US Market Open: Equities in the red amid post-earning losses in LVMH, Tesla and Alphabet, Bunds bid after dire German/EZ PMIs

24 Jul 2024, 11:26 by Newsquawk Desk

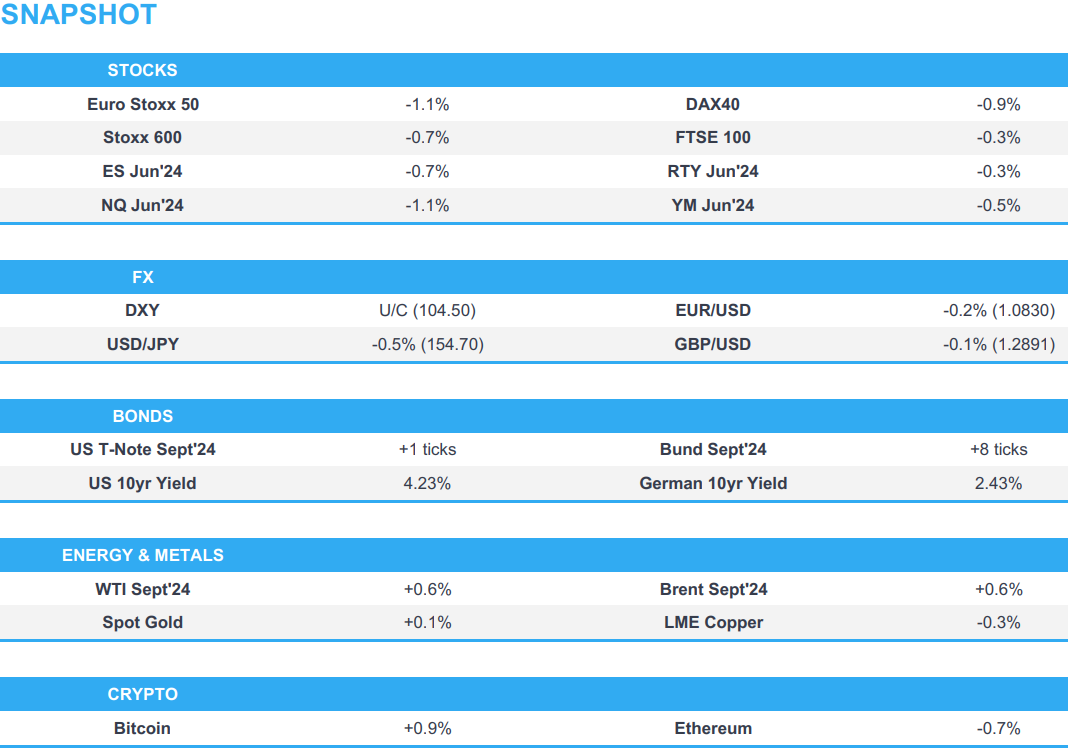

- Equities are entirely in the red, hampered by significant post-earning weakness in key companies; LVMH -3.5%, Google -3.2%, Tesla -7.4%

- Dollar is flat, safe haven pairs outperform, USD/JPY around 154.50, Antipodeans lag

- USTs are flat, Bunds initially propped up on dire German/EZ PMI releases but are now off best levels

- Crude gains, XAU is incrementally firmer and base metals are mixed

- Looking ahead, US Flash PMIs, US Advance Goods Trade Balance, BoC Policy Announcement & MPR, Comments from ECB’s de Guindos & Lane, Fed’s Bowman, BoC's Macklem & Rogers Supply from the US, Earnings from AT&T, CME, Thermo Fisher, Ford, IBM, Newmont, ServiceNow & General Dynamics

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.9%) began the session on a weaker footing, and sentiment has continued to dwindle as the morning progressed; as it stands indices resides at lows.

- Today’s European PMI releases have been poor, with Germany’s composite surprisingly falling into contractionary territory, whilst the EZ managed to stay in expansionary territory and noted that its GDP Nowcast still pointed towards growth in Q3.

- European sectors hold a strong negative bias, with only Travel & Leisure remaining afloat, which is assisted by post-earning gains in easyJet (+5.7%). Consumer Products is the clear underperformer, after LVMH (-4.7%) results, which has also weighed on peers. Banks are also towards the foot of the pile, given the significant losses in Deutsche Bank (-6.7%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is steady around the 104.50 mark with the USD showing mixed performance vs. peers. The USD is softer against havens such as CHF and JPY whilst faring better against risk-sensitive currencies. 104.55 marks today's peak for the DXY with not much in the way of resistance until the 100DMA at 104.82.

- EUR is hampered by a soft set of PMI metrics with the German report a notable lowlight for the region; the release suggests a 0.4% Q/Q contraction for German GDP in Q3. As such, EUR/USD's journey to the low 1.08's has continued, currently around 1.0830.

- GBP is a touch softer vs. the USD with Cable extending its move below the 1.29 mark. GBP/USD saw some slight reprieve from mixed PMI metrics with the low for the pair currently at 1.2878.

- JPY is continuing to edge out gains vs. the USD. Price action has followed the recent broader trend but is also likely being aided by the current risk environment. USD/JPY has taken out support at the 155 level, which some desks had seen as a key test for the pair,slipping to a 154.31 base on a recent Reuters source piece.

- Antipodeans are both the G10 underperformers. AUD is extending its losing streak vs. the USD to an 8th consecutive session with the pair now below the 0.66 level for the first time since 17th June.

- CAD is steady vs. the USD in the run up to today's BoC policy announcement. Consensus is for a cut, however, analysts are not unanimous in this view and therefore there could be some choppiness on the decision itself.

- PBoC set USD/CNY mid-point at 7.1358 exp. 7.2795 (prev. 7.1334).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are firmer after a dismal German PMI series and, by extension, a poor EZ report. The French release earlier sparked some modest pressure in Bunds, but could ultimately be caveated by the impending Olympics. Bunds to a 132.66 new WTD peak but stalling before last week’s 132.77 best. Bunds were heading lower into the German auction, which then fuelled further weakness

- USTs are moving in-line with EGBs thus far with macro newsflow, but docket does pick up later on with the region's own PMIs and a 5yr auction both scheduled. Currently, at a 110-31 peak with yesterday’s best just above at 111-00.

- Gilts were bid their own PMIs, which were mixed, but had an overall hawkish skew, and as such, fell from 98.13 to a 97.94 base, before paring back towards the 98.00 mark, following a strong 2054 auction.

- UK sells GBP 2.25bln 4.375% 2054 Gilt: b/c 3.35x, average yield 4.636%, tail 0.2bps

- Click for a detailed summary

COMMODITIES

- Crude is trading with modest gains thus far following another slump yesterday. Weak Chinese demand is the factor cited for the recent persisting weakness in crude. Brent counterpart resides in a 81.12-67/bbl range.

- Overally mixed and contained trade across precious metals amid a lack of pertinent catalysts to drive price action overnight, whilst the morning saw the complex unreactive to Flash PMI data from Europe. Spot gold trades in a USD 2,419.26-2,405.01/oz parameter after topping resistance around USD 2,412/oz.

- Mixed trade for base metals with the complex awaiting the next catalysts after being unfazed by European Flash PMIs.

- US Private Inventory Data (bbls): Crude -3.9mln (exp. -1.6mln), Distillate -1.5mln (exp. +0.2mln), Gasoline -2.8mln (exp. -0.4mln), Cushing -1.6mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- French HCOB Composite Flash PMI (Jul) 49.5 vs. Exp. 49.0 (Prev. 48.8); HCOB Manufacturing Flash PMI (Jul) 44.1 vs. Exp. 45.8 (Prev. 45.4); HCOB Services Flash PMI (Jul) 50.7 vs. Exp. 49.8 (Prev. 49.6)

- German HCOB Manufacturing Flash PMI (Jul) 42.5 vs. Exp. 44.0 (Prev. 43.5); HCOB Services Flash PMI (Jul) 52.0 vs. Exp. 53.3 (Prev. 53.1); HCOB Composite Flash PMI (Jul) 48.7 vs. Exp. 50.7 (Prev. 50.4)

- EU HCOB Services Flash PMI (Jul) 51.9 vs. Exp. 53.0 (Prev. 52.8); HCOB Manufacturing Flash PMI (Jul) 45.6 vs. Exp. 46.1 (Prev. 45.8); HCOB Composite Flash PMI (Jul) 50.1 vs. Exp. 51.1 (Prev. 50.9)

- UK Flash Services PMI (Jul) 52.4 vs. Exp. 52.5 (Prev. 52.1); Flash Composite PMI (Jul) 52.7 vs. Exp. 52.6 (Prev. 52.3); Flash Manufacturing PMI (Jul) 51.8 vs. Exp. 51.1 (Prev. 50.9)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer and European Commission President von der Leyen plan a meeting to reset UK-EU ties, according to FT.

NOTABLE US HEADLINES

- Alphabet Inc (GOOG) Q2 2024 (USD): EPS 1.89 (exp. 1.84), Revenue 84.742bln (exp. 84.18bln). Revenue breakdown. Google Advertising rev 64.6bln (exp. 64.4bln).Google Cloud Revenue 10.35bln (exp. 10.158bln). Google Search & Other Revenue 48.51bln (exp. 47.65bln). Shares fell 2.2% after hours

- Tesla Inc (TSLA) Q2 2024 (USD): Adj. EPS 0.52 (exp. 0.62), Revenue 25.5bln (exp. 24.77bln). Co. said the focus remains on company-wide cost reduction. Shares fell 7.8% after hours.

- Visa Inc (V) Q3 2024 (USD): Adj. EPS 2.51 (exp. 2.43), Revenue 8.9bln (exp. 8.89bln). Shares fell 3.3% after hours.

GEOPOLITICS

MIDDLE EAST

- IDF launched a new incursion into West Bank’s Tulkarem, according to a source cited by Times of Israel.

- Artillery shelling and Israeli tank fire was reported on east of Khan Younis, according to Al Jazeera.

- Islamic Resistance in Iraq said it conducted a drone attack on a vital target in the north of Eilat, according to Al Jazeera.

OTHER

- French prosecutors said a Russian was arrested over 'destabilisation' plot during Paris Olympics, according to AFP.

- Japanese Chief Cabinet Secretary Hayashi said Russia's decision to restrict 13 Japanese individuals' entry including Toyota Motor's Chairman is "totally unacceptable" and they filed a complaint against Russia over their decision to restrict entry.

CRYPTO

- Bitcoin is slightly firmer and trades just beneath USD 66.5k, whilst Ethereum slips below USD 3.5k

APAC TRADE

- APAC stocks were mostly rangebound with a negative bias seen following the lacklustre handover from Wall Street after risk appetite was dampened by underwhelming earnings results.

- ASX 200 was indecisive and briefly clawed back early losses with sentiment clouded by mixed Flash PMI data.

- Nikkei 225 retreated at the open amid headwinds from a firmer currency, while PMI data was also varied.

- Hang Seng and Shanghai Comp. were subdued with early pressure from demand concerns after China's slowdown weighed on luxury spending which was evident in the 14% decline in LVMH sales in the region, while Chow Tai Fook Jewellery was among the worst hit in Hong Kong after its quarterly group retail sales fell 20% Y/Y. However, the mainland bourse managed to recover losses to return to relatively flat territory after rebounding from a brief dip beneath the 2,900 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ to weigh rate hike next week and have a detailed plan to halve bond buying in the coming years, according to Reuters citing sources. BoJ to taper bond buying gradually at pace near market consensus . July rate hike decision is a close call and consumption outlook is key; source describes it as a judgement call in terms of acting now or later in the year. BoJ sees no compelling reason to rush, given price rises remain moderate and inflation expectations are stable. Source adds the BoJ is likely to taper its bond purchases gradually and in several stages, at a pace roughly in-line with the markets dominate view, to avoid any yield spike.

DATA RECAP

- Japanese JibunBK Manufacturing PMI Flash SA (Jul) 49.2 (Prev. 50.0)

- Japanese JibunBK Services PMI Flash SA (Jul) 53.9 (Prev. 49.4)

- Japanese JibunBK Composite Op Flash SA (Jul) 52.6 (Prev. 49.7)

- Australian Judo Bank Manufacturing PMI Flash (Jul) 47.4 (Prev. 47.2)

- Australian Judo Bank Services PMI Flash (Jul) 50.8 (Prev. 51.2)

- Australian Judo Bank Composite PMI Flash (Jul) 50.2 (Prev. 50.7)