Europe Market Open: APAC stocks mostly green as the region took impetus from the fresh record highs in the S&P 500 and Nasdaq

03 Dec 2024, 06:48 by Newsquawk Desk

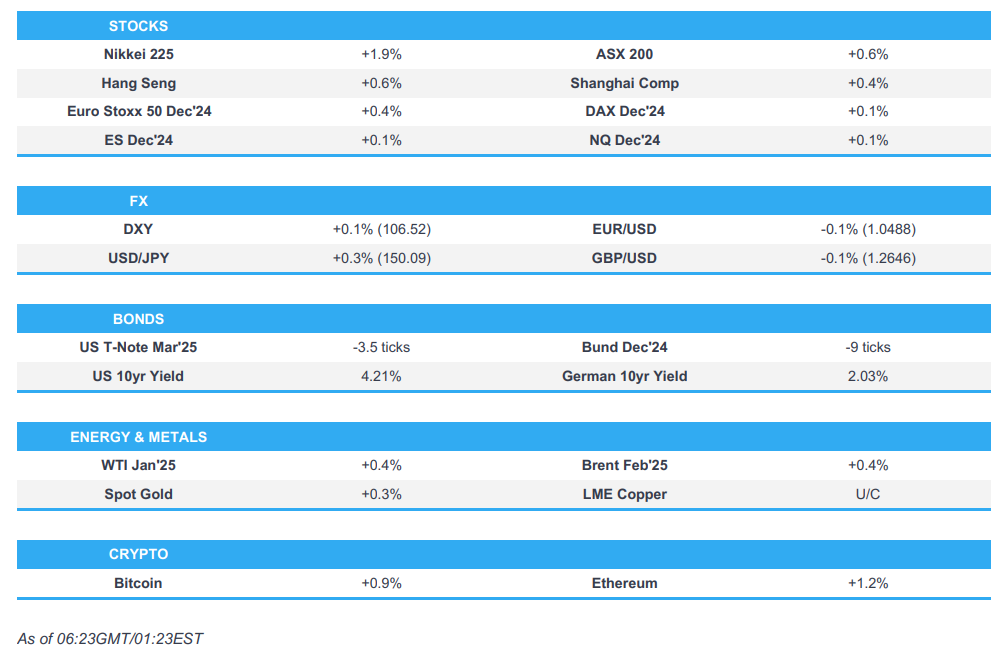

- APAC stocks were mostly positive as the region took impetus from the fresh record highs in the S&P 500 and the Nasdaq.

- Fed's Waller said he leans toward supporting a cut in December, Bostic said December decision is not preordained.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed higher by 0.9% on Monday.

- DXY is net higher with the USD showing differing performances vs. peers, EUR/USD languishes below 1.05.

- Looking ahead, highlights include Swiss CPI, US JOLTS, Fed’s Goolsbee, Kugler & ECB’s Cipollone, Supply from UK & Germany.

SNAPSHOT

US TRADE

EQUITIES

- US stocks ultimately traded mixed in which the S&P 500 and Nasdaq posted fresh record highs but the Dow lagged and the small-cap Russell 2000 finished little changed, while the dollar was bid and treasuries flattened as markets reacted to Trump's recent tariff threat against BRICS nations and following encouraging data including a 'Goldilocks' ISM Manufacturing PMI report.

- SPX +0.24% at 6,047, NDX +1.12% at 21,165, DJIA -0.29% at 44,782, RUT -0.02% at 2,434.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Waller (voter) said he leans toward supporting a cut in December but added that one could argue a case for skipping a rate cut in December and will be watching data closely to decide. Waller said the policy rate is restrictive enough that a December rate cut still allows ample scope to slow the pace of cuts later if needed and forecasts show inflation is to continue on a downward path to 2% over the medium term, while he will support holding rates steady in December if the data shows forecasts of slowing inflation are wrong. Furthermore, he said the direction of the policy rate over the medium term is clearly down, as well as noted that monetary policy remains 'significantly restrictive' and there is still 'a ways to go' in reducing the policy rate to neutral, while he expects rate cuts to continue over the next year with the speed and timing of rate cuts to be determined by economic conditions.

- Fed's Williams (voter) said he expects more rate cuts to happen over time and that monetary policy remains in a restrictive stance, while he added that what the Fed does with policy depends on incoming data and the outlook for the economy and policy remains ‘highly uncertain’. Furthermore, Williams expects US GDP at 2.5% this year but might be higher, as well as noted that they will need to bring interest rates down over time and it is unclear where the neutral rate is right now.

- Fed's Bostic (2024 voter) said the base case is that inflation remains on track to reach 2%, while he is not going into the December meeting with a sense that the outcome is preordained and coming data will be important and keeping options open. Bostic added it is still an open question on how fast and by how much rates need to be cut to keep inflation declining while avoiding undue damage to the job market.

- US President-elect Trump nominated Warren Stephens to be the US envoy to Britain. In other news, Trump said he is against US Steel (X) being bought by a foreign company, in this case, Japan's Nippon Steel (5401 JT), while he added that through a series of tax incentives and tariffs, they will make US Steel strong and great again.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive as the region took impetus from the fresh record highs seen in the S&P 500 and the Nasdaq.

- ASX 200 rose to a fresh record high with advances led higher by healthcare, tech and consumer discretionary.

- Nikkei 225 outperformed and reclaimed the 39,000 level with tech companies benefitting from further US export controls on China as restrictions related to advanced chips could spur a scramble for China to secure legacy-generation chip tools.

- Hang Seng and Shanghai Comp traded indecisively after the US unveiled a new package of chip export controls against China.

- US equity futures were flat after the mixed performance on Wall St and with relatively light scheduled events for Tuesday.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed higher by 0.9% on Monday.

FX

- DXY extended on the prior day's gains following Trump’s recent tariff threats against BRICS nations and data releases in which US Manufacturing PMI was revised upwards and ISM Manufacturing PMI surpassed expectations. There were also recent comments from Fed speakers including Bostic who stated he is not going into the December meeting with a sense that the outcome is preordained and is keeping his options open, while Waller said he leans towards supporting a rate cut in December, absent of any data shocks, which slightly pressured the dollar and saw money markets price in a greater chance of a 25bps cut at this month's meeting. Furthermore, Fed's Williams also said he expects more rate cuts to happen over time and noted that monetary policy remains in a restrictive stance.

- EUR/USD languished beneath the 1.0500 handle amid a possible collapse of French PM Barnier's government and after disappointing PMI data, while the latest rhetoric from ECB officials continued to point to a cut this month which money markets are fully pricing in.

- GBP/USD was subdued after giving up ground to the firmer buck and with UK-specific catalysts light.

- USD/JPY reclaimed the 150.00 handle as outperformance in Japanese stocks dampened haven demand for the yen.

- Antipodeans remained contained following yesterday's weakness with price action not helped by softer-than-expected Australian data and the pressure in the yuan in which USD/CNH breached the 7.3000 level to the upside.

- PBoC set USD/CNY mid-point at 7.1996 vs exp. 7.2702 (prev. 7.1865).

FIXED INCOME

- 10yr UST futures lacked direction following recent price swings amid stronger-than-expected ISM data and dovish Fed rhetoric.

- Bund futures took a breather after climbing to above the 135.00 level and as participants look ahead to a 2-year Schatz auction.

- 10yr JGB futures recovered early losses but with upside limited as money markets lean towards a BoJ rate hike at this month's meeting and following a slightly softer-than-previous 10yr JGB auction.

COMMODITIES

- Crude futures traded rangebound after the prior day's choppy mood as headwinds from dollar strength overshadowed the recent data from China and the US, as well as the geopolitical tensions, while participants await Thursday's OPEC+ meeting.

- OPEC is likely to extend its latest oil output cuts until the end of Q1 2025 during its meeting on Thursday, according to OPEC+ sources cited by Reuters.

- Iraq halted all operations at the Basra oil refinery due to overloaded fuel oil storage tanks, according to Reuters citing officials.

- Spot gold was little changed with the precious metal constrained after the dollar's recent advances.

- Copper futures were lacklustre with prices constrained as sentiment in China lagged after the US unveiled a new package of chip export controls against China.

CRYPTO

- Bitcoin traded indecisively in which prices oscillated around the USD 96,000 level throughout the session.

NOTABLE ASIA-PAC HEADLINES

- Dutch government said it will study the new US restrictions on the export of chip equipment to China and it shares US concerns over the uncontrolled export of advanced semiconductor equipment, while ASML (ASML NA) said it sees the impact of export restrictions to fall within its outlook.

- China is reportedly to hold the Central Economic Work Conference on December 11th-12th on 2025 economic growth targets and stimulus plans.

DATA RECAP

- Australian Current Account Balance (AUD)(Q3) -14.1B vs. Exp. -10.0B (Prev. -10.7B)

- Australian Net Exports Contribution (Q3) 0.1% vs. Exp. 0.3% (Prev. 0.2%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said Hezbollah firing at Har Dov is a serious violation of the Lebanon ceasefire and they will respond strongly, while the Israeli Defense Minister also said Israel will respond to Hezbollah fire with a tough response.

- Israeli military said it attacked dozens of Hezbollah targets but also stated that Israel remains obligated to fulfil the ceasefire.

- Israeli forces blew up residential buildings in the Al-Geneina neighbourhood, east of Rafah in the southern Gaza Strip.

- US Secretary of State Blinken met with Israel's Strategic Affairs Minister Dermer and reiterated the importance of ending the Gaza war.

- US officials are concerned Lebanon ceasefire could unravel, according to Axios' Ravid.

- US President-elect Trump warned there will be all hell to pay in the Middle East if Gaza hostages are not released prior to his January 20th inauguration.

- Syrian Armed Opposition Operations Department said they took control of Halfaya, Maardis and Taiba al-Imam in the northern countryside of Hama, according to Al Jazeera.

RUSSIA-UKRAINE

- US State Department announced new military assistance for Ukraine worth USD 725mln.

- NATO chief Rutter warned US President-elect Trump of a 'dire threat' to the US if Ukraine is pushed into a bad peace deal, according to FT.

EU/UK

NOTABLE HEADLINES

- Barclaycard UK November Consumer Spending fell 0.5% Y/Y in November.

DATA RECAP

- UK BRC Retail Sales YY (Nov) -3.4% (Prev. 0.3%)

- UK BRC Total Sales YY (Nov) -3.3% (Prev. 0.6%)