US Market Open: Sentiment improves with equities and antipodeans on the front foot, DXY flat ahead of US PCE

26 Jul 2024, 11:00 by Newsquawk Desk

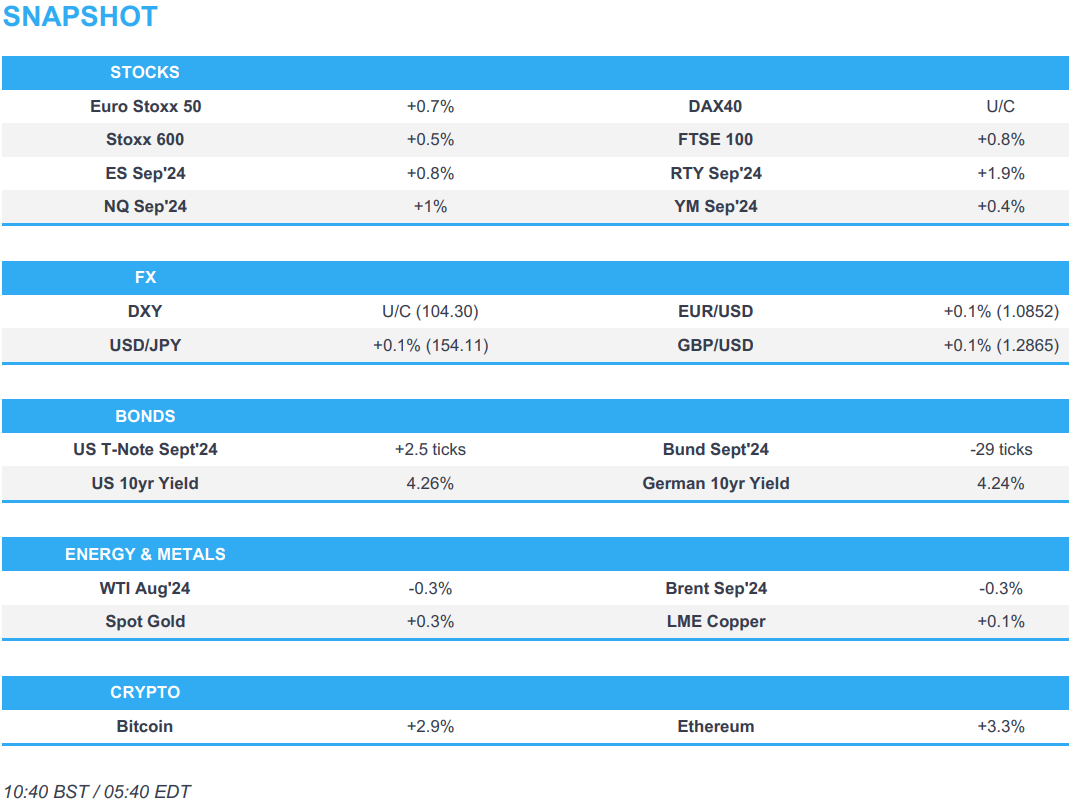

- European bourses are mostly higher as sentiment improves after the prior day’s hefty selling pressure; US futures entirely in the green, with clear outperformance in the RTY

- Dollar is flat ahead of today’s US PCE, safe havens lag whilst the Antipodeans gain in a slight reversal from price action this week

- USTs are rangebound, EGBs softer with European specifics-light

- Crude is incrementally softer and just off best levels, XAU gains alongside base metals

- Looking ahead, US PCE, Earnings from 3M, Aon & Bristol-Myers

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.6%) opened the session mixed and on either side of the unchanged mark, though sentiment picked up as the session progressed and generally reside near session highs.

- European sectors hold a positive bias; Consumer Products takes the top spot, propped by post-earning strength in Luxury name Hermes (+3.9%). Basic Resources and Energy are benefiting from strength in underlying metal prices. Chemicals is found near the foot of the pile, after BASF (-2.7%) and Wacker Chemie (-2.1%) both reported weak earnings.

- US equity futures (ES +0.6%, NQ +0.9%, RTY +1.9%) are entirely in the green, with the NQ and ES regaining their composure after being the subject of heavy selling pressure amid the recent rotation play, which has seen the RTY outperform in the past week. Focus today is on the US PCE at 08:30 EDT / 13:30 BST.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is mixed vs. peers with price action a reversal of recent sessions with the dollar faring worse against risk-sensitive currencies and better against havens. DXY remains within Thursday's 104.08-45 range ahead of today's key US PCE data.

- EUR/USD is currently respecting Thursday's 1.0826-69 parameters with yesterday's base holding above a slew of DMAs; 200 at 1.0818, 50 at 1.0810, 100 at 1.0796. Fresh EZ fundamentals are lacking in today's session with the ECB's SCE passing seeing the 12-month and 3-year projections held at prior levels.

- GBP is a touch firmer vs. the USD after a session of losses yesterday which dragged the pair from a 1.2913 peak to a 1.2849 low.

- USD/JPY is back on a 154 handle after Thursday's wild ride. Overnight saw an uptick in Tokyo CPI (ex-fresh food) in the run-up to next week's BoJ policy announcement, which has seen bets of potential action increase throughout the week. A 15bps hike is currently priced at 46%.

- Both antipodeans are attempting to atone for recent heavy losses alongside a pick-up in risk sentiment.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat and trade has been rangebound in the run-up to US PCE at 08:30 EDT / 13:30 BST. Focus is on the core metric which is seen in a 0.1% to 0.2% range, a 0.2% figure may not knock the narrative for September easing, but could impact pricing for the remainder of the year.

- Bunds are lower to the tune of 30 ticks, but remains above Thursday's 131.95 base. There was no reaction to the ECB SCE, which saw 1 and 3-year inflation outlooks maintained.

- Gilt price action has largely mimicked that of Bunds; currently trading to the bottom end of today's 97.46-97.77 band. Next UK-specific catalyst will be on Monday, where Chancellor Reeves will provide a fiscal update that is expected to show a GBP 20bln funding gap.

- Click for a detailed summary

COMMODITIES

- Crude is slightly softer and off overnight highs, in what has been a quiet session thus far. Brent sits in an USD 82.05-71/bbl parameter.

- Mixed trade across precious metals despite a steady USD, with modest upside seen in spot gold and palladium - albeit with gains capped ahead of US PCE- whilst spot silver underperforms. XAU sits in a current USD 2,355.87-,2379.48/oz intraday parameter.

- Base metals are mostly firmer and to varying degrees, with risk sentiment having picked up overnight.

- Hungarian PM aide Gulyas says the oil deliveries issue, with Ukraine, must be resolved by September and there is a risk of fuel shortages unless there is a resolution. No immediate risk to fuel supply.

- Citi says by Q4, it sees copper back at USD 9,500/t and rallying further to USD 11k/t by early 2025

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish Unemployment Rate SA (Jun) 8.2% (Prev. 8.2%); Trade Balance (Jun) 8.7B (Prev. 11.9B, Rev. 10.4B); Total Employment (Jun) 5.429M (Prev. 5.187M)

- Norwegian Retail Sales Ex. Auto (Jun) -5.1% (Prev. 3.2%)

- French Consumer Confidence (Jul) 91.0 vs. Exp. 90.0 (Prev. 89.0, Rev. 90)

- Spanish Retail Sales YY (Jun) 0.3% (Prev. 0.2%)

- Italian Consumer Confidence (Jul) 98.9 vs. Exp. 98.0 (Prev. 98.3); Mfg Business Confidence (Jul) 87.6 vs. Exp. 87.0 (Prev. 86.8, Rev. 86.9)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves said there is still more work to do on the 'Pillar 1' tax agreement and is optimistic for agreement by autumn, while she wants the tax burden on working people to be lower, but won't make unfunded commitments and will make a statement on Monday about the state of public finances and public spending pressures. Furthermore, Reeves said she is going to fix the fiscal mess that the Tories left and wants fairer, sustainable tax on the wealthy but needs to strike the right balance, as well as noted that Labour wants to be pro-growth and pro-wealth creation, according to Reuters.

- UK Chancellor Reeves is expected to reveal a GBP 20bln hole in government spending for essential public services on Monday, paving the way for potential tax rises in the autumn budget, according to The Guardian.

NOTABLE US HEADLINES

- Former US President Barack Obama and Michelle Obama announce their support for Kamala Harris' candidacy for the US presidency of the Democratic Party

- Morgan Stanley commented to institutional clients on Thursday that computer-driven macro hedge fund strategies on Wednesday sold USD 20bln in equities and are set to shed at least USD 25bln over the next week after the stock rout, in one of the largest risk-unwinding events in a decade, according to Reuters.

GEOPOLITICS

MIDDLE EAST

- Israel is seeking changes to a plan for a Gaza truce and the release of hostages by Hamas which complicates a final deal, according to sources cited by Reuters. It was also reported that Israeli PM Netanyahu told hostage families that Israel will submit an updated ceasefire proposal to Hamas within two days, according to Axios.

- US President Biden expressed the need to close the remaining gaps and finalise the Gaza deal as soon as possible during the meeting with Israeli PM Netanyahu, while he also raised the need to remove obstacles to the flow of aid to Gaza.

- US VP Harris said she had a frank and constructive meeting with Israeli PM Netanyahu and she has unwavering commitment to Israel and its security, while she stands with families of hostages held in Gaza. Harris also expressed serious concerns about the scale of deaths in Gaza and noted that a two-state solution is the only viable path.

- White House said gaps remain in ceasefire talks but believes they can be closed and it believes they are closer to the ceasefire and hostage deal than ever before.

- It was expected that there would be a development in the hostage negotiations after the meeting between US President Biden and Israeli PM Netanyahu, while Netanyahu's office informed the members of the mini-ministerial council that there is progress in the swap deal negotiation, according to Al Jazeera.

- Palestinian government said a Hamas leader in the West Bank died in Israeli captivity, according to Reuters.

- Houthi-affiliated media reports five US-British raids on Hodeidah airport, according to Sky News Arabia.

- Syrian Observatory said US warplanes targeted with heavy machine guns the areas of influence of pro-Iranian militias in the countryside of Deir Ezzor, eastern Syria, according to Sky News Arabia.

- Security source noted missile shelling targeting the vicinity of Ain al-Asad base which hosts international coalition forces, according to Asharq News.

OTHER

- Chinese Foreign Minister Wang said in talks with his Indian counterpart that China-India relations have an important impact beyond the bilateral scope and it is in the interests of both sides to get China-India relations back on track. Wang also said they hope the two sides will work in the same direction and actively explore the correct way for the two neighbouring countries to get along.

CRYPTO

- Bitcoin advances and climbs above USD 67k, with Ethereum also finding its footing and now holding around USD 3.2k.

APAC TRADE

- APAC stocks were mostly higher as risk sentiment in Asia improved with markets finding some composure following the recent sell-off and with some encouragement from stronger-than-expected US GDP data.

- ASX 200 was led higher by outperformance in the commodity, materials, real estate and energy-related sectors.

- Nikkei 225 was choppy and briefly rose above 38,000 following mostly softer-than-expected Tokyo CPI.

- Hang Seng and Shanghai Comp. were varied with the former rangebound as it strived to stay above the 17,000 level, while the mainlained remained lacklustre amid lingering slowdown concerns despite another increased PBoC liquidity effort.

NOTABLE ASIA-PAC HEADLINES

- China SASAC said central state-owned enterprises in China are expected to arrange total investment of about CNY 3tln in large-scale equipment upgrades over the next five years.

- Hong Kong reappointed HKMA Chief Executive Eddie Yue for a term of 5 years effective October 1st.

- Typhoon Gaemi will start impacting Jiangxi, Hubei, Henan and Hebei provinces over the next three days and will bring powerful storms to affected areas, according to CCTV.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said current monetary policy settings remain appropriate and the prevailing rate of appreciation of the policy band will keep a restraining effect on imported inflation. Furthermore, it noted that growth momentum in the Singapore economy should improve in the second half of 2024 and that GDP growth is likely to come in closer to its potential rate of 2–3% for the full year.

- China reportedly weighs tenfold fee increase on high-frequency traders, according to Bloomberg sources; the final plan is still under revision. China Securities Regulatory Commission and Chinese stock exchanges have consulted some market participants on draft plans to raise a CNY 0.1 (1.4%) fee on buy and sell orders to at least CNY 1 if the transactions meet the threshold of high-frequency trading, sources stated. Accounts with a monthly turnover rate below four times their total holdings may be exempt, to avoid negatively impacting mutual funds using automated trades.

- Japan's Ministry of Finance reportedly wants the BoJ to cut bond purchases gradually; wants the BoJ to consider bank capacity in bond plan, according to Bloomberg sources

DATA RECAP

- Tokyo CPI YY (Jul) 2.2% vs. Exp. 2.3% (Prev. 2.3%); CPI Ex. Fresh Food YY (Jul) 2.2% vs. Exp. 2.2% (Prev. 2.1%); Ex. Fresh Food & Energy 1.5% vs. Exp. 1.6% (Prev. 1.8%)