Europe Market Open: APAC stocks benefited from the improved risk appetite, US PCE ahead

26 Jul 2024, 06:30 by Newsquawk Desk

- APAC stocks were mostly higher as risk sentiment in Asia improved with markets finding some composure following the recent sell-off and with some encouragement from stronger-than-expected US GDP data.

- Morgan Stanley commented to institutional clients on Thursday that computer-driven macro hedge fund strategies on Wednesday sold USD 20bln in equities and are set to shed at least USD 25bln over the next week after the stock rout, in one of the largest risk-unwinding events in a decade, according to Reuters.

- Israel is seeking changes to a plan for a Gaza truce and the release of hostages by Hamas which complicates a final deal, according to sources cited by Reuters.

- UK Chancellor Reeves is expected to reveal a GBP 20bln hole in government spending for essential public services on Monday, paving the way for potential tax rises in the autumn budget, according to The Guardian.

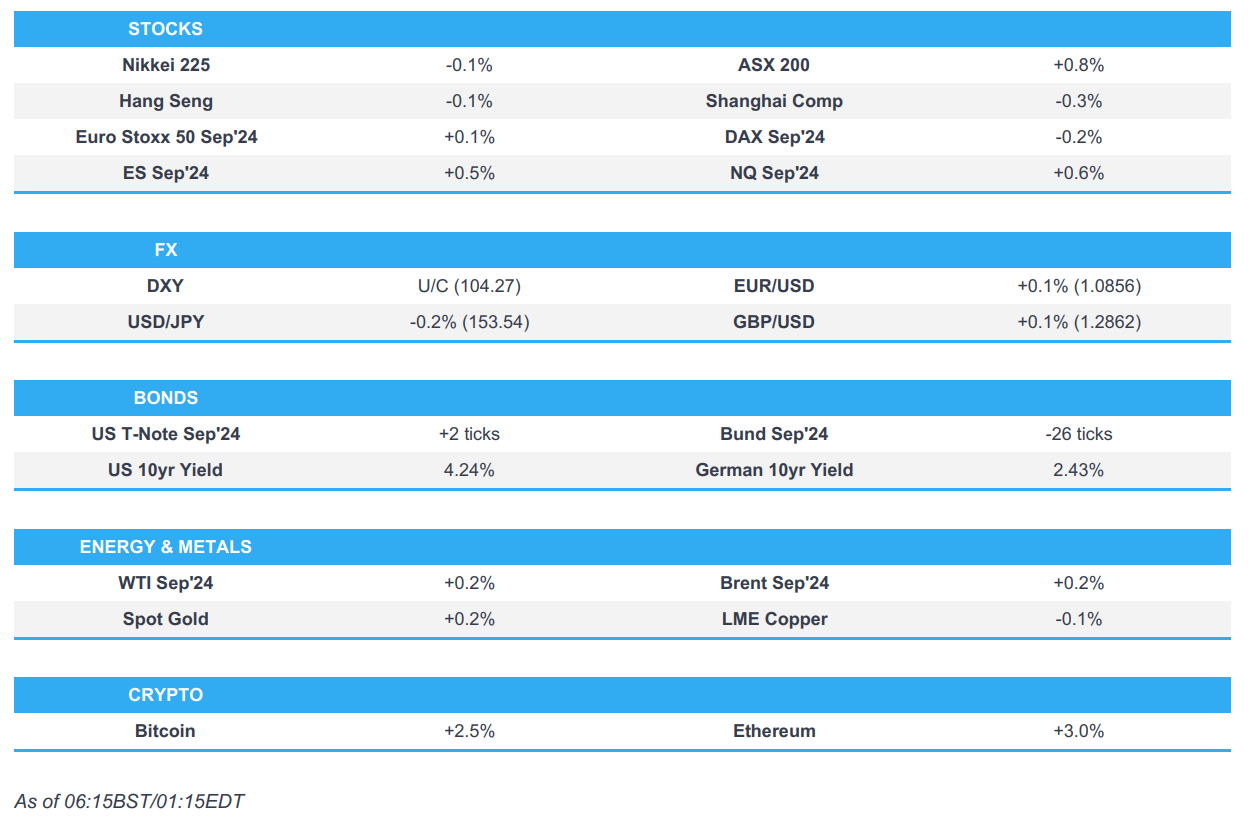

- European equity futures indicate a slightly positive open with Euro Stoxx 50 futures up 0.1% after the cash market finished with losses of 1.0% on Thursday.

- Looking ahead, highlights include German Import Prices, Spanish Retail Sales, Italian Business Manufacturing Confidence, US PCE, ECB SCE, Earnings from Holcim, Capgemini, Air Liquide, Mercedes-Benz, Wacker Chemie, BASF, NatWest, 3M, Aon & Bristol-Myers.

US TRADE

EQUITIES

- US stocks finished mixed and saw two-way price action following the recent bloodbath and as participants digested key data releases including US GDP and Core PCE for Q2 which both printed hotter than expected. Nonetheless, there were late headwinds towards the close amid a sell-side imbalance and the Nasdaq underperformed as some of the tech woes lingered with Alphabet (GOOGL) shares extending on losses, particularly after a report that OpenAI is to introduce "SearchGPT".

- SPX -0.5% at 5,399, NDX -1.1% at 18,831, DJIA +0.2% 39,953, RUT +1.3% at 2,223

- Click here for a detailed summary.

NOTABLE HEADLINES

- Former President Trump leads Vice President Harris 48-46% among registered voters, according to a New York Times/Siena College poll while the margin of error is 3.3 points.

- Morgan Stanley commented to institutional clients on Thursday that computer-driven macro hedge fund strategies on Wednesday sold USD 20bln in equities and are set to shed at least USD 25bln over the next week after the stock rout, in one of the largest risk-unwinding events in a decade, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher as risk sentiment in Asia improved with markets finding some composure following the recent sell-off and with some encouragement from stronger-than-expected US GDP data.

- ASX 200 was led higher by outperformance in the commodity, materials, real estate and energy-related sectors.

- Nikkei 225 was choppy and briefly rose above 38,000 following mostly softer-than-expected Tokyo CPI.

- Hang Seng and Shanghai Comp. were varied with the former rangebound as it strived to stay above the 17,000 level, while the mainlained remained lacklustre amid lingering slowdown concerns despite another increased PBoC liquidity effort.

- US equity futures mildly gained alongside the improved mood in Asia but with upside capped as PCE data looms.

- European equity futures indicate a slightly positive open with Euro Stoxx 50 futures up 0.1% after the cash market finished with losses of 1.0% on Thursday.

FX

- DXY was contained in a tight range following yesterday's mixed performance against major peers, with only brief support seen after US GDP data for Q2 topped forecasts and Core PCE Prices printed firmer-than-expected but notably eased from the prior quarter, while the focus now shifts to the incoming monthly PCE Price data for June.

- EUR/USD edged slight gains after recent whipsawing and with little in the way of tier-1 releases from the EU today.

- GBP/USD mildly rebounded off a floor around the 1.2850 level but with trade constrained ahead of the key US data later and with UK Chancellor Reeves to deliver a statement on Monday about the state of public finances and public spending pressures.

- USD/JPY traded indecisively with some support seen after mostly softer-than-expected Tokyo CPI which facilitated an early reclaim of the 154.00 status although this was only brief as participants continued to second-guess next week's BoJ decision.

- Antipodeans mildly benefitted from the improved risk appetite which provided some reprieve from their recent drop to multi-month lows.

FIXED INCOME

- 10-year UST futures traded rangebound after recent price swings and curve flattening, while the latest 7-year auction was stronger and attracted a larger bid-to-cover than the previous, while the participants now await PCE Price data.

- Bund futures faded the prior day's mild gains after pulling back from just shy of the 133.00 level.

- 10-year JGB futures were supported at the open after Tokyo CPI data printed softer than expected, while results of the 2-year JGB auction were mixed with a higher bid-to-cover and lower accepted prices.

COMMODITIES

- Crude futures remained afloat as risk assets regained some composure following the recent sell-off.

- Spot gold eked mild gains alongside a flat dollar and as participants await the Fed's preferred inflation gauge.

- Copper futures were mildly supported amid the mostly improved sentiment in Asia.

CRYPTO

- Bitcoin gained alongside the improved risk sentiment and briefly climbed back above the USD 67,000 level.

NOTABLE ASIA-PAC HEADLINES

- China SASAC said central state-owned enterprises in China are expected to arrange total investment of about CNY 3tln in large-scale equipment upgrades over the next five years.

- Hong Kong reappointed HKMA Chief Executive Eddie Yue for a term of 5 years effective October 1st.

- Typhoon Gaemi will start impacting Jiangxi, Hubei, Henan and Hebei provinces over the next three days and will bring powerful storms to affected areas, according to CCTV.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said current monetary policy settings remain appropriate and the prevailing rate of appreciation of the policy band will keep a restraining effect on imported inflation. Furthermore, it noted that growth momentum in the Singapore economy should improve in the second half of 2024 and that GDP growth is likely to come in closer to its potential rate of 2–3% for the full year.

DATA RECAP

- Tokyo CPI YY (Jul) 2.2% vs. Exp. 2.3% (Prev. 2.3%)

- Tokyo CPI Ex. Fresh Food YY (Jul) 2.2% vs. Exp. 2.2% (Prev. 2.1%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Jul) 1.5% vs. Exp. 1.6% (Prev. 1.8%)

GEOPOLITICAL

MIDDLE EAST

- Israel is seeking changes to a plan for a Gaza truce and the release of hostages by Hamas which complicates a final deal, according to sources cited by Reuters. It was also reported that Israeli PM Netanyahu told hostage families that Israel will submit an updated ceasefire proposal to Hamas within two days, according to Axios.

- US President Biden expressed the need to close the remaining gaps and finalise the Gaza deal as soon as possible during the meeting with Israeli PM Netanyahu, while he also raised the need to remove obstacles to the flow of aid to Gaza.

- US VP Harris said she had a frank and constructive meeting with Israeli PM Netanyahu and she has unwavering commitment to Israel and its security, while she stands with families of hostages held in Gaza. Harris also expressed serious concerns about the scale of deaths in Gaza and noted that a two-state solution is the only viable path.

- White House said gaps remain in ceasefire talks but believes they can be closed and it believes they are closer to the ceasefire and hostage deal than ever before.

- It was expected that there would be a development in the hostage negotiations after the meeting between US President Biden and Israeli PM Netanyahu, while Netanyahu's office informed the members of the mini-ministerial council that there is progress in the swap deal negotiation, according to Al Jazeera.

- Palestinian government said a Hamas leader in the West Bank died in Israeli captivity, according to Reuters.

- Houthi-affiliated media reports five US-British raids on Hodeidah airport, according to Sky News Arabia.

- Syrian Observatory said US warplanes targeted with heavy machine guns the areas of influence of pro-Iranian militias in the countryside of Deir Ezzor, eastern Syria, according to Sky News Arabia.

- Security source noted missile shelling targeting the vicinity of Ain al-Asad base which hosts international coalition forces, according to Asharq News.

OTHER

- Chinese Foreign Minister Wang said in talks with his Indian counterpart that China-India relations have an important impact beyond the bilateral scope and it is in the interests of both sides to get China-India relations back on track. Wang also said they hope the two sides will work in the same direction and actively explore the correct way for the two neighbouring countries to get along.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves said there is still more work to do on the 'Pillar 1' tax agreement and is optimistic for agreement by autumn, while she wants the tax burden on working people to be lower, but won't make unfunded commitments and will make a statement on Monday about the state of public finances and public spending pressures. Furthermore, Reeves said she is going to fix the fiscal mess that the Tories left and wants fairer, sustainable tax on the wealthy but needs to strike the right balance, as well as noted that Labour wants to be pro-growth and pro-wealth creation, according to Reuters.

- UK Chancellor Reeves is expected to reveal a GBP 20bln hole in government spending for essential public services on Monday, paving the way for potential tax rises in the autumn budget, according to The Guardian.