US Market Open: DXY and US yields softer as Trump trades unwind after weekend polls

04 Nov 2024, 11:25 by Newsquawk Desk

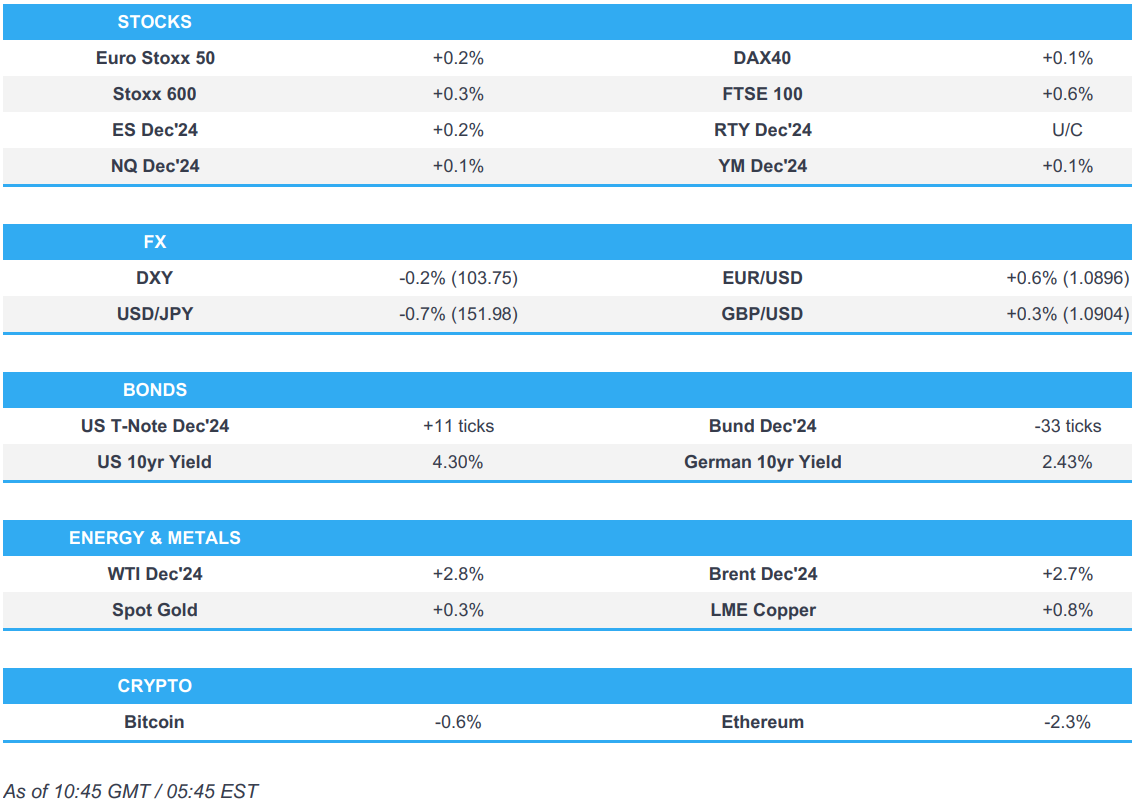

- European bourses generally trade very modestly in positive territory, alongside slight gains in US futures.

- PredictIt odds shifted over the weekend in favour of a Harris election victory; NYT/Siena final polls showed the race was deadlocked in 6/7 battleground states.

- USD is on the backfoot as a shift in polling in the US election towards Harris has seen a scaling back of "Trump trades" across the board.

- USTs benefit from a scaling back of the Trump trade, whilst Bunds lag; reports suggesting that China’s NPC is reviewing local government debt swaps weighed on the complex.

- Crude benefits amid reports that OPEC+ agreed to delay the December oil output increase by one month; base metals move higher in anticipation of the ongoing China NPC meeting.

- Looking ahead, US Employment Trends, Durable Goods, Australian PMIs (Final), Comments from ECB’s Elderson, Holzmann, Supply from the US. Earnings from Fidelity National Information Services, NXP Semiconductors, Vertex Pharmaceuticals, Diamondback Energy, Palantir Technologies, Marriott International & Fox.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.1%) are generally modestly firmer, having initially traded tentatively throughout most of the European morning.

- European sectors are mixed; Autos takes the top spot alongside Energy, with the latter buoyed by strength in underlying oil prices. Tech is found at the foot of the pile, hampered by losses in STMicroelectronics, after it received a couple of broker downgrades.

- US Equity Futures (ES +0.1%, NQ U/C, RTY U/C) are mixed, with the ES and NQ trading tentatively on either side of the unchanged mark in the run-up of the US Election.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is on the backfoot vs. all peers as a shift in polling in the US election towards Harris has seen a scaling back of "Trump trades" across the board, one of which was a stronger USD. DXY slipped below its 200DMA at 103.82 and been as low as 103.62, matching its 21DMA.

- EUR is underpinned by the twin effects from last week's EZ GDP and inflation metrics as well as a paring back in the risk of a Trump Presidency which carries risk for the Eurozone. As such, EUR/USD has made its way back onto a 1.09 handle, peaking at 1.0904. GBP is not as sensitive to the Trump trade unwind and therefore is getting outmuscled by some peers. Cable has been unable to make its way back onto a 1.30 handle, topping out at 1.2998.

- USD/JPY has been as low as 151.61 with JPY benefitting from a potential reappraisal of the Fed easing trajectory in lieu of the shift in US polling over the weekend. Currently trading just shy of 152.00

- Antipodeans are both enjoying a session of gains vs. the broadly softer USD. AUD/USD briefly made its way back onto a 0.66 handle but was unable to hold above the level.

- GBP is firmer vs. the USD but softer vs. the EUR.

- PBoC set USD/CNY mid-point at 7.1203 vs exp. 7.1208 (prev. 7.1135).

- Turkish CPI MM (Oct) 2.88% vs. Exp. 2.61% (Prev. 2.97%); YY 48.58% vs. Exp. 48.2% (Prev. 49.38%)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs enter the election week higher, bolstered by polls showing that Harris could clinch victory in Iowa and with betting odds shifting towards a Harris victory overall. Given this, the Trump Trade is paring with USTs 15+ ticks higher at best to a 110-16+ peak. Thereafter, the complex was weighed on amid reports that China’s NPC is reviewing local government debt swaps; USTs trimmed back to a 110-09 trough, but still firmer on the session.

- Bunds are slightly softer, though off a 131.40 trough which is just below Friday’s base but clear of last week’s 131.15 WTD trough. Weighed on by the above election dynamcs and are also softer as domestic political risk heats up once again, following the leak of Finance Minister Lindner’s economic reform plan.

- Gilts are modestly firmer, caught between the diverging leads from Germany and the US. Weekend press round from Chancellor Reeves saw her stress that the Labour party won’t need to announce a similar budget (in the context of tax rises) during the parliamentary term. Pivoting the 94.00 mark, in a 93.88-94.34 range.

- Click for a detailed summary

COMMODITIES

- Firmer trade across the crude complex amid several factors; (1) OPEC+ is delaying the planned return of production by a month (2) Geopolitical concerns remained heightened (3) China's NPC Standing Committee is due to meet from Nov 4th-8th (4) The Dollar is on a weaker footing amid an unwind of the Trump trade. Brent Jan'25 sits towards the upper end of a USD 73.88-74.91/bbl parameter.

- Precious metals hold a modest upward bias across precious metals against the backdrop of a softer Dollar, heightened geopolitical tensions, and in the run-up to the US Presidential Election. Spot gold currently remains tucked in a narrow range between USD 2,731.93-2,744.93/oz parameter.

- Positive bias across base metals amid a softer dollar coupled with some optimism (or anticipation) as China’s top legislative body, the National People’s Congress (NPC) Standing Committee, convenes from today through to Friday 8th November.

- OPEC+ agreed to delay the December oil output increase by one month, according to a Reuters source, while OPEC confirmed that Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria and Oman extended the 2.2mln bpd voluntary adjustments for one month until the end of December.

- Libya’s NOC said production rates of the Waha Oil Company reached above 335k bpd.

- Canada is to unveil details of a proposed emissions cap on the oil and gas sector on Monday.

- BP (BP/ LN) CEO says that the conflict in the Middle East is the "top risk we hold right now".

- ENI (ENI IM) CEO says gas demand is increasing worldwide; volatility in energy markets will continue in 2025.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Sentix Index (Nov) -12.8 vs. Exp. -12.5 (Prev. -13.8)

- EU HCOB Manufacturing Final PMI (Oct) 46.0 vs. Exp. 45.9 (Prev. 45.9)

- German HCOB Manufacturing PMI (Oct) 43.0 vs. Exp. 42.6 (Prev. 42.6)

- French HCOB Manufacturing PMI (Oct) 44.5 (Prev. 44.5)

- Italian HCOB Manufacturing PMI (Oct) 46.9 vs. Exp. 48.5 (Prev. 48.3)

- Spanish HCOB Manufacturing PMI (Oct) 54.5 vs. Exp. 53.1 (Prev. 53.0)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves said she was wrong to tell British voters before the election that Labour wouldn’t announce new tax increases and she didn’t appreciate the size of the fiscal deficit but noted that Labour won’t need a similar budget during Parliament, according to Bloomberg.

- Former UK Secretary of State for Business and Trade Kemi Badenoch won the race to be the next leader of the Conservative Party after beating Robert Jenrick in the months-long contest, according to Sky News.

US ELECTION

- US VP Harris leads former US President Trump in Iowa at 47% vs 44% in a new Des Moines Register/Mediacom Iowa Poll as she picked up support from women in the ruby-red state which Trump had won in 2016 and 2020. Furthermore, PredictIt odds shifted over the weekend in favour of a Harris election victory.

- NYT/Siena final polls showed the race was deadlocked in six out of the seven battleground states and that all seven of them were within the margin of error with Harris leading Trump in Nevada at 49% vs 46%, North Carolina at 48% vs 46%, Wisconsin at 49% vs 47% and Georgia at 48% vs 47%, while Trump leads in Arizona at 49% vs 45% and the candidates were tied in Pennsylvania at 48% vs 48% and in Michigan at 47% vs 47%.

- Political Polls noted via social media platform X that the updated Nate Silver model on the electoral college shows Harris taking the lead with 270 vs Trump at 267.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- Iranian Foreign Ministry spokesman says Iran is to use all of its means and full strength in its response to Israel.

MIDDLE EAST

- Iran’s Supreme Leader Khamenei said the US and Israel should know they will undoubtedly receive a crushing response for what they do against Iran and the resistance front, according to state media. It was also reported that Iran’s Islamic Revolutionary Guard Corps said the country will “certainly” launch a new attack against Israel, according to ISNA.

- Iran is planning a strong and complex response to Israel involving even more powerful warheads and other weapons, according to WSJ citing Iranian and Arab officials briefed on the plans.

- US warned Iran that it won’t be able to restrain Israel if Iran attacks, according to Axios. It was separately reported that US B-52 bombers arrived in the Middle East after Washington announced their deployment as a warning to Iran, while the Pentagon said the move aims to protect US personnel and interests in the region, according to AFP and France 24.

- Israeli PM Netanyahu said pushing Hezbollah back beyond the Litani River is key to returning residents to homes in northern Israel. It was separately reported that Netanyahu cancelled his visit to Metula after a Hezbollah drone explosion occurred just 20 minutes prior to his arrival, according to Israeli media reports.

- Israeli troops detained a Syrian citizen in recent months who they said was an Iranian operative in Syria who had gathered intelligence on Israeli troops in the border area. It was separately reported that Israeli commandos launched a seaborne raid into northern Lebanon on Saturday and seized a senior Hezbollah operative, while Israel said that it killed Hezbollah’s rocket unit commander in southern Lebanon, according to Reuters and FT.

- Israel officially notified the UN that it is cancelling the agreement that regulates UNRWA operations in Israel, the West Bank and Gaza, according to Axios's Ravid.

- Israel's Channel 12 quoting a senior official noted expectations of reaching an agreement to end the war in Lebanon within two weeks at most, according to Sky News Arabia.

- Hamas senior official Hamdan said dialogue among Palestinian factions in Cairo is positive but added that he didn’t want to jump to any conclusions and noted that Hamas has not received any written proposals regarding a possible ceasefire in Gaza, according to Reuters citing Al Aqsa TV.

- Hamas insists on unified negotiations to prevent Israel from resuming fire after a prisoner release and Egypt continues mediation efforts with Palestinian and Israeli parties to reach a Gaza ceasefire and increase humanitarian aid access, according to a senior security source cited by Egypt’s Al Qahera News.

- Political adviser to Iraqi Prime Minister Fadi al-Shammari told Sky News Arabia that an Israeli strike on Iraq cannot be ruled out but added that they do not want to give justifications for Israel to do so.

- Yemen’s Houthis said it will continue the maritime blockade against Israeli vessels amid intelligence reports of asset transfers and said it will not recognise changes in ownership of Israeli shipping companies, as well as warned against collaboration.

OTHER

- Russia’s Deputy Chairman of the Security Council Medvedev said the US is mistaken if it thinks that Russia will not use nuclear weapons in case of a threat to its existence, according to TASS.

- Russian forces took over Vyshneve village in Ukraine’s Donetsk region, as well as captured Pershotravneve and Kurakhivka in eastern Ukraine, according to the Russian Defence Ministry.

- North Korea and Russia reaffirmed a commitment to implement the strategic partnership reached in June and their foreign ministers agreed to hold more dialogues going forward, according to KCNA.

- India’s Foreign Ministry spokesperson said India and China have commenced verification patrolling on mutually agreed positions in both Demchok and Depsang.

CRYPTO

- Bitcoin is incrementally lower and trading just beneath USD 69k, as the "Trump trade" unwinds, given the recent shift in polling in favour of Harris.

APAC TRADE

- APAC stocks began the week mostly positive but with the gains capped amid the holiday closure in Japan and as global markets braced for this week's major risk events including the US Presidential Election.

- ASX 200 was led by strength in tech, telecoms and utilities, while financials also benefitted after Westpac's earnings.

- Hang Seng and Shanghai Comp were mixed as the former traded indecisively with strength in automakers offsetting the losses in the property sector, while the mainland was underpinned amid tailwinds from an unwinding of the Trump trade and with the NPC Standing Committee convening this week with participants eyeing the approval of over CNY 10tln of additional debt issuance for the next few years.

NOTABLE ASIA-PAC HEADLINES

- China's NPC reviews local government debt swap, according to Xinhua; reviewed bill on raising ceiling on local government debt to replace existing hidden debt.

- China's Commerce Ministry files lawsuit against the EU's final EV tariff.

- China's Commerce Minister met with Australia's Trade Minister on Sunday and said China hopes Australia will continue to improve its business environment and treat Chinese companies fairly and equitably. China's Commerce Minister also met with French Foreign Trade Ministerial Delegate Sophie Primas and stated the EU's countervailing investigation on China's electric vehicles has 'seriously hindered' China-EU auto industry cooperation.

- China is not planning "bazooka" stimulus for this year, according to WSJ sources; Chinese authorities reportedly set to signal after the NPC that more steps to support growth are in the pipeline.

- RBNZ said geopolitical tensions were highlighted as a risk to stability, while it noted that concern about geopolitical tensions has been increasing recently and potential impacts from geopolitical risks cannot be underestimated.

- Indonesia extended its tax holiday policy with an adjustment amid global minimum tax implementation, while it is considering extending tax incentives to property and electric vehicles sectors in 2025 and is considering making it longer for exporters to retain earnings in the domestic market beyond three months.