broadly softer ahead of JOLTS and Fed speak, OATs await Wednesday's confidence vote

03 Dec 2024, 11:35 by Newsquawk Desk

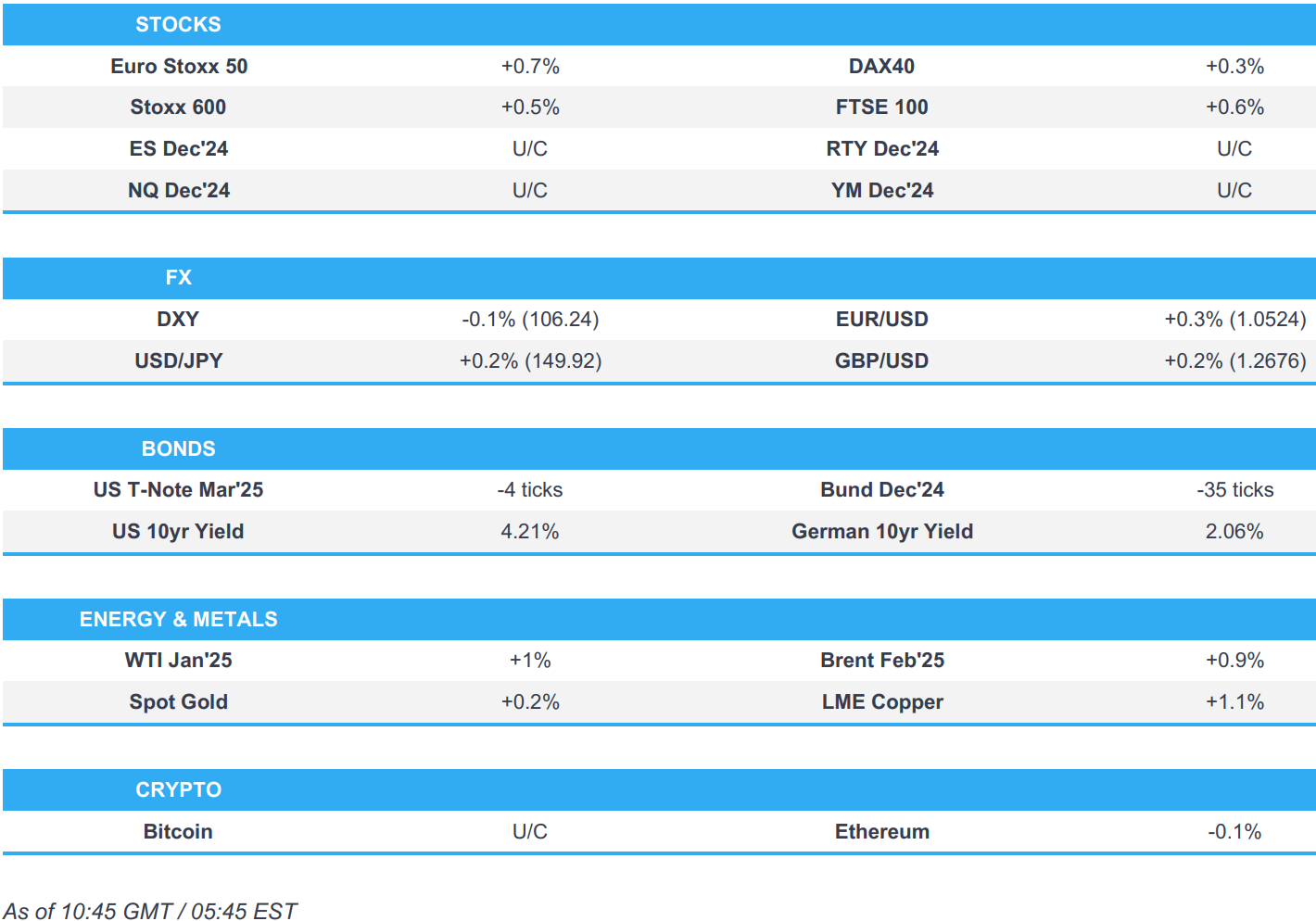

- European bourses are entirely in the green; US futures are essentially flat ahead of US JOLTS and Fed speak.

- USD is broadly softer vs. peers, EUR/USD reclaims 1.05.

- US yield curve steepens ahead of JOLTS, OATs await Wednesday's confidence vote

- Crude climbs higher, base metals benefit from the risk tone and softer USD.

- Looking ahead, US JOLTS, Speakers including Fed’s Goolsbee, Daly, Kugler.

EUROPEAN TRADE

EQUITIES

- European bourses began the European session mostly in the positive territory, and sentiment continued to improve as the morning progressed, to display a sea of green in Europe.

- European sectors hold a strong positive bias, with only a handful of industries in negative territory. The top of the pile is populated by Banks, Travel & Leisure and Tech. The latter is buoyed by gains in heavy-weight ASML (+2.1%) after the Co. noted that the impact of export restrictions will fall within its existing outlook and will not have a direct material impact on business in 2024. Real Estate is the laggard.

- US equity futures are essentially flat and trading on either side of the unchanged mark, and unable to benefit from the positive momentum seen across the pond.

- RBC S&P 500 outlook: raises Communication Services to Overweight from Marketweight; cuts Healthcare to Marketweight from Overweight; cuts Materials to Marketweight from Overweight.

- China's Auto Industry Body says Tesla (TSLA) sold 78,856 China made vehicles in Nov. (82,000 Y/Y).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. peers as markets digest comments from the influential Waller at the Fed who stated that he is leaning in favour of a cut for the December meeting. Ahead, JOLTS ahead of speak from Fed's Daly, Kugler and Goolsbee (twice). DXY is holding above the 106 mark and within yesterday's 105.78-106.73 range.

- EUR has been granted some reprieve vs. the USD. Albeit, it remains to be seen how long this will last given French political issues. The latest reports note that a no-confidence vote will take place at 15:00GMT on Wednesday. EUR/USD is back on a 1.05 handle and within yesterday's 1.0460-1.0587 range.

- GBP is firmer vs. the broadly softer USD with UK-specific drivers on the light side. As such, it is likely that events stateside will continue to dictate the state-of-play for Cable which is currently sat within yesterday's 1.2617-1.2742 range.

- Antipodeans are both near the top of the G10 leaderboard despite AUD facing some soft domestic data overnight and a softer CNY. The uptick in AUD/USD has led the pair back above the 0.65 mark. NZD/USD has been pivoting around the 0.59 mark.

- CHF is modestly softer vs. the EUR following the latest Swiss inflation metrics which saw the Y/Y rate print at 0.7% vs. exp. 0.8% (prev. 0.6%) and fall short of the SNB's Q4 average expectation of 1.0%.

- PBoC set USD/CNY mid-point at 7.1996 vs exp. 7.2702 (prev. 7.1865).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are softer, weighed on by recent strong data which is lifting yields from the belly out. However, short-end debt is bid in the wake of Fed speak overnight with yields at the short-end pressured. Overnight, Waller said he is leaning towards a December cut, though noted one could argue the case for skipping and will be watching the data closely. USTs at the low-end of a 110-31+ to 111-06 band with the curve steeper.

- OAT-Bund yield spread is narrowing down to 85bps having peaked just shy of 89bps on Monday. The main update in today’s session has been the timing of the no-confidence vote on Barnier, which is provisionally set for 15:00GMT on Wednesday.

- Bunds are softer, with specifics somewhat light thus far and while ECB speak is in focus the likes of Cipollone haven’t added anything surprising. At the low-end of a 135.14-40 parameter, which is entirely within Monday’s 134.79-135.46 band. A fairly decent Schatz auction had little impact on Bund prices.

- Gilts were trading in-fitting with peers going into the region's own auction, in what has been a catalyst thin session thus far, aside from BRC Retail Sales data, which was weak. The auction saw a strong cover though both the price and yield tails were elevated when compared to recent taps, sparking some very modest pressure.

- Germany sells EUR 3.607bln vs exp. EUR 4.5bln 2.0% 2026 Schatz Auction: b/c 2.3 (prev. 2.20x), average yield 1.94% (prev. 2.11%) & retention 19.84% (prev. 19.62%).

- UK sells GBP 2.25bln 4.375% 2054 Gilt Auction: b/c 3.0x (prev. 3.08x), average yield 4.747% (prev. 4.735%), tail 0.4bps (prev. 0.3bps).

- Click for a detailed summary

COMMODITIES

- A slightly choppy morning for crude benchmarks but underlying action is firmly bullish with WTI & Brent at the top-end of parameters and within proximity to yesterday’s USD 69.11/bbl and USD 72.89/bbl best. Complex benefitting from both reports that OPEC is likely to extend its latest output cuts and tensions around the Lebanon ceasefire.

- Gold is trading at the top-end of a relatively narrow c. USD 15/oz range, peaked at USD 2650/oz overnight and while XAU remains firmer on the session it is yet to re-test the above high.

- Base metals traded lacklustre overnight, but did catch a slight bid in tandem with the broader risk tone and the softer Dollar. 3M LME Copper probing USD 9.1k to the upside, a marked rebound from Monday’s USD 8.91k trough.

- OPEC is likely to extend its latest oil output cuts until the end of Q1 2025 during its meeting on Thursday, according to OPEC+ sources cited by Reuters.

- Premiums for Russia's espo blend reach 2yr record of USD 1.30-1.50/bbl to brent, according to Reuters sources.

- JPMorgan says Brent crude oil price is projected to average USD 80/bbl in 2024; says US Nat Gas 2025 price expected to average USD 3.50/MMBtu.

- JPMorgan expects gold to rise towards USD 3,000/oz in 2025 with an average price of USD 2,950/oz in Q4 2025; says catch up trade later in 2025 could push silver prices towards USD 38/oz whilst platinum rallies to USD 1200/oz. Sees copper price towards USD 10,400/MT by Q4'25 and average USD 11,000/MT in 2026. Sees aluminium prices towards USD 2850/MT over H2'25.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss CPI MM (Nov) -0.1% vs. Exp. -0.1% (Prev. -0.1%); CPI YY (Nov) 0.7% vs. Exp. 0.8% (Prev. 0.6%)

- UK BRC Retail Sales YY (Nov) -3.4% (Prev. 0.3%); Total Sales YY -3.3% (Prev. 0.6%)

- UK ONS reweighting: The employment rate is revised up 0.1 percentage points to 74.6% in April to June 2024, meanwhile, the unemployment rate is largely unchanged at 4.2% and the economic inactivity rate is down 0.1 percentage points to 22.1%.. The new data also show that the overall employment level is now 313,000 above pre-coronavirus (COVID-19) pandemic levels, rather than at a similar level as current data do.

NOTABLE EUROPEAN HEADLINES

- ECB's Kazaks says a data-dependent and gradual approach are still appropriate, the pace and depth of easing will be determined by data and judgement.

- France to hold no-confidence vote on Wednesday, 4th December. Press report that the vote will take place at 15:00GMT.

- Barclaycard UK November Consumer Spending fell 0.5% Y/Y in November.

NOTABLE US HEADLINES

- Fed's Williams (voter) said he expects more rate cuts to happen over time and that monetary policy remains in a restrictive stance, while he added that what the Fed does with policy depends on incoming data and the outlook for the economy and policy remains ‘highly uncertain’. Furthermore, Williams expects US GDP at 2.5% this year but might be higher, as well as noted that they will need to bring interest rates down over time and it is unclear where the neutral rate is right now.

- US President-elect Trump nominated Warren Stephens to be the US envoy to Britain. In other news, Trump said he is against US Steel (X) being bought by a foreign company, in this case, Japan's Nippon Steel (5401 JT), while he added that through a series of tax incentives and tariffs, they will make US Steel strong and great again.

GEOPOLITICS

MIDDLE EAST

- Israeli Defense Minister says if ceasefire collapses "we will no longer differentiate between Lebanon and Hezbollah"

- Israeli forces blew up residential buildings in the Al-Geneina neighbourhood, east of Rafah in the southern Gaza Strip.

- US Secretary of State Blinken met with Israel's Strategic Affairs Minister Dermer and reiterated the importance of ending the Gaza war.

- Syrian Armed Opposition Operations Department said they took control of Halfaya, Maardis and Taiba al-Imam in the northern countryside of Hama, according to Al Jazeera.

CRYPTO

- Bitcoin is incrementally lower and holds just above USD 95k; Ethereum remains flat and sits just ahead of the USD 3.6k.

APAC TRADE

- APAC stocks were mostly positive as the region took impetus from the fresh record highs seen in the S&P 500 and the Nasdaq.

- ASX 200 rose to a fresh record high with advances led higher by healthcare, tech and consumer discretionary.

- Nikkei 225 outperformed and reclaimed the 39,000 level with tech companies benefitting from further US export controls on China as restrictions related to advanced chips could spur a scramble for China to secure legacy-generation chip tools.

- Hang Seng and Shanghai Comp traded indecisively after the US unveiled a new package of chip export controls against China.

NOTABLE ASIA-PAC HEADLINES

- China's Semiconductor association say US chips are no longer "safe and reliable". Relevant industries will have to be cautious about procuring these US chips.

- China's Internet Society call on domestic companies to carefully consider the procurement of US chips and seek to expand cooperation with chipmakers from other countries. US chip export controls have caused substantial harm to stable development of China's internet industry

- China's MOFCOM bans to export of "dual-use items" relating to gallium, germanium, antimony and super-hard materials to the US. Tighter end-user and end-use vetting for graphite dual-use items which are exported to the US. Effective Dec. 3rd. Export of dual-use items to US military users or for military reasons is prohibited.

- China is reportedly to hold the Central Economic Work Conference on December 11th-12th on 2025 economic growth targets and stimulus plans.

- Fast Retailing (9983 JT) reports November UNIQLO sales +12.2% (prev. -7.5% Y/Y).

DATA RECAP

- Australian Current Account Balance (AUD)(Q3) -14.1B vs. Exp. -10.0B (Prev. -10.7B)

- Australian Net Exports Contribution (Q3) 0.1% vs. Exp. 0.3% (Prev. 0.2%)