Europe Market Open: Trump announces tariffs on Canada, China & Mexico; FOMC Minutes due

26 Nov 2024, 07:00 by Newsquawk Desk

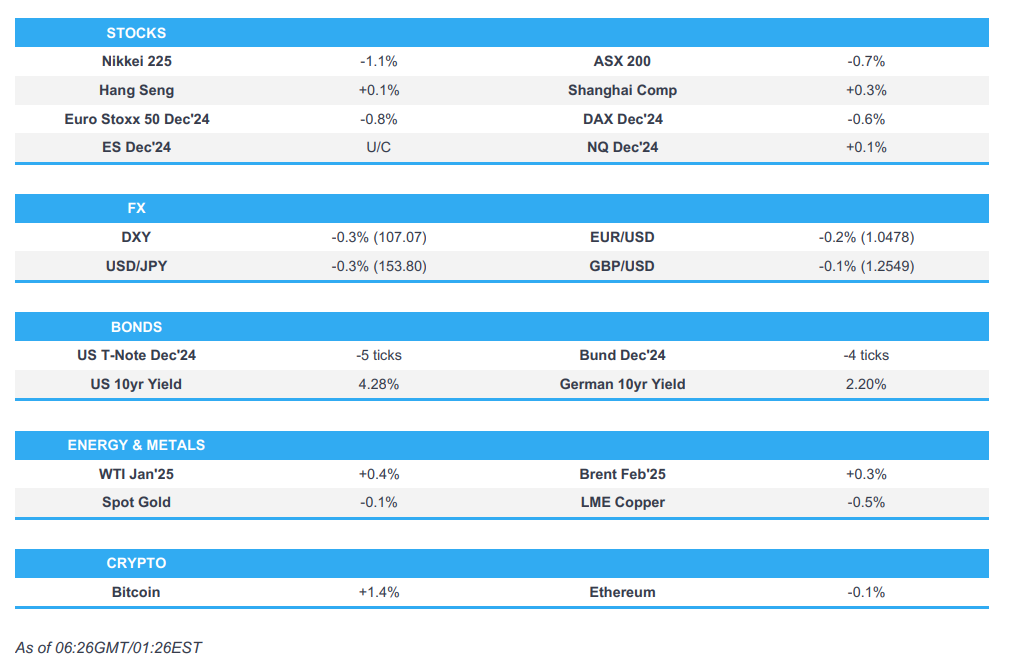

- APAC stocks were ultimately mixed but with early jitters seen following Trump's tariff remarks.

- Trump announced he is to charge Mexico and Canada a 25% tariff on all products and will charge China 'an additional 10% Tariff, above any additional Tariffs'.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.9% after the cash market closed higher by 0.2% on Monday.

- Israeli official said the Security Cabinet is likely to approve the ceasefire agreement, according to Bloomberg.

- DXY is firmer and back above the 107 mark, JPY is the best performer vs. the USD, EUR/USD is back below 1.05.

- Looking ahead, highlights include US Building Permits, Richmond Fed Index, FOMC Minutes, Speakers including ECB’s Rehn & BoC’s Mendes, Supply from Italy, Germany & US.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were positive in which the S&P 500, Dow and Russell 2000 all made fresh ATHs, while Treasuries bull flattened with the upside in both stocks and bonds primarily a response to the market-friendly pick of Scott Bessent as US President-elect Trump's Treasury Secretary as Bessent is seen as a fiscal conservative and has urged for a phased approach to the implementation of tariffs. Meanwhile, the dollar initially sold off on the news but then gradually nursed some of the losses ahead of this week's key events.

- SPX +0.30% at 5,987, NDX +0.14% at 20,805, DJIA +0.99% at 44,737, RUT +1.47% at 2,442.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President-elect Trump said as one of his many first executive orders, he will charge Mexico and Canada a 25% tariff on all products coming into the US which will remain in effect until drugs, in particular Fentanyl, and all 'Illegal Aliens' stop invading the US.

- US President-elect Trump stated on Truth Social that he would charge China “an additional 10% Tariff, above any additional Tariffs, on all of their many products coming into the United States of America” until drugs stop pouring into the US.

- US President-elect Trump spoke with Canadian PM Trudeau about trade and border security, while they had a good discussion and agreed to stay in touch, according to a Canadian source cited by Reuters. It was also reported that Canadian Deputy PM Freeland noted in a statement that Canada places the highest priority on border security and the integrity of the shared border with the US, while she added the relationship today is balanced and mutually beneficial, particularly for American workers.

- Fed's Goolsbee (2025 voter) said they are closer to the median on the neutral rate estimate but noted rates have a fair way to go before they go to neutral and reiterated that interest rates will be lower by the end of 2025, according to Fox Business.

- Fed's Kashkari (2026 voter) said the government must take steps to achieve a sustainable fiscal path, while he added that the natural rate may be higher and policy not as restrictive. Kashkari said geopolitical risks remain at the forefront of the economic outlook and that tit-for-tat tariffs may lead to inflation. Furthermore, he said it reasonable to consider a rate cut next month and said they are still considering a 25bps cut in December which is a reasonable debate for them to have.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed but with early jitters seen following Trump's tariff remarks against Canada, Mexico and China in which he announced to charge Mexico and Canada a 25% tariff on all products and will charge China 'an additional 10% Tariff, above any additional Tariffs'.

- ASX 200 declined with weakness seen in energy, gold stocks and financials after the recent drop in underlying commodity prices and yields.

- Nikkei 225 underperformed as firmer-than-expected Services PPI data supports the case for the BoJ to resume policy normalisation.

- Hang Seng and Shanghai Comp kept afloat in rangebound trade amid the latest Trump tariff threat but with the downside cushioned as increased tariffs would also likely be met with further policy support measures by China, while the PBoC recently pledged measures to promote tech including prioritising policy support for private, small and medium firms.

- US equity futures (ES U/C, NQ +0.1%) retreated as markets digested Trump's tariff comments but then gradually recovered and returned to flat territory.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.9% after the cash market closed higher by 0.2% on Monday.

FX

- DXY was initially boosted in reaction to Trump's latest tariff threats against Canada, Mexico and China which pressured CAD, MXN and CNH, while the selling then permeated across the greenback's major counterparts. However, the moves were then gradually reversed throughout the session ahead of upcoming data releases and the latest FOMC Minutes.

- EUR/USD reversed some of the prior day's gains and slipped back beneath the 1.0500 handle amid the firmer buck, while there were several comments from ECB officials including Nagel who said he is increasingly confident over disinflation but rate cuts must be gradual as risks remain.

- GBP/USD gave back yesterday's gains after failing to sustain the 1.2600 status and with headwinds seen following Trump's tariff comments, while a continued decline in the UK BRC Shop Price Index had little impact.

- USD/JPY trickled lower throughout the session and slipped beneath the 154.00 level amid firmer-than-expected Services PPI.

- Antipodeans were pressured as CNH weakened following Trump's latest tariff threats but have since bounced off worst levels, while the rebound was capped amid a quiet calendar and as participants await tomorrow's RBNZ meeting.

- PBoC set USD/CNY mid-point at 7.1910 vs exp. 7.2357 (prev. 7.1918)

FIXED INCOME

- 10yr UST futures took a breather after the recent bull flattening in response to the nomination of fiscal hawk Bessent as US Treasury Secretary, while participants now look ahead to a 5yr auction stateside and the FOMC Minutes.

- Bund futures traded flat as price action calmed down from the prior day's temperamental mood and ahead of German supply.

- 10yr JGB futures gave back some of the opening gains with resistance seen around the 143.00 level and after firmer-than-expected Japanese Services PPI data.

COMMODITIES

- Crude futures attempted to nurse some losses after falling by around 3% yesterday amid reports of an approaching ceasefire between Israel and Lebanon which was said to be announced within 36 hours, while the Israeli Security Cabinet will convene to vote on the Lebanon ceasefire deal.

- Spot gold was pressured as the dollar strengthened following Trump's latest tariff threats, although the precious metal then bounced back from lows to provide some relief after slumping by more than 3% yesterday.

- Copper futures declined amid the predominantly cautious mood owing to tariff-related concerns.

CRYPTO

- Bitcoin gained overnight and returned to above the USD 94,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Embassy in Washington said China believes China-US economic and trade cooperation is mutually beneficial in nature and said no one will win a trade war or a tariff war.

- China's Ambassador to Australia Xiao Qian said US policy on trade with China and other countries will have an impact, while he expects China and the US to engage with each other to talk about each other's policies on how to manage the relationship. Furthermore, he said he looks forward to a constructive relationship with Australia irrespective of what happens elsewhere.

- Shanghai Securities News cited analysts stating that the reduction in the MLF operation raises the possibility of a RRR cut and a 25bps-50bps RRR cut is expected in December.

DATA RECAP

- Japanese Services PPI (Oct) 2.90% vs. Exp. 2.50% (Prev. 2.60%)

GEOPOLITICS

MIDDLE EAST

- Israel’s government was reported to still have reservations about some details of the agreement regarding the Lebanon-Israel ceasefire, according to Al Jazeera. However, it was later reported that an Israeli official said the Security Cabinet is likely to approve the ceasefire agreement, according to Bloomberg.

- Israel Broadcasting Corporation quoted an Israeli political official stating the agreement with Lebanon is not an end to the war, but a ceasefire that will be evaluated daily, according to Sky News Arabia.

- Israel's Security Cabinet will convene today at 17:30 local time (10:30EST/15:30GMT) at the IDF headquarters in Tel Aviv to approve the Lebanon ceasefire deal, according to Axios citing an Israeli official.

- US President Biden and French President Macron will announce a ceasefire in Lebanon on Tuesday morning for about two months, according to Sky News Arabia citing the Israeli Broadcasting Authority.

- Four Senior Lebanese sources said there is a plan for US President Biden and French President Macron to announce a Hezbollah-Israel ceasefire deal within 36 hours, while the French Presidency said discussions on a ceasefire in Lebanon have made significant progress.

- US State Department believes that the gaps in the ceasefire agreement have been narrowed significantly but there are still steps that need to be taken, while it doesn't believe it has an agreement yet on Lebanon.

- White House said discussions Hochstein had on a Lebanon-Israel ceasefire were positive and going in the right direction, while National Security spokesman Kirby said they are close' on a Lebanon ceasefire. White House separately announced that US official McGurk will be in Saudi Arabia on Tuesday to discuss using a potential Lebanon ceasefire as a catalyst for a potential Gaza ceasefire.

- Israeli Channel 12 reported rocket shelling from southern Lebanon on Nahariya, according to Sky News Arabia. There were also reports of two Israeli raids on Lebanon's southern city of Nabatieh, according to Al Jazeera

- Israeli Broadcasting Authority said discussions on demarcating the border with Lebanon will take place 60 days after the ceasefire, according to Al Arabiya.

RUSSIA-UKRAINE

- Ukraine's Kyiv was under multi-wave Russian drone attacks, according to the Mayor, while it was separately reported that Russian air defences destroyed 39 Ukrainian drones overnight, according to Russian news agencies.

- Ukrainian Defense official said Moscow is "recruiting Yemeni Houthis to participate in hostilities against Ukraine" but added the current numbers are extremely low, serving as "cannon fodder", according to Fox News.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves said the UK budget measures will be good for growth and jobs.

- UK outlined the first steps of a plan to get more people back into work including increasing access to mental health support and to reform job centres.

- ECB's Makhlouf said rates are on a downward trajectory, while he is confident about inflation hitting the 2% target in 2025 and is open-minded on the slope of this downward trajectory. Makhlouf also noted there is substantial uncertainty over the policy of trade partners.

- ECB's Nagel said he is increasingly confident over disinflation but rate cuts must be gradual as risks remain, while he commented that Germany's growth is likely to stagnate in Q4 and Germany is falling behind the Eurozone average. Furthermore, he said the inflation goal is ‘soon’ to be met, but noted that risks remain and rates are still restrictive.

DATA RECAP

- UK BRC Retail Shop Price Index YY (Nov) -0.6% (Prev. -0.8%)