Europe Market Open: Lebanon ceasefire is in effect, RBNZ cut by 50bps & no surprises from FOMC Minutes

27 Nov 2024, 06:58 by Newsquawk Desk

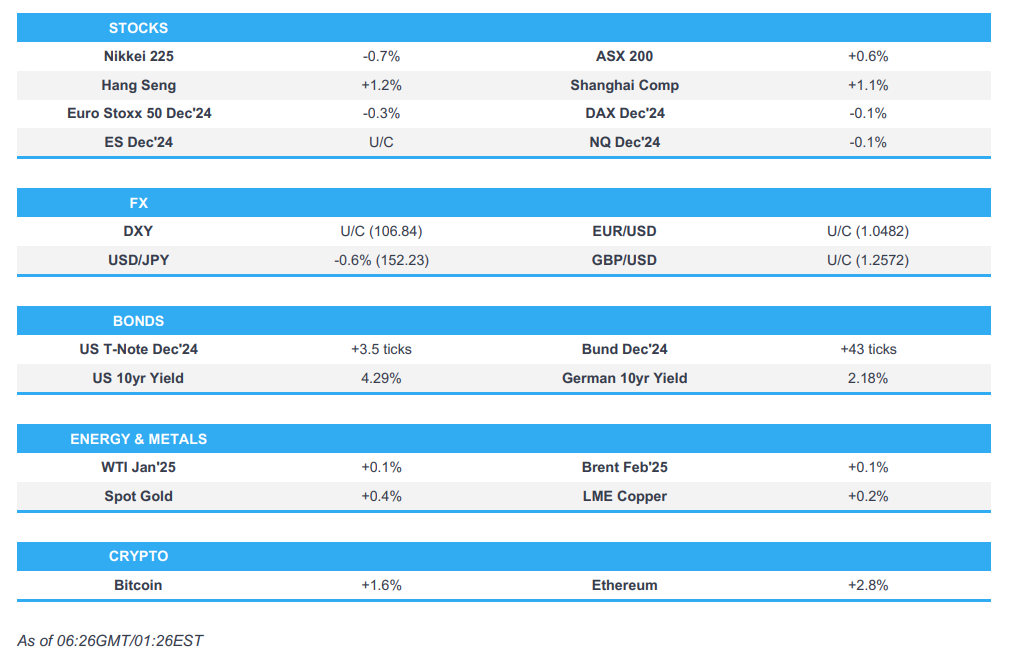

- APAC stocks were mixed after the S&P 500 and DJIA posted fresh record highs but the small-cap Russell 2000 underperformed.

- FOMC Minutes noted uncertainty over the neutral rate level makes it appropriate to reduce restraint gradually; some said the Fed could pause easing.

- Israel’s cabinet approved the ceasefire deal with Lebanon; ceasefire has since gone into effect.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.3% after the cash market closed lower by 0.8% on Tuesday.

- RBNZ cut the OCR by 50bps, which was widely expected, although there were outside bets for a greater 75bps reduction.

- DXY is steady below the 107 mark, NZD leads gains across the majors, JPY supported as BoJ hike expectations build.

- Looking ahead, highlights include US PCE (Oct), GDP 2nd Estimate (Q3), PCE Prices Prelim (Q3), Initial Jobless Claims (23 Nov, w/e), Durable Goods (Oct), Advance Goods Trade Balance (Oct), German GfK Consumer Sentiment (Dec), Comments from ECB’s Lane, US Supply.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were ultimately mixed in which the major indices gained and large caps outperformed driven by strength in Communications and Utilities, while Materials and Energy lagged and the small-cap Russell 2000 was pressured by a higher US yield environment in response to the latest tariff threat by US President-elect Trump on all products from Canada, Mexico and China.

- SPX +0.57% at 6,022, NDX +0.57% at 20,923, DJIA +0.28% at 44,861, RUT -0.73% at 2,424.

- Click here for a detailed summary.

FOMC MINUTES

- FOMC Minutes noted that many said uncertainty over the neutral rate level makes it appropriate to reduce restraint gradually and participants anticipated it would be appropriate to move gradually towards a more neutral stance, while some said the Fed could pause easing and hold rates at restrictive levels if inflation remains elevated. However, some also said that easing could be accelerated if the labour market weakened or activity faltered, and almost all agreed that the risks to achieving dual mandate goals remain roughly in balance. Furthermore, participants continued to observe that inflation had eased substantially from its peak, although core inflation remained somewhat elevated.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 Voter) said it makes sense to slow cuts as rates approach r-star, according to an Overshoot interview last week.

- US President-elect Trump picked Jamieson Greer for USTR and Kevin Hassett to head the National Economic Council.

APAC TRADE

RBNZ

- RBNZ cut the OCR by 50bps to 4.25%, as expected, while it said the OCR was lowered further as inflation returns to the target and expects to cut the OCR again early next year. RBNZ noted global economic growth is to remain subdued in the near term and economic activity is subdued but added that economic growth is expected to recover over 2025. Furthermore, the central bank lowered its OCR forecasts across the projection horizon with the March 2025 view at 4.07% (prev. 4.62%), December 2025 view at 3.55% (prev. 3.85%) and March 2026 view at 3.43% (prev. 3.62%).

- RBNZ Governor Orr said during the post-meeting press conference 'misnomer' that projections show a slower pace of cuts and stated that projections are consistent with a 50bps cut in February depending on activity, while he added the track suggests a sharper reduction in the Cash Rate than projected in August leaves the door open to further 50bps cut in February. Orr also stated they did not discuss cutting by 75bps and there were no plans for a 25bps or 75bps cut today, as well as noted that they can rule out rates going up in the near-term because of tariffs which they are concerned about.

EQUITIES

- APAC stocks were mixed following a somewhat similar performance stateside where the S&P 500 and DJIA posted fresh record highs but the small-cap Russell 2000 underperformed amid higher yields owing to Trump's recent tariff threat.

- ASX 200 traded higher with strength in gold, consumer discretionary, tech and financial stocks, while mixed data releases also provided some encouragement as monthly CPI printed softer-than-expected, whilst the trimmed mean metric rose and Q3 Construction Work Done topped forecasts.

- Nikkei 225 underperformed amid a firmer currency and with money markets leaning towards a hike by the BoJ next month.

- Hang Seng and Shanghai Comp were positive albeit with gains capped by a lack of major catalysts and as Industrial Profits data continued to show a double-digit percentage drop Y/Y for October although was not as steep as the prior month's decline.

- US equity futures (ES U/C) were rangebound ahead of a deluge of data releases later before tomorrow's Thanksgiving Day holiday closure.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.3% after the cash market closed lower by 0.8% on Tuesday.

FX

- DXY traded rangebound beneath the 107.00 level after softening yesterday and with no major fireworks from the FOMC Minutes which noted that many members said uncertainty over the neutral rate level makes it appropriate to reduce restraint gradually, while some said the Fed could pause easing and hold rates at restrictive levels if inflation remains elevated, although some also said easing could be accelerated if the labour market weakened or activity faltered.

- EUR/USD was contained amid few catalysts for the single currency and after recent ECB rhetoric provided little incrementally.

- GBP/USD lacked direction following the recent fluctuations and in the absence of any major data releases from the UK, while recent comments from BoE's Pill and Lombardelli did little to shift the dial.

- USD/JPY gradually extended on its recent declines beneath the 153.00 level with money markets pricing around a 60% chance for the BoJ to resume hiking rates at next month's meeting.

- Antipodeans were mixed as AUD/USD traded sideways following mixed data and with NZD/USD boosted after the RBNZ cut the OCR by 50bps, which was widely expected although there were outside bets for a greater 75bps reduction, while the central bank's rate projection for the OCR in December 2025 was at 3.55% which was higher than what money markets are currently pricing.

FIXED INCOME

- 10yr UST futures kept afloat in muted trade after uneventful FOMC Minutes, while participants await US supply and a deluge of data.

- Bund futures added to the prior day's spoils and looked to retest resistance around the 134.00 level.

- 10yr JGB futures were lacklustre amid a quiet calendar and following weaker results from the latest 40yr JGB auction.

COMMODITIES

- Crude futures lacked decisiveness after the prior day's choppy mood with demand hampered as Israel and Hezbollah began a ceasefire, while the weekly private sector inventory data was mixed which showed a much larger-than-expected crude draw and a surprise build for gasoline.

- US Private Inventory Data: Crude -5.9mln (exp. -0.6mln), Distillates +2.5mln (exp. +0.1mln), Gasoline +1.8mln (exp. -0.1mln), Cushing -0.7mln

- US President-elect Trump's plan to impose 25% tariffs on Canadian and Mexican imports does not exempt crude oil, according to Reuters citing sources.

- Russia may lift the ban on gasoline exports from refineries for two months from December 1st to January 31st, according to Kommersant citing sources.

- Citi Research said its base case is for OPEC+ to delay the unwind of output cuts by a quarter to April 2025.

- Spot gold eked mild gains in rangebound trade after the dollar's recent swings and ahead of a flurry of US data releases.

- Copper futures regained some composure following yesterday's fluctuations but with the upside capped amid the mixed risk appetite.

CRYPTO

- Bitcoin mildly gained but with upside capped after failing to sustain a brief return above the USD 93,000 level.

DATA RECAP

- Chinese Industrial Profits YY (Oct) -10.0% (Prev. -27.1%)

- Chinese Industrial Profits YTD YY (Oct) -4.30% (Prev. -3.50%)

- Australian Weighted CPI YY (Oct) 2.10% vs. Exp. 2.30% (Prev. 2.10%)

- Australian CPI ANNL trimmed mean YY (Oct) 3.50% (Prev. 3.20%)

- Australian Construction Work Done (Q3) 1.6% vs. Exp. 0.3% (Prev. 0.1%, Rev. 1.1%)

GEOPOLITICS

MIDDLE EAST

- Hamas says it is ready for truce in Gaza after the ceasefire deal between Israel and Hezbollah, according to journalist Guy Elster.

- Israel’s cabinet approved the ceasefire deal with Lebanon in a 10-1 vote, while PM Netanyahu said they will return all citizens in the north to their homes and are determined to prevent Iran from having nuclear arms. Furthermore, Netanyahu said they have set Hezbollah back decades and if Hezbollah breaks the deal, they will strike at them, while he stated that a ceasefire deal now means they will focus on the Iranian threat.

- US President Biden confirmed Israel and Hezbollah have agreed to a ceasefire deal with the deal to take effect at 04:00 local time on Wednesday (02:00GMT/21:00EST), while he stated over the next 60 days, the Lebanese army will take control of their own territory again and Israel will gradually withdraw and civilians will return home. Biden said there will be no US troops in southern Lebanon and the US will make another push over the coming days with Turkey, Qatar and others for a ceasefire in Gaza. Biden also stated the US remains ready to conclude historic deals with Saudi Arabia and it is possible for normalisation of relations between Israel and Saudi Arabia.

- Israel conducted a series of raids on the town of Naqoura in southern Lebanon and Hezbollah announced targeting "sensitive" military sites in Tel Aviv with a swarm of drones in the hours prior to the ceasefire.

- Streams of cars headed to southern Lebanon after the ceasefire came into force, according to Reuters.

- US senior official said they must all focus on making sure Iran does not continue to use Syria as a highway for weapons into Lebanon.

- Iran's Foreign Ministry said it welcomes the ceasefire in Lebanon and emphasises the responsibility of the international community in effectively pressuring Israel to stop the war in Gaza.

- Syrian state agency reported six people died including two soldiers in an Israeli attack on border crossings between Syria and Lebanon in the Homs countryside.

RUSSIA-UKRAINE

- US Secretary of State Blinken said the US is continuing to surge security assistance to bolster Ukraine's defences in the east, and the involvement of North Korean troops in the Ukrainian conflict was a matter of grave concern for all G7. Blinken said they are finalising "getting out the door" the USD 50bln that has been secured on the basis of frozen Russian sovereign assets and going into 2025, Ukraine has the money, munitions and forces to fight effectively or negotiate.

- Russia’s new missile fired at the Ukrainian city of Dnipro last week carried warheads without explosives causing limited damage, according to Reuters citing sources.

OTHER

- US President-elect Trump’s team weighs direct talks with North Korea's Leader Kim Jong Un, according to Reuters citing sources.

EU/UK

NOTABLE HEADLINES

- BoE's Lombardelli said US tariffs would pose a risk to UK economic growth and it is unclear what impact tariffs would have on UK inflation, while she added that a tight UK labour market remains a problem and is worried that services inflation remains above pre-COVID levels.