US Market Open: Dollar & USTs flat ahead of US CPI and a slew of Fed speakers

13 Nov 2024, 11:20 by Newsquawk Desk

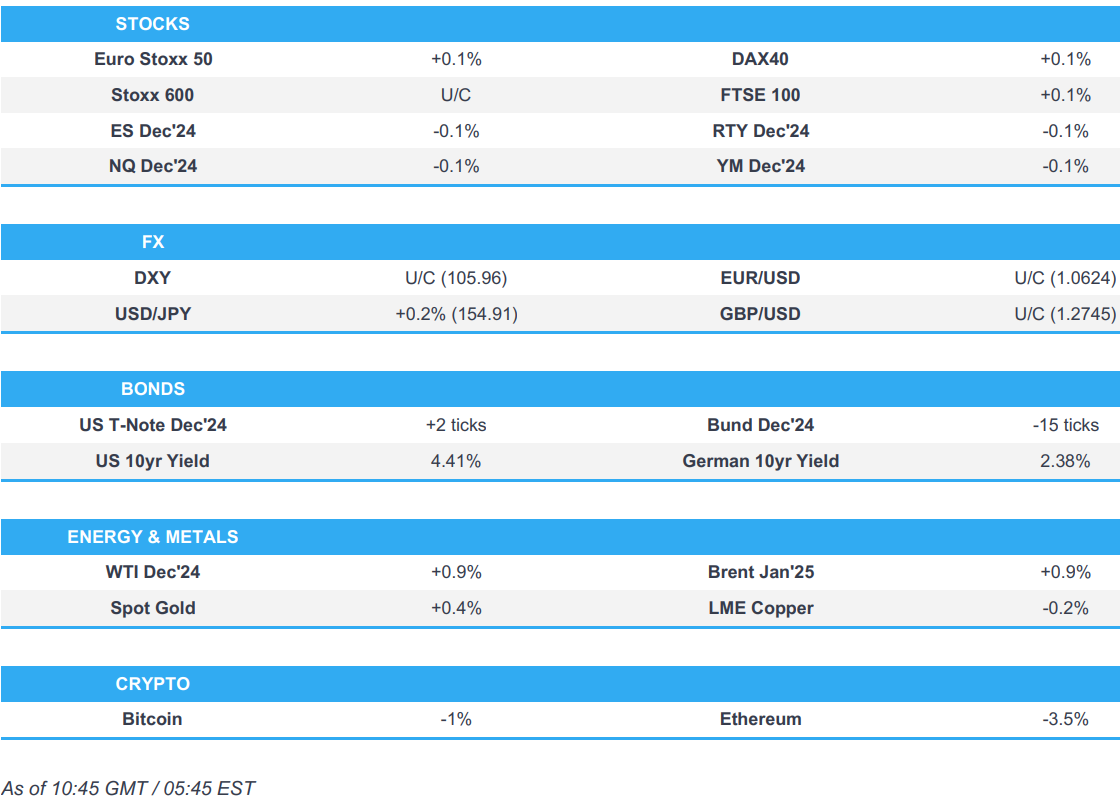

- European bourses are mostly on a modestly firmer footing; US futures are incrementally lower ahead of US CPI.

- Dollar is flat, JPY marginally underperforms with USD/JPY briefly topping 155.00.

- USTs are incrementally firmer and ultimately in stasis ahead of US CPI; Gilts continued to underperform.

- Crude and precious metals gain but base metals remain subdued.

- Looking ahead, US CPI, EIA STEO, Speakers including Fed’s Logan, Williams, Musalem, Kashkari, Schmid & RBA’s Bullock. Earnings from Cisco.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) initially opened very modestly lower across the board, in a continuation of the subdued price action seen in Asia overnight. However, sentiment soon improved just after the cash open to display a more positive picture in Europe.

- European sectors are mixed, having initially opened with a slight negative bias. Energy takes the top spot, lifted by significant gains in Siemens Energy after it raised its mid-term targets; gains in oil prices in recent trade may also be propping up the sector. Basic Resources follows closely behind, attempting to pare back some of the prior day’s losses. Tech is found at the foot of the pile.

- US Equity Futures are very modestly lower across the board, with price action tentative ahead of US CPI.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY started the session off on the front foot once again as the ramifications of a Trump Presidency remain at the forefront of investor sentiment, but is now flat and holding around 105.98. Focus ahead will no doubt be on US CPI, and then a slew of Fed speakers thereafter.

- EUR started the session on the backfoot vs. the USD and briefly made a fresh YTD low at 1.0594. The pair has since moved back onto a 1.06 handle. However, the ramifications of a Trump Presidency continue to act as a drag for the Eurozone outlook.

- JPY's run of losses since the start of the week has continued with USD/JPY crossing the 155 threshold for the first time since 30th July (155.21 was the high that day); this may spark some further jawboning from Japanese officials.

- GBP steady vs. the USD and EUR with fresh macro drivers for the UK on the quiet side aside from commentary from MPC-hawk Mann. She kept her hawkish-tone and noted that inflation has "definitely not been vanquished", adding that UK services inflation is pretty sticky.

- AUD/USD initially extended on its recent run of losses with sentiment surrounding China acting as a drag on the pair. NZD is steadier than its Antipodean peers vs. the USD and is currently caged within yesterday's 0.5909-72 range.

- PBoC set USD/CNY mid-point at 7.1991 vs exp. 7.2305 (prev. 7.1927).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are incrementally firmer. Specifics so far have been light with USTs coming under modest pressure overnight, to a 109-9 trough, on a soft 30yr JGB tap and above-forecast Japanese corporate good prices. Docket ahead is headline by CPI, after which we hear from numerous Fed speakers. USTs at a 109-17+ peak, resistance some way off at yesterday’s 110-04+ best before 110-07+ from Monday.

- Bunds are softer, printed a 131.62 base in the early European morning with drivers at the time light. Since, the benchmark has been gradually making its way off that trough but is struggling to make real ground above 132.00; current high 132.08. US CPI is the highlight, but for Germany specifically, Chancellor Scholz is set to speak at 12:00GMT, remarks which follow him seemingly accepting calls for an early confidence-vote with December 16th touted.

- Gilts are once again the underperformer. Gapped lower as the benchmark caught up with overnight UST action and then extended further below yesterday’s 93.30 trough to a 93.19 base. BoE's Mann kept her hawkish-tone and noted that inflation has "definitely not been vanquished", adding that UK services inflation is pretty sticky. This sparked some very modest pressure in Gilts. UK auction was well received, but had little impact on price action.

- UK sells GBP 4bln 4.375% 2028 Gilt Auction; b/c 3.12x, average yield 4.499%, tail 1.0bps.

- Italy sells EUR 8.25bln vs exp. EUR 7-8.25bln 2.70% 2027, 3.50% 2031, 2.50% 2032, 4.15% 2039 BTP Auction.

- Germany sells EUR 3.346bln vs exp. EUR 4bln 2.60% 2034 Bund: b/c 2.30x (prev. 2.30x), average yield 2.38% (prev. 2.31%) & retention 16.35% (prev. 17.43%)

- Click for a detailed summary

COMMODITIES

- Modest gains across the crude complex this morning after a relatively flat settlement on Tuesday as the initially heightened Middle East rhetoric was later offset by the broad Buck bid. Brent Jan trades towards the upper end of 71.78-72.63/bbl.

- Mild gains across precious metals as DXY pulls back from best levels (105.88-106.21 parameter) with newsflow light and with traders gearing up for US CPI. Spot gold resides in a current USD 2,597.72-2,613.28/oz range

- Copper futures hold a modest downward bias after lacking direction in APAC trade in a continuation of price action seen from the disappointing NPC Standing Committee announcement on Friday.

- Iran reportedly made plans to keep oil exports stable under a Trump presidency, according to local press Shana.

- Citi revised its 0-3M copper price target to USD 8,500/t (prev. USD 9,500/t); revised Q4 2024 average to USD 9,000/t (prev. USD 9,500/t)

- Oil output at Kazakhstan's Tengiz field -21% since Oct 26th to 496,200 BPD, according to Reuters sources.

- Russia's seaborne oil product exports in October -7% on the month, according to data and Reuters calculations.

- Click for a detailed summary

NOTABLE DATA RECAP

- French ILO Unemployment Rate (Q3) 7.4% vs. Exp. 7.4% (Prev. 7.3%)

NOTABLE EUROPEAN HEADLINES

- BoE's Mann says headline CPI "is not telling us whether underlying inflation dynamics have been vanquished". UK services inflation is pretty sticky. Energy prices are more likely to go up than down. Sees more volatility and upward bias to some inflation drivers. Will focus on how much UK financial conditions are affected by BoE actions vs moves in the US. Better for the BoE to lean against risk that inflation is higher than expected, than to wait and see. Ready to cut rates in bigger steps when inflation risks have gone. Still sees a desire from workers and firms to catch up on lost wages and margin caused by past high inflation. Some evidence that hospitality firms are finding it harder to pass on cost increases.

- ECB's Villeroy says he expects more rate cuts. Regarding France, expects inflation to remain moderate and the unemployment rate to increase to ~8% before easing back down to 7%. US election result risks lifting inflation. Bitcoin remains a risky asset.

- ECB's Kazaks says ECB should not deliberately set out to undershoot or overshoot its 2% inflation target, via Econostream. ECB’s best bet was therefore to aim strictly for 2% at all times, so, it should continue to follow its current cautious approach. ECB should proceed with a ‘measured pace, step by step’, avoiding ‘sharp moves’ but retaining ‘full optionality and flexibility. Economic activity was ‘still within the confines of the baseline scenario’. Kazaks said the analysis underlying the Governing Council’s monetary policy decision next month should more heavily weight what it projected would happen next year rather than in 2027, for which an initial set of projections would be unveiled.

- ECB's Nagel says core inflation rate is still quite high; there is still noticeable price pressures, particularly in services. Trump's proposed tariffs could cost Germany 1% in economic output

- UK grocery sales growth slows as consumers wait for Christmas and Black Friday, according to NIQ; says UK has a polarised consumer with half the households feeling pressure on personal finances.

- German Chemical Association VCI says in Q3, production rose 0.1% Y/Y or +3.3% without pharma; Q3 producer prices -0.3% amid weak demand and falling raw material costs

NOTABLE US HEADLINES

- US President-elect Trump picked John Ratcliffe for CIA Director and will nominate Pete Hegseth for Defense Secretary, while it was also reported that Trump told allies he wants Robert Lighthizer as his trade czar. Furthermore, Trump said Elon Musk, working in conjunction with Vivek Ramaswamy, will lead the department of government efficiency and aim to dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure federal agencies.

- Punchbowl News notes that the GOP is planning to pass a major tax bill in the first 100 days of the new Trump presidency. Sources add that conversations between Republicans from the House and Senate Budget Committees yesterday were largely a big-picture discussion about what Republicans are looking at for reconciliation.

GEOPOLITICS

MIDDLE EAST

- Lebanon is reportedly awaiting concrete ceasefire proposals, according to Reuters citing Parliamentary speaker Berri, after a senior US official said he saw a shot at a truce soon

- Israel conducted raids on the Haret Hreik and Lilaki areas in the southern suburbs of Beirut, according to Al Jazeera.

- US envoy to the UN told the Security Council that Israel has taken some important steps to address the undisputed humanitarian crisis in Gaza and that it is of urgent importance that Israel pause implementation of legislation targeting UNRWA, while the envoy added Israel must ensure its actions are fully implemented and improvements are sustained over time.Syrian media reported air strikes targeting the outskirts of the city of Albu Kamal on the Syrian-Iraqi border, while the US military later confirmed that it conducted strikes against an Iranian-backed militia group's weapons storage facility in Syria.

OTHER

- Chinese military organised naval and air forces to patrol the territorial waters and airspace of Scarborough Shoal in the South China Sea and surrounding areas on November 13th.

- US sanctions agency OFAC conducts an inquiry into Russian clients UBS (UBSG SW) took over with Credit Suisse, according to Reuters sources.

CRYPTO

- Bitcoin edges lower, and ultimately takes a breather after soaring to ATHs in the prior few sessions; currently sits around USD 87.5k.

APAC TRADE

- APAC stocks were mostly subdued following the negative lead from the US amid higher yields and cautiousness ahead of US CPI data, while the region also digested a slew of earnings releases.

- ASX 200 was dragged lower by underperformance in the mining-related stocks and with the top-weighted financial industry also pressured in the aftermath of CBA's earnings which posted a flat Y/Y cash profit of AUD 2.5bln for Q1.

- Nikkei 225 retreated following the hotter-than-expected PPI data, while losses were initially stemmed by recent currency weakness and with Sharp and Tokyo Electron among the best performers post-earnings, although selling eventually worsened

- Hang Seng and Shanghai Comp were mixed amid light catalysts and as participants await Chinese tech earnings, while US President-elect Trump's first picks for his administration included China hawks such as Waltz, Rubio and Lighthizer, although he also named China-friendly Elon Musk to lead the department of government efficiency with Vivek Ramaswamy.

NOTABLE ASIA-PAC HEADLINES

- China cuts taxes for home purchases in fiscal support effective December 1st; MOF says tax cuts targets boosting the property market

- China is to release its homebuying tax cut plans soon and will likely cut taxes for home purchases by end-2024, according to China Securities Times.

- China's Taiwan Affairs Office said in response to the TSMC (2330 TT) chip curbs that the US is playing the Taiwan card to raise tensions in the Taiwan Straits and these chip curbs ultimately undermine the interests of Taiwan’s companies, while it added that restrictions also cause Taiwan companies to miss further opportunities for industrial development.

- Tencent (700 HK) Q3 (CNY): Revenue 167.19bln (exp. 167.93bln). Net Income 53.23bln (exp. 45.33bln). EPS 5.6444 (prev. 3.752 Y/Y)

- Japan's government is considering restarting electricity and gas price subsidies from Jan-March

DATA RECAP

- Japanese Corporate Goods Prices MM (Oct) 0.2% vs. Exp. 0.0% (Prev. 0.0%); YY 3.4% vs. Exp. 3.0% (Prev. 2.8%, Rev. 3.1%)

- Australian Wage Price Index QQ (Q3) 0.8% vs. Exp. 0.9% (Prev. 0.8%); YY 3.5% vs. Exp. 3.6% (Prev. 4.1%)