Europe Market Open: Wall St. sell off reverberated into APAC trade, PBoC cut the 1yr MLF

25 Jul 2024, 06:35 by Newsquawk Desk

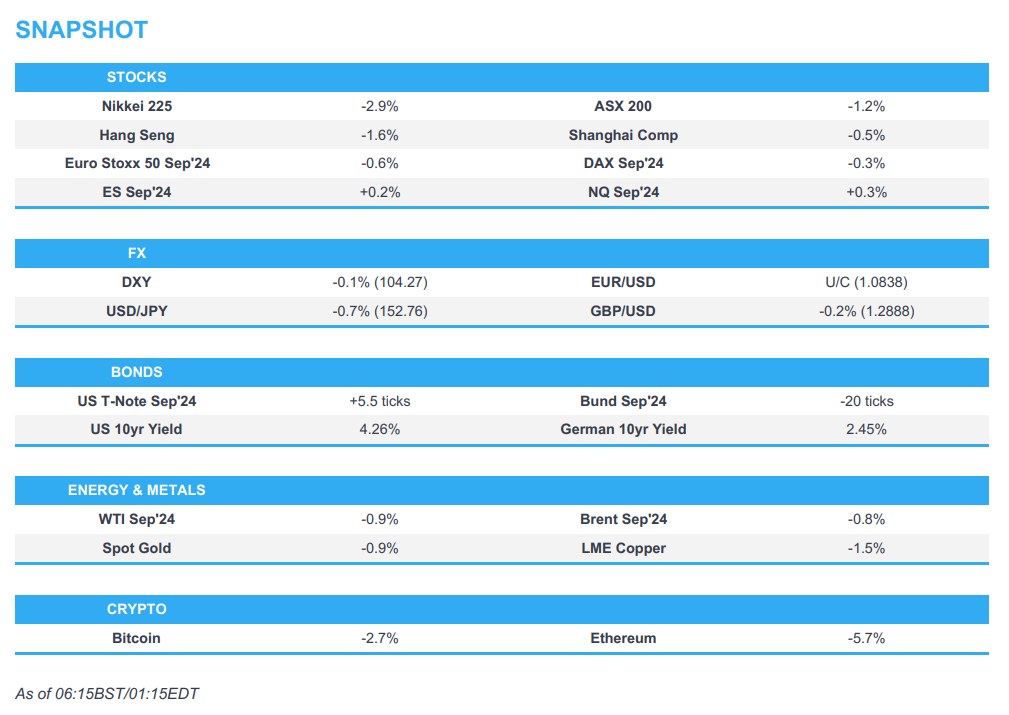

- APAC stocks were negative following the sell-off on Wall St where the S&P 500 and Nasdaq suffered their worst declines since late-2022.

- The PBoC surprised markets with a 20bps reduction to the 1yr MLF rate.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.5% after the cash market finished with losses of 1.1% on Wednesday.

- DXY is softer vs. havens (JPY and CHF) but firmer against the Antipodeans; extension of yesterday's price action.

- Looking ahead, highlights include German Ifo, US Durable Goods, GDP Advance (Q2), PCE Prices Advance (Q2), US IJC, ECB President Lagarde, Supply from Italy & US

- Earnings from BE Semiconductor, Roche, Julius Baer, Nestle, Lonza, Sanofi, STMicroelectronics, Hermes, Vivendi, Vinci, EssilorLuxottica, Stellantis, TotalEnergies, Dassault Systemes, IG, Anglo American, Lloyds, AstraZeneca, ITV, Vodafone, Unilever, AbbVie & Willis Towers.

US TRADE

EQUITIES

- US stocks tumbled with heavy losses in the S&P 500 and Nasdaq which suffered their worst declines since late 2022 alongside substantial weakness in large-cap Tech, Consumer Discretionary and Communication Services after post-earnings losses in Alphabet and Tesla weighed on risk appetite ahead of the other Magnificent Seven results in the upcoming weeks. Sentiment was also not helped by mixed data releases including a surprise contraction in Manufacturing PMI although the risk-off trade supported defensives and the mild reprieve in oil prices underpinned the energy sector.

- SPX -2.3% at 5,427, NDX -3.7% at 19,032, DJIA -1.3% at 39,854, RUT -2.1% at 2,195

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden said America is to choose between hope and hate, optimism and negativity, while he added that he needs to unite the party and it is time to pass the torch but will continue his duties as President for the remainder of his term. Furthermore, he also commented that Vice President Harris is experienced, tough and capable.

- Republican Presidential Candidate Trump holds 49% support among registered voters nationwide vs. Harris’s at 46%, according to a CNN poll which was a closer contest than previous CNN polling on the matchup between Biden and Trump.

APAC TRADE

EQUITIES

- APAC stocks were negative following the sell-off on Wall St where the S&P 500 and Nasdaq suffered their worst declines since late-2022 owing to disappointment following some mega-cap earnings and a surprise contraction in US Manufacturing PMI.

- ASX 200 was dragged lower by notable losses in tech, while miners also suffered after several quarterly production updates and lower underlying commodity prices.

- Nikkei 225 underperformed and briefly dipped beneath the 38,000 level after shedding over 1,000 points with pressure from currency strength and prospects of a BoJ rate hike at next week’s policy meeting.

- Hang Seng and Shanghai Comp. conformed to the broad selling in the region and fell towards the 17,000 level where support held, while the mainland index also retreated albeit to a lesser extent than regional peers after the PBoC’s surprise MLF operation and 20bps rate cut to the 1-year MLF rate with markets seemingly unimpressed by China’s piecemeal stimulus efforts.

- US equity futures were rangebound and attempted to compose themselves after recent selling and as key data looms.

- European equity futures indicate a lower open with Euro Stoxx 50 futures down 0.5% after the cash market finished with losses of 1.1% on Wednesday.

FX

- DXY mildly weakened after recent flows into haven peers and the surprise contraction in US Manufacturing PMI although the downside was limited as attention turns to the upcoming key data including advanced GDP later followed by PCE prices on Friday.

- EUR/USD lacked direction after yesterday’s choppy performance, soft PMI data and quiet newsflow.

- GBP/USD was lacklustre after failing to sustain the 1.2900 status and as catalysts remained light for the UK

- USD/JPY continues its slide and breached the 153.00 level to the downside amid haven flows and prospects of a BoJ rate hike next week, while Services PPI data also printed hotter than expected.

- Antipodeans were pressured alongside the risk-off mood and slump in metal prices.

FIXED INCOME

- 10-year UST futures regained some composure after yesterday’s late dip but with the rebound capped ahead of key data and incoming supply with a 7-year auction scheduled today.

- Bund futures were subdued following recent selling but are off worse levels and just about reclaimed the 132.00 level.

- 10-year JGB futures remained in negative territory heading closer to next week’s key BoJ meeting with a source report noting the central bank will weigh a rate hike and have a detailed plan to halve bond buying in the coming years, while firmer-than-expected Services PPI data and a lack of BoJ purchases also kept prices in check.

COMMODITIES

- Crude futures were subdued amid the negative risk tone, proving yesterday’s mild relief was a mere dead cat bounce.

- Spot gold was pressured following a break below the key USD 2400/oz and coincided with a sharp drop in silver which fell to its lowest in over two months.

- Copper futures retreated amid the downbeat mood despite the PBoC’s surprise MLF operation and associated rate cut.

CRYPTO

- Bitcoin declined amid the sell-off in risk assets and tested the USD 64,000 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 200bln via 1-year MLF loans with the rate lowered to 2.30% vs prev. 2.50%.

DATA RECAP

- Japanese Services PPI (Jun) 3.00% vs. Exp. 2.60% (Prev. 2.50%)

- South Korean GDP QQ Advance (Q2) -0.2% vs. Exp. 0.1% (Prev. 1.3%)

- South Korean GDP YY Advance (Q2) 2.3% vs. Exp. 2.5% (Prev. 3.3%)

GEOPOLITICAL

MIDDLE EAST

- Israel PM Netanyahu said Israel will do what it must to return security to the northern border, while he added that America and Israel can forge a security alliance in the Middle East to counter the Iranian threat. Netanyahu said all countries that will make peace with Israel should be invited to join this alliance with the new alliance to be a natural extension of the Abraham accords and will be called the Abraham Alliance.

- Israeli PM Netanyahu told leaders of Jewish organisations on Tuesday night that he would present a plan for the day after the war in Gaza, according to Axios.

- Hamas official said Israeli PM Netanyahu's speech shows he doesn't want to conclude a ceasefire deal, while the group also said that Israeli PM Netanyahu's talk on intensified efforts to release hostages is pure lies, according to a statement.

- US senior official said Gaza ceasefire negotiations appear to be in their closing stages and negotiators have worked out a pretty detailed text of the arrangements for how a Gaza hostage deal would work in which the initial phase of the hostage deal would see women, men aged over 50 and the sick and wounded hostages released over a 42-day period. Furthermore, the official said the remaining obstacles to a Gaza hostage deal are bridgeable and there will be activity on this issue in the coming week, while US President Biden and Israeli PM Netanyahu will talk about how to close final gaps holding up a Gaza hostage deal during their meeting on Thursday.

OTHER

- Ukrainian Navy spokesman said Russia has pulled all its vessels out of the Sea of Azov, according to Reuters.

- Russian Foreign Ministry says experts from Russia and the US have met to discuss Ukraine although the ministry does not see such contacts as practical because the US side is biased, according to RIA

- US Treasury imposed sanctions targeting a China-based network supporting North Korea's ballistic missile and space programmes.