Europe Market Open: DXY, US Futures, Yields & Crypto surge on Trump’s lead

06 Nov 2024, 07:00 by Newsquawk Desk

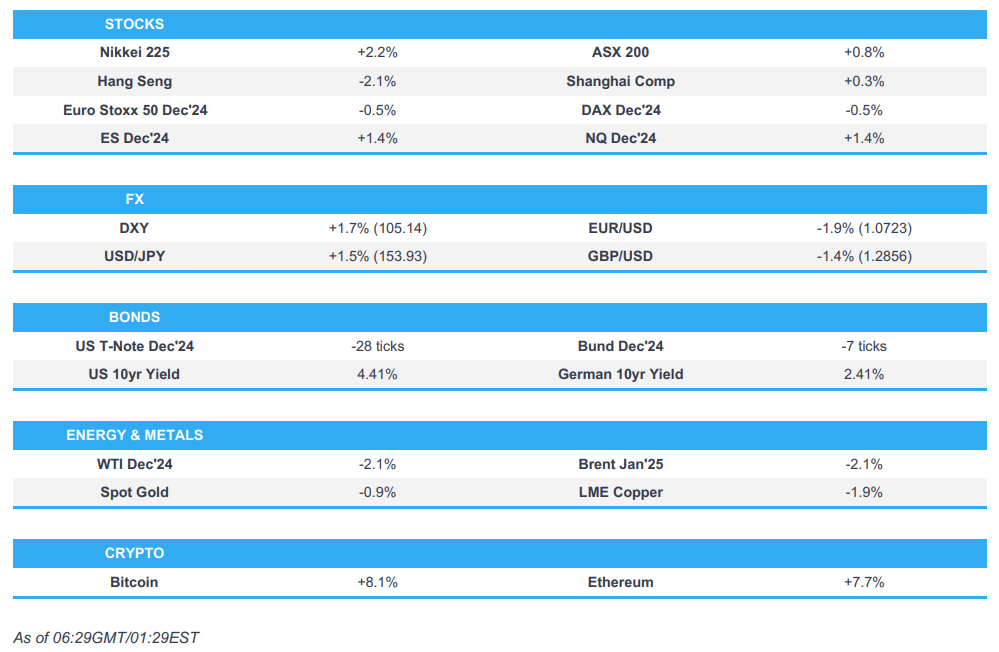

- US Presidential Election results are indicative of a Trump victory and Republicans taking the Senate; House is too close to call.

- US futures have ripped higher, while European futures have been hit given the potential EZ growth implications.

- DXY is currently up 1.5% and has seen its largest jump since March 2020; EUR, JPY and antipodeans are suffering.

- In the fixed income space, US yields are higher across the curve with the curve bear-steepening.

- Bitcoin is up over 8% after surging to a record high, crude has been hit by the stronger USD.

- Looking ahead, highlights include German Industrial Orders, EZ PMIs (Final), NBP Policy Announcement, US Election Results, ECB President Lagarde, de Guindos & BoC’s Rogers, Supply from Germany & US.

- Earnings from Pandora, Novo Nordisk, Banco BPM, Bper Banca, Enel, Poste Italiane, Snam, Vonovia, Commerzbank, Fresenius, Henkel, Puma, Siemens Healthineers, BMW, GEA Group, Evonik Industries, Eurazeo, Arkema, Teleperformance, Credit Agricole, Wise, Persimmon, Marks and Spencer, Beazley, Williams Companies Inc, CVS Health Corp, Gilead Sciences Inc, Sempra, Qualcomm Inc, Johnson Controls International & Arm Holdings.

SNAPSHOT

US PRESIDENTIAL ELECTION

- What happened: US Presidential Election results pointed to a very strong showing so far for former President Trump and the Republican party overall as Trump has won the three swing-state battlegrounds that have been called so far (North Carolina, Pennsylvania and Georgia) and was also polling ahead of Harris in Arizona, Michigan, Wisconsin and Nevada showing a clear path for victory for Trump. At pixel time, Trump has 247 electoral college votes vs Harris at 210 (270 needed to win). Furthermore, Polymarket assigns him a 97% chance of winning the election, while the Senate is also flipping and heading to the GOP's, but, in contrast, the House is still exceedingly close and up for grabs for both sides, and as such it could take days to work out and would be the deciding factor to whether we see a Republican clean sweep or a split Congress.

- Market reaction: With the market now running on the assumption that Donald Trump will win the Presidency and Republicans take the Senate (House is still too close to call), US equity futures have been boosted given his low tax and pro-growth agenda; ES +1.2%, NQ +1.2%, DJIA +1.3%, RTY +2.5%. Given the potential trade ramifications of a Trump Presidency, European equity futures have been sent lower (Eurostoxx 50 -0.9%), whilst in APAC trade the Hang Seng is lower by over 2% and the Nikkei 225 is up around 2.2% (boosted by a softer JPY). In the fixed income space, the Dec'24 UST contract is lower by some 28 ticks at a contract low. US yields are higher across the curve with the curve bear-steepening given the deficit concerns associated with the Trump Agenda. In FX markets, the DXY is currently up 1.5% and has seen its largest jump since March 2020. In terms of its major counterparts, EUR is currently bottom of the G10 leaderboard given the potential trade risk for the Eurozone, whilst China exposure has acted as a drag on AUD and NZD, JPY has also been sent lower given the potential for tighter Fed policy going forward due the potential US inflationary impact of a Trump win. With regards to Fed pricing, expectations for tomorrow's meeting are unchanged with a 25bps cut still near-enough fully priced, whilst around 3bps of easing has been trimmed for the December meeting. Given Trump's association with the crypto space, BTC has surged and is up over 8% to a fresh record high. In commodities, crude has been hit by the stronger USD whilst Gold is modestly lower in choppy trade.

US TRADE

EQUITIES

- US stocks gained in a risk-on session on US election day with equities rallying and outperformance seen in the Russell while all sectors closed in the green. The advances were led by Consumer Discretionary, Industrials and Utilities, while Materials, Energy and Staples were the relative underperformers. Elsewhere, T-notes sold off throughout the European session with lows seen in the wake of the stronger-than-expected ISM Services PMI, however a solid 10-year note auction, as well as further unwinds of Trump trades provided a cushion for T-notes which settled marginally higher with the curve flattening.

- SPX +1.23% at 5,783, NDX +1.32% at 20,227, DJIA +1.02% at 42,222, RUT +1.88% at 2,261.

- Click here for a detailed summary.

APAC TRADE

EQUITIES

- APAC stocks mostly followed suit to the risk on performance on Wall St as participants digested the US Presidential Election results where Trump is leading so far and betting markets boosted their pricing of the former President returning to the White House.

- ASX 200 was lifted with outperformance in tech, consumer discretionary and financials leading the gains seen in all sectors.

- Nikkei 225 surged above the 39,000 level with the momentum propelled by a weaker currency.

- Hang Seng and Shanghai Comp lagged with the Hong Kong benchmark the worst hit as tech was pressured amid the increased tariff threat for Chinese companies, while the mainland traded indecisively as prospects of looming fiscal stimulus offset the tariff threat.

- US equity futures extended on the prior day's gains as election results so far suggested increased prospects of a Trump victory.

- European equity futures are indicative of a negative cash open with the Euro Stoxx 50 future -0.6% after the cash market closed higher by 0.4% on Tuesday.

FX

- DXY rallied amid an early resurgence of the Trump trade after initial results from the election showed Trump in the lead in electoral votes and boosted betting market odds for a Trump victory with Polymarket assigning a 97% probability for him to win a second term.

- EUR/USD suffered as a function of the broad dollar strength which dragged the single currency beneath the 1.0800 level.

- GBP/USD gave back the 1.3000 status with price action solely driven by the election, while both the FOMC and BoE policy decisions are still due this week.

- USD/JPY steadily advanced and briefly climbed north of the 154.00 level owing to the broadly firmer buck and widening of US-Japan yield differentials.

- Antipodeans suffered alongside the selling across the greenback's counterparts and with pressure on the CNH on the heightened prospects of a Trump 2.0.

- BoC Minutes stated they felt upside pressures on inflation will continue to decline so policy did not need to be restrictive, while they considered the merits of cutting the policy rate by 25bps and there was a strong consensus for taking a larger step. Furthermore, members wanted to convey that a larger step was appropriate given the economic data seen since July.

- PBoC set USD/CNY mid-point at 7.0993 vs exp. 7.1011 (prev. 7.1016).

- China's major state-owned banks were seen selling dollars in the offshore FX market to prevent rapid yuan depreciation, according to Reuters sources.

FIXED INCOME

- 10yr UST futures suffered heavy losses as the Trump trade regained momentum and lifted yields across the curve.

- Bund futures saw early resilience but eventually succumbed to the selling pressure in US counterparts and with supply ahead.

- 10yr JGB futures lacked demand amid strength in Japanese stocks and following outdated BoJ September meeting minutes.

COMMODITIES

- Crude futures were lower amid headwinds from a stronger buck and after the larger-than-expected build in private crude inventory data forced a reversal of some of the prior day's advances.

- US Private Inventory (bbls): Crude +3.1mln (exp. +1.1mln), Distillate -0.9mln (exp. -1.1mln), Gasoline -0.9mln (exp. -0.9mln), Cushing +1.7mln.

- Saudi Aramco cut December oil prices for Asian buyers with the Arab light crude OSP to Asia set at + USD 1.70/bbl (prev. 2.20) vs Oman/Dubai average and the OSP to NW Europe was set at - USD 0.15/bbl (prev. -0.45) vs ICE Brent settlement, while the OSP to the US was set at + USD 3.80/bbl (prev. +3.90) vs ASCI.

- Iraqi cabinet issued a decision to immediately deliver Kurdish oil to state-run SOMO, according to the state news agency.

- Spot gold was ultimately flat in choppy trade and largely weathered the pressure from a firmer dollar.

- Copper futures declined with the metals complex weighed on by the stronger dollar as participants digested the results so far from the US Presidential Election with betting markets heavily boosting the pricing for a Trump victory.

- Armed rebels were reportedly taking control of key rare-earth mining areas in Myanmar in a development that could disrupt supply chains for EVs and more that pass through China, according to Nikkei.

CRYPTO

- Bitcoin rallied to a fresh record high as the results of the election so far suggest a strong Trump performance.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said in a meeting with Malaysia's PM that the sides should push forward flagship railway and industrial development projects, while he added that both should look into emerging areas and new areas for potential cooperation, according to Xinhua.

- BoJ September meeting minutes stated that members shared the view BoJ will continue to raise interest rates if its economic and price forecasts are met, while members agreed that the BoJ must scrutinize market developments and the overseas economic outlook for the time being as markets remain unstable and many members said BoJ must scrutinise not just market moves but the factors behind their volatility such as US and overseas economic developments. Furthermore, a few members said the BoJ can afford to spend time scrutinising the impact of overseas and market developments on Japan's economy and prices, while one member said the BoJ should hold off on raising rates until global and market uncertainties diminish and a member also said it is undesirable to change the policy rate level now as financial and economic uncertainties are high, although one member said there could be times when raising rates would be appropriate even when markets are unstable.

DATA RECAP

- Australian AIG Manufacturing Index (Oct) -19.7 (Prev. -33.6)

- Australian AIG Construction Index (Oct) -40.9 (Prev. -19.8)

- New Zealand HLFS Job Growth QQ (Q3) -0.5% vs. Exp. -0.4% (Prev. 0.4%)

- New Zealand HLFS Unemployment Rate (Q3) 4.8% vs. Exp. 5.0% (Prev. 4.6%)

- New Zealand HLFS Participation Rate (Q3) 71.2% vs. Exp. 71.5% (Prev. 71.7%)

- New Zealand Labour Cost Index QQ (Q3) 0.6% vs. Exp. 0.7% (Prev. 0.9%)

- New Zealand Labour Cost Index YY (Q3) 3.4% vs. Exp. 3.4% (Prev. 3.6%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu fired Defence Minister Gallant and appointed Foreign Minister Israel Katz as the new Defence Minister and Gideon Saar as Foreign Minister, according to Axios. It was separately reported that PM Netanyahu intends to dismiss the IDF chief of staff and Shin Bet chief, while he said there have been too many gaps between him and Gallant over the management of Israel's wars.

- Former Israeli Defence Minister Gallant said in a speech that he was fired because of disagreements over three issues including ultra-Orthodox military conscription, his support for a Gaza hostage and ceasefire deal and his call for a commission of inquiry for the October 7th failures.

- US official said the surprising decision by Israeli PM Netanyahu to fire Defense Minister Gallant is concerning, especially in the middle of two wars and as Israel prepares to defend against a potential attack from Iran, while the official said they have real questions about the reasons for Gallant’s firing and about what is driving the decision, according to Kann's Stein.

- There was an assessment in the security establishment that Iran may reconsider the nature of its response in light of tonight's developments in Israel, according to N12 news.

- Iraqi factions announced the targeting of a vital site in Eilat in southern Israel with drones, according to Sky News Arabia.

EU/UK

NOTABLE HEADLINES

- UK think tank NIESR forecasts the BoE cutting rates this week and to deliver three more cuts in 2025, while it sees the Bank Rate at 3.25% in 2026.