Europe Market Open: Fed speak in focus with DXY above 106.50 & USTs lacklustre, Powell ahead

14 Nov 2024, 07:03 by Newsquawk Desk

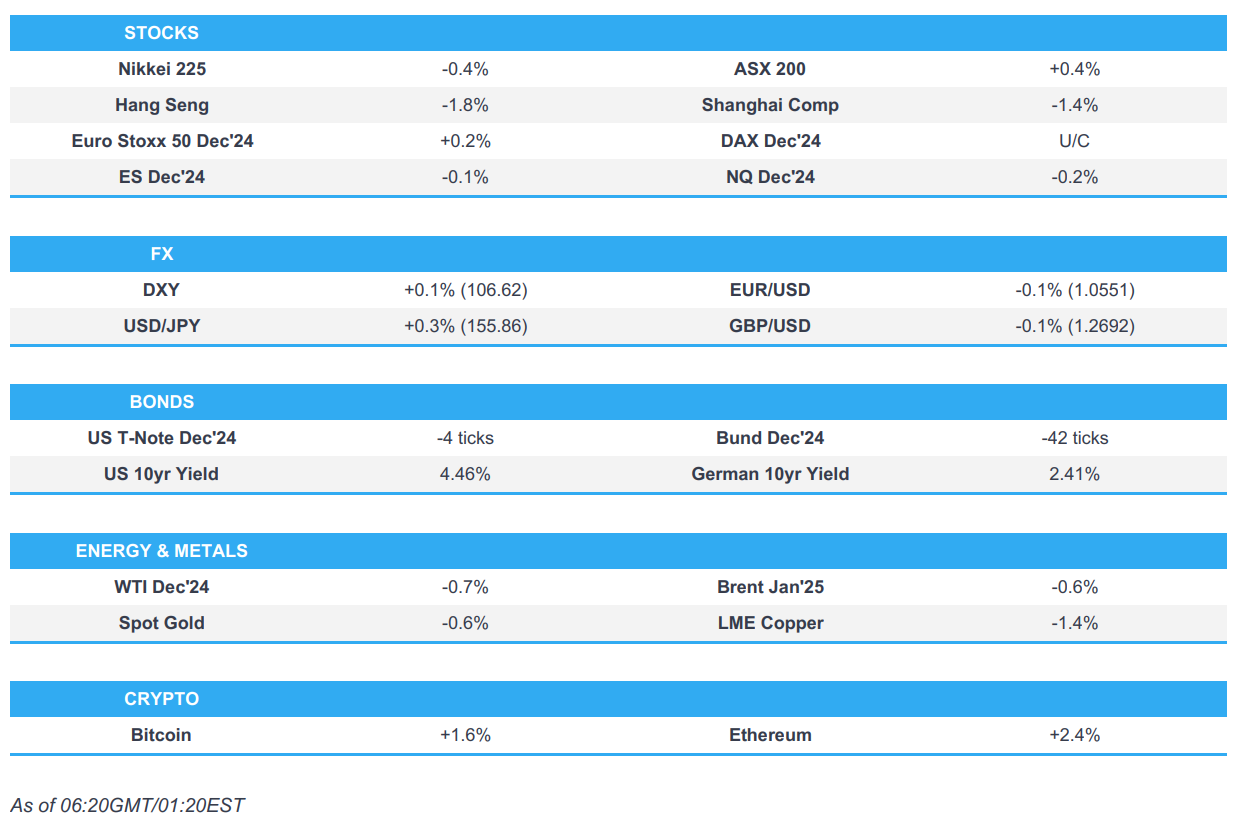

- APAC stocks were mostly subdued following the indecisive lead from Wall Street. DXY extended above 106.50 and 10yr UST futures were lacklustre, while there was a lack of fresh major catalysts.

- Fed's Musalem (2025 voter) noted recent information suggests that the risk of inflation moving higher has risen and risks to the job market remain unchanged or have fallen.

- Fed's Schmid (2025 voter) said "it remains to be seen" how much more the Fed will cut rates and where they may settle.

- China reportedly armed itself for a potential trade war with Trump as Beijing has enacted sweeping laws since the US President-elect’s first term that would allow it to retaliate if threatened, according to FT.

- Israel is reportedly preparing a Lebanon ceasefire plan as a "gift" to US President-elect Trump, according to WaPo.

- Looking ahead, highlights include EU Jobs & GDP, US Initial Jobless Claims, US PPI (Final), Japanese GDP, IEA OMR, ECB Minutes. Speakers include ECB’s Lagarde, de Guindos & Schnabel, Fed’s Powell, Barkin, Williams & Kugler, BoE's Bailey & Mann. Supply from the US. Earnings from Siemens, Deutsche Telekom, Merck, Swiss Re, Burberry, Disney, Brookfield, Applied Materials, JD.Com & Advanced Auto Parts.

SNAPSHOT

US TRADE

EQUITIES

- US stocks were choppy and finished mixed following the US CPI data which printed in line with expectations and initially triggered a dovish reaction owing to the lack of upside surprise which boosted December Fed rate cut bets, as well as benefitted bonds and pressured the dollar.

- However, the initial moves were then reversed as the 'Trump Trade' gathered steam once again which lifted the dollar to YTD highs, weighed on bonds and boosted Bitcoin to briefly above USD 93,000.

- SPX +0.02% at 5,985, NDX -0.16% at 21,036, DJIA +0.11% at 43,958, RUT -0.94% at 2,369.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said the Fed may be on the "last mile" to price stability and inflation is expected to converge to the 2% target over the medium term, while he noted recent information suggests that the risk of inflation moving higher has risen and risks to the job market remain unchanged or have fallen. Musalem added that monetary policy is 'well positioned' and the Fed can 'judiciously and patiently' judge incoming data to decide on further rate cuts. Furthermore, he noted monetary policy is to remain 'appropriately restrictive' while inflation remains above 2% and further rate easing is appropriate if inflation continues to fall. He added that the data since the Fed policy meeting suggests the economy may be materially stronger than expected and inflation data is also stronger but has not yet changed the view that policy is on a path to neutral.

- Fed's Schmid (2025 voter) said "it remains to be seen" how much more the Fed will cut rates and where they may settle, while he added that Fed rate cuts to date are an "acknowledgement" of growing confidence inflation is on the path to the 2% goal. Furthermore, Schmid said the baseline of interest-rate cost appears to be higher than people thought a year or two ago.

- US President-elect Trump confirmed he will name Marco Rubio as Secretary of State and he picked Matt Gaetz (who is seen as pro-marijuana) to serve as Attorney General.

- Pennsylvania Senate seat race will be subjected to a recount after the vote result was within the threshold for an automatic recount under state law, according to NBC.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the indecisive lead from Wall Street where stock markets were choppy after in-line CPI data and continued 'Trump trade' flows, while there was a lack of fresh major catalysts to drive price action.

- ASX 200 gained as strength in Tech and Financials picked up the slack from the weakness in the commodity-related sectors but with the upside capped by disappointing jobs data.

- Nikkei 225 wiped out all of its initial gains and returned to beneath the 39,000 level despite a weaker currency.

- Hang Seng and Shanghai Comp remained pressured despite the lack of fresh catalysts and ahead of tomorrow's activity data with weakness seen in property stocks, while tech names are mixed ahead of key earnings, although Tencent was an early outperformer in Hong Kong after its quarterly results beat estimates on the bottom line.

- US equity futures were restricted after the prior day's choppy performance ahead of more data and Fed speakers.

- European equity futures are indicative of a slightly higher cash open with the Euro Stoxx 50 future +0.2% after the cash market closed lower by 0.1% on Wednesday.

FX

- DXY extended on gains to a yearly high with a firmer footing above the 106.00 level after the prior day's intraday rebound whereby a continuation of the Trump trade offset the headwinds from the lack of upward surprise in the latest CPI data. There were also remarks from Fed members including Fed's Musalem who noted recent information suggests that the risk of inflation moving higher has risen and that the Fed can 'judiciously and patiently' judge incoming data to decide on further rate cuts.

- EUR/USD fell to its lowest levels in a year after slipping beneath 1.0600 and is on course for a fifth consecutive daily loss, while there is a slew of EU releases ahead including Q3 GDP, Industrial Production, Employment Change and ECB Minutes.

- GBP/USD trickled beneath the prior day's lows with little to spur a rebound ahead of comments from BoE's Bailey and Mann.

- USD/JPY continued its upward trend and breached the 156.00 level as the dollar remained firm and with Japanese officials relatively tight-lipped so far about the latest currency moves.

- Antipodeans were pressured amid dollar strength, the mixed risk appetite and weaker-than-expected Australian jobs data.

- PBoC set USD/CNY mid-point at 7.1966 vs exp. 7.2326 (prev. 7.1991).

FIXED INCOME

- 10yr UST futures were lacklustre after the prior day's whipsawing following the in-line CPI data from the US which boosted bets for a 25bps rate cut in December and initially lifted prices, before reversing the entire move alongside the 'Trump trade', while participants now await several Fed speakers including Powell and data releases such as PPI and the latest jobless claims numbers.

- Bund futures remained subdued after the recent selling pressure and ahead of a slew of upcoming data releases from the EU.

- 10yr JGB futures lacked demand following the declines in peers albeit with the downside cushioned in the absence of any major catalysts from Japan and with a floor around the 143.00 level.

COMMODITIES

- Crude futures were lacklustre after yesterday's choppy performance owing to mixed geopolitical headlines, while the latest private sector inventory data was mixed with a surprise draw in crude and a larger-than-expected build in distillates.

- Private Inventory Data (bbls): Crude -0.8mln (exp. +0.1mln), Gasoline +0.3mln (exp. +0.6mln), Distillate +1.1mln (exp. +0.2mln), Cushing -1.9mln.

- EIA STEO sees 2024 world oil output of 102.6mln BPD (prev. 102.5mln) and 2025 output of 104.7mln BPD (prev. 104.5mln), while 2024 world oil demand is seen at 103.1mln BPD (prev. 103.1mln BPD) and 2025 demand of 104.4mln BPD (prev. 104.3mln).

- Spot gold declined further beneath the USD 2,600/oz level with pressure from the broad dollar strength.

- Copper futures retreated to a 3-month low amid the uninspired risk sentiment and weakness across the complex.

CRYPTO

- Bitcoin eased back after a brief ascent above USD 93,000 and oscillated around the USD 90,000 level overnight.

NOTABLE ASIA-PAC HEADLINES

- China reportedly armed itself for a potential trade war with Trump as Beijing has enacted sweeping laws since the US President-elect’s first term that would allow it to retaliate if threatened, according to FT.

- US President Biden and Chinese President Xi are to meet on Saturday in Lima, Peru and are expected to 'take stock' of their relationship, while China is taking some steps to help the US combat the global fentanyl crisis. Furthermore, Biden will express concerns to Xi over Chinese support for Russia's war in Ukraine, North Korean deployment in Russia, and Chinese actions in the Taiwan Strait and South China Sea, as well as cyber issues.

- Japan is planning a JPY 13.5tln extra budget to fund the stimulus package with PM Ishiba looking to finalise the stimulus package on November 22nd, according to Sankei.

DATA RECAP

- Australian Employment (Oct) 15.9k vs. Exp. 25.0k (Prev. 64.1k)

- Australian Unemployment Rate (Oct) 4.1% vs. Exp. 4.1% (Prev. 4.1%)

- Australian Participation Rate (Oct) 67.1% vs. Exp. 67.2% (Prev. 67.2%)

GEOPOLITICS

MIDDLE EAST

- Israeli officials stated as of now, the Iranians withdrew from their decision to respond and that Trump's election had an impact on Iran's decision on whether to retaliate, according to Kann News' Stein.

- Israel is reportedly preparing a Lebanon ceasefire plan as a "gift" to US President-elect Trump, according to WaPo.

- Israeli army warned of striking buildings in Haret Hreik and Burj al-Barajneh in the southern suburbs of Beirut, while it was later reported that Israeli warplanes attacked Beirut's southern suburbs.

- Israeli Home Front said sirens sounded in Averim and Ma'a lot-Tarshiha in Upper Galilee after rocket fire was detected, while Hezbollah said it shelled with a rocket barrage a gathering of the Israeli enemy forces in the settlement of Sa'saa, according to Al Jazeera. Hezbollah also announced the targeting of the headquarters of the Israeli Ministry of Defense and General Staff in Tel Aviv for the second time on Wednesday.

- Iraqi armed factions said they attacked a vital target in northern Israel with drones, according to Sky News Arabia.

- There were initial reports of Israeli aggression targeting Syria's Homs countryside, according to Syrian state media.

- European powers are reportedly pushing for a new resolution against Iran by the UN atomic watchdog's board next week to pressure Tehran over its poor cooperation, according to Reuters citing diplomats.

OTHER

- White House said US President Biden reinforced the need to back Ukraine in the meeting with President-elect Trump.

EU/UK

- UK Chancellor Reeves is planning on introducing pension legislation changes to create a series of "megafunds" by pooling pension savings, according to Bloomberg.

DATA RECAP

- UK RICS Housing Survey (Oct) 16.0 vs. Exp. 11.0 (Prev. 11.0)