US Market Open: DXY on the backfoot & crude sells off after constructive ceasefire advancements

15 Nov 2024, 11:15 by Newsquawk Desk

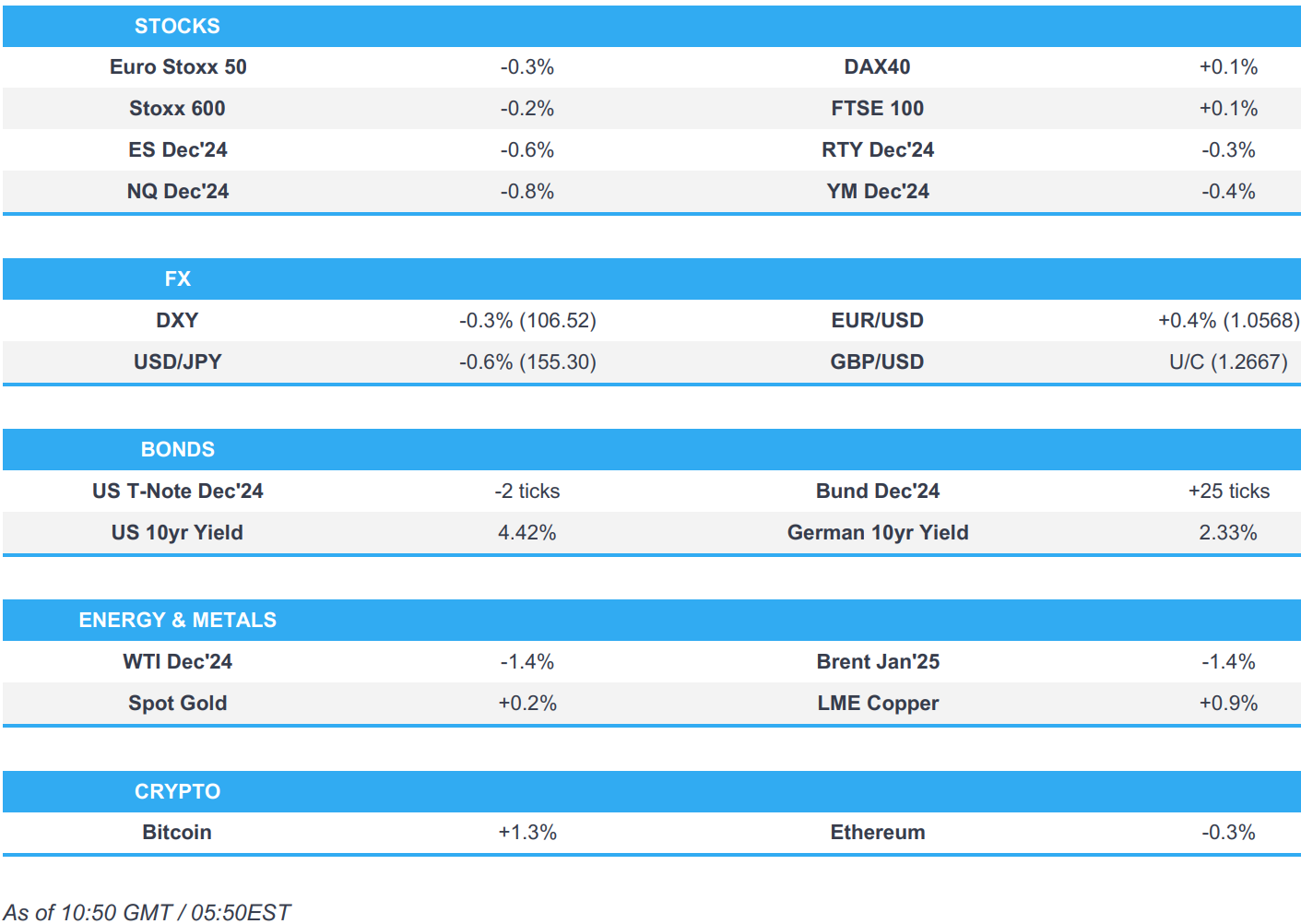

- European bourses are mixed vs initially opening entirely in the red; US futures sit in negative territory.

- DXY is on the backfoot and holds around 106.50, JPY outperforms.

- USTs are under pressure in a continuation of the price action seen following a hawkish-leaning Powell; Gilts bid after the UK’s downbeat GDP metrics.

- Crude is in the red, XAU is flat, whilst base metals hold a positive bias alongside the pullback in the Dollar.

- Looking ahead, US Retail Sales, Capacity Utilisation, BoC SLOS, Speakers including ECB’s Lane & Cipollone, Panetta, Fed's Goolsbee, Collins & Williams, Barkin, Earnings from Alibaba.

EUROPEAN TRADE

EQUITIES

- European bourses began the session on a mostly lower footing, in a continuation of the losses seen on Wall St. in the prior session; a paring of the strength seen in Europe on Thursday may also be at play. Since the cash open, sentiment gradually improved, but indices now display a mixed picture in Europe.

- European sectors are mixed vs initially opening with a strong negative bias. Energy is towards the top of the pile, with Banks and Insurance following just behind. Healthcare is by far the clear underperformer, with several heavyweights within the sector seeing notable downside after US President-elect Trump picked vaccine sceptic RFK Jr as HHS Secretary.

- US equity futures are entirely in the red, with slight underperformance in the tech-heavy NQ, in a continuation of the negative price action seen in the prior session; which was ultimately sparked by a hawkish-leaning Powell.

- US finalises USD 6.6bln chips subsidy award for TSMC, according to the US Commerce Department.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is pulling back after another surge on Thursday which saw a high of 107.07, with hawkish Powell keeping the buck afloat in late hours. Ahead, US retail sales and a number of Fed speakers. Comments from Fed's Collins who noted that a December rate cut is "certainly on the table but is not a done deal", had little impact on the index.

- EUR is benefitting from a softer Dollar and seeing a rebound from yesterday's worst levels (1.0496 low) as the pair attempts to climb back to yesterday's best (1.0582).

- GBP is relatively flat and unable to benefit from the pullback in the Dollar following downbeat GDP data across the board.

- JPY is the G10 outperformer after a week of underperformance with desks citing pre-weekend profit-taking, whilst Japanese GDP data mostly matched or topped estimates. USD/JPY overnight hit a fresh weekly high of 156.74 before pulling back to a current 155.40 low.

- Antipodeans are modestly firmer as DXY pulls back from its weekly highs, in turn offering some reprieve to peers alongside the base metals complex.

- PBoC set USD/CNY mid-point at 7.1992 vs exp. 7.2482 (prev. 7.1966).

- Indonesia's Central Bank says it has conducted "triple intervention" within the FX market to maintain market confidence.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are under slight pressure as markets continue to digest the hawkish tone from Powell. As it stands, USTs have climbed above the overnight low at 109-06, and currently sits below its session high at 109-16+. Yields are currently firmer across the curve with the short-end leading after the Fed Chair. US Retail Sales and Fed speak is due.

- Bunds spent first part of the morning with a very slight negative bias, in-fitting with USTs. Benchmarks seemingly derived some support most recently from the latest Commission forecasts. EZ-specific updates have been fairly limited, but the docket ahead sees Lane, Cipollone & Panetta.

- Gilts are the modest outperformer as the morning’s GDP data serves as a dovish impetus. Though, market pricing hasn’t really changed with just a ~20% chance of a December cut. Up to a 93.89 peak, having surpassed the 93.85 from Thursday but is yet to test the 94.00 mark.

- UK DMO plans to hold three syndicated Gilt sales in the January-March 2025 period; intends to sell a new 10yr Gilt and 20-25yr I/L syndication in February and March.

- Click for a detailed summary

COMMODITIES

- Crude is lower across the board heading into the end of the week amid efforts to reach a ceasefire between Israel and Lebanon whilst Iran attempts to cool tensions with the US. Brent Jan also trades towards the lower end of its USD 71.33-72.39/bbl range.

- Mixed trade across precious metals this morning despite the substantial pullback in the Dollar, with some potential tailwinds emanating from attempts to cool geopolitical tensions amid efforts to reach a ceasefire between Israel and Lebanon whilst Iran attempts to cool tensions with the US. Spot gold yesterday briefly dipped under its 100 DMA (2,545.21/oz) to a USD 2,536.71/oz low.

- Mixed trade across base metals with a positive bias in recent trade as prices recover alongside the pullback in the Dollar. 3M LME copper trades on either side of USD 9,000/t in a current USD 8,997.50-9,077.50/t range. Copper caught a slight bid following news that China's Finance Ministry will cancel the export tax rebate for aluminium and copper products.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP Prelim QQ (Q3) 0.1% vs. Exp. 0.2% (Prev. 0.5%); YY 1.0% vs. Exp. 1.0% (Prev. 0.7%)

- UK GDP Estimate MM (Sep) -0.1% vs. Exp. 0.2% (Prev. 0.2%); YY 1.0% vs. Exp. 1.1% (Prev. 1.0%, Rev. 1.1%); 3M/3M (Sep) 0.1% vs. Exp. 0.2% (Prev. 0.2%)

- French CPI (EU Norm) Final YY (Oct) 1.6% vs. Exp. 1.5% (Prev. 1.5%); CPI (EU Norm) Final MM (Oct) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- Italian CPI (EU Norm) Final MM (Oct) 0.3% vs. Exp. 0.3% (Prev. 0.3%); Consumer Prices Final YY (Oct) 0.9% vs. Exp. 0.9% (Prev. 0.9%); CPI (EU Norm) Final YY (Oct) 1.0% vs. Exp. 1.0% (Prev. 1.0%)

NOTABLE EUROPEAN HEADLINES

- European Commissions sees EZ economic growth at 0.8% in 2024, 1.35% in 2025, 1.6% in 2026. Sees EZ inflation at 2.4% in 2024, 2.1% in 2025, 1.9% in 2026. Sees German GDP to expand by 0.7% in 2025 (prev. forecast 1.0%). GDP growth expected to accelerate to 1.3% in 2026 (remains below EZ avg. of 1.6%). German economy contract 0.1% this year vs 0.1% growth in spring forecast.

- Germany's SPD leader says they do not need to wait for a new gov't to begin debt brake reform, willingness to reform from the opposition leader is a good starting point, via Handelsblatt.

NOTABLE US HEADLINES

- Fed's Collins (2025 voter) says a December rate cut is "certainly on the table but is not a done deal", according to WSJ. Expects lower rates will be warranted. Says Fed policy is restrictive. Does not see signs of new price pressures. There will be more data between now and December meeting.

- US Treasury's semi-annual currency report found no major US trading partners manipulated currency to gain unfair trade advantage in four quarters through June 2024 as no major trading partners met all three criteria for enhanced analysis during the review period. However, the monitoring list of trading partners whose currency practices 'merit close attention' includes China, Japan, South Korea, Singapore, Taiwan, Vietnam and Germany.

- US President-elect Trump picked RFK Jr to be Health and Human Services Secretary and said North Dakota Governor Burgum will be the Interior Secretary. It was separately reported that a US private funds group asked Trump to review harmful rules, preserve pro-growth taxes and promote alternative assets, according to a letter cited by Reuters.

GEOPOLITICS

MIDDLE EAST

- The Senior Advisor to Iran's Khamenei says "we support any ceasefire decision taken by the Lebanese government and resistance".

- Israeli source says Hezbollah's response to the American outline is expected "within days", according to Kann News.

- Iran provided written assurances to the US administration in October that it was not seeking to kill Presidential contender Trump, via WSJ citing a US official; assurances which were intended to cool tensions between the US and Iran.

- Iran is preparing for Operation Sincere Promise 3 to respond to the Israeli attack, according to Sky News Arabia citing a Member of the Expediency in Iran.

- Israeli army issues new warnings to evacuate buildings in Burj al-Barajneh and Ghobeiry in the southern suburb of Beirut, according to Sky News Arabia.

- Israeli forces push deeper into Lebanon in a widening war campaign, while the expanding ground operation risks protracted conflict but could build leverage for ceasefire talks, according to WSJ.

- Hezbollah said it targeted a military base in Israel's Tel Aviv and targeted a gathering of Israeli enemy forces in the Kiryat Shmona settlement with a barrage of rockets, according to Sky News Arabia.

- Elon Musk and Iran's ambassador reportedly discussed how to ease US and Iran tensions, according to NYT. Iran's ambassador told Musk during the meeting on Monday that sanctions waivers should be obtained from the Treasury Department, while Iranian sources said the meeting was positive, according to Al Arabiya.

OTHER

- US President-elect Trump said they will avoid what happened before with their military in Afghanistan and will deal with the situation in Ukraine better, as well as work to reach a solution to the crisis.

- US President Biden administration official said the US must be prepared to expand its nuclear weapons force, while the decision on expanding US nuclear force will be left to President-elect Trump, according to WSJ.

- US and UK brought into force an amendment to the 1958 agreement between the two countries for cooperation in the uses of atomic energy in defence which will make the agreement enduring in its entirety, according to the US State Department.

- North Korean leader Kim guided a test of attack drones and ordered the mass production of suicide drones.

- Taiwan President Lai is planning to stop in Hawaii and maybe Guam during a visit to Pacific allies in the coming weeks, according to sources cited by Reuters.

- China's Coast Guard said with China’s permission, the Philippines sent a civilian ship to transport supplies to its 'illegally' beached warship at the Second Thomas Shoal.

- The US plans additional sanctions to restrict Russia's energy trade, plans to prohibit banks from dealing with Gazprombank, according to Nikkei.

CRYPTO

- Bitcoin is back on a firmer footing and holds just above USD 89k.

APAC TRADE

- APAC stocks traded with a predominantly positive bias albeit with gains capped following the uninspiring handover from Wall Street and as participants digested recent earnings releases and mixed Chinese activity data.

- ASX 200 was led by outperformance in Utilities and with gains in nearly all sectors aside from Healthcare amid headwinds for the latter following pressure in the industry stateside after US President-elect Trump picked vaccine sceptic RFK Jr as HHS Secretary.

- Nikkei 225 rallied on the back of recent currency weakness and with outperformance seen in some financial names after Japanese megabanks' earnings results, while GDP data was mostly either inline or better than expected.

- Hang Seng and Shanghai Comp ultimately gained but saw mixed price action throughout the day after various data releases in which Industrial Production disappointed but Retail Sales topped forecasts, while Chinese Home Prices showed a steeper Y/Y drop although the M/M decline moderated. Participants also digested tech earnings and the PBoC's largest daily liquidity injection via reverse repos in over four years which is meant to counteract factors including maturing MLF loans and tax payments.

NOTABLE ASIA-PAC HEADLINES

- China's Finance Ministry will reduce export tax rebate rate for refined oil products, photovoltaics, batteries, and select non-metallic mineral products from 13-9% from Dec 2024. Will cancel the export tax rebate for aluminium and copper products, and chemically modified animal, plant, or microbial oils and fats.

- Alibaba (BABA/ 9988 HK) reportedly mulling offering USD 5bln in bonds.

- China's MOFCOM is releasing a dual-use item export control list, which will be effective from December 1st; does not involve adj. to specific scope of export control.

- Hong Kong revises 2024 GDP forecast to 2.5% (prev. forecast at 2.5-3.0%)

- PBoC injected CNY 981bln via 7-day reverse repos with the rate at 1.50% which was the largest daily cash injection through reverse repos since February 2020, while it stated that Friday's cash injection through reverse repos was meant to counteract factors including maturing MLF loans and tax payments.

- China's stats bureau said domestic demand is still insufficient but noted major economic indicators recovered 'markedly' in October and China's consumer expectations improved, while they will consolidate the trend in economic recovery, step up policy adjustments and expand domestic demand. Furthermore, it stated that recent policies have shown positive effects on the economy and it is increasingly confident of achieving the 2024 economic growth target but noted that consumption growth still faces some constraints.

- Japanese Finance Minister Kato said they will take appropriate action against excessive FX moves, while he added that one-sided, sharp moves were seen in the FX market and it is important for FX rates to move stably reflecting fundamentals.

DATA RECAP

- Chinese Industrial Output YY (Oct) 5.3% vs. Exp. 5.6% (Prev. 5.4%)

- Chinese Retail Sales YY (Oct) 4.8% vs. Exp. 3.8% (Prev. 3.2%)

- Chinese FDI (YTD) Oct) -29.8% (Prev. -30.4%)

- Chinese Urban Investment (YTD)YY (Oct) 3.4% vs. Exp. 3.5% (Prev. 3.4%)

- Chinese Unemp Rate Urban Area (Oct) 5.0% (Prev. 5.1%)

- Chinese China House Prices MM (Oct) -0.5% (Prev. -0.7%)

- Chinese China House Prices YY (Oct) -5.9% (Prev. -5.8%)

- Japanese GDP QQ (Q3) 0.2% vs. Exp. 0.2% (Prev. 0.7%)

- Japanese GDP QQ Annualised (Q3) 0.9% vs. Exp. 0.7% (Prev. 2.9%)