US Market Open: Dismal EZ PMIs hit risk sentiment, with Bonds bid and EUR at lows

22 Nov 2024, 11:15 by Newsquawk Desk

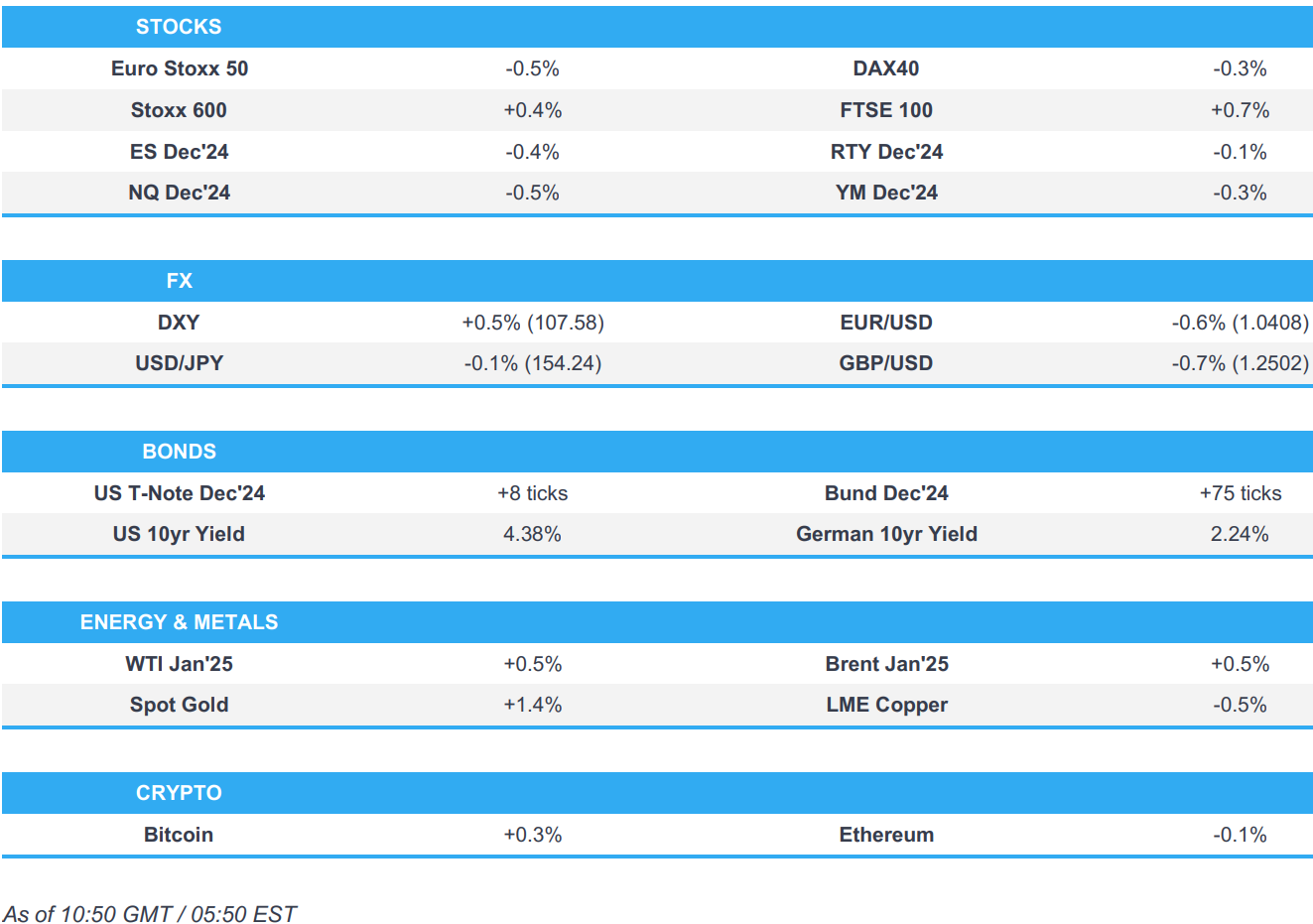

- Equities began the session on a firmer footing but now reside in negative territory after dismal EZ PMI metrics.

- USD firmer and ultimately benefiting from poor EZ PMIs which forced EUR/USD briefly onto a 1.03 handle. Sterling hit on its own data and Retail Sales beforehand.

- Bonds soar in reaction to dire EZ PMIs which have boosted the odds of a 50bps ECB cut.

- Crude is slightly firmer, XAU bid and base metals hit by sentiment.

- Looking ahead, US Flash PMIs. Speakers including ECB’s Nagel, Villeroy & Schnabel, SNB’s Schlegel & Fed's Bowman.

EUROPEAN TRADE

EQUITIES

- European bourses began the session entirely in the green, but sank into negative territory following the release of the French, German and then the EZ-wide PMI figures which continue to fuel anxiety related to growth within the region.

- European sectors opened with a strong positive bias, but following the PMI figures sectors are now mixed and display a slight defensive bias. Healthcare takes the top spot alongside Utilities, benefiting from the risk-off sentiment whilst Real Estate benefits from the relatively low yield environment.

- US equity futures are lower across the board in tandem with the dip in sentiment seen in Europe following the region's poor PMI figures.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD firmer vs. all peers (ex-JPY) alongside risk aversion triggered by a dreadful set of Eurozone PMI metrics. Ahead, S&P Global PMIs are due and whilst they normally play second-fiddle to the ISMs, a strong showing from the US could see a widening of US-EZ rate differentials. DXY has been as high as 108.09 which marks a fresh YTD peak.

- A dismal set of EZ PMI metrics has acted as a drag on EUR/USD with the pair printing a fresh YTD low and slipping onto a 1.03 handle for the first time since December 2022. ECB's Schnabel is due later (slides already released). Price action has since stabilised around the 1.0420 mark.

- JPY is steady vs. the USD following a session of outperformance yesterday. The latest Japanese inflation data provided little to spur price action as the figures printed mostly in line with expectations aside from the core reading which was slightly firmer-than-expected.

- A busy day of data for the UK has seen retail sales and PMI reports. On the latter, all three metrics fell short of expectations with the all-important services slipping to neutral territory. GBP/USD briefly slipped onto a 1.24 handle for the first time since 9th May.

- Antipodeans are both softer vs. the broadly firmer USD and in the wake of losses in Chinese equities overnight. AUD/USD has slipped back onto a 0.65 handle.

- PBoC set USD/CNY mid-point at 7.1942 vs exp. 7.2502 (prev. 7.1934).

- PBoC official said they will prevent the formation of one-sided expectations on the yuan and will keep the yuan basically stable at a reasonable and balanced level.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are firmly in the green and resides just off session highs following the release of the French, German and then the EZ-wide PMI figures, which boosted the odds of a 50bps cut at the ECB's December confab. Overall, the data leaves Bunds and OATs near highs of 133.32 and 125.52 respectively.

- Gilts opened lower by a handful of ticks and printed a 93.88 trough before then climbing as participants digested the morning’s retail sales data which was softer than expected across the board. Thereafter, Gilts picked up in tandem with peers and then took another leg higher following region's own PMI figures which were softer across the board. Action which saw Gilts spike higher from 94.58 to a 94.90 peak before fading essentially all of the move.

- USTs are firmer moving in tandem with the above thus far. Rose to a 109-25 peak on the morning’s flash PMIs from the bloc and France/Germany beforehand. For the session ahead, USTs await their own PMIs with the Fed docket very light today until Bowman after hours.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are modestly firmer on the session, though the benchmarks came under pressure on the growth/demand implications of the EZ and UK Flash PMIs and as the USD picked up. Currently at USD 70.20/bbl and USD 74.45/bbl respectively, in the green but at the lower-end of circa. USD 0.80/bbl parameters.

- Gold is in the green, benefiting from the ongoing tense geopolitical backdrop and lifting with fixed income on the dismal PMIs out of the EZ and UK. As it stands, the yellow metal is just off a USD 2707/oz best, well above Thursday's USD 2673/oz high and at a new peak for the week.

- Base metals began the session on the backfoot and then took another leg lower in tandem with the souring risk tone spurred on by the abysmal PMI metrics from France, Germany and the EZ.

- Goldman Sachs sees upside risks to Brent prices in the short term with Brent seen rising to mid-USD 80s/bbl in 2025 H1 if Iran supply drops 1mln bpd on tighter sanctions enforcement, but sees medium-term price risks skewed to the downside given high spare capacity and estimates Brent to drop to the low USD 60s in 2026 in a 10% across-the-board tariff scenario or if OPEC supply rises through 2025.

- Russian Deputy PM Novak tells the OPEC Secretary General that they plan to develop cooperation with OPEC. Energy market is under significant pressure, incl. price fluctuations.

- Worldsteel (Oct): Global steel output 151.2mln/T, +0.4% Y/Y; China 81.9mln/T, +2.9% Y/Y.

- Oil loadings from Russia's western ports seen falling by 100k bpd to 1.8mln bpd in Dec-Nov, according to Reuters sources.

- Click for a detailed summary

NOTABLE DATA RECAP

- German HCOB Composite Flash PMI (Nov) 47.3 vs. Exp. 48.6 (Prev. 48.6); "...the modest increase in the future output index might reflect some hope that the next German government will manage to turn the economy around with bold measures"

- German HCOB Manufacturing Flash PMI (Nov) 43.2 vs. Exp. 43.0 (Prev. 43.0); Services Flash PMI (Nov) 49.4 vs. Exp. 51.6 (Prev. 51.6)

- French HCOB Composite Flash PMI (Nov) 44.8 vs. Exp. 48.3 (Prev. 48.1); "particularly alarming is the outlook for the future." & "The only silver lining is that service providers are still creating new jobs"

- French HCOB Manufacturing Flash PMI (Nov) 43.2 vs. Exp. 44.5 (Prev. 44.5); Services Flash PMI (Nov) 45.7 vs. Exp. 49.0 (Prev. 49.2)

- EU HCOB Composite Flash PMI (Nov) 48.1 vs. Exp. 50.0 (Prev. 50.0); "The eurozone's manufacturing sector is sinking deeper into recession, and now the services sector is starting to struggle after two months of marginal growth."

- EU HCOB Services Flash PMI (Nov) 49.2 vs. Exp. 51.6 (Prev. 51.6); HCOB Manufacturing Flash PMI (Nov) 45.2 vs. Exp. 46.0 (Prev. 46.0)

- UK Flash Composite PMI (Nov) 49.9 vs. Exp. 51.8 (Prev. 51.8); "The November PMI is indicative of the economy slipping into a modest decline, with GDP dropping at a 0.1% quarterly rate, but the loss of confidence hints at worse to come – including further job losses –unless sentiment revives."

- UK Flash Manufacturing PMI (Nov) 48.6 vs. Exp. 50.0 (Prev. 49.9); Flash Services PMI (Nov) 50.0 vs. Exp. 52.0 (Prev. 52.0)

- UK Retail Sales MM (Oct) -0.7% vs. Exp. -0.3% (Prev. 0.3%, Rev. 0.1%); Ex-Fuel MM -0.9% vs. Exp. -0.4% (Prev. 0.3%, Rev. 0.1%)

- UK Retail Sales YY (Oct) 2.4% vs. Exp. 3.4% (Prev. 3.9%, Rev. 3.2%); Ex-Fuel YY (Oct) 2.0% vs. Exp. 3.3% (Prev. 4.0%, Rev. 3.2%)

- German GDP Detailed QQ SA (Q3) 0.1% vs. Exp. 0.2% (Prev. 0.2%); YY NSA (Q3) 0.1% vs. Exp. 0.2% (Prev. 0.2%)

- UK GfK Consumer Confidence (Nov) -18.0 vs. Exp. -22.0 (Prev. -21.0)

NOTABLE US HEADLINES

- US President-elect Trump considers Kevin Warsh to serve as Treasury Secretary and then Fed Chair, according to WSJ.

- US President-elect Trump nominated Pam Bondi as Attorney General after Matt Gaetz withdrew himself for consideration.

GEOPOLITICS

MIDDLE EAST

- US Envoy Hochstein leaves Israel at dawn for Washington without announcing the outcome of the talks, according to Alhadath

- Israeli Home Front announced that sirens sounded in Haifa Bay and Krayot, according to Al Jazeera.

- Israeli army called on residents of three towns in southern Lebanon to evacuate their homes immediately, according to Asharq News.

- IAEA's board of governors passed a resolution ordering Iran to urgently improve cooperation with the IAEA, while the board asked the IAEA to produce a 'comprehensive' report on Iran by the spring of 2025.

OTHER

- "Fearing a Russian missile attack on the government quarter in Kyiv, all sessions at Ukraine’s parliament (Verkhovna Rada) have been cancelled for today. Politicians warned to avoid the area", via Michael Bociurkiw on X.

- North Korean leader Kim called for developing and upgrading weaponry, as well as vowed to continue developing defence capabilities, while he said the US has ratcheted up tension and provocations while expanding nuclear-sharing alliances. Furthermore, Kim said the Korean Peninsula has never faced such risks of nuclear war as of now and that previous experience of negotiations with the US only highlighted its hostile policy, according to KCNA.

CRYPTO

- Bitcoin climbed above USD 99k briefly in early European trade before stabilising back to around USD 98.5k.

APAC TRADE

- APAC stocks mostly sustained the momentum from Wall St where stocks ultimately gained after whipsawing on geopolitical-related headlines and amid mixed data, although pressure was seen in China after weak earnings and an underwhelming briefing from Beijing.

- ASX 200 rallied with energy leading the advances seen in nearly all sectors aside from tech, while sentiment was also unfazed by the contractions across Australia flash PMI figures.

- Nikkei 225 gained following confirmation from Japanese PM Ishiba of a JPY 39tln stimulus package, while the latest inflation data from Japan printed mostly in line with expectations and is unlikely to have any ramifications for BoJ policy.

- Hang Seng and Shanghai Comp were pressured with Baidu the worst performer in the Hang Seng Index following a decline in its profit and revenue, while sentiment was also not helped by the PBoC's net liquidity drain and after comments from China's Vice Commerce Minister on foreign trade failed to inspire.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Commerce Minister Wang said China's foreign trade maintained positive momentum and a stable and sound development trend but noted that China has seen slower foreign trade growth since August. Wang said regarding Trump tariffs and the yuan that China is able to resolve and resist impacts of external shock, while he added that China will safeguard its sovereignty, safety and development benefits, as well as announced that MOFCOM will roll out policies on expanding trade of green products sometime next year.

- China’s MIIT said it is to develop policies for digital transformation in manufacturing and AI-driven new industrialisation.

- China is willing to engage in "positive dialogue" on trade with US under President-elect Trump, according to the FT citing senior officials.

- China smartphone sales +8% Y/Y in Q3, via counterpoint research

DATA RECAP

- Japanese National CPI YY (Oct) 2.3% vs. Exp. 2.3% (Prev. 2.5%); Ex. Fresh Food YY (Oct) 2.3% vs. Exp. 2.2% (Prev. 2.4%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Oct) 2.3% vs. Exp. 2.3% (Prev. 2.1%)

- Japanese JibunBK Manufacturing PMI Flash SA (Nov) 49.0 (Prev. 49.2); Services PMI Flash SA (Nov) 50.2 (Prev. 49.7)

- Japanese JibunBK Composite Op Flash SA (Nov) 49.8 (Prev. 49.6)

- Australian Judo Bank Manufacturing PMI Flash (Nov) 49.4 (Prev. 47.3); Services PMI Flash (Nov) 49.6 (Prev. 51.0)

- Australian Judo Bank Composite PMI Flash (Nov) 49.4 (Prev. 50.2)

- Singapore GDP QQ (Q3 F) 3.2% vs Exp. 2.5% (Prelim. 2.1%); YY (Q3 F) 5.4% vs Exp. 4.6% (Prelim. 4.1%)